In this post I’d like to attempt to merge two topics from the forum, and add in a little more food for thought. The overall topic that we will be looking at is the cost of cruising full time, or pretty much living on a cruise ship, the ghetto way.

The neat way to live on a cruise ship was explained by BuddyFunJet as negotiating a long term agreement with the line, and parking up for an extended period of time, but that does tend to cost a fair amount of money, even with discounts. And stemmed from a conversation that Plane2Port started with her post:

How much does it cost to live on a cruise ship? this post drilled into specific examples such as:

- How much does it cost to live on a Royal Caribbean cruise ship?

- How much does it cost to live on a Carnival cruise ship?

Coming soon is an NCL version.

As I have a bit of insider knowledge of NCL, I wanted to put forward a few more ideas, that really dive into the notion of basis and burn pivots.

Basis

Our last cruise was around Cape Horn. All in, the price might have been around $2600 for the 3 of us in a Mini Suite. Personally, I don’t think that as the cost, rather that is perhaps the exchange of appreciated assets for services. A tax free event, akin to donating appreciated assets.

Freequent Flyer, who digresses into discussion on personal finance when he wants to stir up trouble recently posted about Capital Gain Tax treatment, asserting that it should be treated as ordinary income. The conversation raises interesting thoughts about the value of wealth, and how the US focuses on tax realization events for revenue. In his example, someone who owned an entire company, valued at Billions would not be taxed unless that person did something to trigger taxation, and therefore wouldn’t be considered rich.

When we think of Capital Gains, it is the spread between Basis and Sale price. The basis is what we paid for the item, the sale price what we received for it. Basis is key. When you take that principle into travel, rather than consider the Sale price of my cruise as being $2600, we could instead consider the basis, since basis is really what the impact was to wealth. For example, imagine if I earned $2600 using some underwear method that cost very little time, and say, $1 per $50 earned. $2600 to me would actually be a basis of $52 in fees, and the redemption of capital gain for $2548, tax free of course.

Burn Pivot Points

I try to remind people that there are always at least 2 areas of influence when completing a transaction: how things were earned (Basis in this case) and how you can leverage Burn pivots. The burn pivot is product specific. For example, if you wanted to buy something from Bestbuy, you might use a case specific 10% Bestbuy coupon, this is a burn pivot. In the case of a cruise, a burn pivot could be the NCL CruiseNext program.

CruiseNext allows you buy NCL money at half price. If you buy $500 onboard you get a rebate of $250 instantly, even if you have no other charges. If you consider basis and burn pivots here you get to buy $500 of NCL cruise money for a basis of $5, the double pivot points create 100x leverage. There are some rules in place to restrict use of these certificates, generally speaking you should only use 1 per booking, and the booking needs to be 6 days or longer.

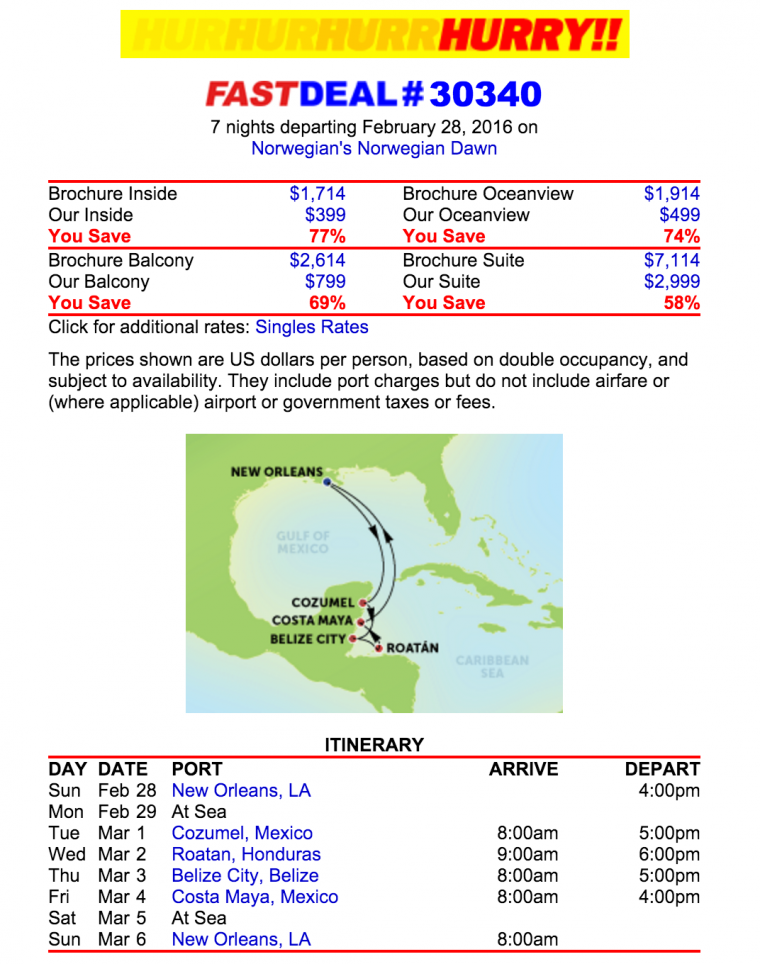

While I hope to see the next post from Plane2Port soon, here’s a nice example of a NCL deal, $399 for 7 days.

I didn’t add on port fees and whatnot, but let’s say $200 pp. And then we should add on $95 pp for tips. Total price:

- Base Fare $399

- Port Fees $200

- Tips $95

Total for 2 pax $1388 ($694 x2)

Now let’s run the basis and burn pivots on that:

- minus $250 of credit ($5 basis)

- $1138 balance (basis of $23)

Total cost for 2 pax $28. Not too shabby.

How about sustaining it?

Let’s pretend that you were able to remove the 3% convenience fee on the ship for casino charges. This can be done either via social engineering, or by attaining NCL Casino at Sea Golden Status. On paper, this allows you to charge $3K per day to your card at zero expense (there’s another hack here, but it’s not one for google). You’ve created the perpetual points machine (in theory, until you get caught out and forced to walk the plank).

7 day cruise, $3K per day= $21K at 2% = $420 of future travel money at $0 basis.

So let’s go onto that cruise, you’ve already accounted for everything upfront, so no more expenses, if you were to only buy $500 in CruiseNext your total bill for the cruise would be $250. Minus that from your $420 of travel money, and you’ve got $500 towards the next cruise, plus $170 left over. As you can see it isn’t ‘quite’ enough by itself, but if both passengers were spending $3K it’s pretty close, even more so when you are able to apply more than one CruiseNext voucher to your itinerary.

Interestingly, you also rack up status on NCL through their regular ‘latitudes’ program, which I explored back in the day in my post Stacking Casinos at Sea and Latitudes. So it won’t be too long until you get some really nice benefits, if you were able to attain Golden Level Casinos at Sea and Platinum level Latitudes your cruise could look something like:

- Free premium drinks (includes wine, premium liquor such as Woodford Reserve)

- Free dinner at Le Bistro

- $150 Spa credit (for haircuts etc)

- $100 food credit for speciality dining

- Free bottle of sparkling wine in room

- Free laundry

- Free cocktail receptions (2-3 per cruise)

So you have a combination of Basis of cost, burn pivots, two loyalty programs stacking together to create a pretty neat lifestyle. One that isn’t quite sustainable, but the shortfall isn’t as much as you might think.

Having worked for cruise lines for over 30 years I personally know a number of people that live on cruise lines but they are in the luxury end of the market. For these people it is less expensive then going to assisted living. Of course the cruise line will not accept you if you are in need of looking after so to speak.

There are a couple of flaws with your outline. First, the casino would put a hard stop on them being a piggy bank and it would be obvious after 1 cruise what was being done. At that point the casino manager would say No and they are within their rights so your perpetual money machine would come to a screeching halt. Many cruise lines are now limiting how much you can take out and when they see you are not playing they stop you. We were stopped on a Princess Cruise and a HAL cruise when we started to get greedy. Other cruise lines limit you to $300. per person per day. Not bad but not what you are thinking. You may be able to do a deal as you outlined once but anything more then one week and your faces will be known by the casino cashier, the manager and they will not have smiling faces.

Unless you “cut a deal” with the cruise line you would be in different cabins every week/cruise. If you are willing to do that, cool. You would have to book everything in advance and the pricing could vary per week depending on the season.

Perhaps. Let’s also remember that I’ve worked in casino management on a cruise ship.

I do agree that if you do this without social engineering and common sense you will be flagged, but also I know how those flags can be avoided.

For example, you reduce the casino manager influence by not back to backing on the same cruise. The message will still get through, but will take longer this way.

I also know the daily limits are much higher than what I discussed in the post.

Now.. That said I think you are right that many people can screw this up, but if they folded this into a lifestyle, eg did 5-6 cruises per year, per line, they may be able to get away with more.

The real message I’m trying to focus on here though is basis and pivots for lifestyle. The cruise aspect is just an anecdote.

I always appreciate posts that show multiple ways of traveling to minimize cost, but aren’t you making this *unnecessarily* complicated conceptually by wrapping taxation themes around the idea of saving money?

I just think there might be more straightforward ways to make the point, but wtfdik?

The point I’m trying to make is to understand basis of the transaction and the leverage that can be gained uniquely from the transaction.

If you can understand the concepts then the traveling aspect becomes just an example or anecdote, allowing you to find your own deals.

My purpose is writing the “cost of living on cruise ships” posts is to provide a base line for further investigation. There are many factors that determine final cruise price; indeed, we need a statistician to do a multi-variant analysis to determine the cheapest cost-per-day cruise.

As you’ve correctly determined, once you know the basis, then you can begin leveraging, or stacking opportunities. Everyone might start with the same basis, but the stacking opportunities will often be individualized.

For example, not everyone could take advantage of casino offers, but they might be able to take advantage of shareholder discounts or cruise line gift cards.

However most people don’t even know where to start and that’s why I’m writing my series. Hopefully it will serve as a catalyst for people to brainstorm their own opportunities.

Yep, helped me brainstorm ideas here for sure!

Btw, would anybody be happy living in an inside cabin that’s 200 square ft (if that). That is the cabin for the price advertised. Maybe for some people they could do it for a week but sustaining living in a glorified closet? There are usually no shareholder discounts. You can get a SBC for being a shareholder of The publicly held companies like CCL and RCI.

Kudos though on thinking outside the box. This one is not as easy in practice as it looks in theory.

How long ago were you a casino manager?

I wouldn’t, but maybe some would. Principle applies to a balcony too though, just the shortfall is larger.

I did the job after college to get some ‘free’ travel in.