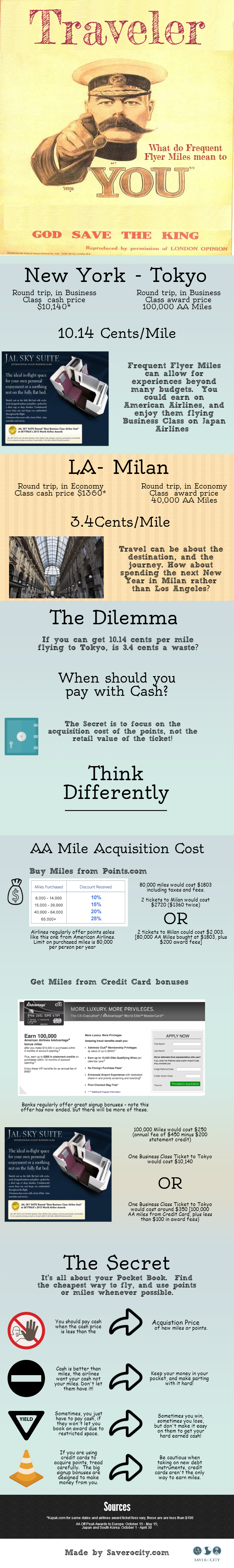

Frequent flyer miles are a great way to travel for free (or close to it) but too many people over value their miles, and dip into their pocket to pay cash instead. The secret to understanding value, and knowing when to pay money, or pay miles is to compare the cost of acquisition of new miles, to the cost of buying a ticket for cash.

Copy/Paste Embed Code for Infographic

Feel free to copy the infographic code and share it on your website.

Excellent infographic, Matt, with additional pointers Saverocity style 🙂

Thanks Kumar – was actually very much inspired by you and the talk on the forum about when to use those SPG points!

So in that case do you have a problem using your UR points to book a flight through their portal (using sapphire or ink bold/plus)?

There was a poll on FT or MP one time about the various redemptions and it seemed I was in the minority group who used the points as cash through the portal for cruises, thus getting a value of $.0125.

If you are going to go on that cruise, and you can acquire points for it then it is a better option to use the Ultimate rewards. The only issue occurs when you can no longer acquire points, and if you also need to use them for something else (opportunity cost) but since it seems to me at least that most people are able to generate points faster than they can spend them. So, yeah, you could get better value, but if it is cheaper than cash and the alternative is cash – you made the right choice!

Quite true for redeeming biz class tickets. But when you redeem for economy class tickets, the mileage earning for cash tickets should be factored in. Even for a non-elite, a round trip from LAX-MXP would yield ~13,000 miles. So essentially you should compare airfare with 40,000 miles+13,000 miles opportunity cost+$100 in fees. Also factoring the factor of possible elite bonus earnings, flexibility of cash tickets, for economy awards even off peak awards may not seem reasonable.

Agreed- that is a more accurate notion, but I kept things simple here. It doesn’t change the philosophy I am suggesting, that we look at acquisition costs rather than ‘equivalent retail value’ when making the decision though – it just gives a more realistic valuation on the price side.

Of course, that is also just another points acquisition notion too 🙂 As in mileage run pricing.

on a roll today huh