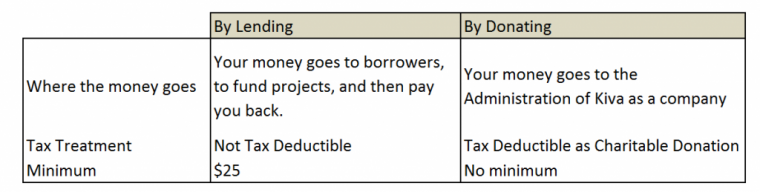

A reader just contacted me regarding their thoughts on Kiva, and giving back to the company. Kiva is a micro lending site, that is not as cool as Zidisha but still does some good by crowd funding loans to people who otherwise wouldn’t have access to credit, primarily in developing Countries. There are two distinct ways to support Kiva, the differences are as follows:

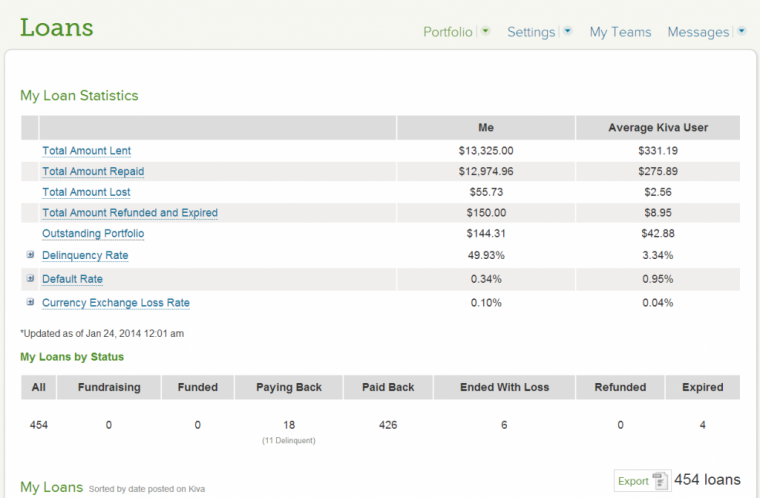

The decision to ‘give back’ is always subjective. Some people will say that the mere act of loaning their money to the borrowers at Kiva is a fair exchange for any earnings or benefits from doing so. Indeed, it could be said that the ROI when factoring in risk of default isn’t great with Kiva, but typically it is good enough. I dropped into my account page to see what my ROI is from the program.

My actual deposits were $12,149, the number shown includes the lending that I did from repaid loans. So my minimum earning from the site (assuming that I used at least 2 cents per point from a Credit Card) has been $248.38, from that I have already lost $55.73 in defaulted loans, and I have a further $72 in delinquency, which may or may not be money that I never see again. Looking at this conservatively, we could say that I have lost about 50% of the gain when calculated at 2% profit per point.

The Hail Mary Pass Value

However, reader Will, who contacted me about this question brought up his reasons as very similar to my own, (though he did get 3% profit per point!) it wasn’t so much the cash back value, but the time pressured need that Kiva fulfilled, there were several times where I bit off more than I could chew on an App-O-Rama and needed to throw $3,000 at Kiva to meet the 90 minimum spend requirement of a card, so the value they offered me was above and beyond the ‘average return on investment’. Will also mentioned events like when he bought a Gift Card and the PIN wasn’t working, Kiva provided an outlet.

Donating To Kiva

So, in fairness, they have done great things to help, beyond simple mathematics, and as such giving back a little might be a good idea. The Donation Page on Kiva allows you to select an amount that you want, and you could calculate it from your overall profit. When you do remember that Donations (not loans) to Kiva are deductible. So in my case if I was to donate $124 (my estimated profit at 2%) I would still be ahead since they helped me with the minimum spends, and I would get a deduction of the $124.

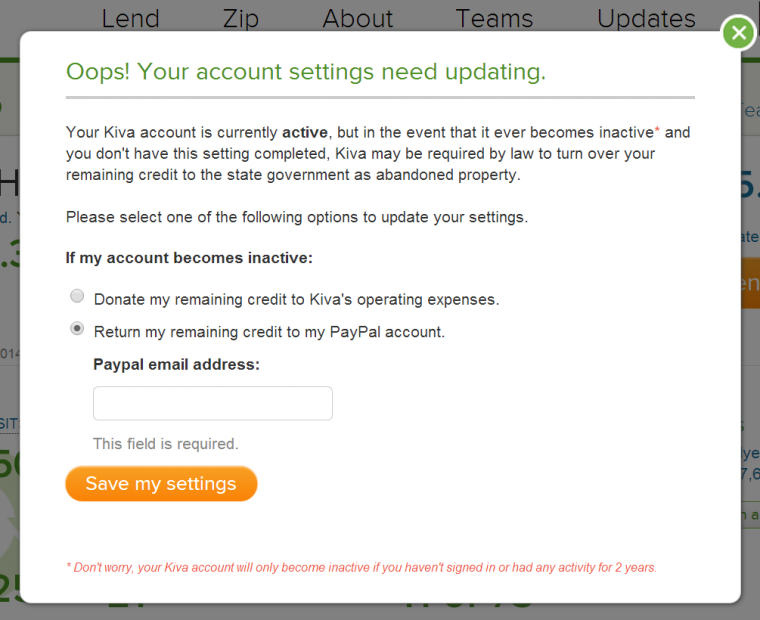

Also, you may wish to login to your Kiva account and check your settings, as it might well be that your funds automatically donate to Kiva unless you check the ‘return via Paypal option (they would sit there for 2 years before taking the donation from you).

If you decide to voluntarily donate , if you cashed out the balance of your account first then donated with a card, you could get some more of those highly addictive points you have been craving. The ultimate decision rests with you, my personal opinion is that simply investing as a lender is enough to create a ‘quid pro quo’ situation, but going above and beyond and giving a donation is actually quite beneficial, and may have the added value of keeping this outlet alive longer.

Do you really want me to get started on this? 🙂

Your views on charity or your views on putting 7 figures through Kiva? Both would be an interesting read!

To be honest, I’ve reduced my lending now that a) I’m down to a single credit card that Paypal won’t reject for Kiva funding, b) loading gift card funds repeatedly resulted in Paypal freezing accounts and a number of headaches, and c) my delinquency rate shot up. With the 1.1%+10 return on the Chase Freedom, I had always given Kiva the 0.1%. A friend of a friend once worked there; it’s a shoestring operation mostly dependent on donations and grants, which puts the long-term model in doubt.

Glad to hear they are on a shoestring in some ways, I have seen too many 503 companies that are too spend happy with their profits and take money away from the target. My delinquency rates are up too, but still below the profit line.