Earn AAdvantage Miles from Money Orders by USPS

I’m sharing this deal since the Merger between American and US Airways is pretty much approved and my feeling is that the AAdvantage program will go away soon, so lets get as many folk in on the deal before it is taken away. Get on this now, and crank up your mileage balance before this option goes away!

This is one of my favorite Travel Hacks because your money is right back in your pocket in seconds with this deal, and you don’t need to worry about complicated ways to get the cash back out of the system. Other hacks, like purchasing Gift Cards aren’t terribly difficult, but they do require you floating the funds for a little longer before they come back to you.

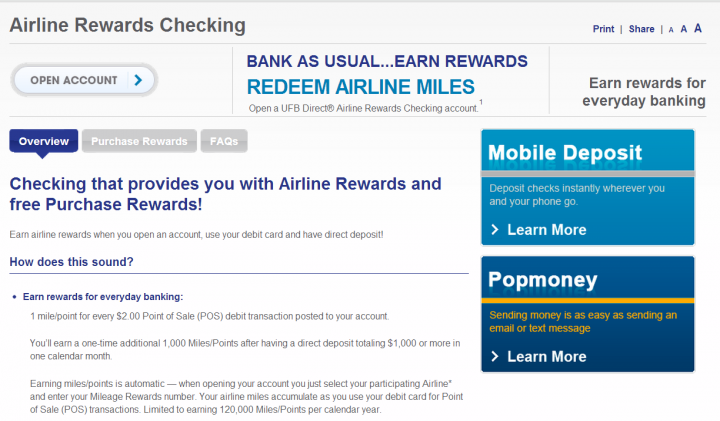

At the moment, you get 1000 AAdvantage points for signup and starting off with at least $1000 in deposits, then you earn a further 1 AAdvantage point for every $2 spent on the card. Here is the sign up link

There is a cap of 120,000 miles per account per year… pretty sweet if you ask me! The cost of the Money Order is $1.60 for around 500 AAdvantage miles. To give you an idea of what that means in real Travel Hack money – 50,000 miles for $160 (50K will get you Roundtrip from New York to Tokyo in Coach).

Here is what you do once you have your Debit Card and Pin.

- Go to your local USPS and ask for a money order (pick a random number between $950 and $999 to look less obvious on your account)

- Write out the money order to yourself immediately (do this at the post office)

- Take the money order to your local branch of your bank and deposit into Checking

- Transfer random amount from local branch to UFB direct (something around the $1,000 mark)

Repeat

does it work for ufb with you? usps normally post mo purchases as cash advances and so they typically do not earn miles. certainly true for the delta st and bofa alaskan, and gift cards just flat out dont work. have you actually earned miles on ufb card at usps?

Works like a charm, I wrote this post back in Feb, and have been doing way before and every since successfully.

MilesAbound said “usps normally post mo purchases as cash advances and so they typically do not earn miles…”

I am not a big debit card user and rarely (if ever!) buy MOs. But I am trying to branch out. So, if I may ask a newbie question: can one actually end up with a cash advance on a debit card? In other words, if I got the UFB Direct account and its debit card, and used it to buy a MO at my PO, could I end up paying cash advance fees because my PO codes it differently from Matt’s….? Is this up to the discretion of the clerk or do I just say “debit” and it goes through…. Thanks!

Hi Elaine,

Couple of things to consider:

1. Cash Advance Fees – these are something that the credit card company makes you aware of. Anyone who needs a cash advance on their card is desperate, so they charge you horrible amounts of interest and fees. It is exploitation, but it is return for a service. They are loaning you money. Debit cards do not loan you money, so they cannot have a ‘cash advance’ fee option.

2. Credit or Debit – that said a third party could charge you a convenience fee, an example of that would be if you decided to use your debit card as a credit card in a casino to pull large amounts of cash. But that would charge up as $5000 + $100 fee at the point of sale, charged by the machine/person giving you the money.

When you are using a Debit card as a Debit card they need a PIN, if they don’t ask for a pin and ask you to sign then it is running as a Credit Card transaction, you will not face fees from your bank for doing that, but you may not qualify for the rewards.

This is where you check the terms and conditions of the card and see what it says for PIN based transactions vs non Pin Transactions (akin to running it as Credit).

Great explanation. Pretty much what I understood about debit cards re: the cash advance part. But the importance of using a pin, not a signature, was not something on my radar, since the only time I use debit cards is at ATMs in foreign countries, which demand a pin. Thanks; most helpful!

Matt,

Do you know if UfB does a hard or soft pull on your credit when you open an account? This might be a consideration for some.

That, I do not know. Sorry to show my naivety here but I have never worried about hard pulls from a checking account. I would certainly like to hear more about this from someone else though.

it is a soft pull.. however your credit reports cannot be frozen. Mine were so I got denied. I’ll apply with my aor in Jan.

Great info- thanks Andreas

Is this deal still alive?

Does the $1000 deposit have to be a monthly one like a gov’t payment or paycheck or can it just be a payment that you initiate from your other bank account on your own?

Also, can you load to Bluebird with this debit card and get points for it?

This sounds very promising.

Still alive and kicking, the link is above in the post (It is not an affiliate link). Funded mine via ACH from Citibank, miles posted without problem.

As for the BB, that is what I am testing this month, along with SC, will let you know!

I applied and my account is open.

What is SC?

Do you know if the checks earn miles the same as using the debit card?

Thanks for this!

Great- SC is the 2500 a week thing I talked about in the email

Matt, how long have you been doing this and do you have other regular transactions with UFB that are not MS-related?

Years. I sometimes draw cash from ATM when I need it, refunded ATM

Fees make this a great card for that alone!

Hi – Just applied and got this:

“Your Airline Rewards Checking account – Under Review

Your application is currently under review which simply means that we need to verify some of the information you provided. Within 1-2 business days you will receive an approval email or we will contact you by telephone or email if additional information is required to complete the review process.

If you have any questions regarding your application, do not hesitate to contact our Direct Bankers at 1-877-472-9200, Monday through Friday from 6:00 am to 6:00 pm PT.”

So I guess I just sit tight and see. Thanks.

Hi Matt,

Were you able to verify if SC and/or BB worked for UFB? Thanks!

Something’s working- I think BB. It’s such a weird posting cycle that I’m not sure which one is triggering the points right now and have tried to transfer random amounts so I can track the source.

Most SC have been shut down but mine works still- I’ve used it very lightly which is why, but don’t know for certain if I’m earning yet.