Inspired by the comments over at Travel Blogger Buzz I’d like to talk about the sinister world of Cash Back Kick Backs…. I’ll give my view, based upon my understanding of how they work, and open the floor to anyone who would like to share perspective or correct them. Of course, if anyone decides to talk about how I make money I will have to delete that comment and ban your IP 🙂

It is OK to make money

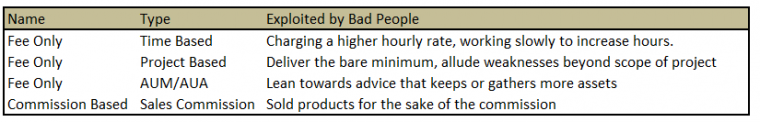

Before diving into this sordid world, we must remember that it is OK to make money. And how you make money does not necessarily make you a bad person. Bad people can make good money in any number of ways. Good people can also make good money using the same compensation models. This challenge is something that I encounter constantly in the Financial Planning world, when talking with planners who posit that commission based financial planning equates to a non fiduciary role. Well lets quash that for starters with the following model:

As you can see, regardless of model, bad people can exploit it for their betterment, and while you can find a lot of good people who are working for the client on the Fee Only side, there can be bad people there too. Likewise, there can be good people, offering fiduciary advice and being compensated by commission.

I draw an exact correlation here between bloggers who push a ton of links to a small client base vs someone like Frequent Miler, who has enough support and respect that people use his links as a method of compensation, without the content being driven by the links.

It is OK to have a site that is driven by affiliate revenue

I may have been guilty of calling people out for this, but in reality it is perfectly OK for a site to have content purely driven for affiliate revenue. It is a commercial venture, and as I just stated it is OK to make money. Even the most respected journalistic institutions, such as The New York Times place restrictions that are related to financial, and political leanings on its writers, and having a job there does not equate to a free pass to say whatever they feel on that day.

Money is a wonderful thing, and so is transparency

What this post has being building up to is that we should not think of money as an evil, nor should we think of the desire to make it as evil. However, transparency, and disclosures are very important, as they allow the reader to evaluate what is happening, and perhaps decide if any exploitation is occurring. If I had it my way I would disclose everything, and my one Achilles heel right now is that Credit Card affiliates won’t let me disclose the commission I earn else they will force me out of the program. There isn’t much I can do about that if I want to keep the links, and I do want to keep them as a means of compensation akin to the Frequent Miler scenario above. So today, let me disclose that they do pay me something. And lets dig into the world of Cash Back Kick Backs.

Big Crumbs

There is some excitement about abuse of Big Crumbs in the comments over at TBB, and I don’t quite ‘get it’ – here is how I see it:

Signup for Big Crumbs with this link and You will earn X whenever you shop there.

Signup for Big Crumbs with this links and You will earn X whenever you shop there.

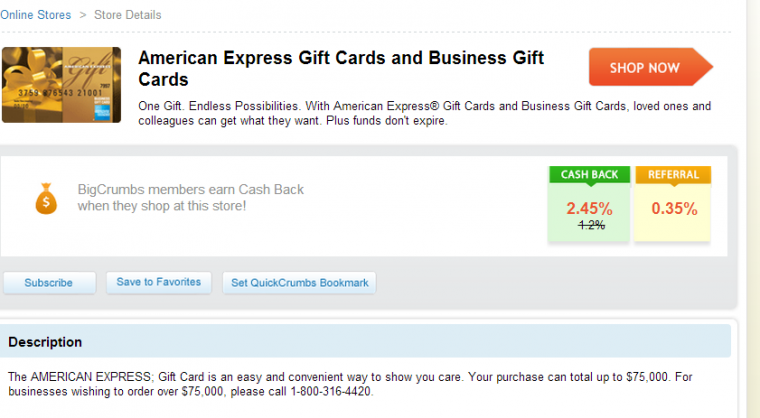

X is constant. You lose nothing between the two links. However, if you use the first link you become my ‘first level referral’ and I get a cut of your purchase, when a double commission is offered. This is quite transparent when you see the following:

As you can see, Amex Gift Cards are currently offering Primary Cash Back of 2.45% and referral Cash Back of 0.35%. Let’s go ‘big’ on that and look at someone rocking the DC Broker method of $75,000 per month, that equates to:

- Primary Cash Back $1837.50

- Referral Cash Back $262.50

So in this example, if you sign up for Big Crumbs using my link (and are a heavy hitter) your X will be $1837.50 per month. And I will make $262.50 per month. Not too shabby eh? In fact, an affiliate driven site might be inclined to write a post about that and pop their own link inside it…

Here’s the thing. When I signed up for Big Crumbs I used someone else’s link. And then I though to myself, you know what… my wife shops online MUCH more than I do, why don’t I introduce her so she too can earn such great cash back, and heck, I can get a commission from her!

What many people don’t tell you is that if you go on to refer someone else then effectively you get to keep both the primary commission and the referral commission, should you be paying the bills. Now, here is why I think it is OK to use Big Crumbs, because I used some other guy to sign me up, and then I signed my wife up, and we are able to make:

- Wife: Primary Cash Back

- Me: Referral Cash Back

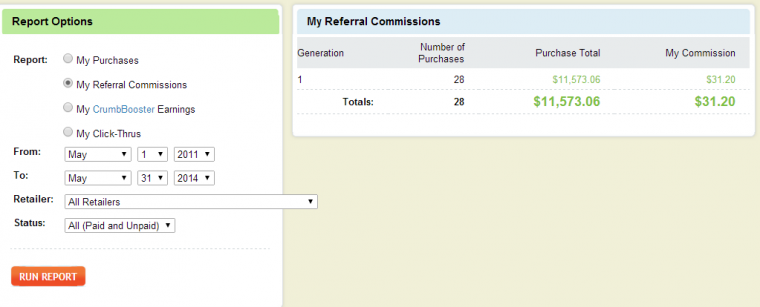

So I am not really ‘losing anything’ here. However, it is worth noting that the person who does introduce you could possibly earn a recurring income from your purchases. Let’s look at mine:

In conclusion, I do not think that Big Crumbs is a bad thing, but I do think it is good to make people aware of the fact that I can earn a commission from them, and if they so chose, they could ‘reallocate’ that to themselves. If you are one of the people who signed up, I earned an average of a buck from you and I hope you don’t feel that I tricked you, I didn’t see any harm in it, but reading through replies from people on TBB I guess I can see scope for abuse. If you are on my list, just mail me and I will be happy to send you back the money via Amazon Payments.

EDIT – Frequent Miler informs me in the comments that the referral layer is actually two deep, meaning that if my wife buys $75,000 of gift cards:

- She gets $1837.50

- I get $262.50

- The guy who ‘introduced me’ gets $262.50

All in all this is a total rebate of 3.15%, shared out among the three of us. Additionally, we should note that Big Crumbs is not doing this from the kindness of their hearts, they too are taking a slice of the pie. With that in mind it is worth remembering that firms like Big Crumbs have a customer acquisition budget from places like Amex, and some will kick back more. Two of note from Frequent Miler are Lucky Rewards and Barclay’s Reward Boost, both offering a 4x reward!

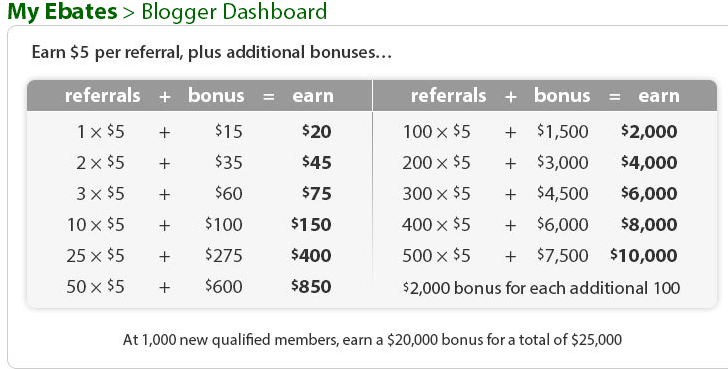

Ebates

Ebates offers a flat fee, the numbers are below and speak for themselves. Ebates does not take a recurring commission, it offers an upfront payment as an introduction as per the below. Here’s my introduction link if you haven’t joined, I can’t see it doing any harm other than making me incredibly wealthy and even more obnoxious.

TopCashBack

TopCashBack offers $10 to refer a friend.. and no recurring income. Here is my TopCashBack link. I believe that for the payment to be made you have to make a purchase too, as you do with Ebates.

OK enough pimping! Let’s look at some dirty stuff

Going back to the start of this article I mentioned how even those on the most innocent and well respected compensation model could abuse the plan. The same can be said for this referral game. For example, if a Blogger could latch on and pull in $262.50 per heavy hitter, they could be inclined to not talk about how much they make from this, and what’s more they could encourage a reader to not do something that was actually in their best interests.

This is how a ‘bad’ Fee Only Planner who was being compensated using an AUM (Assets Under Management) model could be inclined to advise his client to not take money out of assets in order to pay down their mortgage, as it would reduce their annual income, or similarly ‘encourage’ more money to flow into the AUM umbrella rather than elsewhere. The BigCrumbs model doesn’t have to a bad thing, I still don’t think it does harm (especially when disclosed like in this post) but it can be abused by bad people.

For example, they could ‘advise’ people to stick with Big Crumbs, for any number of reasons, but their motivation is to gather the referral commissions. They could offer doubt and confusion towards other models that perhaps might offer a greater level of reader cash back (but no Cash Back Kick Backs for them) and they could sit back and make money from ignorance of this. The worst examples of this behavior take active steps to moderate out reader comments that alert their fellows about what is happening.

We see this with Credit card bonuses, and also in this weird, and sinister world of Cash Back. For bloggers out there remember, it is OK to make money, but try to keep your eye on the real prize, which is being a helpful addition to the community and offering interesting content, which may be compensated. Sometimes it is hard to write post after post and see no income, but if you are in it for the money then how far are you willing to go to make a buck from your fellow man?

Frankly I don’t see anything wrong in this but I will support only those bloggers I trust and not those money sucking pimpers out there. And if it is for a charitable cause I might do more because it is benefiting the society at large. By the way, I liked the photo in this post. Reminds me of those pimpers behind masks and hope they don’t come after me like that in my dreams:) nice thought provoking discussion once again adding value to the entire travel blogging community. Keep it up, Matt.

Thanks Kumar, I like the idea of shining a light on the money side of things. It doesn’t make it bad to earn, but it makes it more clear HOW it is happening.

Agreed; it’s not that people earn money from my clicks, it’s WHO earns money from my clicks.

If I, too, earn money, that makes it even better. I see this all the time in my business; I’ve been with the same (big) network marketing company for over 13 years, and I will hear of people who quit, because they don’t like their uplines for whatever reason, and “I don’t want so and so making money off me.”

But here’s what’s interesting. In Matt’s example, the person whose link he first used for Big Crumbs makes whatever they make from Matt’s purchases in his account. But, if that person is lazy, or not such a good guy, then s/he will have few people using that link, and the income will stabilize from it, and eventually drop off.

OTOH, Matt, being a good guy AND a go-getter, will get a lot more people using his links, make more money, and, in the final analysis, will be better off using the link he first got, because otherwise that link HE created goes away.

The same is true in my business. If your upline is a jerk, the absolute best thing you can do is to work your butt off and pass them up–because you can. I’m lucky enough to have a wonderful person who has become a dear friend as my upline. But hers is not so nice. And makes less than 1/3 of what she makes, because my friend works her butt off and is a good person. The other, not so much.

Click on those links all you want, folks. Pay attention to whose links you deign to click, and then, rest secure, in the knowledge that you, too, can have your very own affiliate links, if you want them.

Hey MickieSue,

I agree the corporate world has a lot of similarities and things typically can work out if you work hard enough, comp models are strange things, but usually allow for success. It is important to share how things work though, so people can make savvy choices.

I hate scary clowns.

I picked a cute one…wait til you see the next!

I do remember that when I first started reading Saverocity, Big Crumbs and Ebates came up when you replied to my question in a comment, or perhaps it was an email. While we did not go into all the mechanics you describe above, you were very open that my using your link would/could benefit you. Which is just fine with me.

I get so much benefit from the bloggers I read regularly that I am happy to click their links when I can. Too bad I don’t buy enough through portals to make them real money 😉 ! But I appreciate knowing the specifics – and now, if CB is roughly the same among the various sites, I will choose BG because it is one more way to help compensate “my” bloggers.

Thanks Elaine – remember though, only use Big Crumbs if the other offers aren’t better, then it is a win win. People have talked recently of Barclay’s Boost mall and TopCashBack as being better for you sometimes.

I love the offer to pay people back through amazon payments. Hilarious!

Also, totally agree with this post.

I should have disclosed I would keep the cash back from sending through Amazon Payments too 🙂

Thanks for the positive shout out Matt. This is a great topic for discussion. I think that, more often than not disclosing financial interests, a lot of blogs don’t mention hat there are better options than the one that will benefit them. In this case, blogs should reveal:

1. Both Lucky Rewards (4%) and Barclays RewardsBoost (4X) currently offer better rebates for Amex gc purchases

2. Big crumbs offers two levels of referrals. This is confusing, but here goes: suppose blogger A offers his/her referral link and reader B uses that link to sign up, then person C uses reader B’s link to Signup. Then, if C goes through big crumbs to buy Amex gift cards:

C: gets 2.45% back

B: gets .35% back

A: gets .35% back

So, total payouts in this case are slightly over 3%, which is good but not the best available current option. The 2 layer thing makes it difficult for blogs to give full disclosure because it’s pretty confusing.

Anytime sir, you are doing it right, and it is a great inspiration for folks like me.

I will update the post – I think the key to my point remains though IF BC offers the highest amount THEN referring someone is ok, ELSE it is better to go with the others – and the referral issue doesn’t really matter.

I get that it could be 3.15% with all 3 layers as per your description, but if the best on offer from RewardsBoost and LuckyRewards happens to be <2.70% then BC with 2 people can still be better.

The essence of it all remains that if BC is offering a kickback, will people talk about Lucky Rewards and RewardsBoost if it means losing money?

What if you stop liking your favorite blogger?

I used Ingy’s TCB link many years ago. How do undo this mistake?

As I mentioned, it’s not ongoing, so you kicked him $10 back in the day. In fairness that was likely in exchange for some sort of useful info.

Big Crumbs seems harder to shake- need to get you descendants to sign up to get rid of grandpa 🙂

Sorry BC (not TCB).

You will have to invite someone- you could try ‘inviting’ yourself under a new email if you don’t have another family member, not sure about fallout/closure for trying that…

Interesting discussion, learned something. I am still waiting for the person to sign up for BC with my own BC referral link damnit!

What makes this thing harder is that the darn % bonuses CHANGE NON STOP! Same with banks having different offers out there, probably drives bloggers nuts.

I personally like ebates…after my own Amazon link of course 🙂

Glad to hear that! Our mission is to steal better ideas, and then to Entertain. Educate. Inspire. In That Order

Matt, while disturbing, I really like the scary clown,. Feel free to randomly change some of my more boring post graphics with some similar pictures!

Thanks, BH

I’ll see if we have an app for that 🙂

Here’s my problem with BC. Reasonable compensation for a portal referral is $10 (max) NOT a lifetime income stream, and certainly not 2 deep. I mean, why would anyone “recommend” a portal that has 3 middlemen? And despite what the prolific BC pimpers would lead you to believe, you ARE getting shorted when you use their referral link. This becomes quite clear when you look at BC’s historical payouts. About the only time BC is competitive for AMEX GCs is when the referral payout is minimized, and vice-versa. So why would anyone recommend a portal that will have a 2 stroke handicap vs. other portals? And why is it the most common referral link in people’s sigs at FT? Why on earth is it so highly recommended? LOL. The only way I’ll recommend it is by telling people to keep the 2 deep referral in the family.

I will disagree with you – lifetime income is absolutely fine, providing it doesn’t take out of the pocket of the individual. For those times when BC offers more than the other portals then the person isn’t losing out, and if they can invite their own family to capture more of the kickback it is even better.

Throughout this I believe that it can encourage bad people to mask over other options for their own betterment, which I think is very bad indeed, but if everyone knows the ‘truth’ then it isn’t a bad thing from what I can gather.

The whole BC gripe started years ago when the Mint Coin thing was in full effect. Before the avalanche of bloggers yrs later, ppl had the BC link in their FT handle. At one point there was no cap on buying ax gcs so everyone who you signed up to BC was a revenue stream. Seems like after Apr 1 2013 Frankstein came back to life and here we are again.