A common question among the masses is, how can American Express pay you to buy gift cards? There are rebates that vary between 1-2.25% currently, and 4% or so have been seen in the recent past. That’s on top of Credit Card rebates. Let’s dive into some economics and see why they would do it, and how profitable for them it is.

Starting with credit card rebates

Credit card rebates, points, miles etc are kickbacks that encourage a customer to spend on their card. The economics of the kickback work in such a way that the card you use gathers a fee for the transaction, and they push back some, sometimes all, and sometimes more than all.

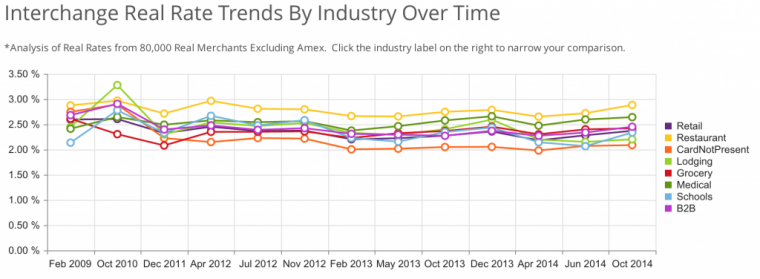

Many people cite numbers of 2-3% for such fees (Amex being on the top end of that, hence why many small businesses don’t accept Amex, barring that on a Saturday in November..) however, the numbers fluctuate further between the merchant codes. Here’s a useful chart by VantageCard.com:

Summary: the bank generates some revenue and passes it back to the consumer in order to further fuel growth.

Buying a gift card through a portal – who pays whom?

In the case of a person going to TopCashBack to buy an Amex Gift Card with a Visa Credit Card, the following happens:

- Amex pays Visa interchange fee (~ 2%)

- Amex pays TopCashBack affiliate fee (perhaps ~3%)

- TopCashBack pays Customer 2.25% and retains 0.75%

- Visa pays Customer in 1 reward token per 2% earned

$1000 Example

- Amex paid $50 to gain $1000 in accounts

- Visa paid $20 to gain $20 interchange fee

- TopCashBack paid zero to gain $7.50

- Customer gains $42.50

From an economics perspective, who has lost out? Certainly not the customer right? They have gained both credit card points AND cash back on their $1K.

Perhaps Amex lost out? They had to pay $50 to gain $1000. Is that really such a bad thing though? Consider the following:

In a low interest rate environment it seems like debt could be acquired for less than 5%, however, this is a special kind of debt. If you borrow from an institution you have a liability to pay back that won’t go away. But a gift card liability can actually go away. Amex is decent in that they don’t charge a dormancy fee, but even if they don’t there is still upside potential from lost or forgotten cards. If a person was to buy $1000 and die prior to spending it, the family of the estate might have no idea of the location of the card, and Amex has no obligation to inform them.

How much revenue does American Express generate from unloading the Gift Card? Remember they are one of the most expensive networks. Interestingly, they aren’t that greedy, and have actually reduced the merchant discount rate from 2.10% to 1.80% for prepaid cards, as you can see here in a letter to Michigan State University.

Let’s look at that as investment:

Would you pay $50 for an investment that will be worth something between $18 and $1000 in the future? Of course, there is a curve here, and would imagine that most gift cards would be cashed out in full, so in more cases than others, you’d lose $32. But if you ‘lose’ 31 times, you’d only need 1x $1000 ‘hit’ to be in profit. Likely there would be a broad mix, with some people cashing out in full quickly, and others never doing so, and all sorts in the middle.

A 2014 study by Card Hub stated there is $44B of unused giftcards in the US.

Still not for you?

I can get it, but what if you were also regulated to lend money out to people at rates of say, up to 30% APR? Would you take the cash in at that price? In the previous paragraph I highlighted quickly because we are now entering into the land of debt exchanges. IE Amex is buying money to service debts. And even if we picked a conservative credit card APR of 14.99% the discount value of $1000 for 12 months at 14.99% is $861. In other words, should we compound monthly, as a credit card does, an amount of $861 is worth $1000 12 months from now at that rate.

So, Amex isn’t losing, although their profit is clearly variable and averages out over many accounts.

Does TopCashBack lose?

TopCashBack – easy, they never pay out more than they take in, so they are winning. They can win more because they don’t autopay. Again, they earn money when it is forgotten about, so they only see upside from the transaction.

Visa – do they lose money?

Not really. If they were to give away 2 cents for 2 cents it would be a breakeven. However we must also consider how many ways that can be offset to bring them to profit:

- 1% cashback cards would create a profit of 100%. This could be leveraged further if points are forgotten about, or if they offer alternative, inferior cashout options (a toaster for $80 anyone?)

- Travel (airline/hotels) points and miles are acquired at a discount rate, far below 2 cents a pop. Should the airlines liability increase too much, they simply devalue the points. This keeps acquisition costs low.

Again, there is only upside here. Worst case is a wash, best case is that people forget all about their points and they expire. And the holy grail of it all – they get people in debt paying interest.

Conclusion

Everyone wins because of averaging. Even with a few extreme cases where people shuffle money rapidly through the system, there are more than enough people out there with mediocre performance, and attrition of debt to cover any loss leaders like that.

Good read as I always wonder how the economics work for amex thanks for sharing

Great post Matt. Very informative and good breakdown of why GCs (and specifically AGCs) works so well!

Thanks for the great read… Just curious…what about the retailer which you use to liquidate the card, assuming manufactured spending? I’ve always wondered how much drug stores, office supply stores, and grocery stores pay in interchange fees when we buy gift cards from them. A $500 GC purchase or $1000 Redcard load at Target with an Amex GC is probably a money loser, assuming a 3% interchange fee (which I’m sure is a bit lower because no one would sell gift cards if they lost money with every purchase).

Yeah, I’ve thought about this a lot too, I’m not totally sure. On one level there remains that not everyone will pay with a CC or the full amount. For example someone might even buy a variable $20-500 GC for $25.95 with cash (or even with a CC).

The other question is what they earn from the transaction – is it just the handling fee, or do they acquire the cards at a discount?

Good one, Matt. I like your way of analysing and simplifying things and making them clear for readers as well.