I wrote recently about a new idea that came to me for generating some ‘free cash’, it leveraged a tool to help funnel money back onto your credit card, reviews of my concept were mixed, I thought it might be timely to explore risk and reward based upon that, so that we might fully understand opportunities and their consequences.

In doing so, I will hope to draw analogies to traditional risk and reward models that are deployed in financial decision making, and see if we can extract concepts from them to apply to more esoteric ways to generate income, since I feel both the risk and reward aspects of this hobby are often brushed over.

What do we mean by Risk?

In it’s most innocent form, the measure of risk we are exploring is that an asset or vehicle will not perform as expected. Both Beta and Standard Deviation are measures of volatility of the investment, which doesn’t mean that it will necessarily lose money, but that it is harder to predict. When we consider the Risk Free rate of return (which can be argued is only theoretical in nature) people frequently take the 6 month T-Bill as a measure. If you compare that to some doolally tech stock like Twitter, we could expect that predicting our 6 month ROI would be more accurate with the T-Bill, but that doesn’t mean that Twitter couldn’t suddenly pull a surprise out of it’s hat and actual make less of a loss this quarter,and thus double in value….(psst, don’t buy it) a high risk asset can go up as well as down, it is the predictability of it that is the issue, along with the range of possible results.

Consider Risk as a distinct variable from impact of risk, the same way you look at a disease having both symptoms and causes, risk is a Cause, losing money is a Symptom of Risk.

CAPM, and the SML

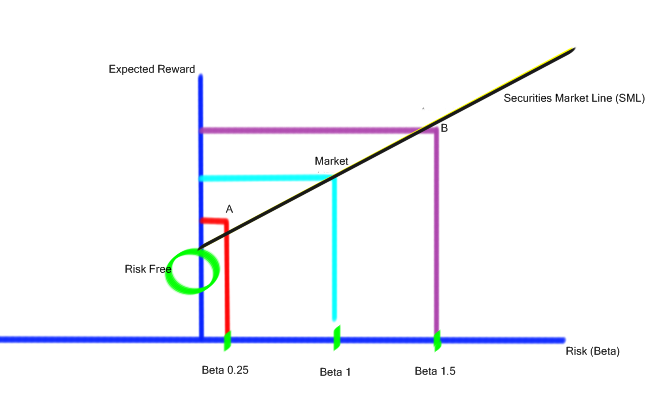

Let’s start with a look at Capital Assets Pricing Model (often called CAP-M), and the Securities Market Line (the SML). This model is a theoretical pricing system that explores the expected Return on Investment for a particular asset class based upon risk (Beta). The important lesson that must be taken from this is that when comparing any risk and reward equation, A risk free investment will still have a reward element to it, so when calculating value of risk, we don’t start at zero for reward:

The graphic shows 4 investment variables for comparison:

- Risk Free rate

- Asset A

- The Market

- Asset B

The purpose of the SML is to show where assets are considered undervalued, or overvalued, in relation to risk premiums. Taking Asset B, you get a higher reward for this asset compared to the market average, but because its risk (Beta of 1.5) is higher that then SML it is a disproportionate risk/reward equation and you are overpaying for the Asset. Asset A, conversely offers a lower reward than both Asset B and the Market, but also offers a disproportionately lower amount of risk for such reward, so is a better investment.

Is Risk and Reward in Manufactured Spending different?

The interesting thing with Manufactured Spending is that the Reward is reasonably equal, because upside is limited to:

- Card Return + Stackable Bonuses (things like Plink or Supermarket rewards etc)

Since all cards offer the same return by type (EG all Ink Bolds offer 5x at Office Supply stores) and all stackable bonuses are available, they actual act more like a fixed income asset, in that the ROI will remain consistent, and the risk reward focus shifts towards how much is too much.

To recap: as opposed to a financial asset, volatility of earnings is not the major risk factor, though there is some risk attached to a financial review if you spend too much. The real risk lies in the liquidity and marketability of the asset within Manufactured Spending.

When we think of it like this, and look at Liquidity, we start drawing more precise risk evaluations. Before we do, lets stop a moment and take a look at how most people view risk and manufactured spending within a single vehicle, such as Amazon Payments.

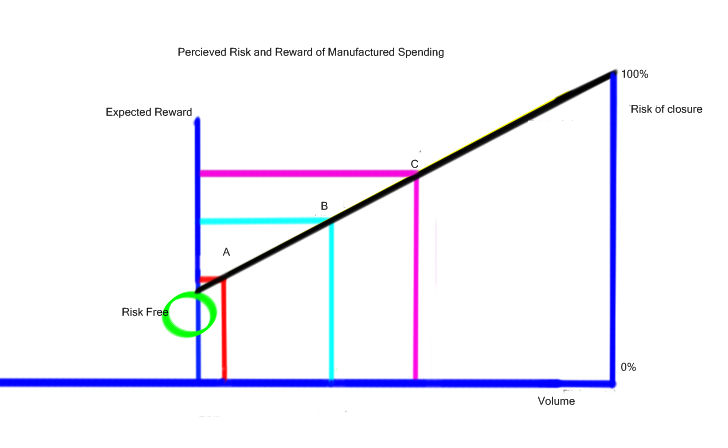

I adjusted the model above to indicate the general consensus towards manufactured spend in general, the major difference here is that the common thinking is that volume is the risk driver, so as you increase spend you increase chances of being shut down. People think that if they ‘fly under the radar’ they will avoid account closures. If you look at the model above and think of A as being sending smaller amounts of say $250-$500, B as being something in the $1000 range per person, and C as being above $1000, requiring multiple accounts you can see how people will think the higher they go the more like it will be shut down.

However, it is also likely that simply having more accounts increases the chances of an account being flagged, and that individually it makes no difference, again speaking from my personal experience with several accounts I see no ill effects yet.

Dirty Data prevails

The problem we encounter is that most people don’t have accurate data as to why account closures actually happen, there is some discussion of theory, and there is a lot of anecdotal evidence, but for the most part people don’t know what the logic is behind a closure. I saw this recently with the Evolve card where one reader told me he was frozen for sending two genuine payments to his 529 plans, whereas another reader conversed with me via email that he is running a lot of money through this card in a very different way, not at all as intended. Just a quick look at Flyertalk will show you that using Amazon to send money back and forth between two people will get you shut down, yet I have done exactly that for years.

The truth is that there is some risk profiling possible, but it is fear that prevails, and by its nature, a lot of that fear is unfounded.

Deliberate Preying on Fear

Another angle to consider would be very similar to an individuals view on Risk of Amazon payments, but from a Macro level, in that some people view a programs longevity to be directly correlated with the number of participants. As such, if they can deliberately ‘scare’ people away from a certain product, it may increase the chances that the product will be available to their own small group of participants. Frankly, there is some truth to this, as much as it is a seedy approach in someways.

The Manufactured Spending Tournament

If you are following along with this you will see that we imposed rules, such as restricting bankroll and controlling the return of funds into play. The race is to get as much earning on a high percentage card back onto that card as quickly (and safely) as possible. The risk in the tournament mimics the greatest risk to people manufacture spending, if their funds are locked up, they are unable to ‘play’ with them, which means the biggest risk in spending is that cash flow cycle, and liquidity.

What’s the worst that can happen?

When a financial investment fails to perform it generally means a loss of capital, such as an equity dropping in value due to sentiment, or a bond that can’t be traded at face value due to interest rate moves, however the manufactured spending risk is that the money will be frozen should a liquidity vehicle trigger a red flag.

As such, providing you are playing with stakes you can afford; which means the entire money needs to be disposable cashflow that you can live without indefinitely then your real risk is focused on how much opportunity cost is lost when your own personal ‘bankroll’ is locked up.

Other Real Risk Considerations

These are what I consider ‘Symptoms’ that perhaps people don’t think about:

- Vanilla Reloads – there has been talk of these being swapped out in stores for cards that have already been scratched off, I guess the trick here is that when activated they get an alert, and they use the PIN that they wrote down to liquidate before you can.

- Giftcards in General – several times I have found myself walking around all day with $5000 in very hard to trace funds in my pocket, if Iwas robbed the impact of that robbery would be more severe from a cashflow perspective, similarly even carrying a single card it could be misplaced.

- Depositing large amounts of cash into Chase and some other banks has led to account closure. If you are depositing cash, or even money orders, it might be wise to set up a separate account, if that gets shut down doesn’t have all of your bill payments attached to it.

- Manufactured Spending can impact your credit score, if you make a big purchase, as I often do, that can hit your credit utilization for a day or two as you pay it off again, if they score is pulled for monthly reporting in that interim then you could get a ding. Meaning that people applying for loans should watch Manufactured Spending along with new account applications.

Conclusion

Try to first consider risk distinctly from the impact of risk. At some point you will need to bring these concepts back together again as there is an intrinsic link, but it is wise to first separate them and understand them as their own entities. Breaking them down in this manner will allow you to make more sophisticated decisions when it comes to what is the correct course of action for you to take.

In part 2 I will explore the Risk analysis of products and spending strategies, if there is anything specific that you wish me to address in that please let me know in the comments section.

Nice analysis. I would add the risk of account closure is real. I just had a bank that I had been with for over 20 years send me a form letter indicating that they were executing their right under the personal deposit contract to close my account. I had great relationships with the Branch managers and tellers, but the corporate office shut me down without making an inquiry to any of my branch managers. I had erroneously thought that I would at least get a signal that I was on somebody’s radar before getting a closure letter. In my case this wasn’t a big deal as I didn’t have any recently significant relationship with them (just a checking account). I did run over $500k in 6 months through this particular account in Money Orders. Now I keep 2-3 “throw-away” accounts. I am also now never buying more the $10k in cards a day nor cashing out more than $10k at any one time or having in my possession more than $10k of money orders. I don’t want any possibility of my activity being construed as structuring.

Yep, that is a real risk, I mentioned it in the penultimate paragraph regarding Chase, it is something to factor in, and as such something that can be mitigated.

Now what would be fun would be to estiamte the non linear risk of closure relationship with volume, type of MS, etc…shoot, that might even be publishable in a RAND or JIE

Yep, I was planning to do something like this next, but a key factor is that the data isn’t good… so I think it loses a lot of power.

walking around with $5000 hard to trace funds you know your stuff.

Thanks for sharing. I always enjoy reading your thought provoking commentaries.

Thanks Nil, appreciate your comment here too