I’m in a bit of a pickle, and wanted to share some of my thoughts on spend with you today. The challenge is to accept clean, or dirty spend, and to explore the nuances of each. My scenario is twofold. Firstly, I’m setting up a new business that is turning out to cost a ton of money.. and since it is new I’m putting it all on a Business Debit card. It really breaks my heart. I’d applied for an Ink, but was rejected due to the age of the business.

That said, a ‘ton’ for me in this case is only a few thousand, so in terms of real spend, its pretty marginal. I spent more than that on groceries last week. But there is some part of me that looks at say $3K in a week and thinks – wow, that’s a credit card sign up bonus missed right there.

Additionally, I still need a flight to take me back from Aruba in 2016, JetBlue got me there for dirt cheap, but the return price was a little more expensive, Delta has seats on my desired flight for 17.5K in economy and 30K in business. So I could do with some Delta points. I do have the SunTrust card, but I don’t have time to earn on it due to opportunity cost.

The solution – The Gold Business Delta Amex, 50K pts +$50 statement credit, no annual fee in Yr1. I now have a $2K spend to meet.

Delta Sucks

But what sort of solution is that? I like Delta, but if I’m really doing this for regular monthly business spending then I’d rather something valued over 1 cent per mile, perhaps a Membership Reward or an Ultimate Reward.. the sign up is great, but the ongoing spend is pointless….

I need points FAST

I hate seeing my seats available but my points not. Whenever I get a new card I like to meet spend ASAFP, lock them in, and then turn on to using a card genuinely, but then things get a bit ugly when reconciling accounts.

Clean vs Dirty

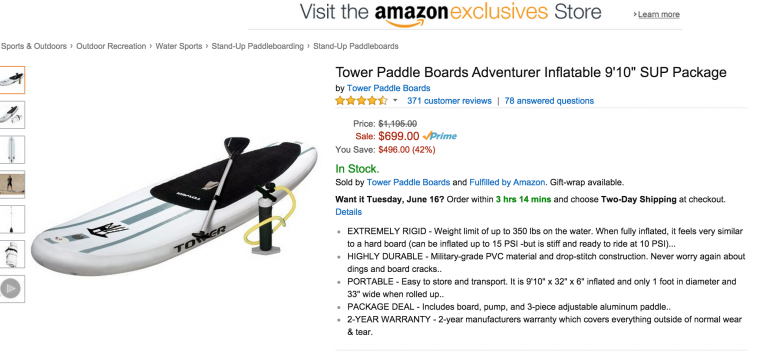

As it happens, I met many of my major expenses last week, so in order for me to meet even a $2K spend for the Delta Amex points its going to take some time, maybe too much time to even earn the bonus… so I’m going to need to ‘goose it’. Interestingly, I also need to have a pretty major personal purchase this month, as I’m keen to buy a SUP, one that I’ve seen from Tower costs $699.

$699 gets me a fair way towards $2,000, and its what I call ‘dirty spend’. Dirty spend to me is rough numbers, clean spend on the other hand would mean me going to Kiva and buying $2000 of slumlord loans. The min is met immediately, and its super easy to track… or is it?

From a business perspective, if I was to start off by goosing the following:

- $699

- $159 (real groceries)

- $220 in eye cream

- $992 on shoes

- Total $2000

It would probably be a pain the arse to find, tag, and deal with for reconciling accounts, and explaining to the IRS in an audit. However, if I just had a $2K single line transaction, it would be a lot ‘cleaner’.

However, this cleanness would also bring its own problems:

If it is easy for me to spot it as ‘not real’ spend then it is easy for someone else to, we are programmed to spot things like this. A series of odd payments are more obscure. However, this is compounded by the problem that it is obviously generic. This makes for huge problems in other areas, such as your own tracking.

Let’s look at another obviously generic charge: $1000.70. Imagine that you have a store that will only allow one transaction like this per visit. If you look at your statement you might have several repeat charges for the same exact amount, this creates a pattern of weirdness, but also creates a difficulty to back track when you face a problem. Having ‘clean’ spend here means that you don’t always know which transaction is which quite so easily, but if every transaction was different, or dirty, it would be a lot easier to drill down into problem transactions. The price itself becomes a tracking code.

Going ‘All Cash’

Phil brought up the topic of going all cash and I think it has a lot of merit. In the case of my business card spend, once flowing, I expect expenses may be a few thousand a month tops. Let’s pretend that means 20K miles ‘wasted’ per year. But that waste makes for super clean accounting. And is it really a big deal? There’s two ways to look at it, objectively and subjectively. From a subjective perspective I would look at it and think ‘man, cleaning up my books is a pain in the arse’. Objectively, I could drill into the value, being generous and saying we are losing $300 in points… would I pay $300 to have clean books? Or, how many hours would it take to clean the books up, removing the non business spend, and what would that mean in terms of my hourly pay?

Inconclusion

I’m still on the fence. I find it hard to leave the points on the table, I need them fast, and I hate to ‘waste’ spend. My solution is going to be either to spend $2000 in one pop, and then use it for regular business expenses, or to spend it fast (maybe a mix of the paddleboard and some groceries) and never use it for business… I’ll be pinging my accounting software firm to see how easy it is to delete imported transactions, and that will likely be the guiding force.

The irony is, I desperately wanted a Business Credit Card, but as soon as I get one I just want to max it out to get the points in cycle one, and then i’ve ‘burned it’….

PS – I actually need 72000 pts on DL for F seats.. so if I want to sit up front the same rules apply, but on a higher scale.

I use an older Quicken program where I can divide the spend into different categories. And I have two different names for the app on my computer. So I put all the business uses in one program and all the personal or household expenses in the other. Then at the end of the year you can generate a report with all your business income and expenses, but exclude those expenses that are “dirty”. Hope this is a clear explanation. I suppose the new Quicken program would work the same.

I use a couple of programs for various businesses, Xero and Quickbooks, the latter was tricky (for me) to eradicate spend on, I will check on the former. I really don’t want to build accounts that offset it, I’d just want to delete it from the face of the earth….

I use Mint, and then assign categories like “Redbird”, Bluebird”, etc. Then for transaction details, something like “Transfer to ABC card” to reconcile. When viewing just by the category, your net should only be the fees. But then it gets messy when I do use the Redbird for Target purchases… And also, Mint still doesn’t quite support Redbird yet…

Redbird enables me to meet all min spending requirements so that’s not an issue.

I’ve considered going cash only many times for real spend and doing only MS.

however there are many problems:

1. I do some online shopping.

2. I like return protection

3. only amex and csp seem to have good protections. CSP is superior to amex.

4. I cannot use amex exclusively for real spend b/c of amex sync offers

5. i often buy gift cards in amex sync offers. e.g. current whole foods offer

So other than GCs where I can get a discount rate >10%, I’ve decided to spend exclusively on CSP to keep life easier. My real spend is $12-15k per year so by using CSP I lose around $300 per year due to the AF and not maximizign categories.

I also don’t like keeping track of cash. I always get teh feeling that I lost some cash somewhere but usually I’ve spent more than i budgeted.

I feel like credit cards have given me bad habits. Maybe I should maintain a cashbook on my phone to keep track of where I’m spending cash

Yeah, I’ve suddenly found myself using the Arrival card (previously Fid Amex) but have always tried to keep a ‘goto’ where I can… but I still use category spend cards and can’t pass up 5x..

I do the GCs a lot too.

Interestingly, bought my latest ‘big’ purchase on an Amex for protection, then closed it and later remembered I’d bought it for its protection… so I think I’m screwed! Something to consider (if the case) is that you might forget 1 year from now that you bought for a 3 year extended warranty…

IIRC, you can still do AMEX claims even after account is closed. I think there is an option somewhere asking you about. Been awhile since I used the benefit, so memory is muggy now.

That’s interesting- I’ve not checked into it but good to hear.

Matt are you getting sucked into a sub-optimal purchase decision that the CC company would love you to make – specifically, could you not get the SUP cheaper used and pay with cash?

I have certainly checked for used, but weirdly craigslist is super expensive and ebay is charging more than Amazon…

This article speaks a lot to me as I try my best at doing proper accounting for my gift card business. I refused to not put spending on credit cards (that is part of my margin… sort of), so reconciling everything has become a huge pain. Compound that even more when I have the fiance pick up some ebay gift cards on her trip to the store with HER personal card.

My current plan is to get a business SPG card and just put all of the business spending on that and pay it cleanly from my business checking account.

It’s still messy at the moment, but I’m picturing this nice system that makes it all work cleanly with minimal effort. Let’s hope I can get there in a reasonable amount of time.

The key is to start ASAP! So much easier than cleaning it all up