Rebates are the key to the next big thing. They show their faces in several areas, and it really is a murky world indeed. I will try to shed some light on how the rebate system works, and how we can both generate more income from this, and also avoid the traps that come with the corporate manipulation of rebates. I personally lost $10,000 last year because of this, which motivated me to explore options to protect against that which I shared in the recent post ‘How to Properly Locate Speculative Stocks’ hopefully my loss can be your gain.

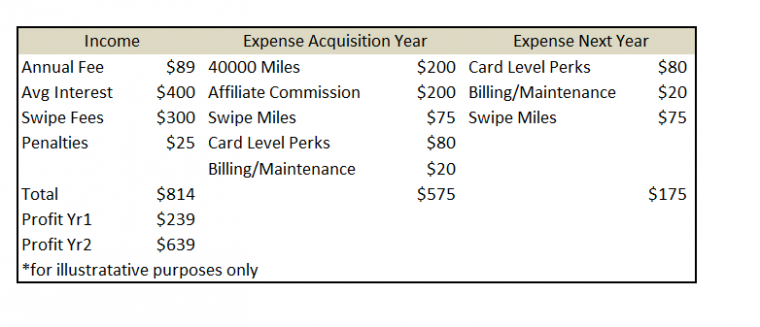

Rebates were created to improve Customer Acquisition and Customer Retention. In acquisition we commonly see signup bonuses. If we look at a simple acquisition model used by a company the calculations occur as follows:

- Net Value of Customer – Acquisition Costs = Income

In the case of a Credit Card company, Barclay’s may offer you the chance to acquire 40,000 US Airways Miles with their current credit card, for the customer they would see an offer of 40,000 miles in exchange for an $89 fee, which might seem like a good trade. However from the credit card side we have a more complex equation:

As you can see, in year one due to Carrot (40,000 miles) and the Stick (affiliate pushing sales) the acquisition costs for a new customer here are $400, a profit is still made in Yr1, but it leaps up in Yr2.

I based this example on a person swiping $15,000 per year, some of the numbers are for illustration only as specific details are prohibited to me as a stick wielding affiliate sales pimp.

As you can see, in this example the Card company still nets a profit in year one, though it could well be the case that customer acquisition pricing and rebates create a net loss for the company. This is more common in businesses that follow a ‘repeat business’ model, such as card companies, or subscription based services.

Corporation’s Role within the System

I will start with a quick tangent to the Groupon business model, and how it fell foul of accounting rules, it is slightly different from the rebate/fee model, but incorporates a lot of parallels that are very useful to understand.

When we think of a company like Groupon, the business model is to approach existing businesses and offer to create a customer acquisition system for them. Let’s say that Groupon approaches a restaurant who, in exchange for advertising power and new foot traffic, offers a $100 value dinner for $40. Groupon then goes onto split that $40 with the restaurant 50/50. Essentially Groupon is plugging itself into the system as an affiliate channel to drive customers acquisition strategies.

Out of Groupon’s $20, they can then in turn offer say $5 as a rebate to a third party affiliate channel, which can split revenue shares with a blog like this one, or offer cash back/rewards to the end user. For more on how companies slice up the pie check out my Affiliate Link Disclosure Post

Groupon got in trouble for its accounting methods in 2012 in a Scandal that impacted valuation. In that accounting issue they weren’t properly accounting for liabilities on their balance sheets: A Groupon is sold to the customer for $40, Groupon was reporting $20 as income. However, until the customer redeems the Groupon the income should actually not be counted, as it is not earned when there is a liability attached. Of course, this simply have been an oversight in accounting, but the result of this was that Groupon IPO’d with a very different set of books to the reality, and it was the stockholders and investors who were hurt by this due to over paying.

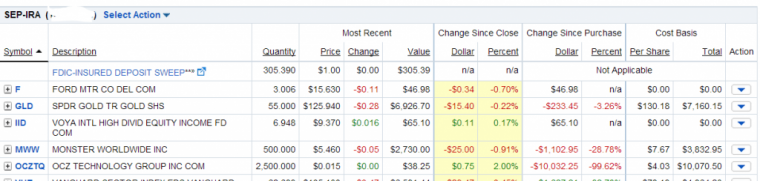

The OCZ Example

I wasn’t burned by Groupon, but as mentioned at the start of this, I was burned by a speculative purchase of OCZ. This company manufactured Solid State Hard Drives (SSD) and the CEO of the time was heavily into a rebate program. It would have a number of channels, including mail in rebates. By leaning on this system quarterly sales data can be manipulated. For example, by pushing a rebate system they can generate $10,000,000 of sales for the quarter, with a mail in return within 90 days.

The inflows appear to have $10,000,000 on the books which can be used as collateral to secure debt, or influence the price of the underlying stock on the market. However, in reality they were shipping each SSD with a coupon rebating perhaps 40% of the ticket price, meaning that their actual sales were only $6,000,000 and associated profit margins were depleted. As an investor, I have learned to be very careful about companies that are offering Rebates to drive sales, as it becomes very murky to see what the financials of a firm really are. It is not unknown for a corporation to lean upon a rebate system to create the illusion of growth.

How does this apply to the next big thing?

As we saw previously the rebate system as applied to new customer acquisition can be very lucrative for the consumer. In credit cards we are talking about several hundred dollars for signing up, and more as you ‘swipe’. The key to maximizing this understanding the interplay between flat fees and percentages, as with Vanilla Reloads, there was a flat fee $3,95 per $500 card, and a percentage that was correlated to full purchase price.

As is seen here, when correctly correlated, the percentage earned greatly outweighs the fees paid. If we can take this underlying concept and expand it beyond credit cards and reloads, we can tap into new ideas. This post series is about understanding what is really happening in processes that are well known, so that we can learn how to identify them in new places.

Ethics and Harm

As you can see in the case of OCZ the real victims were people like myself, the stock holder. Abuse of the rebate system does cause harm. When it is a Credit Card point people generally are ‘ok’ with that harm, but when it is something beyond this we should always take a moment to consider who is getting harmed by our actions. If the company is publicly traded and they have an exploitable rebate program then it could well be that the stock holders get hammered by individuals exploiting the machine.

Just like in the recent Lifemiles post, I don’t think an acceptable answer is that ‘they left the loophole there so they are to blame’ is always the right answer. I’ll allow you to decide upon your course of action based upon your own moral compass.

Where to look

Company Size

Firms that are seeking to rapidly accumulate market share. These tend to be tech based companies, in as much as the transactions are handled online. These can often be late seed venture companies that are seeking too ‘rosey up’ the balance sheets to either secure a final seed round, or to IPO. Such firms will allocate funds to acquisition that can go so far as to create a loss leading sale, and as an aside is why I recommend being very cautious as a financial investor.

You can also find more established companies offering rebates which have some degree of value. Those will be firms that have already built the infrastructure, and final products have low replication costs. Just like with OCZ, firms in the software space, particularly internet security will lean very heavily on rebates. The primary difference is that OCZ had high cost of product manufacturing whereas a Norton could easily ship you a download code for very low cost.

Business Model

Rule of Thumb when exploring rebates and fees: B2C for product acquisition, B2B and C2C for transaction profit capture

B2C business are best for product acquisition, which is good to acquire products you actually want, like the OCZ hard-drive, or that you are willing to resell. Gift cards are an example of a product that you actually want, and you use them either in single swipe transactions, or by using a consolidation card that you can load the cards onto and make larger, neater transactions.

You see the ‘coupon affect’ working to offset cash gift cards frequently, such as when Staples offers a $20 off $300 Gift Card deal.

Caution- for those pursuing products that you don’t actually want, but are significantly cheaper than market price after rebates. If you resell you have to consider at what point you are becoming a business, and the tax and reporting issues of that.

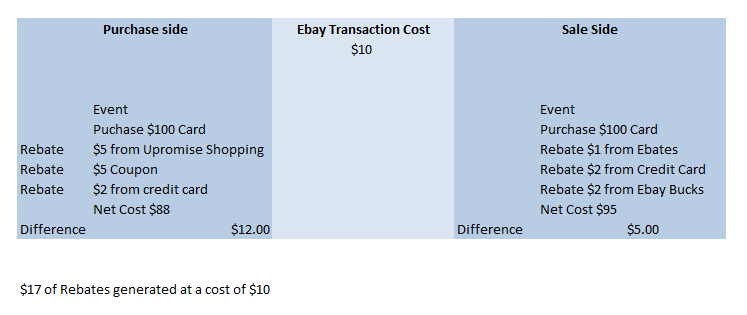

B2B or C2C business models offer the most scale-able opportunities. The reason for this is that you able to control the prices of the goods sold. Let’s say we have a tangible commodity, like a gift card, that has a value of $100. If we were to acquire it for less than face value then we could profit from reselling it at or perhaps even from below its face value of $100 should the spread suffice. If there was a great enough market place for the transaction then a narrow spread would emerge. However, there might be times when you don’t need a broad market, and could simple sell into a tightly knit P2P network….

If we delve deeper into the C2C model we could look at a site like eBay. Their standard user pricing model is to take 10% of the final sale value. This 10% is generally higher than a rebate you can find, (barring a coupon for a greater percentage discount) so if you sold a $100 gift card (with a $95 basis) for $100 you would still lose $5 net of shipping. However there are other stacking tools that could offset that.

The Coupon Effect

If a program offers a rebate as a percentage of cost it is likely that this isn’t the next big thing. Simply put if you buying a product that costs $100 and get a rebate of $5 then you aren’t making much of a deal (yes its great if you actually need the thing, but that is a different story) in essence what you have in this case is:

- Base Cost of goods $70

- Rebate: $5

- Sale Price $100

- Profit: $25

So you are getting 1/6 back in rebate. But if you apply a fixed value coupon to this, say $15 off then you can shift the value. This is very important in reselling goods as the coupon is used to cover costs of shipping/handling and reselling at a price under Fair Trading Value, allowing you to access the Rebate for free. Flat fee coupons are powerful tools for bargain hunters when applied to a percentage based company profit model.

How Stacking Works

Stacking is a way to bring several rebate models together and apply them all to a single promotion. In the eBay example one self contained stacking tool is payment method, and another is eBay Bucks. If you had a P2P team with credit card that offered say 2% cash back the following stacks could occur.

Jim ‘sells’ a gift card to his buddy Bob

Of course, he doesn’t ‘need’ to sell it to Bob at all, all he needs to do is offload the card. But the interesting part of this sort of transaction is that due to the large number of rebate stack levels at play, he doesn’t need to turn a profit on the card to make a profit.

- If you haven’t signed up for Ebates yet, here is my introduction link, it is free and pays us both a ‘rebate’ for signing up, providing you buy $25 of goods with it within a certain period of time.

- If you haven’t signed up for eBay Bucks yet – do so here, it is also free and offers 2% back on your eBay purchases, it doesn’t come with a signup ‘rebate’ for either of us.

Power users don’t like house percentages

Many power users or sellers within C2C transaction systems don’t like the house taking a percentage of sales. Due to the competitive nature of the marketplace transaction networks are having to pander to these high value customers and offer a flat fee option. Fees and percentages, therein lies the secret. In a flat fee model the seller will agree to provide the transaction network with a flat retained price, perhaps $20 per month. In exchange for which they receive a discount on the percentage charged for the sale. Sometimes as much as 100% discounted….

In the example of Jim and Bob, the investment of $20 per month will allow them to open the sales volume pipeline, and each sale will reduce the impact of the flat fee, and accelerate profit. The ‘house’ still wins, it is the rebate companies that are paying for the profit, which in turn could harm shareholders and venture capitalists.

In closing, if you can find a B2B or C2C business model that has stacked rebates, you can find some very interesting opportunities, especially within those firms attempting to rapidly increase customer base ready for IPO….

Please note, the scaling that can be created from this knowledge is quite considerable, and when done an eye should be kept on taxation and legal implications. This post is not intended to encourage you to do anything dishonest, it is simply intended to illustrate the economics involved in Rebates and Fees.

– Logo Image Courtesy of WikiPedia under creative commons license

First!

(couldn’t let you go without a single comment).

Thank you!!!! I was feeling very unloved.

Very thought provoking read, this community needs more posts like this!

I appreciate your analysis in what to look for and consider when looking for the next MS opportunity. I enjoy posts of this nature much more than step by step instructions on how to complete MS.

Glad to hear it Josh, thanks for stopping by.

I am a newbie to MS and appreciate the insight and thought provocation. If only there were more hours in a day.

Stacking and rebates.

I never thought about it from that perspective.

CVS is public…

Too busy getting ready to leave for the weekend to read much on the blogs today, and yours need to be read, not skimmed. (That’s a compliment.) I will read it tomorrow, in the Admirals Club, as I await my first flight. See ya in Charlotte!