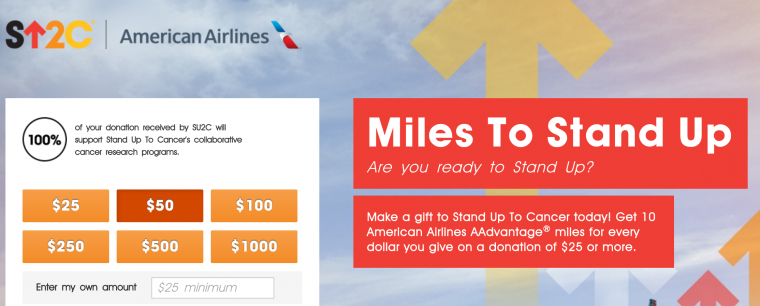

Cancer sucks. No argument there. But there are many ways to fight it. I was chatting recently with a friend about the American Airlines partnership with Stand up to Cancer, the deal is that for donations in excess of $25 they award you 10 miles per dollar. Additionally, as a registered 501(c)(3) charity, you’d be able to deduct the donation.

Sounds like a great deal right? Not so fast.

Reason 1

No due diligence. When you get gigs like this that are incentivizing you to donate, people often ignore the details of the underlying charity, they see $$$$ from the points, and ignore the finer details. Personally, I’ve not researched Stand up to Cancer, and they might be a damn fine organization. Point is, if you want to actually donate to a Cancer charity, you probably should check to make sure they are run efficiently and doing a good job.

Tools for this include: Charity Watch and Charity Navigator I encourage you to take a look at any charity that you support on sites like this to get a bit more perspective on them.

Reason 2

You have to itemize. When it comes to tax time, you get two choices, to itemize or to take the Standard Deduction. The latter is actually quite generous and often much better for many people. There’s nothing worse than donating $1000 to charity and then having to reduce your deduction from the standard ($12,600 for a married filing jointly couple) to $5,000. In cases like that the value of deducting is lost completely, so you revert to the Standard Deduction, and the donation has zero tax value.

Reason 3

You are receiving something in exchange for the donation. The IRS forces you to reduce the amount of any deduction by the value of the item received. A common example is a gala dinner: if the ticket costs $200 and is to a registered 501(c)(3) charity many people think they can deduct $200 per ticket. However, the IRS wants you to back out the value of the dinner. Sometimes this is stated explicitly in the terms of the ticket, and if it isn’t you have to calculate the value yourself.

In the terms for SU2C you can see a point valuation of 3 cents per mile. Here’s how that would work out:

- Donation of $2000

- Miles Earned 20000

- Value of Miles Earned $600

- Amount of donation to be reported $1400 ($2000-$600)

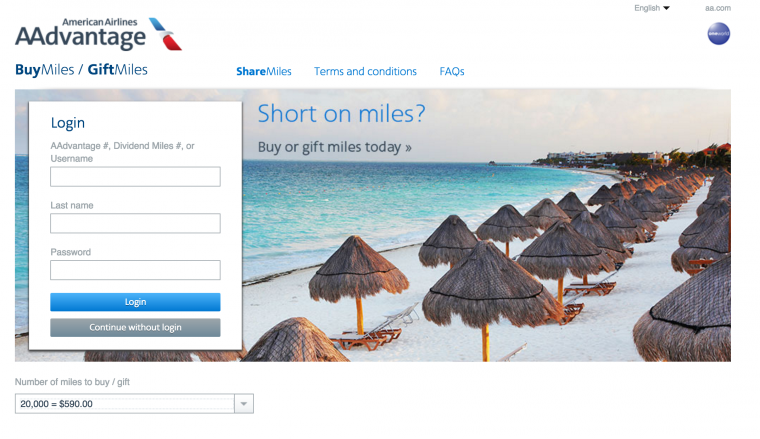

So you’ve donated $2,000, got 20,000 miles, and will reduce taxes by $1400 (providing you itemize and that makes sense). However, if you were to pick any other charity, donate $1400 to them, and buy miles from AA you’d pay $590 for 20,000.

Also, let’s remember (how can we forget when they pay commission..) that AA and other programs have bonus miles sales, so you could get 15% or more miles if you buy them at the time you like.

Conclusion

There’s two ways to look at this gig. From one perspective is purely financial – it is smarter to pay less money and get the same tax deduction and miles. The other way is to look at it that by losing out on the $10 you’d save, the charity gets $600 in extra cash to play with. This should make the donation to SU2C a better option, but if you are really serious about getting extra cash to a charity, you need to remember the first rule of charitable donations, due diligence. There are certainly some charities out there that would do more good with $1400 than others could do with 10x that amount.

Amen on due diligence. I love how American Cancer Society is a charity, yet the head of ACS makes $1 million plus a year as salary! Why? Because all the other charities based out of DC do too. Check it out. Rising water raises all the ships kinda thing.

The associated admin costs with ACS are obscene too.

What a joke, if all your donation money isn’t going to the actual cause, what’s the point? I’ll donate my money to my small community, I know the volunteers all pro-bono, so no one’s in it for the money!