I just decided to downgrade from the Chase Sapphire Preferred to the Chase Freedom card, in doing so I retained the old card number, the rather hefty credit line I had with them, my earned Ultimate rewards points, my 7% Annual CSP bonus. Additionally I reclaimed my $95 annual fee that just posted to my account, and made a powerful step to leaning out my wallet.

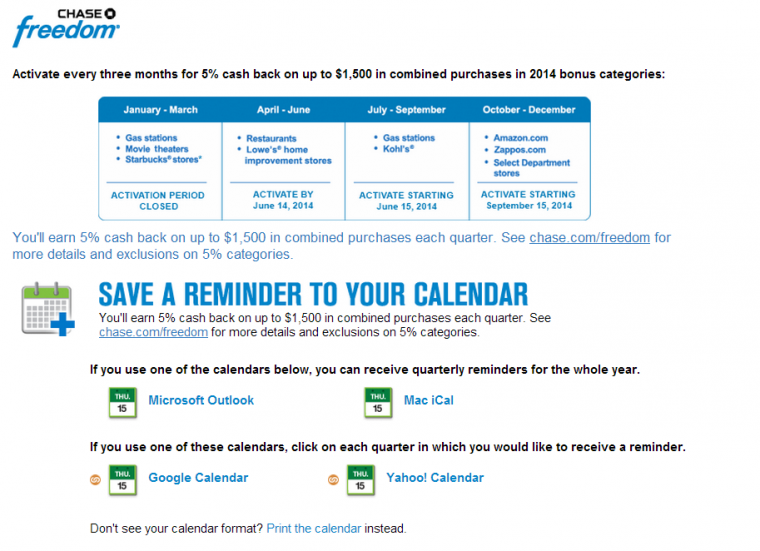

As I just discussed regarding ‘putting your wallet on the Gift Card diet‘ one of the major advantages of the Chase Freedom cards is its low limits on bonuses. Each quarter they offer a 5% earning rate in different categories – but only if you remember to activate the bonuses, which I must say I think is more than a little shitty of Chase, I see things like this rather as they actually decided to switch them off rather than ask you to switch them on.

You might argue that if they didn’t want you to get the bonuses they wouldn’t have added the calendar options to remind you on this page, I would counter that with they don’t want you to ‘accidentally’ earn 5%, but they are excited to help you lock your full attention on using the Freedom card during this time and keep it fresh in your mind.

The great news though, is that with a measly $1500 cap on what you can earn at 5% each quarter you can specifically target spending in these areas in a highly controlled manner. I do already have a 5% card for Gas, Groceries and Drugstores in the form of the 5% Old style Amex Blue Cash, but in fairness the freedoms 5x is worth more as I would be able to transfer the 5% cashback into Ultimate Rewards at 1:1 ratios as I also hold the Chase Ink Bold. This adds value to the Freedom as Ultimate Rewards are clearly worth more than a penny each.

Strategy for Q2 Lowes and Restaurants

Dining is a powerful category with regular spending here I should put a dent in that $1500 limit, but if I run the numbers and think I am a little short then I would look at pre-purchasing dining spend by exploring giftcard options at Lowes, I haven’t checked out their offerings yet, but most stores like this offer Starbucks or other cards and I could load up any missed spend to capture the last few drops of 5x. The store specific cards are more limiting than a generic Visa, but also they come without a purchase fee so I would earn a ‘profit’ if you consider buying Starbucks a healthy use of your money you might agree… I can see that some might not. I may buy a few personal use cards, but likely not many.

Strategy for Q3 Gas and Kohls

Again, I would use Gas first, for 90 days we would probably get through about $150, we could push that to $200 if we were topping off the tank right at the end of the month, then Kohls, like Lowes, sells gift cards, so we could stock up on more. Unlike in Q2 there is quite a large balance remaining to spend, so I might not max out the $1500 unless I saw very pertinent gift cards that I would personally use within a 90 day period, or ones that could be liquidated at profit (when factoring in the rebate).

Strategy for Q4 Amazon, Dept Stores and Zappos.com

Q4 leads us into Holiday shopping season, Amazon is a great solution, same old plan, regular spend calculated in advance, topped up with future purchases. I might be inclined to max out the spend on Amazon gift cards as I think they have a high correlation to cash based upon my spending habits. That decision will be made based upon a review of my current cash flow situation.

The problem with future purchases

You are offering the gift card company money when you pre-purchase their cards, there is a time value of money and an opportunity cost discussion to have when doing this, however, I personally feel that the TVM equation is easily offset with the 5x Ultimate rewards, as locking up my funds for a few months at that earning rate is worthwhile.

The problems associated with the loan are offset by the benefit of purchasing giftcards in that you are more likely to stretch out your spend over the coming months than overspend during the period – just as discussed in my Gift Card Diet post, if you set a budget of $1000 for dining and stick to it you can still benefit from the slight rebate bump from pre purchasing future dining at a higher rebate.

Timing is everything

Not only do we not want to lock up our money in giftcards too soon (as each day they are earning interest rather than we are) but the added benefit of waiting to finish spending is that opportunities may arise for discounted use of the card. For example, Lowes might decide to run a campaign that sells visa cards for free, by waiting you get to keep your own money longer, and have opportunities to pounce on hot deals like that.

What does 5x mean to you

As mentioned I have 5% cash back available for Drugstores, Gas and Groceries, so really I would only really be capturing the spread between 5% cash and 5x ultimate rewards, we could argue the value of that spread, but I would say perhaps 1.5-2 cents is what is right for me, meaning I would value 5xUR at 6-7 cents. As such I would only load up personal use giftcards for the near term future. However, if I did not have a 5% card, I would load up for as far as a year in advance providing I had enough money to pay the cards off in full. So really it comes down to what is the opportunity cost in your wallet. At the start of this, I discussed how the low limits can easily be met, it is worth keeping an eye out for $500 giftcards that can be liquidated, as they are easy money makers, with just 3 of these you are already over you spend cap for the quarter, and you can put the Freedom card back in the cupboard. This is the key to managing the low earning caps, but if they don’t exist, I think regular spend with a little gift card top up is a good alternative.

Conclusion

- Transferring the CSP to the Freedom eliminates an annual fee, you also lose the +1 UR for dining and travel, so to do this you need an offset card. Mine will be the Fidelity Amex which earns 2% (meaning a slight loss in value here for me) if you are spending a large amount on dining and travel then the CSP might be worth the annual fee, but it would have to outweigh the Fidelity Amex or the Barclay Arrival at 2.22% which would be a stretch.

- The Freedom’s 5% becomes 5x Ultimate Rewards only when you have a linked account to transfer the earned points to, such as the CSP (which we just cancelled..) the Ink Bold or Ink Plus, else it is consider 5% cashback, which is great, but less than 5x URs. If you already have a 5% cash back card then the value of the Freedom degrades, but it is still good to keep a credit line open without an annual fee.

- The quarterly bonuses on the Freedom can be maximized with Gift Card purchases, but don’t buy too many or too much just to capture 5x as you are locking up funds, even more importantly don’t over spend at these categories just to capture 5x rebates, your budget shouldn’t be impacted by a rebate of this size.

- Remember to activate the bonus categories on your Freedom card at the start of the month, but be ready to wait on spending that $1500 in case something spectacular arises during the month that can cash in the full amount for no fee, such as a store specific coupon or rebate that reduces the fees associated with acquiring a cash like gift card.

You need to get in touch with Gary @viewfromthewing

http://boardingarea.com/viewfromthewing/2014/04/02/top-ten-reasons-love-chase-sapphire-preferred-card/

Perhaps if I had read that first I wouldn’t have thought of this post, I mean he has a point about it being heavier than a normal card, which speaking for myself here, tends to get more tail.

It certainly has that WOW factor.

Per OneMileatatime

http://boardingarea.com/onemileatatime/2011/07/19/man-i-love-my-chase-sapphire-card/

“I just went to Starbucks and as I was paying the [whatever they call people that work at Starbucks nowadays] goes “oh my God, is this one of those cards? This is the first one of these I’ve ever seen before, you’re a total legend.”

Legends certainly get more tail.

If you already own the Freedom card, are there advantages to simply downgrading the CSP to the non-annual fee version (other than saving the AF)?

Lowes has a very nice display of gift cards.

Your account will continue to age, which is good for your credit score and you still earn 2x points on travel.

Get more tail? GET MORE TAIL?

Gentlemen! There are ladies present!

Whoops! My wife reads this stuff too, maybe time for some censorship!