Every now and then I catch myself opening my wallet and having way too much cash in it… it gets me to thinking about how efficiently we are using our money, and what difference we could see from holding it vs putting it to work. Having pondered this for some time I have gone through a cycle of thoughts and will explore them here. And I also want to share a cautionary word on trying to work it too much.

Some cash is good

When a country has inflation Money is always devaluing, so holding cash in your wallet means that to a degree, it is losing value every second. However, if you didn’t hold it in your wallet there would be a time where you needed access to cash for a purchase and it wasn’t there. Keeping a zero balance would therefore be inefficient and require multiple side trips to obtain cash.

So, having some cash is good, too much is bad. Too much is subjective based on your habits. I would say that greater than the risk of lazy money is the risk of loss/theft when you hold too much cash.

Depositing that money into Checking

I have a number of bank accounts (into double digits) but only one of them is a Bricks and Mortar bank – Citi. Therefore if I want to deposit cash I tend to go to the local Citi ATM and insert bills. Psychologically, this feels better to put the money in the bank, but with current market rates is it even worth it? I have a Citigold account, offering the most interest from their retail banking options, and even that is a paltry 0.05%

Let’s say I was carrying $500 too much in Cash, over the course of a year having that in Checking would yield 25 cents in interest (which would be taxable) so we are talking about 15 cents lost by being ‘on top of my money’.

In a low interest environment is it worth the effort to chase percentages?

Excess wallet cash fluctuates – you might receive a gift, require cash for travel, sell something etc several times over the course of one year. If we simplified the inflows and outflows to a nice, $500 in, $500 out, say 3 times over the year you have 6 transactions in order to reap that 15 cents. Ideally we would have more inflows than outflows, but with cash being a transaction tool it wouldn’t be uncommon to see more evenness. So now we are down to being paid 3 cents to take that money to the ATM. The term penny wise, pound foolish springs to mind.

The next level – tapping Equity

The majority of middle class American wealth is in home ownership and retirement plans. Common arguments for the reason for this is that they are forced saving schemes. While these can be considered assets that are appreciating, to an extent there is the same concept of lazy money happening here too.

Home Equity – if your home has appreciated in value it is easy to find equity to tap into. HELs and HELOCs are tax advantaged (up to the first $100,000) for many people, and $100,000 of equity is certainly more notable than the $500 that was yelling at me from my wallet. Due to the value of the money in discussion now, checking accounts wouldn’t be the location for this, rather a more attractive yielding investment, but for descriptive purposes $100k in checking (assuming I now take the time to transfer it to a high yield account like CapOne 360) would kick off $800 per year.

Of course, tapping a HEL/HELOC would cost at least 2% in tax advantaged APR, so you would be paying about double the $800 in fees.. not a money maker, yet. However, a 30 year treasury bond is currently paying about 3.4%, which would offer a low risk investment at a profit.

Don’t fund long term investments with short term debt

The problem with the Treasury idea is that you are locking in 3.4% for the duration. If interest rates rise (and they will) the face value of your bond devalues. That means you pretty much have to hold at 3.4% even when the market is offering higher. The real problem here is that the interest rates on the short term borrowing (HEL/HELOC) are not fixed for 30 years, they are variable rates, so as rates rise you pay more to float a crappy investment, and soon are underwater.

Higher Risk, Higher Rewards

There needs to be a correlation between higher risk strategies and higher rewards. It is the basic premise behind the Capital Asset Pricing Model (CAPM) simply put you know you can earn $800 from Checking, why would you take on additional interest rate risk for a marginal reward? The simplified value calculation that you need to make is what is the suggested rate of return minus the risk free rate of return and then decide if the risk is worth the product of that.

Simplified Example of $100,000 Equity Leverage

- Cost to borrow 2% APR $2,000

- Risk Free annual Rate 0.8% APR $800

- 30 Year Treasuries 3.40% APR $3400

Treasuries offer $3,400 – ($2000+$800) for $600 upside

The amount of upside offered is then measured against risk, both in its likelihood and its severity.

If interest rates rise 1.5% then cost of borrowing becomes 3.5% (for illustration) and the bond pays a fixed 3.4%. Therefore you are losing 0.1% on the spread (ignoring tax) and you are holding a bond that nobody wants (the new issues will pay more) you will see the inverse relationship between bond prices and interest rates at play.

Please note at this time that there is an extra variable at play – if you are borrowing on the HEL/HELOC at 2% then you have the underlying interest rate plus the banks profit in there, so if the rate of underlying interest should raise by 1.5% the banks lending rate won’t increase 2% +1.5% it will likely increase at a higher rate than that in order to maintain margins.

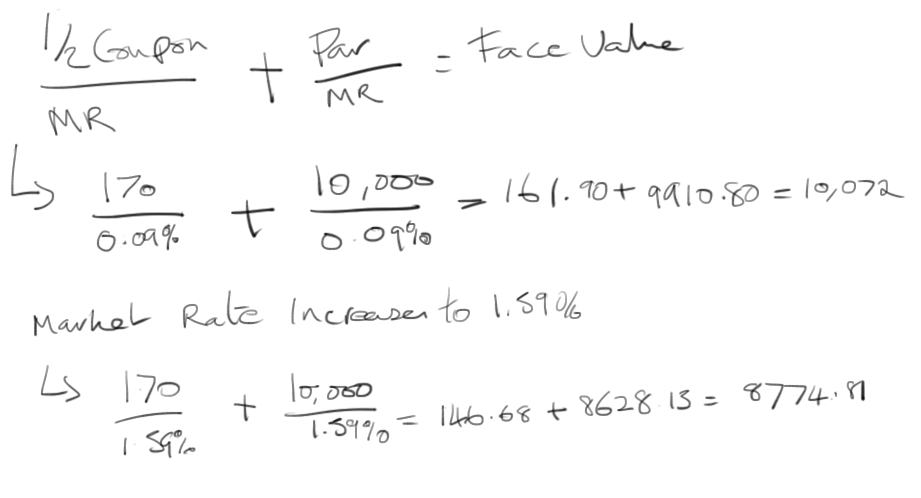

The severity of the change here would mean that if you locked up your $100,000 in the Bonds you would have to sell at a loss, the face value would have dropped from $10,072 per $10,000 to $8,774. So you have two choices:

- Keep the bonds for 30 years and be losing the spread between the HEL/HELOC and the Bond each year, which could easily be 2-3% of $100,000,

- Cash them out, and take an immediate hit of about $1,300 per bond, use that to pay down the $100,000 HEL/HELOC and be in debt to the shortfall.

Calculating the likelihood of this event is a lot harder to predict, and would require a careful eye at both Micro and Macro economic trends, plus a lot of crystal ball gazing.

Why is this in the Travel Section?

It’s here due to a conversation I had in The Forum. I build a resource that explains Roth IRAs for reference. A reader wants to tap into something much more risky than this in order to leverage money. There is a very narrow window within an IRA withdrawal (60 days) where you are supposed to be ‘rolling over’ from one provider to another. My reader wants to pull out this money and put it to work, then replace it within 60 days.

I used a financial example of the HELOC/Bond Aribitrage to show the risks involved and how to think about things. In the IRA example the risks are worse.

If the money is not replaced in time, the account will be penalized, the penalty would be 10% and there would be ordinary income tax on the distribution also. What’s more, the money can’t be replaced, so it would have to be rebuilt over years, making a massive difference to compound interest growth. The severity of the risk is huge. What’s more the likelihood of the risk is also huge, because money is frequently locked up during manufactured spend. That makes it an awful decision to make.

While this is an extreme example, I have had many people come to me and ask if they should hold off putting money into an IRA and use the money as a manufactured spending float – the answer NO WAY!

You have to realize your limits and stop getting wrapped up in seeing other people ‘earning’ more than you. I know of folk who are putting 7 figures through manufactured spend every month, if they have the float then good for them, but you need to realize the relationship between wealth and ability to leverage it safely.

Too much focus on squeezing pennies not earning pounds

As your wealth grows you start to learn that chasing after pennies is less important. I certainly think you should make your money work for you, but every decision you make needs to factor in the real upside, and the real risk involved. The first few hundred thousand dollars or net worth are going to come from hard work (or an inheritance) you can’t achieve the things others are achieving if you think you can dial down the work front after accruing a $100,000 IRA or $300,000 house.

Getting that far is awesome, but squeezing pennies out of it too soon, especially without truly ranking in risk is a recipe for long term disaster.

What’s more- it is totally unnecessary, unless you have bought into the bullshit of bragging and envy. If you are still on the way up the financial ladder then aim moderately today, the real goal isn’t if you can be like some idiot blogger flying First Class, it is true financial independence. Building that takes time, caution, and calculated risk. Don’t waste your time chasing your lazy money, use your time to earn more, and don’t start slacking off the earning and looking to tap into long term equity to support a short term fix. You need that wealth to really hit the big time, don’t waste it following the crowd. The average person doing average manufactured spending can easily travel for much more than they have time for (when holding down a job) in very good style. There is no need, nor sense in going bigger – especially when the risk is serious harm to your net worth.

I fear that people are losing sight of the value of the strategies I discuss. They can compliment a holistic, value driven lifestyle, very nicely indeed. But they are not the replacement for going out there and working hard. It is no different from the people who think they can quit work at 30 with $100,000 in the bank and day trade… just don’t do it!

I believe there was a recent court decision penalizing a tax attorney for doing serial rollovers and investing his and his wife’s IRAs. If I find it again, I will post a link in the forum. Maybe the reader needs to think about legal risk, as well as financial risk?

That would be interesting to see, thanks!

http://www.marketwatch.com/story/ira-rollover-ruling-stuns-advisers-and-savers-2014-04-04

Ah.. very interesting! Yeah I had seen it but I hadn’t connected the dots… the Rollover VS transfer issue. Rollover 60 day window that we were talking about whereas the transfer is instant… I’ll have to do some more reading to see if the limits are going to impact transfers too -one good article is never enough 🙂

it was on fatwallet a while back. Pretty much it was an arrogant tax attorney who rolled over funds from one ira into another. I think he did it about 60 times, and it was just so he could give himself an interest free loan, heres the link i believe http://www.fatwallet.com/forums/finance/1350083/

Well, it’s not a bad idea 🙂 especially with the welcome bonuses they are offering…

Matt – your comments are usually sound and thoughtful. I used to listen to such advice. And never got anywhere – the Average Joe isn’t going to do much better than underlying economic growth rates with the “safe” strategies that are talked about.

The wealthy (the 1% – mostly the 0.1%) made their fortunes by taking LOTS of risk. They quit their jobs/started companies and most off all, were extremely lucky with their timing. Couldn’t have been Zuckerberg in the 90s. Couldn’t have been Gates in the 70s. Couldn’t be Buffet now (no way to outperform overall market on sustained basis without insider information or some scheme like HFT that is quasi illegal).

Most of the wealthy concentrated their investments, watched them like a hawk and became experts, knowing far more than the Average Joe, let alone investment banksters and other similar incompetent idiots. Only when your main consideration is preservation of wealth are when the usual hackneyed investment strategies worthwhile (bonds/ETF/Mutual Funds etc).

Paul,

If you understand the risk, then I am totally fine with it and completely agree with you. My real issue is with so many people not understanding risks properly and going off half cocked.

Furthermore, and a very important piece of the puzzle, the mindset of the people that I am seeing and describing here is not to risk it by going all in on a high risk venture, but it is those who just want to take their foot off the pedal and relax. It is a different thing from an entrepreneur.

Matt,

I think I understand your reasoning regarding the 1-2% spread of the Home Equity and the 30 Year Bond. However the interest rate risk in my opinion is HUGE. I think I am not alone to predict double digit inflation within the next 10 years and then good luck selling your 30 year at anything close to face value.

If you can get a “guaranteed” ROI of 10-20% doing MS instead of putting that flow money to IRA, I say go for it. You will be hard pressed to do anything close to that on your IRA.

My 2 cents.

I didn’t say it wasn’t HUGE! 🙂

However, for your 10-20% MS over an IRA – take it a step further. Who is this person that cannot afford an IRA but can afford to play with say $5000 into an IRA each year? Clearly they are earning very little for that cash flow to be an either/or equation. The IRA is not just about asset allocation but asset location. If you are looking at a Traditional IRA then you could be looking at way more than 10-20% Return just from tax deductions, plus you have compound interest.

Also – don’t forget many people are MSing points, that they value at 10-20% but are actually worthless in relation to a retirement account – they are fun, but they are to be burned.

I used to think IRAs were the best thing since sliced bread, but not so much anymore. Everything being equal, of course I will put my money in a tax advantaged account. However 99% of the IRA market is controlled my “Wall Street”. EVERYTHING seems to be inflated there. I am not saying you will not make money there, but to me it is a big gamble everywhere I look. Most stocks have eye bleeding P/E ratio Bond yields are artificially kept low by the Fed. Surely, there are some other asset classes that you can utilize an IRA account like real estate for instance, but because of the fees you have to play big to make it worthwhile. I think for small players with less than $100K, the question should be can I make more money using MS float or putting my $5K in an IRA. Sorry to be so pessimistic. I think in one day the stock market will be great place to be. When P/E ratios will be around 10….

I used to say I want to invest in a business that will yield at least 10% return on my money, if it is a risky investment. Everything is relative, now I guess I should risk my money for a 3% return.

Was that a typo when you said you know of people who are putting 7 figures, a million dollars, through ms every month? How is that possible? Aside from having high credit limits which I’m sure many people have, where can they find places to buy $33,000 worth of whatever they are buying every day? Can you elaborate on this a little more with some examples of what ms is being done at this high level?

No typo- it is easy to put 1m through in a month if you can float the money. It is simply a case of being able to cycle back to the card at an accelerated rate.

People can do this with just one ‘gig’ or ‘pipeline’ and everyone has more than one pipeline.

For more specifics I would be happy to talk in The Forum.

Easy? I’ld say it’s hard work . For most type of MS techniques, circulating $12M/year would be a full time “job”.