Float with regard to spending (manufactured or otherwise) is the basic premise that you retain enough cash to pay your bills at any moment. The concept is designed to protect people from the myriad of problems that will occur when they read a blog post and go balls to the wall, and end up with a debt they cannot pay due to frozen funds.

Float 2.0 is an advanced version of this where you can, under the right circumstances, extend into the debt zone ‘safely’. I call the technique sitting in the pocket, which has roots in Jazz music, but I prefer the Boxing reference, where a fighter is positioned in such a way that they can strike their opponent without being stuck. I like the analogy because it is very dangerous when done incorrectly, and very effective when done correctly.

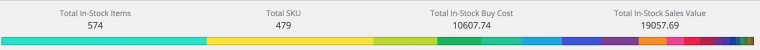

Building $20,000 of inventory from $6,000 cash

I experimented with reselling in the summer, and to start with I seeded $6,000 into a company. However, it was always my intention to use credit cards to purchase, and ideally make a profit – so why $6,000? The amount was intended to bridge loan ‘Float’ and also help cover fixed upfront costs for reselling software and hardware.

Selling at a loss for points

Some people object to this idea, but I would, on occasion, buy an item for a loss, ideally one close to breakeven. The reason for this was to earn portal rewards. However, if you do this, not only do you run the risk of the portal not tracking, but you also have to wait out the statement in order to get paid. I started this in summer, and sometime this week I’ll be earning my Discover Cashback. I earned around $1900. Big picture, $1900 of cashback with a $100 ‘loss cost’ is just fine, but locking up ‘Float’ while waiting for the money to come back to you is challenging.

It’s great to think that (should the portal track) you made $100 on each pair of those Jordans you sold, but if you don’t see $110 of that money for 3 months you still have bills to pay. As an aside, you’d be better buying a gift card with a 4% discount than a portal at 5% due to the tracking risk, but sometimes I found myself doing both, depending on the market spread.

Using concurrent credit cycles to extend float

This is where you are in the dangerzone. After buying say, $500 of shoes, and knowing that you’ve got the Discover card bill due in 12 days, with $499 of inventory to sell, how do you make ends meet? If you have more credit available, you could step into the ‘pocket’ and buy more inventory on the next card, giving you breathing room of another reporting cycle.

Essentially you are bouncing around the reporting cycle across cards like mini balance transfers, but the difference is that you are actually adding more debt each time.

Example:

Buy $500 in shoes on Discover, with $0 in checking to pay the bill in 3 weeks. You have an inbound payment date from Amazon 4 days before statement is due. Your statement has just closed on the ATT card, so you go and buy $1,000 in new inventory, knowing that the statement on this will be due 4 days after the second Amazon inbound payment date, 31 days from now.

The $1,000 can now be a mix of things… a portion could be slightly slower to sell, yet more profitable items, with the goal of profit, and fast, low profit (or even a loss again) items that are intended only to return cash flow to checking to pay Discover, this is what I refer to with a range of IRR (internal rate of return, which factors in both % profit and time to profit) items. You bridge loan between cards.

When I was ‘sitting in the pocket’ it wasn’t uncommon for me to have a statement that looked like this:

- Business Credit Card Balances $14,000

- Business Checking $8,000

- Inbound Accrued Amazon Payment $2,000

Risks are very high here. Worst case is that Amazon shuts down your entire sales channel, and you have to pay two credit card bills and have inventory that cannot be moved (or must be greatly discounted). So how can you do this with a degree of safety?

Likelihood of Event, and Impact of Event

The interplay between these two concepts is the key to risk management and decision making. The easy answer is that if you have a stash of cash elsewhere, the impact of event is marginal. Losing some money is undesirable, but it is acceptable. If you don’t have a backup of accessible cash, what would the impact to you be?

Fees and Interest are OK

This goes against the grain of the travel hacking mser.. but under the correct circumstances it can be OK to carry a balance and pay interest on a credit card or loan. If the worst case is that you’d have to carry a balance on your cards for a short while, then that is something you can price into your business strategy.

In my case I had several options:

- Personal Cash

- Investments

- Roth IRA funds (contributions, not earnings, withdrawal is tax free)

- 529 Plan for my son (comes with a State Tax recapture and a penalty on earnings, and sorry kid!)

- etc, etc

So in my case if things had gone wrong it would have required intervention and money movement, which I wouldn’t have wanted to do, but could have done. If your own dynamic is different, your risk analysis needs to be different too.

Conclusion

While it goes against the grain of traditional advice, this is intended to be considered by the more experienced reader. It is possible to ‘over extend’ yourself and get away with it. However, the rules I would suggest that you take clear note of are as follows:

Decide how you would unravel a blackswan event. In Float 1.0 you have a 1:1 ratio to free cash and extended debt. If you step into Float 2.0 what can you do to create free cash to get you back to zero? If making payments on your debt on a monthly basis is the only option then your upside from profit must be high enough to make the risk worth it. Ideally you will have other sources that can be tapped to fix this.

Do not over extend too far into any one channel when expecting future earnings. For example, don’t ‘buy’ $20,000 of future Discover Cash at a discounted rate of $7,000. Keep an eye on the ratio, and diversify. Points, miles, and rebates are great, but money talks, and bullshit walks.

Do not overextend too soon. Learn the business first. Float 2.0 is an accelerant to success. If you go out and buy $100,000 of stuff that never sells, or can’t be liquidated, you’re just more in the hole. However, if you have a strong understanding of sales rank, risks, and profit, accelerating using Float 2.0 is the first step before getting a formal business loan. While arbitrary numbers, consider selling perhaps 500-1000 units before you step things up, so you understand deal flow.

When you are adept at this subject you can use this to create interest free business loans to cover personal expenses, but that’s 3.0 and beyond….

No interest was paid in the making of this concept.

Why tap into retirement/college funds instead of borrowing from, e.g., HELOC?

(perhaps even from a brokerage margin account)

That would work too. I just don’t have a HELOC so I used what I do have.