I’ve been watching the rise of the USD against a number of currencies recently, and it has got me wondering about how to game it. My initial thoughts were that currency arbitrage must happen swiftly. And I think to an extent there is truth in that.

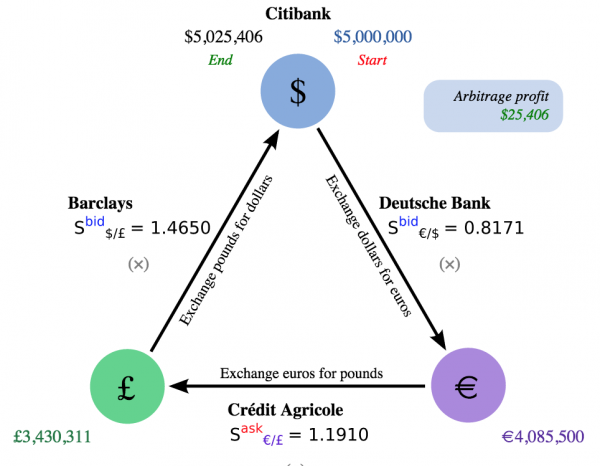

Currency arbitrage, like all forms of arbitrage seeks to take advantage of mispricing in the market. This means that your money is suddenly ‘worth more’ than it was before. More complex forms of it become triangular arbitrage, and the ‘timing’ factor that I alluded to earlier can become fractions of seconds, manipulated by high frequency trading. Below is an example of it in action from Wikipedia.

A currency that I have been watching closely is the Euro in relation to the Dollar. While the Japanese Yen is also a good opportunity, I decided the Euro had more scope in it as it is more widely accepted. Not only are there the core Eurozone countries, but several other European countries, along with a smattering of Caribbean islands, and small outcropping near Canada have embraced the Euro.

If we look at the Euro to USD decline over the past 12 months we have close to an 25% gain in purchasing power.

My gut reaction was that in order to counter this the countries would have somehow adjusted the pricing via inflation. I looked up the CPI rates for the EuroZone Countries, and found that most were in a period of low inflation, or even deflation.

| Country | Location | Inflation | |

|---|---|---|---|

| Guadeloupe | Caribbean | ? | |

| Martinique | Caribbean | ? | |

| St Barts | Caribbean | ? | |

| St Martin | Caribbean | ? | |

| Andorra | Europe | ? | |

| Saint-Pierre-et-Miquelon and Mayotte | Canada | ? | |

| Vatican Cit | Europe | ? | |

| San Marino | Europe | ? | |

| Monaco | Europe | ? | |

| Austria | EuroZone | 0.83% | |

| Belgium | EuroZone | -0.4% | |

| Cyprus | EuroZone | -1.40% | |

| Estonia | EuroZone | -0.87% | |

| Finland | EuroZone | -0.15% | |

| France | EuroZone | -0.27% | |

| Germany | EuroZone | 0.09% | |

| Greece | EuroZone | -2.16% | |

| Ireland | EuroZone | -0.49% | |

| Italy | EuroZone | -0.09% | |

| Latvia | EuroZone | -0.1% | |

| Lithuania | EuroZone | -1.8% | |

| Luxembourg | EuroZone | 0.25% | |

| Malta | EuroZone | 0.1% | |

| The Netherlands | EuroZone | 0.1% | |

| Portugal | EuroZone | -0.21% | |

| Slovakia | EuroZone | -0.49% | |

| Slovenia | EuroZone | -0.38% | |

| Spain | EuroZone | -1.07% | |

| Kosovo | Europe | -0.3% | |

| Montenegro | Europe | 0.6% |

I found it hard to find accurate information for the Caribbean Islands in terms of their inflation rates. The most recent ones were relating to 2013-2014 data which would not have relevance to the Euro price move. I did note that St Martin was looking at 4% to 2.5% inflation rate reduction during that period.

Why is this important to travel?

The CPI (consumer price index) measures costs of things that are relevant to the traveler. Things like food, drink, transportation etc. If these prices are showing a negative CPI that means that they actually cost less than previous years within the country.

To take a practical example. If a glass of wine in Spain cost 1 a year ago, at a negative CPI of 1.07 it would now cost about 93 cents. But that Euro also costs us 25% less, so we have a double win.

Not only does this make it an attractive time to travel overseas, it makes an attractive time to invest there, I’ve been thinking for quite some time about purchasing an overseas property. However, I feel that even with ‘some’ data I’m out of my depth in terms of market knowledge for such a decision right now. We must remember that even if we can discover accurate CPI data that doesn’t mean that certain products aren’t inflating at a different rate.

A common example of dual inflation in the US is seen within the college education world. If we were to look at college education and forecast it based on CPI our numbers would be startling far from accurate, as the rates are rising using a different index.

Having said that, I do find it intriguing when I see websites like this one in Martinique that list property prices in USD using an exchange rate of 1:1.25…certainly something to explore further.

Buying Property in Martinique

There are no restrictions to foreigners owning property in Martinique.

This property is priced in Euros. For your convenience, this has been converted to US Dollars using an exchange rate of US$1.25 to 1 Euro. The indicated US Dollar asking price may therefore vary according to the exchange rate.

It really does require some good local knowledge to see if the prices here have inflated, or deflated, since the corresponding drop in the Euro.

What can we do with this?

With long term fluctuations, I am pleased to see that our money really ‘does go further’ at this time overseas. I had initially assumed it would be eaten up by an inflationary force. That said, it may be that to take full advantage of this you might need to live more like a local on vacation. It is quite easy for a tourist focused area to hike up prices in the knowledge that the dollar can handle it. Long term stays, leveraging things like Airbnb where you would buy groceries rather than eat out every night do seem more insulated from this.

Fast movements in an interconnected world?

While we cannot move as fast as the high frequency traders taking advantage of triangular arbitrage, I do think that certain opportunities lend themselves toward ‘gaming’. The key here is the inventory load speed. Instead of thinking USD,GBP,EUR as per the first diagram, if we visualize USD>CURRENCY>PRODUCT there may be opportunities. Seat31B brought this up regarding the Ruble, where he managed to find prices 20% off market rates as the inventory hadn’t adjusted to reflect the currency shift that occurred.

Since we generally cannot move fast enough to catch a lot of this inventory the angle here might be to find a slower paced inventory load. I feel that airlines update pricing too quickly, but there might be things with slightly different products, such as cruises, or vacation packages that are sold by local travel agents in countries where there is an exchange rate adjustment. Things that are printed in brochures and sold through less efficient channels may be fruitful.

Can you cut to the chase? I have a Passover seder to host tonight and can’t read it now!! Should I be buying euros? 🙂

Just kidding, of course, and I will read the post over the weekend.

To all my virtual friends out in Saverocity land, Happy Passover, Happy Easter, or have a great weekend, whatever you do!

I wouldn’t necessarily buy Euros.. But Euro related products. There will probably a further dip against the dollar. I’m buying into long term Euro based investments, such as an etf and perhaps some other things. Enjoy the soup!

Recently returned from a trip to europe. My less-involved form of arbitrage involved withdrawing sums of cash from the ATM there using my schwab card to sew into my pillow and mattress in the hopes that when i return the euro will have recovered somewhat. Of course that does not partake in the double dip, which I think is a neat concept. I am a bit wary of buying euro products/properties as I feel that is well out of my scope of comfort but you certainly bring up an excellent idea investing in an ETF. Any particular ones you were looking at?

I explored the difference between hedged and unhedged here https://saverocity.com/forum/threads/european-etfs-%E2%80%93-hedged-vs-unhedged.142264/ Personally I opted for VGK

How would you manage payment of whatever product in the local currency?? The company I work for has locations in a couple of different continents and pricing for tech hardware/software in the Asia markets is almost always cheaper than what you get in the US. UK is always the most expensive. This is 100% doable as I’ve seen prices for local people or in local currency for Indian travel agencies are always cheaper than for US. Again, the issue comes up in how you would actually get the cash to the local sellers. Any ideas?