The Barclaycard Ring is offering something unique in the credit card space, they are willing to pay you 1% of the amount that you balance transfer in the first 60 days to the card. I think this makes for an interesting proposition should you be in the right financial position.

Clearly the goal of incentivizing the transfer is to create a book of business with Barclay’s of accounts that carry balances, and if successful they will certainly turn a nice profit on these new accounts. However, there are a couple of scenarios to explore to see if this card may be right for you.

Someone who needs to lower their APR on cards that carry a balance

With an attractive 8% APR as standard, this is clearly a lower cost of debt than many existing cards, which can run as high as 20% for existing balances. Whilst it is far from ideal to carry a balance on a card because of this there simply are times and situations where people already have existing debt, and restructuring it by finding a cheaper option would be better. The average household in America has $7,128 in credit card debt (those who are actually in debt average out over double this number). Let’s see what the impact of the Barclaycard Ring would be on this number.

The attraction of the Barclaycard Ring is that it offers that lure of 1% upfront to transfer over, this would translate to a statement credit of $71.28 in the first month. However, the typical balance transfer from other cards includes an interest free period (before leaping up to regular rates) whereas the Ring kicks in right away at 8%. Clearly, if you are paying a high APR, for discussions sake lets use 18.99% you would benefit from switching to the Ring, but lets compare with a regular transfer to a card that offers 12 months of interest free credit.

The catch on the interest free transfer card, they typically come with a load fee of 3% (sometimes more) of the total balance. So we will factor that one in too. Let’s start with looking at all three scenarios, keeping an old card that has a balance with an APR of 18.99%, the BarclayCard Ring, and the DiscoverIT which in this iteration actually comes with 18 months interest free credit on Balance Transfers. There are several versions of the DiscoverIT card, this here is the one that comes with the 18 months interest free: DiscoverIT 18 month interest free balance transfers

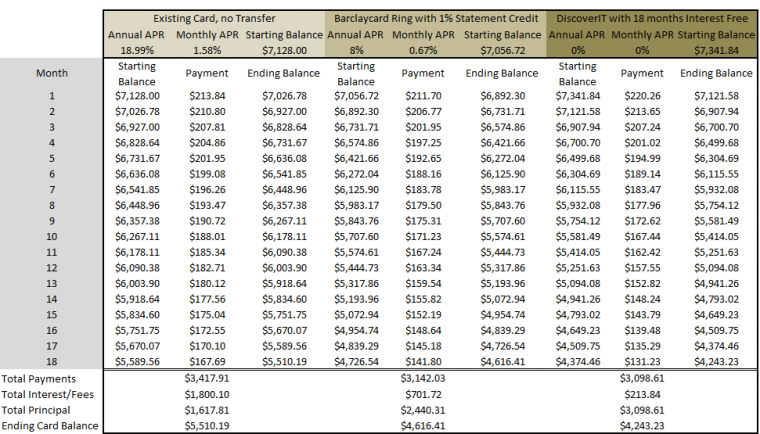

Scenario 1 Minimum Payment Payer

In this first Scenario, which may apply to some people who are carrying balances we see the absolute worst case scenario for a person in debt. The credit company allows you to select as an option:

- Minimum Payment

The problem with this, as the chart above shows is that each money your payment amount decreases, whilst that may make you think that you are getting closer to goal the reality is that by paying 3% of your balance each month you can never actually reach zero, the only way that the credit card companies prevent you paying for a balance for infinity is to add in the phrase:

- Minimum Payment (the greater of) 3% of outstanding balance or $10

I cannot stress this enough, if you have a balance and are struggling to pay off your cards every month, at the very least make sure your payment is a fixed amount not the Minimum Payment. Even if you set it as the same as this months minimum, but never decrease it! If you select ‘minimum payment’ it will take you 215 months to reduce your $7,128 to $10 for the final payment, over which time you will pay $14,363 and will still have a balance remaining of $329, to clear it off in full will take you another 47 months of paying $10 per month… 262 months to clear that debt off! If you instead start out with the same first payment of $213.84 you will have your debt cleared in full in 48 months, making total payments of $10,264. That is huge, and I am not even getting into the amount of money you can save and EARN interest on in the 200 months that the other guy is making his minimums on.

This chart shows the difference, between selecting the minimum payment option and selecting a fixed amount that starts the same, but never decreases:

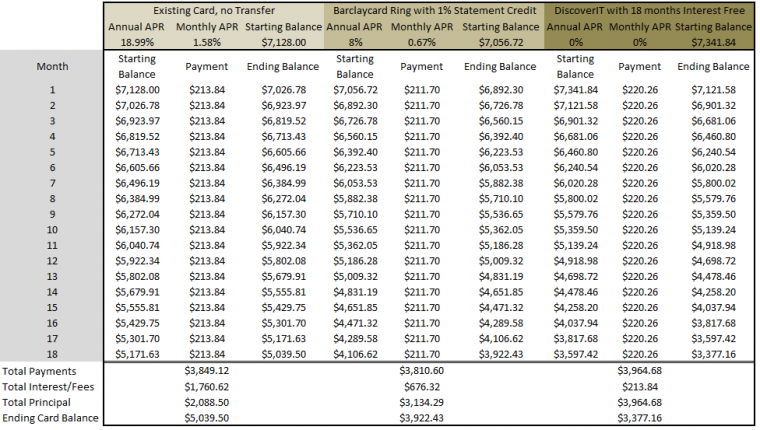

One factor to consider is that since the balance transfer to the DiscoverIT 18 Month Interest Free Balance Transfer Card comes with the 3% front load fee your first month payment is higher, and if we keep that up you are paying more per month for in your outflows for that card. In order to level the playing field lets try one final scenario where each card has the same monthly payment. I picked a higher number here, just for diagramatic purposes, of

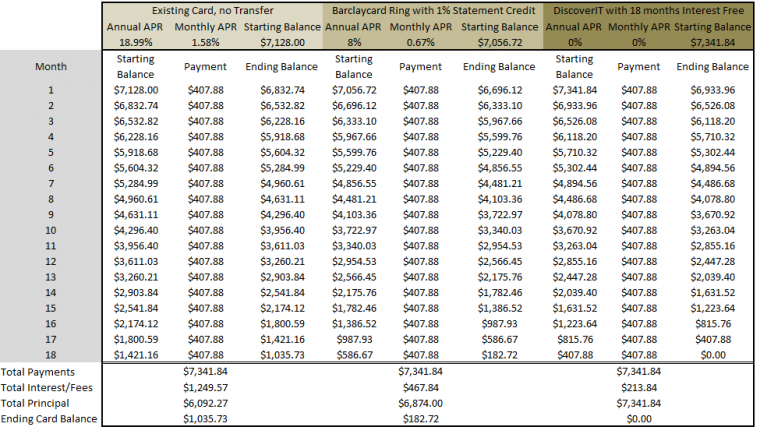

I selected an aggressive repayment amount of exactly $407.88, that is the number that you need to bring your debt down to zero in the most cost effective manner. The total cost of your credit card debt would be the amount of the Balance Transfer initiation fee (3% of $7,128) for $213.84 that is added to your total debt.

The real benefit of moving so aggressively is to kill the impact of the time value of compound interest. Even if we took the worst example, of not making any transfers to a new card and paying off at 18,99% APR by accelerating payments by the end of the 18 month period you have hammered down the amount of your actual principal balance to the point where it has only $1,035 remaining, and in doing so you have saved $550.53 in interest payments.

If you are thinking of going for an interest free transfer I would urge you to also consider the Chase Slate card, it comes with 15 months interest free balance transfers (if done in the first 60 days) and doesn’t have that 3% front load fee.

Where the Ring can Help

Thus far we have seen that the DiscoverIT with 18 months interest free balance transfers is a better option, however, at the end of that introductory period is where the Ring will start to become more beneficial. The best route would be to bounce from card to card (actually best for your credit too if you don’t have a mortgage or other loan due soon) but if you don’t want to apply for another card at the end of this period it could be better to hold the Barclaycard Ring, depending on your repayment schedule.

If you are not able to pay down aggressively, such as the example above where I show how you can clear the debt in full using a monthly payment of $407.88 then the amount of your payment will impact the best card option for you.

I am actually going to terminate the analysis of this situation here, because it is my opinion that if you fall into the category of:

- Carrying Large Credit Card Debt

- Unable to make a payment of $407.88 per month

- Currently paying a large amount in Interest per month

Then you do certainly need help and advice, but this post could do more harm than good. The risk that is present, if you are in such a position as I outline above, is that you could create new credit lines in order to lower your interest rates and fall into the trap of spending more because your old, bad financial habits kick in and view it as ‘free money’.

If you are in this position please don’t apply for any new cards, whilst doing so can provide a respite from interest payments and get you out of debt faster, it is only a strategy that can work as part of a greater plan that includes a very disciplined budget, and is not a silver bullet for your needs. If you would like some advice in this area please feel free to email me via matt @saverocity.com and I will try to provide a more comprehensive solution to your situation.

Conclusion

If your credit and debt are under control, then both the Barclaycard Ring and the DiscoverIT card can be powerful tools to play with, but if you are actually in financial difficulties, and are the target customer of the Ring then you need to understand that the 8% APR starting immediately negates the 1% statement credit and you could do better with other options, but more importantly, you need a proper financial plan and budget in place.

Affiliate Disclosure – The Barclaycard Ring and the DiscoverIT with 18 months interest free balance transfers are affiliate links, they pay me a commission. The Slate is not an affiliate link.

As long as you can come out ahead (even if only slightly) by using VRs and BB, why would you use any other mechanism to transfer a balance? For example, the Barclays Arrival card has 12 mo 0% interest. Transfer the balance to it using CVS VRs and add the signup bonus, and you have $542.56 statement credits toward travel or $271.28 cash statement credits, and $59.25 in VR fees. If you can MS at grocery stores, you can do even better with AMEX BCP which has 15 mo at 0%.

Agreed, that has some considerable value. But I think we need to also understand a distinction between a sophisticated person (able to work that out) and a person who needs to do a balance transfer for cost reduction as part of a debt reduction strategy.

I like your idea here for people who want to float extra money for a temporary loan perhaps, and who are able to be disciplined with the funds rather than spend them.

Yes, unfortunately the ones who could benefit from these programs the most can’t use them due to their inability to see credit as anything other than available cash. My suggestion only really works for someone who has credit card debt as a result of a truly one-time event that was out of their control and has the ability to manage both money and debt.