The IRS issues a list of Merchant Categories, which the business use for calculating how they report their income. Credit card companies also use this listing process in order to identify which stores count as reward multipliers. Credit card companies list stores by their categories which can impact the reward multipliers available. Understanding how this works opens up unique opportunities in places that may not appear immediately obvious.

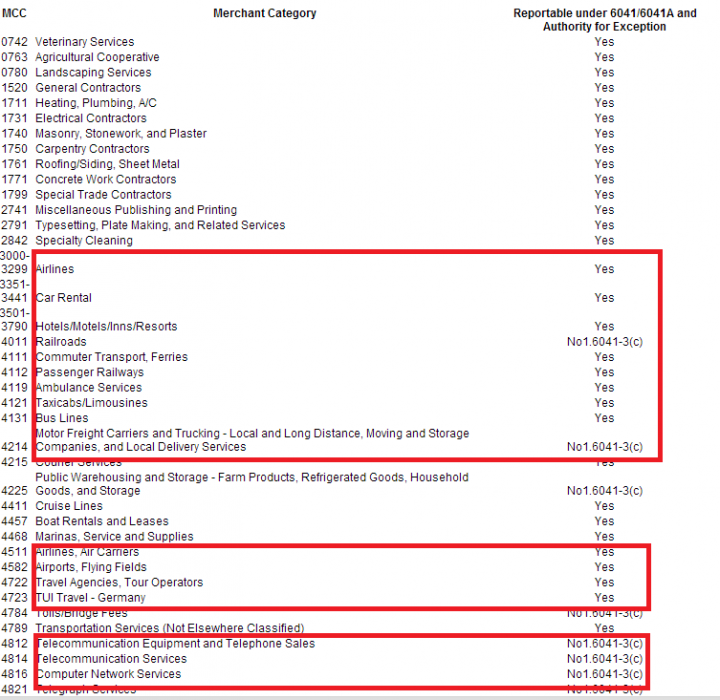

The MCC code is a four digit identifier, some to watch out for are:

- 5411 – Grocery Supermarket

- 5943 – Office Supply Stores

A quick search near my office location in TriBeCa shows almost 50 stores that aren’t the big names of Staples etc, they do seem all fairly genuinely related to office supplies, but if you know your neighborhood you might find ones that aren’t always what they might appear on paper.

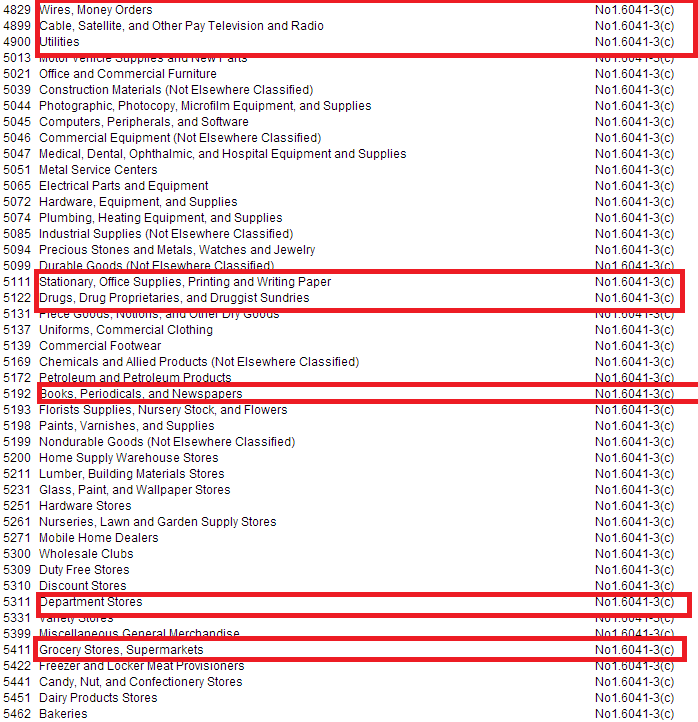

The full is list is quite lengthy, and can be viewed here at the IRS Website for MCC here are a few that I copied and highlighted for areas of interest:

And some more:

Applying this to Manufactured Spending

The difficulty in finding manufactured spending opportunities is that as the most common options are hammered by the crowds, and eventually store policies change, taking away lucrative earning opportunities, the most attractive earning opportunity in recent years has been the 5x earning at office supply stores. When these stores offered a $500 prepaid card for sale at $3.95 a tidy profit could be earned. When the office supply stores took these away it meant looking further afield to find such opportunities, a new contender became the Drugstore category that triggered 5x or 6x earnings on various cards.

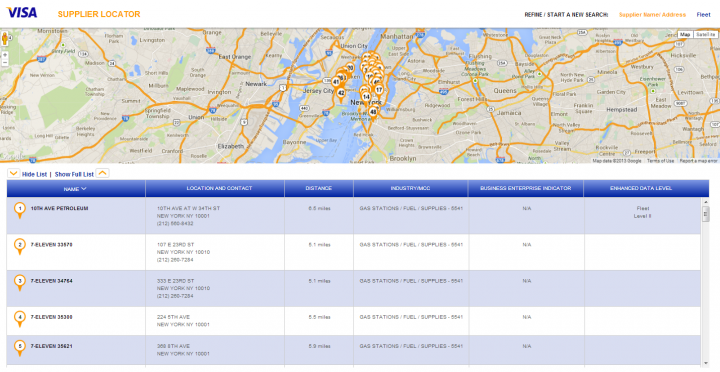

An interesting scenario appeared recently when certain 7-11 stores were coded as gas stations. This combined with the fact that certain of these stores sold Vanilla Reloads allowed for new 2 x (Ink Bold) and 5x (rotating categories on the Discover and Freedom card) opportunities to appear. New opportunities can arise anywhere there is sufficient value, the cost of manufactured spending on a card typically would call for a 2x or more multiplier, though in truth 1x offers profit (if we ignore the time costs for a moment). So where can we look for spending options similar to the 7-11 incident?

I would suggest that the most efficient process is to shortlist the cards that you hold (or are planning to get) and note their rotating category bonuses, looking for high level ones that you can then cross check merchants for suitably mis-coded stores.

Cards that offer Rotating Categories (5x but with low spending caps)

- DiscoverIT

- Chase Freedom

Cards that offer attractive everyday category multipliers

- 6 x for the Blue Cash Preferred at Grocery Stores

- 2x on Gas for the PRG Amex or Chase Ink Bold

So once we have the cards we need to then confirm the stores that work, remember, just like the 7-11 example they aren’t always obvious, in fact the way they report the store on the electronic network (and that therefore triggers the bonus) is due to something called their Merchant Category Coding, or MCC. Each of the three main networks of Visa, Mastercard and Amex have their own lists and codes and not all agree, for example Visa might code a Walmart as a Grocery store whereas Amex may code the same store as a discount wholesaler.

One super category that I found interesting is the co-branded card category for hotel spending. These offer the highest multipliers across the board. The Visa tool shows clearly hotel family searches, and one that I tried for fun was the Hilton Family Category 3535 and came up with an equipment repair store in NJ. Now, who knows how to leverage that properly, but it codes as a Hilton Hotel according to Visa MCC so you could be looking at 10 HHonors Points per dollar using the Citi Hilton Reserve, and 12x from the Hilton Surpass, along with the Hotel/Travel multipliers of cards like the Chase Sapphire Preferred…

I couldn’t a current link for Mastercard (I think I found one and somehow lost it!) or Amex but here is the Visa MCC list: VISA MCC Finder

Also, it is interesting to see that the banks also have MCC lists, discrepancies in which might indicate why Citi codes certain ‘cash like’ transactions as Cash Advances whereas Chase considers them a purchase.

Remember:

If Visa codes a store into a Hilton property but Amex does not then the Citi Hilton Visa will likely work, but your Amex Hilton might not (unless it also codes into that category) so make sure you correlate the card with the MCC network you are testing.

It isn’t a flawless process since even when a store has been miscoded sometimes it just doesn’t post as anticipated – most likely due to manual override on that specific location, so if you find something that looks interesting (such as a Walmart coded as a Grocery for the Amex Blue Cash Preferred) don’t go all out in your first attempt, buy something reasonable, and see how it posts to your account using your online bank login, if you strike gold then go bigger. Another good one would be Target since they have some interesting reload options with the Amex Target card, getting 6% Cash Back on those purchases would be pretty neat.

Other Relevant Data

There is another code called Merchant Category Group Description MCG Code which makes the difference between a Cash Advance and a Purchase as follows:

- Travel 1

- Lodging 2

- Dining and Entertainment 3

- Vehicle Expense 4

- Office Services 5

- Cash Advance 6

- Other 7

Mastercard also uses a letter next to the 4 digit code, known as the Transaction Category Code TCC:

- A Automobile/Vehicle Rentals

- C or Z Cash Disbursement

- F Restaurant

- H Hotel/Motel

- O College/School Expense

- O Hospital

- P Payment Service Provider

- R All Other Merchants/U.S. Post Exchange

- T Pre-Authorized Mail/Telephone Order

- U Unique Transaction Quasi-Cash Disbursement

- U or R Cardholder-Activated Terminal

- X Airline, Railroad, Travel Agency/Transportation

For more info on the MCG and TCC see this link

Conclusion

There are a number of errors out there to explore, using the Visa or IRS codes work well to get things started but don’t go too big on things until you see them code per Network – a Visa may work when a Mastercard does not. However, since the underlying source of these codes comes from a consistent place (the IRS reporting) then it is likely to find overlaps that work well for you across networks.

Happy shopping!

Amex PRG is 2x gas ;). The 3x is airfare.

Thanks Mike – going from memory is never a good thing!

You also can get 3% cash back for gas using blue cash preferred, no cap. IMHO that’s better than 2x for PRG or Ink

Thanks for this informative post.

I noticed that there are 2 codes for OSS, 5111 and 5943, would the bonus multipliers apply to both codes?

actually the 5943 definitely works, the 5111 would be the one to test…and i’m not sure right now how it posts.

I’ve used MCC to look in my area for office supply eligible stores besides the usual chains, but I’ve never found anything other than industrial-type companies that sell to other businesses. Hopefully somebody else is having better luck.

Yeah, I think I need to run a kickstarter campaign for an office supply store that sells groceries 🙂

Purchases at 7-11 with an AMEX are coded as a Grocery store, perfect for the PRG card @ 2x

Nice! Great value when they pull those avios transfer bonus thingies too..

Great post! I’ve got a few stores that show up under the Visa Office Supplies category (5947) I need to check out by me. Brookstone, Brighton (my wife’s favorite store), Yankee Candles, etc… There’s even Passion Parties by Zor – WTF? 5x for bedroom toys!!! haha…

Wow 5x literally everywhere…

Is there an updated link to this? I tried to access the link but it no longer works. (I do realize this post was several years ago.)

Nevermind. I think I figured it out. 🙂