I spoke recently about Finding, not Killing , the next big thing. That post was the ‘why killing a deal is wrong’ which is pretty obvious… this post is intended to help people on the path to finding the next big thing, without blowing it up. Though one of the hardest parts is towards the end, when you think you may have struck gold, and how to use this knowledge. This post series is not going to tell you the next big thing, it is going to tell you about how to think about finding the next big thing.

I know that this concept won’t appeal to everyone, because sometimes you are just too busy to want to put the time in and want something handed to you (I know I feel like that at times) but having the proper knowledge is important, because when you think about things properly you are able to spot a ‘deal’ when you stumble on it.

Free your mind

If you are trapped within certain parameters or frames of thinking your ability to find new tricks or deals will be severely limited. I talk a lot about starting at the basics and moving forward from there, addressing notions such as Kihon and Shu Ha Ri. If you were to explore the personalities who operate at the edge of the points and miles world it is not unusual to find people in highly paid jobs within finance. The reason is simple, they have a deep understanding of the economics of rebates, and enjoy the ‘thrill of the hunt’.

Newer players who are gobbling up low hanging fruit often don’t come at the game from the same bottom up viewpoint, and as such fail to miss key components of a deal. Let’s explore that further.

Mythbusting the next big thing

It has to include a gift card like Vanilla Reload or XXX!

False – The next big thing could indeed come in gift card form, but why would it be? Let’s normalize the characteristics: Buying a giftcard with a points earning card can create a profit if the price paid is less than the currency earned. It is simple return on investment (ROI).

ROI is subjective! My time is worth more than yours!

True, but why are you comparing me and you? The comparison available to make it objective is opportunity cost, and we should refer to Capital Market Asset Pricing for the solution. The notion here is that there should be correlation between the risk of a specific investment, the market risk, and the premium (or discount) that the investment offers. Let’s use an expired example:

Vanilla Reloads at Office Supply store:

- Acquisition Cost $503.95

- Profit After Fees (using 1c to 1.38 cents value) Min$21.95 Max $30.29

- Time to acquire: From 5 minutes upwards

- Time to liquidate: 48hrs

As you can see, the turn around time is so fast that it creates a phenomenal IRR, however it isn’t fair extrapolate that number out to an annual rate of return because of supply controls. There was limited supply due to natural high demand, and also the liquidation was throttled by the exit mediums.

Building the Points Pipeline

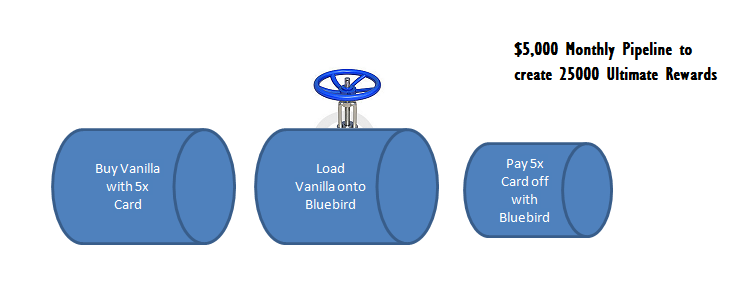

If we were looking at a deal and assessing its viability we must consider how to build a points pipeline. Plugging one side into the Source, and the other back into our bank accounts. The concept is simply to find a way to flow funds through the pipeline that generate a net profit. Note that I said we didn’t need to flow credit card purchases through, because we are freeing our mind of the trappings, and credit cards are only one answer to the problem. Here’s the above Vanilla Reload office supply points pipeline:

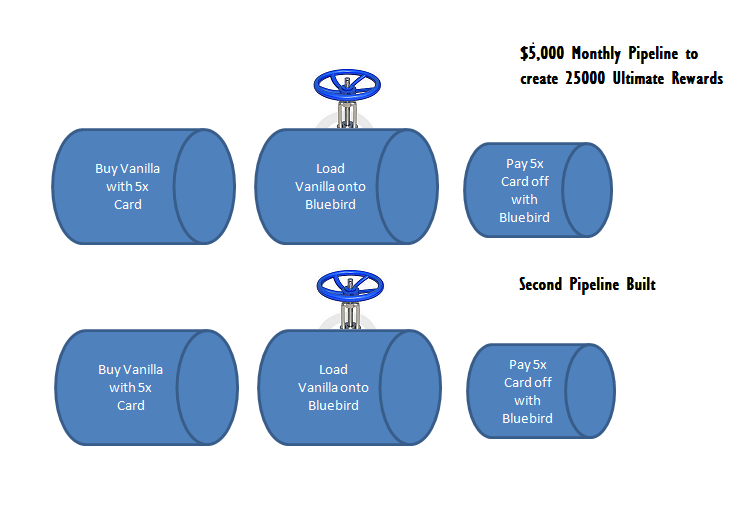

This was so popular because of the simplicity, however scale was limited by the valve indicated on Loading (step 2) because Bluebird would only allow you to load on $5,000 per month. That was enough for many people, but scale is important. The only way to increase the scale for that pipeline would be to add another in perfect mimicry, using a family member or friend:

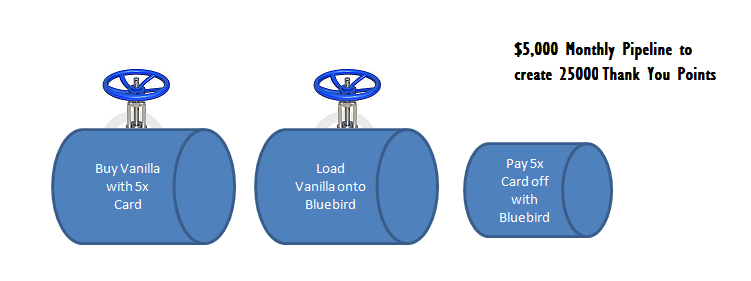

Since you cannot ‘beat’ the Bluebird control valve, you simply increase your overall inflows from the pipeline by duplication. There are people who have many duplicated pipelines. Another flow control could be placed into play here in this pipeline model, as was seen by the Drugstore version of this model, as stores implemented anything from $1,000 to $5,000 per day limits on the first acquisition phase:

As you can see, even the most restrictive $1,000 per day limit would not break the pipeline, since you had one full month to flow through it. And in truth there was another step two limit that was also $1,000 daily loads onto the Bluebird, which again slow the flow of money, but do no real harm to the pipeline because you have at least 28 days in the month to load $1,000 per day up to a max of five times.

These valves are important to understand, because some of them cannot be changed, whereas some of them can have mitigated impact if you follow the duplication model.

Duplication Models

Many products will be created with a ‘one per person’ design, and use these valves to throttle inflows, deciding to find ways to circumnavigate these rules raises obvious ethical questions, and I am not endorsing doing so. I am suggesting though that we realize that ‘compliance’ with rules is optional, based upon our own moral code, and simply stating ‘one per person’ doesn’t mean you can’t have more.

Some products are coded ‘tighter’ than others, the Bluebird example above is well coded to prevent multiple Bluebirds in the same name. Other products are less so. It is important to recognize this duplication model strategy can change the landscape of your overall strategy.

Duplication protection from the client side tend to be in the form of linking accounts to unique identifiers. Here are some common data fields used in forming Unique Account Identifiers:

- Social Security Number

- Bank Account Number

- Credit Card Number

- Email Address

- Name+Date of Birth

What we find is that some programs will tie into SSN, which makes duplication require greater resources, in the form of other SSNs. There are many ways to acquire these (spouse, kids) which are quite legal and above board. As would be to create certain things using business TIN numbers, which are the same length as a SSN, and are assigned one per person, but one person can have many. It is worth noting that most pipelines will ask for the SSN, but that does not mean that the client on the back end is using that for Unique Identification purposes.

Knowing what Unique Account Identifier is used to track duplication on the client side is key. For example Bluebird included SSN, where as AP did not. Duplication is one of the most powerful forms of scaling, and before moving on to new strategies we should decide if the current pipelines are being maximized correctly. There is some debate that over duplication or over scaling a specific strategy will increase account closure.

If you believe a pipeline to be at risk of closure through duplication the greatest protection is insulating it from any other identification, this is a cellular approach. If you have a duplicate model operating on the same address, either physical or digital, it is more likely to be correlated than if you have different data. Being mindful of this can ensure that if one account is terminated there is no traceable route to account 2 on the client side.

This topic is so large that it will be a multi-part series, next to come will be:

- Understanding the Fee/Rebate model to spot opportunities in your next big thing

- Scaling – how far is too far?

- Pushing more through an existing pipeline

- Moving beyond Credit Cards

- Testing and sharing – why would you want to share, and who can you trust?

Great post! The pictures are great too!

Glad you liked it – I think we both ‘stumbled’ onto some interesting things over the weekend and this post is all about how to know when you are looking at something special or not 🙂

Great post. You are getting my creative juices flowing

Thanks Yakov, glad it helped

This is a very timely post as I am trying learn to scale in a more efficient way right now . The pipeline drawings are are great example

Thanks Shawn thanks for stopping by.

This is a great post. I am in the process of scaling several different tools, slowly and cautiously I may add (and to varying levels of success)… I look forward to your thoughts on what you think is “too much” in this regard! Though I am sure, characteristic of your level headed approach, you will err on the side of each individual’s subjective situation.

I’m glad you like it- I’ll try to keep a level head because ‘too much’ really can get out of control!

Matt,

Based on my experience, I’d include time as one of the factors.

Total profit = Ʃ ((Profit per avenue) X (Number of times per time period)) for all possible avenues.

Bluebird example – Number of times you can load and spend 5K is once per month. So, max profit per month is limited to a percentage of that 5K.

There are other avenues that can be churned continuously. In fact, one of my goals now is to minimize the time to complete a cycle for each avenue. And I have identified avenues that I’ll not participate in because of the time involved.

This month, I started something new that took a lot of time to complete just one cycle. It’s then I understood not all avenues are equal and you got to pick the most efficient one. Efficiency depends on type of credit cards you have, geographical location where you live, amount of card limits, number of retail locations and distances between them, which retail locations are busy/not busy and even time when they are busy.

I’ve time tracked my efforts for the last 2 months and have some inkling on making the process more efficient.

Yeah, I’m having BA discussion with myself as to what is more important- time or capacity. Time is finite, opportunity costs could provide more variable options.

My next post on fees includes time more in conjunction with fees and flows.

Love this start! All change begins with awareness.

Perspective follows! Bring it on!