I had a wonderful lesson last week with my NYU Finance Professor, he is a great guy with wonderful stories and anecdotes, but brings up some of the most politically incorrect stuff you could hope to hear. Last weeks story was how when Oil went above $200 a barrel a great and wonderful thing happened – we got into Fracking.

Now, from a purely economic perspective it truly is a great thing for the Nation, indeed the world, but to a room full of idealistic New Yorkers it was cringe worthy. However, he had a great point, to paraphrase:

When economics of cost change sufficiently they both motivate the innovation of alternative solutions, and also make previously untenable solutions incredibly viable.

The same can be said for our latest series of devaluations which have slammed into the Chase Ultimate Rewards program. Previously we would use Chase and its multipliers to earn Ultimate Rewards at greater than 1x per dollar, by dining at 2x with the Sapphire Card, or shopping excessively for things at Staples with the Ink Bold for 5x. Spending these aggressively generated points would involve swapping at a 1:1 ratio to any of the Transfer Partners, with the general acceptance being that United and Hyatt were the best options due to their award prices.

Well, one thing changed – the price to redeem within program for United and Chase – but something else did not change, the earning multipliers and ease of earning Ultimate Rewards. However when spending them in the traditional manner is about to become less exciting, it is time to adjust and open the door to new possibilities.

Paying for Travel with Points through the Ultimate Rewards Travel Portal

Could this be the new sweetspot? Certainly not for luxury international flights, but perhaps for hotels? Booking your hotel through the Chase Ultimate Rewards travel portal allows you to ‘pay with points’ and get a discount of 20%, which due to the weird way mathematics work makes them 25% more valuable than cashing them out 1:1 as a statement credit (another option).

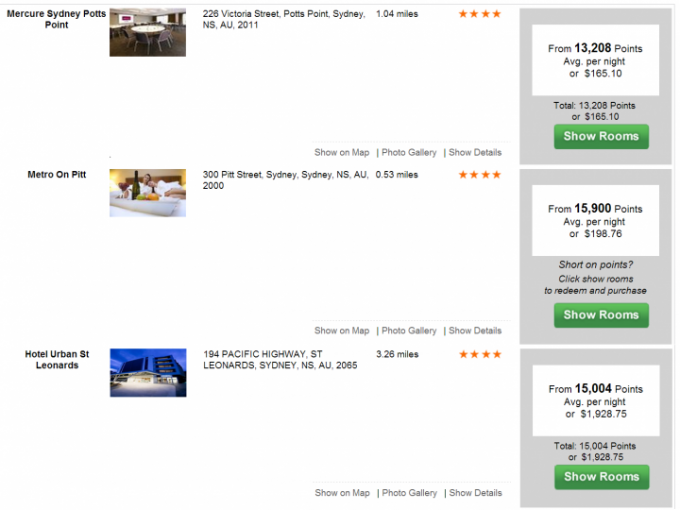

I have found some ‘cheap’ options for 4* and below properties. You can also find some deals for 5* Hotels, but it will vary by city with regard to how viable such a redemption is. For example when I searched for the Hyatt Zurich, which will become a Hyatt Cat 7 hotel for 30,000 points per night, paying with points would cost a whopping 70,221 Ultimate Rewards per night.

If you are blinkered to thinking that it ‘must be the Park Hyatt’ then of course this option of Paying with Points is not going to work, but if your approach to a hotel is the following, then we still have real value with our Ultimate Rewards.:

A hotel should be clean, safe and conveniently located. Ideally it will be free, or as close to that as possible using points.

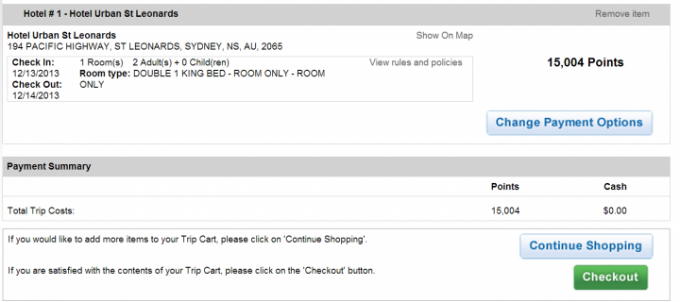

Any one of these hotels looks like something that I would be more than happy to stay in when in Sydney, location looks good, hotel looks clean, and I think I would be really happy there. One thing I would like to draw the eye to is a buggy price (Hotel Urban St St Leonards for $1928.75 per night!), and that is actually a really good thing, as it reminds us that we cannot accept the price the website offers in cash.

Setting a realistic basis price

This is the proof of the pudding, if we blindly trust Chase (repeat after me: we will never blindly trust a bank) then we would have already bought that room for a price way lower than transferring to Hyatt, sure it wouldn’t be quite as swanky as the Hyatt but it would do the job. However, lets check the basis.

The basis we need to establish for value cannot be garnered from the same website where we are redeeming points – if we thought like that we would be completely at the mercy of a false economy. It is just the same was when you book a business class flight for points on United and it offers you the choice to pay $20,000 cash and save your 120,000 points. You have to look elsewhere, and shop around to find if you have a real bargain.

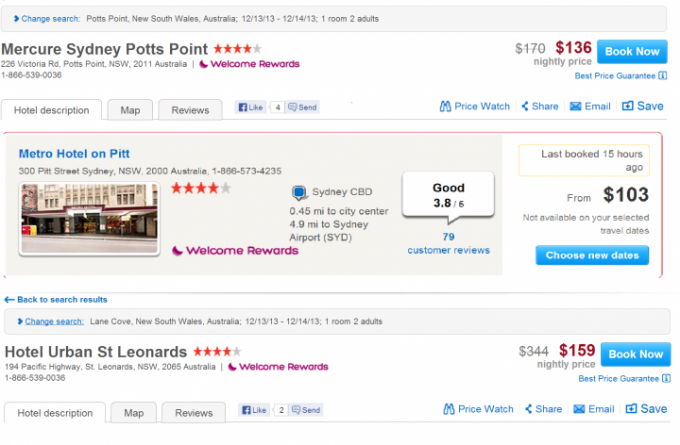

With hotels I tend to use Hotels.com as my first price check, though if I actually need to book through Hotels.com I would cross check that price with competing sites like Booking.com or Travelocity. However, they are all typically closely priced so it is a good benchmark. Let’s see what Hotels.com thinks the fair market value of these three hotels is:

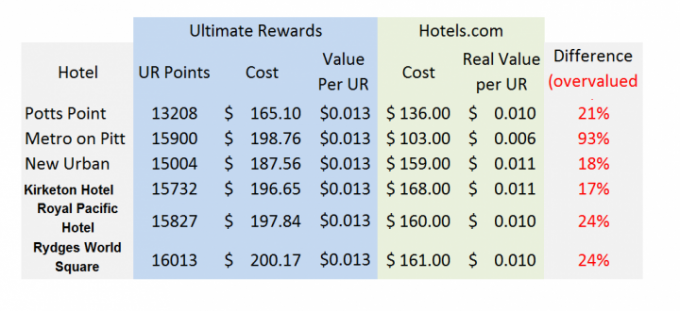

So what we have found is that Ultimate Rewards has boosted the value of our dollars by 25%, but then boosted the costs of spending the dollars, to negate the value! Here is how it would compare (note that one hotel is not available and offering the ‘average price’, which may differ from the actual price, with that in mind I searched a few others to give a more accurate image. I also found the proper price of the hotel in St Leonards by clicking through.

Thoughts on the Markup

If we ignore the Pitt example we are looking at around a 20% increase in cost to book through Ultimate Rewards rather than Hotels.com. Additionally there are some interesting things in favor of booking at Hotels.com, lets look at a scenario:

Book with your Chase Sapphire Preferred, through Ultimate Rewards Shopping to Hotels.com then use Statement Credits of 1:1 rather than Travel Credits of 25% ‘extra money’

Portal Rewards

If you pay for your hotel with your credit card you will be able to access Hotels.com through an online shopping portal. These can offer an average of 5% back on your purchase. A good example would be to go through Ultimate Rewards Shopping which is currently offering 5x Ultimate Rewards.

Card Multiplier Rewards

Hotels.com is Travel, so you get 2x from your Chase Sapphire Preferred

Third Party Loyalty Program

Hotels.com has Welcome Rewards, which when you book 10 nights you get 1 free at the same average price, which roughly equates to 10%.

So we are earning 7% back (card+portal bonus) in Ultimate Rewards that can pay for our next trip, plus working towards earning a free night through the Welcome Rewards program.

Lets run a test case:

Rydges World Square, Sydney 1 night

- Price to pay with Ultimate Rewards Travel (25% bonus value…) would be 16013 Ultimate Rewards

- Price to pay with Credit card on Hotels.com using the portals and programs above: 1 night cost $161 at 1:1 statement credit cost in Ultimate rewards would be 16100, 87 more than paying with points through travel. BUT you would earn 161*7 points for your spend, which is 1127. So your net cost would be 14973, plus you would be earning a night towards your free night with Welcome Rewards.

Clearly, based upon what you see here, it would be better to NOT pay with Ultimate Rewards Travel, and instead pay with your card and take the lower redemption of 1:1 as a pure statement credit, but there is one last thing that will confuse matters.

Taxes and Fees

I hate taxes and fees. What I hate most about them is what is padded inside them. One of the most frustrating experiences of Taxes and Fees is the Resort Fee you pay in places like Las Vegas. Here they drop the ticket price of the hotel so you think it is a bargain, than add it back on again in the form of a hefty resort fee.

One could say the same here for Hotels.com, they come in with the low price for the hotel, but then when you check out there are times when the fees are huge. I cannot see any rhyme or reason for this, because for the first time ever, just to confound me on this post they charge no fees at all for the hotels in Sydney! But it is something to be wary of when finding your basis.

Conclusion

- If prices go up in one direction, look for other opportunities for value

- Do not think that just because it seems better, 25% better in this case, to use your points on travel rather than 1:1 that it is the case, as paying with a card has other value that can exceed the apparent savings

- Do not ever allow a person to set both prices in the equation, you need an external reference point for basis when calculating true value

It is my opinion, that if you do plan to take the approach of paying with points, a better solution would be to use the BarclayCard Arrival Mastercard, since it offers you 2.222% and you can pay through portals to get the best of both worlds here. If you would prefer the Chase Sapphire Preferred Card you can find it here, both cards will pay me a commission if you decide to choose them.

Just a side note, I think you have a typo in your opening paragraph, i should probably say “over $100”, as I do not believe oil ever hit over $200.

Who is your Finance professor? I just wonder if I had the same one at Stern.

Cheers,

PedroNY

Hey Pedro,

Good spot- in my defense it is his story not mine! Name is Wetzel. He is a great guy.

Tell your professor that the story is great, but his “facts” are dead wrong.

Oil never got close to $200 bbl. Maxed out at ~$147 (after being manipulated by the WS Banksters ~$10-15/day in the days leading to the top) and less than 12 months later was $35 – thanks to the same boys in “finance”.

And modern fracking wasn’t driven by “$200” oil – far from it. It was driven by one guy’s dream to release the vast quantities of known “tight oil” rather than rely on stripper wells doing 1-5 bpd that cost a lot to maintain and were barely profitable. At the time, oil was btw $10 and $20 bbl when he was perfecting the basics of modern hydraulic fracking in Texas.

I’ll wait til I get the grade locked in first 🙂 He’s a good one for bringing up solid concepts, such as the desire to innovate, but not the best for the purely factual anecdote. I forgive him though.

Thanks for the data, I thought that the oil part might be interesting to you.

The problem with pay for hotel this way is the portal used to book them sources some of the worst availability and rates from god know what obscure booking companies. The result is you get much worse underlying prices than booking through other sites (like hotels.com / priceline). I’ve run into this problem with Citi TYP bookings, and they use the same aggregator. On top of that, you also don’t usually earn any hotel points for the stays and the reservations are pre-paid, which is hugely inconvenient. Not worth it, IMHO, but for cheap flights it’s a good alternative.

For hotel bookings, outside of my loyalty requirements, I like Booking.com better thanHotels.com, simply because mostly they allow cancellations. I tried Hotels.com for a booking in Mexico City recently, and they tried to slip in a charge for an extra person per room, and prepaid. I cancelled and booked the same room, same price, at Booking.com, without the advance payment. I also like Booking.com’s mapping, and reviews, because I may prefer a particular location over price.