Forward Shifting is a concept that allows us to prepay for certain items now, in order to reap present day benefits. A good example of this in personal finance is to over pay state income taxes, because your annual Federal deduction is calculated by the question “How much did you pay this year?” rather than “How much were you asked to pay this year?” The advantage here is that you can defer income tax at a high rate (particularly useful prior to retirement, sabbatical, returning to college, etc). Don’t forget to pay with a gift card or 20 too….

When it comes to credit card minimum payments, forward shifting (FS) is another opportunity to meet spend requirements. Let’s explore that.. much more fun than taxes, right?

Key considerations:

- Category Bonuses (of FS Card)

- Category Bonuses opportunity cost (alternative cards)

- Discount rate via

- interest saved, such as: student loans, mortgage

- interest earned such as: high yield checking, selling drugs, binary options (listed in order of risk)

- Loss Risk and Change Risk

- Future Bonus Risk

Category Bonus considerations

If you own a Chase Ink Bold, which has 5x for your cell phone, and need to FS $3000 of Barclay Arrival (2x everywhere) then FSing cellular has opportunity costs of the points spread. Example:

- 3000×5 = 15000 ultimate rewards

- Average phone bill $100 per month

You therefore are ‘paying’ 15000 in lost opportunity in order to receive your min spend bonus on the Arrival. All things considered, if you have no other option and risk losing the 40,000 pts of signup bonus then it is worth paying this, but in a bigger picture it would be wiser to find an alternative category to FS should you hold the Ink Bold. The perfect solution of course, is to FS into your own bonus category, which is why when I apply for Ink Bolds I might well prepay $1-2K of ATT bills with it, should I be struggling to meet the spend.

Discount Rate

Even if you find the perfect category, you must accept that you are tying up money which could be used for other things. In a low interest rate environment this is an attractive proposition, but if you have debts, such as a student loan or mortgage payment you should price in the (tax adjusted) APR of these liabilities when considering a FS. Example:

You prepay $2000 onto your ATT Bill Via Ink Bold

- Earns 2000X5 = 10000 ultimate rewards

- Average Bill $100

This is (somewhat) like you are gifting a bond to your cell phone carrier… it has a face value of $2000 and each month they receive a premium of $100 from that. In exchange you receive 10,000 ultimate rewards in advance, rather than each month. There is some value to receiving them in advance as it can be the difference in booking an award trip today, prior to a future devaluation- but is it worth the free loan to your cellular carrier?

If you have a student loan with an after tax interest rate of 3% and $2,000 of cash available you could apply it to principle, it might appear like this:

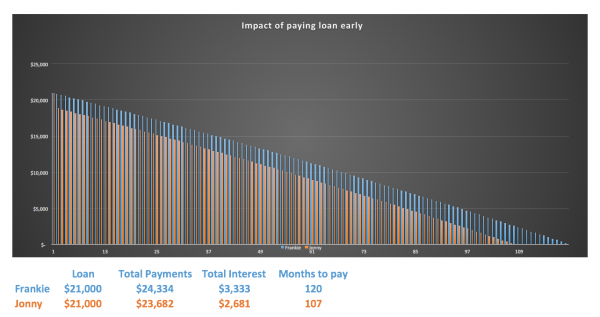

- Frankie has graduated with $21000 at 3% and pays $202.78 per month towards the loan over 10 years, he’s free and clear in March 2024.

- Jonny graduated with the same debt, but put the lump sum of $2000 against it, maintaining payments at the same rate:

As you can see, Jonny will pay off his loan 13 months earlier, and save $652 in interest payments, even at a low rate of 3%. However, it should be noted that he will also have to pay his cell phone bill every month whereas Frankie does not. While this is important, I think the value Frankie has here is offset via the behavioural finance concept of forced savings/forced impoverishment. IE because Frankie has less monthly outflows but no firm saving plan he is more susceptible to lifestyle inflation. Not guaranteed, but something to be mindful of.

Loss Risk and Change Risk

Forward Shifting can be a direct payment to a cell phone carrier, which seems hard to lose, but it could also be created via a spend analysis. For example:

You might spend $100 per month on Starbucks, forward shifting $1,000 of spend onto Starbucks giftcards would help you achieve the minimum spend on a credit card, but might also mean that you lose a gift card. Some streams, such as Starbucks would allow you to upload your balance, but others may require that you hold a physical giftcard. Indeed, you could FS pure cash buy purchasing giftcards (not to be MS’d) but these can be susceptible to loss. Many cards are replaceable, providing you have registered them, or have access to the card number, but reclaiming the funds can take a lot longer than you might imagine. Worst case, you could just be SOL.

Change risk might come should you prepay Starbucks and suddenly elect to stop buying coffee for health reasons, or move to a town that doesn’t have a Starbucks. You might think it is a good idea today, but if you are FSing a year or more in advance, you bring in risks that you might not have thought of by committing to a brand. Another example might be to buy airline gift cards, only to have your airline of choice stop service from your departure airport.

Future Bonus Risk

You might have figured out every angle, and decided that there was no better way to get Amazon credit than to FS an arrival card. But what happens if you have $3,000 of Amazon credit secured and then the Freedom announces that Amazon is a 5x category? Or if they suddenly sell discounted giftcards? If you have pushed your money into Amazon in advance you lose this opportunistic value, often something that cannot be planned for. I’d suggest looking at Freedom et al category bonuses as far out as you can before thinking of this.

Conclusion

Overall, FS is a good way to make minimum spend bonuses in a pinch. It is particularly helpful to people who find MS difficult or undesirable, however, you should be mindful of opportunity costs and risks associated with it.

Leave a Reply