If you are delving into the world of Points and Miles based Travel, or as some call it Travel Hacking, you might have heard of the the term App-O-Rama or AOR. These are events where you select a series of credit card applications in a short space of time in order to net the most points, with the lowest long term impact to your credit score. This post will explain the how and why of a successful App-O-Rama.

A Cautionary Note for First Timers

Start small and build up gradually, it is tempting to try to bit off more than you can chew when applying for for multiple cards. Remember, the goal of the App-O-Rama is to net a bunch of points quickly, but in order to do so you need to meet a minimum spend requirement for each card you apply for. If you apply for too many cards and fail to meet the deadlines to run up spend then you just wasted that application, as frequently you cannot apply for the same bonus on the same card for quite some time.

Complete Credit Card Virgins

If you have never held any cards before then you really must start with just one card. You’re App-O-Rama will technically be known as an App. This is because to you, credit is an unproven entity and you need to establish if you have the mental fortitude to manage the beast. This is not intended to be derogatory, it is a very real warning. The hobby we talk of here to leverage the Credit Card points system means find ways to leverage a system that is designed to make money from you. From my own personal experience with early Credit it can be very deceptive and you might fall into a debt trap. Remember: WE DO NOT PAY CREDIT CARD INTEREST OR LATE FEES, EVER. If you cannot afford to pay in full every month do not get a card.

The Best Cards for your App-O-Rama

You need cards that offer lucrative signup bonuses, and should pick the ones that fit into your travel goals. Here are my top 3 cards for your App-O-Rama, if you are experienced with credit and ready to sign up these would be the best additions to your wallet (at this time..):

Citi Visa American Airlines 50,000 Point Signup Bonus after $3,000 spend in first 3 months. No Annual Fee in First Year, second year $95 used for American Airline Flights. With 50K points you could fly to Europe RT in off-peak season in Coach and have some left over. This offer is what I term a ‘grey offer’

Chase Sapphire Preferred Card 40,000 Point Signup Bonus after $3,000 spend in first 3 months. No Annual Fee in First Year, second year $95. Best used by transferring at 1:1 to United Flights or Hyatt Hotels. This is a great card, and also offers 2x earning on Dining and Travel. This offer is direct from bank.

Barclaycard Arrival World MasterCard 40,000 Point Signup Bonus after just $3,000 spend in first 3 months. No Annual Fee in First Year, second year$89. These points are used like cash for travel, on any airline or hotel and you would earn points from the booking. The most flexible card here, earning 2.22% per Dollar. This offer is an affiliate link.

To learn more about Grey offers, direct from bank and Affiliate links see this post. Whilst all three come from different sources, these are the best three offers that I could find at time of writing for you, the reader.

Understanding Your Monthly Regular Spend

This is actually a budgeting tool that is handy to have. If you already have a credit card or cards it is easy to track monthly spend by category, but if you don’t then you might want to sit down and write out an (honest) plan. How much do you spend eating out, how much on groceries, how much on other things etc. Once you find your number, this is a key component in telling you how many cards you can handle in on App-O-Rama.

Ways to Increase Regular Spend Card Minimum Spend Requirements

Firstly, make sure that you aren’t forgetting anything that could be paid by a credit card – some people think that you can only use a card for a certain purchase size, and indeed some retailers state X minimum required for Credit Card. However the big chains don’t have this requirement in general, so if you were shopping in a store like CVS or Duane Reade put those $1 purchases on your card, they add up.

Nabbing the Cash at restaurants. This does not mean grabbing the money and running, it means when you are splitting a check make sure you put as much as possible on your card. Often times people will put their part in with cash, take that, and charge the amount to your card. That can quickly add up.

Look for Old Bill Pays. Especially if you are just moving to credit cards, most of your monthly services will be on Bill Pay, which deducts directly from your bank account. Look through utilities such as Electric, Telephone, Cable TV and see if you can put them onto the card.

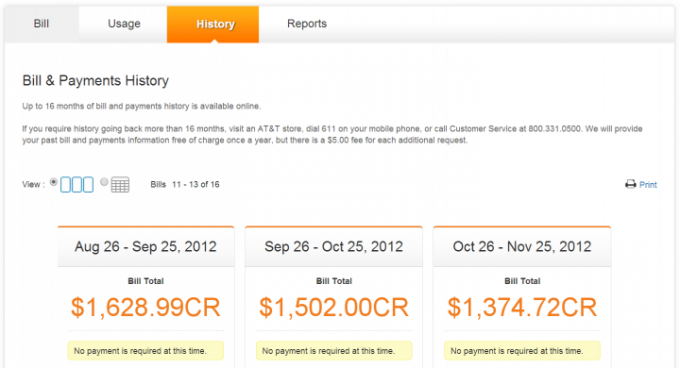

Pre-Pay Cable or Telephone Bills. I use this tactic when I need a quick boost to my spend, you can carry a Credit Balance on your cellphone or other bill:

Now, if your spend is closer to $1,000 per month based on the above habit changes you can easily handle the $3,000 minimum spend requirements of the Citi Card or the Chase card. If not, then the Barclaycard Arrival World MasterCard is the best place to start. If you think it is easy to hit around $1,333 per month then you could take on two cards (unless you are a complete newbie, in which case I would urge caution on your first App-O-Rama).

Want to Manufacture Spend to Meet Spend Requirements?

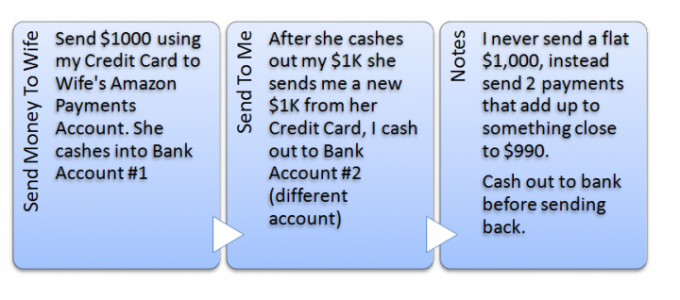

There are several ways to manufacture spend to meet spend requirements, the best, providing you have a trusted second person is Amazon Payments. This service allows you to ’email’ credit card money to one another, up to $1,000 per person per month. I have been successfully send $1K to my wife, who then cashes it out to our bank account, and then sends me back a different $1K for a year or more now.

Some people suggest that sending like this ME>WIFE>ME is a flag and will get your account shut down, it hasn’t for me but take the approach that it could, and therefore make sure you have enough cash reserve to float the money in case your $1K gets a temporary freeze as they shut you down.

For me, I make sure that the linked bank accounts are different too – so the pattern looks like this:

As you can see, just by using Amazon Payments you can knock out a $3,000 spend requirement in 3 months per person. I use this monthly, and when I don’t have any spend needed I use my Fidelity American Express to earn a free $20 each month per card.

Amazon Payments is the best form of manufactured spend as it contains these two critical elements: Zero Transaction Cost, Minimum Time to Execute, because your time costs money too. It is impeded by the relatively low $1K per person per month, but remains the best option for manufactured spend.

Setting up for Success

Pay your bills on time and in full! First step with a new card is to set up Auto-pay to cover the full payment, note that some cards need a cycle or two in order to register the Auto-Pay so you need to make manual payments initially. Additionally, if you have a small line of credit, as may happen on your first card, make extra payments early. Try to keep your utilization low, so that you don’t ding your score.

Credit Score Impact

The reason that many people decide to App-O-Rama is that your credit score gets a ding with every new application. This ‘hard credit pull’ will knock some points off your credit score. However the credit score has a natural elasticity built into it and it will rebound to the previous level (actually it will go higher in time). By applying for more than one card at one time it resets the clock once, as opposed to getting a new card say, every 2 months which keeps your score from rebounding.

It will take around 90 days or so to rebound your credit score in general, but you will hold notes on the account regarding new credit applications for longer, so if you plan any real credit needs, such as a Home Loan in the next year or so, don’t apply for credit cards, don’t worry – they will still be there when your loan is secured (I hope).

App-O-Rama Day

Now that you have realistic expectations of what you could handle from an App-O-Rama you should select the cards that you want, and start applying. It is possible to go big on App-O-Rama’s and apply for 6-10 cards at a time, and I think it is OK to do this providing you build up to it and know what you are doing. Remember, taking on too many is a waste of a credit pull and an offer.

- Spread out your applications, no more than 2 per bank/institution at any time.

- Consider business versions of the same card if you have a small business (you could then get 2 Citi AA cards for example)

- If you are declined an application be prepared to call in to ask for reconsideration, if you are nice you might be able to get a rep to reverse the decision.

Good Luck, be responsible with your credit, and make sure that you are playing the game, rather than let the game play you.

Agree with AA card and Arrival picks. But I would substitute Chase Sapphire Preferred with Chase Southwest card, because the second is a limited time offer. CSP most likely will stay the same for some time. Even if you don’t fly Southwest, you can cash out on 500 dollar Amazon gift card. So even after a 69 dollar annual fee, thats a good haul. I know the increased offer comes back regularly, but you never know.

Thanks for that, it does sound like a solid offer too. I’ve never flown SW so never thought of getting that card, i’d put it neck and neck with 40K CSP off the top of my head since 40K could also be worth $500 on travel at 1.25, and both travel and amazon cards are great, but not as good as cold, hard cash!

Definitely something to think about for my next round of apps!

I started in January, and did 2 cards (AMEX SPG and Chase CSP). I then did the same 3 months later for my wife plus Chase BA. Then, 3 months later, I did AMEX SPG Business and Ink Bold and Chase BA. I’m on hold until next January, as I want my score to rebound a bit, and I’m still on the last leg of spending requirement for the AMEX SPG Business. I haven’t been rejected yet, but I’m starting small. I may look to do 4 or 5 cards per AOR next year….we’ll see 🙂

But the way I’ve used my points, will be looking at $7k – $10k worth of rewards for just this year. Been a lot of fun learning the ropes.

Yep, the value that can be gained from these is just incredible, but expansion into larger Apps must be done with caution until you become comfortable with managing the larger numbers.

Very solid advice. There are two things I wouldn’t recommend, though. First is ME>WIFE>ME. I understand it works for you, but introducing a third party if possible will remove unnecessary risk. There is no more free MS options left except Amazon, so it’s a very precious resource.

Another thing I wouldn’t do is two apps for US Bank and Barclay. Citi are good 8 days apart. As to Amex, I would do one credit and one charge card at a time, but not two charge or two credit.