I actually have one Serve and one Bluebird Card (more accurately, my wife owns the Serve) the rules of these cards dictate that you can only hold one or the other, and one person cannot have both. For some time it seemed that the Serve was inferior to the Bluebird, but with recent changes allowing the Serve to accept Vanilla Reloads they are all but equal, with one minor difference… the Swipe Reload at CVS, which I first read about on Frequent Miler here, this allows you to reload $500 per transaction (max $1K per day) fee free let’s see what this means to the effective interest rate of each.

Calculating IRR

The Internal Rate of Return is a measure that can effectively calculate interest rates, it is particularly useful when using different periodic cashflows, but also is a good way of comparing effective interest rates from products. This post will compare the Effective Interest Rates between Bluebird and Serve, to show the impact of associated load fees, at various spend multipliers in order to determine which card is the best, and by how much.

I typically use a financial calculator for this task. In essence you need to create ‘periods’ and a single net amount per period, since both Bluebird and Serve have monthly load caps of $5,000 the period is set at a month, and the Net will be determined by the rewards earned net of fees.

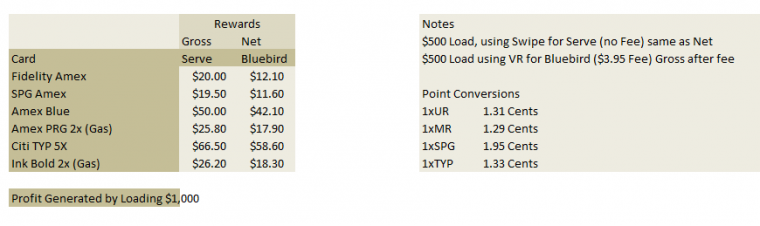

Before getting into that, lets quickly look at just $1,000 a number that also is significant because it is the maximum amount that you could load onto either the Serve or Bluebird using either the swipe or the Vanilla Reload method, and compare that with the Risk Free Benchmark, 3 month T-Bills. The current interest rate on 3 month T Bills is 0.05%, which would be worth 50 cents on $1,000, it is a touch above that since it compounds quarterly, but we are talking fractional pennies.

So, as you can see, the Serve with the Oldschool Amex Blue will generate $50, 100x more profit than the T-Bills, but further to which it does so in a single day. In a fantasy land where you could earn that every day, within 1 year, that $1000 would grow by $50 per day and would be worth $19,250. The Bluebird, with its fees would be worth $16,366.50, and your annual Effective Rate of Return would be:

- T-Bill Effective Annual Rate of Return of 0.0500114599%

- Serve 5% creates an Effective Annual Rate of Return of 296.95% (compounded daily)

- Bluebird 4.21% creates an Effective Annual Rate of Return 280.60% (compounded daily)

Bluebird Vs Serve Card Annual Profit Comparison

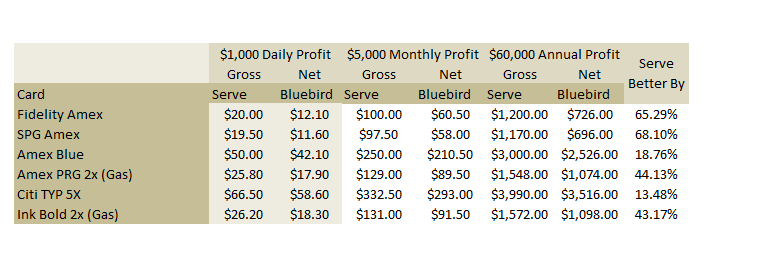

Going back to the practicalities of the cards, and their limits, lets look at how much profit can be generated on a Daily, Monthly and Annual Basis based upon card choice:

As we knew from the start, the Serve would be better, but the interesting thing to note is that the amount it exceeds the Bluebird in value is correlated to the amount of profit per $1,000 earned. Simply put, the more you earn per Vanilla Card, the less it matters about the fee you pay. Therefore, someone who is only willing to use a Fidelity 2% Amex would see a 65.29% benefit in switching to the Serve.

Note the slight anomaly that occurs as I tried to equate points to a fair trading value, in that you see a benefit of 68.10% for SPG players, but in reality the number is infinitely better (literally) as the go from paying zero per point to and amount >$0. Also, this is theoretical for the Serve, I haven’t tried to load it with SPG so am not totally sure you can even earn your SPG points in this way.

This is a chance to consider your points or cash strategy, and see where it fits, and how much impact changing could have for you.

Buying $1,000 or buying $5,000 in a day?

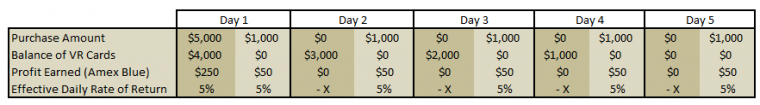

For the Serve when using Swipes, only $1k per day is possible, and you can’t tie up more funds. If you take the Vanilla Reload route you can opt to buy $1K per day, or up to $5K in one fell swoop.

This is a tricky one to calculate, I will try my best… Since you can only liquidate $1,000 per card, buying any more than $1,000 per card per day ties up your money, because you are locking up the additional funds required to purchase that card. On the other hand, buying $5,000 at once generates the full $250 in cash back (using the Old Amex Blue) sooner, which from a time value of money perspective offers a benefit, since you can take that money and use it right away, earning interest or increasing Cash Flow. Conversely, buying $5,000 in one go ties up your bankroll, which harms you from a time value of money perspective.

Of course, we are talking about requiring to wait for a credit card cycle to get the money, so some might argue that doesn’t matter (since the card would pay you on a batch cycle system) however, there will be a cut off date, and if you can capture that $250 in full before the cut off it will offer value, the solution to this – track your cut off date and if you are about to hit it, buying $5K would offer time value benefits, if it is more than 5 days away from the date of your first purchase, buying $5K would offer no time value benefit. Both purchases of $5K would offer a cash flow and opportunity cost, so if in the latter it is best avoided.

In effect, your first $1,000 liquidates on day 1, you swipe load the Serve, or you Vanilla Load the Bluebird and you can billpay immediately, cycle closed. However, the next $1,000 cannot liquidate until midnight that night, as your $1,000 load resets:

The X here would be a negative number, equal to the opportunity cost of loaning Mr Vanilla Reload Inc your money; $4000 for a day, $3000 for two days, $2000 for three days and $1000 for 4 days. The value of the X is subjective, clearly it cannot be greater than the 5% earned from the Serve, or the 4.21% earned from the Bluebird (5% after fee) else you would be doing this already.

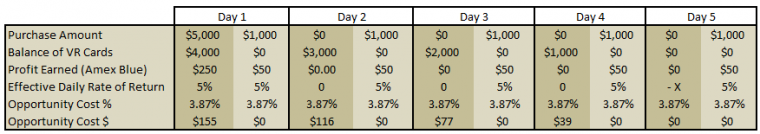

The next best opportunity is what it would be valued at, which depends on your toolkit. An example of a next best option may be: $500 Visa Giftcard bought for $4.95, unloaded via Money Order at Walmart for a fee of $0.70. Total profit and rate of return for this would be:

$19.35 or 3.87% for the day, per $500 card.

If we use that number and insert it as a negative opportunity cost into the calculations we get the following:

Opportunity Costs of Buying $5,000 upfront

$4,000 that you loan to Vanilla could earn you $154.80 on day 1, the next day it drops to a $3,000 loan which could have earned you $116.10, and so on.. until you clear the cards off for a total opportunity cost of $387.

A more realistic way to approach opportunity costs

Of course, here is where many would argue that the theory fails, since you always have more credit, but from a closed system, this is how opportunity works, and any time that you willingly lock up cash, that simply cannot be liquidated you are degrading the value from each card. However I think a better way to look at it would be to consider each vanilla reload that you buy in advance is like a Certificate of Deposit (which is like a short duration Bond), this gives a more agreeable statistical perspective to actual opportunity costs providing that you have enough of a Credit Line to buy $5K, and still buy more of other items, such as the gift-cards outlined above. In that case, you could look at it like this, as a CD or a Bond for the balance of $4,000.

Yield To Maturity Values (YTM) of Vanilla over 5 days

- VR Pair 1, Par Value $1000, Coupon $50 Maturity today >>Daily APR 5% and a YTM of 5%

- VR Pair 2, Par Value $1000, Coupon $50 Maturity today+1 >> Daily APR2.5% and a YTM of 2.47%

- VR Pair 3, Par Value $1000, Coupon $50 Maturity today+2 >> Daily APR1.667% and a YTM of 1.64%

- VR Pair 4, Par Value $1000, Coupon $50 Maturity today+3 >>Daily APR 1.25% and a YTM of 1.23%

- VR Pair 5, Par Value $1000, Coupon $50 Maturity today+4 >>Daily APR 1% and a YTM of 0.98%

I think approaching like this, as Bond type purchases is a more realistic way to show how the value of the VR degrades the longer you hold it, however, we are talking about a ‘daily YTM here’ so even the worst of this bunch is a hundred X multiple of a regular investment. Additionally, you need to factor in that buying in bulk is not only more efficient, as it saves you an additional 4 visits to acquire the cards, but also, depending on your location may also require supply and demand equations – if you are NYC and you see Vanilla, you need to buy it all as fast as humanly possible, regardless of its potential mathematical inefficiency.

If you aren’t pushing your credit lines daily and don’t need the extra funds, buying in bulk and holding VRs is a good option, but if you want to get to completely ‘optimized’ ideals, live in a place abundant with Vanilla, Walmart’s and CVS you would be better to buy the minimum daily, and use the remaining credit lines to acquire gift cards and other options that don’t lock up your line of credit.

Conclusion

So, the Serve is better than the Bluebird because:

- You can load it fee free

- It is not dependent on the availability of Vanilla

- Acquiring vanilla that cannot be liquidated has opportunity costs

- It accepts Vanilla, so any argument about buying Vanilla is moot; it also accepts MoneyPak reloads

Hopefully the charts on actual annual differences between the Serve and Bluebird will help you decide which is best for you. If I didn’t own either I would certainly pick the Serve. You are able to change from Bluebird to Serve, or vice versa, but it takes a little time. Personally, despite it being the smarter option I am not going to swap my Bluebird to a Serve since I don’t want the hassle of doing so, and there is a chance that once those dastardly bloggers start writing about no fee loads Mr CVS, who read the blogs daily, will put a stop to that.

Three additional considerations:

– Serve has 2K monthly online loads (1K debit, 1K credit).

– BB has paper checks (aka super-easy liquidation).

– Serve is elligible to AMEX Sync deals (via twitter).

IMHO Serve still wins.

By the way, do you simply go to CVS and say “I want to load 1K on my Serve but let’s do it in two transactions since the transaction limit is 500 and the daily limit is 1K”? or use two CCs?

Good points thanks R

I’ve never understood why people use the checks. BP or withdraw are much easier liquidation methods. Why order checks, prepay online, write out the check, mail or deliver it, and hope it arrives and gets processed correctly? I’d much rather liquidate via BP. Enter amount, click “pay” and be done with it.

For me: My Rent is payable via Check only. I imagine lots of people are in the same boat.

I opted for Bluebird solely for that reason. It’s gives me a nice lump “legitimate” monthly purchase each month, along with all the filler.

I don’t know of any landlord that doesn’t accept money orders.

Except when the money order is lost or your landlord says they didn’t get it. Even a postal money order can take months to trace.

I’ve used the checks for those last minute items where payment is required immediately that seem to come up – mostly for my kids school related activities/fundraisers. I think I’ve written about 30 checks since the checks became available. Also, not all payees can be entered into BP as AMEX seems to be very picky about the verification process.

Hi Matt,

What a really insightful article! One question though, about your first table. Why do you have a “2x” next to the Chase Sapphire Preferred? I’m pretty sure it gets 2x only on dining and travel.

Good point rich- I meant the bold.

You can’t billpay with serve though. And you cannot load serve with GCs upto 5K

I bill pay and load with Vanilla with my Serve

Wanted to clarify a couple things, and flyertalk made my head spin. Tell me if I’ve been sniffing glue:

1) Article doesn’t factor in online loads, which Serve has $2k (half of which is debit) to BB’s $1k. Unclear whether you can online load a debit and CC each day, but if you can, then there’s time value there as well.

2) You DO get amex points when you load Serve in store, correct?

3) Have you had any trouble loading Serve in store? Seems a mantra is that some CVS’s “don’t know how to do it.”

4) Have you had any trouble at all with Serve billpay?

I swipe loaded Serve today for the first time. I wrote down the instructions from Fatwallet, but the cashier figured it out without me telling her. I have had no problem with Serve bill pay; it seems to be the same as bluebird bill pay. I would also like to know about whether you can online load $1k credit card plus $1k debit card as well for a total of $2k online. I hope to be in a position to test it next month, but maybe shaky02dd is already telling me that it is cumulative to $2k? Would love confirmation.

Can you load Serve with both swipe and VR in the same month (for $10k total), or is it $5k combined?

5 total

Can you load 1k to Serve from your wife’s BB as the debit?

Why would you want to?

Hi Matt,

Great post. I am new to both serve and BB. Now with the reload with credit card gone from CVS, I am wondering what is your take on how to maximize serve with least $$ spent per month? You can load 200/day with a credit and debit with 1000 max per month and a total of 2000 from both methods combined online. However, does loading serve directly online with cc count as cash advance? Also, can a prepaid debit like visa buxx or visa gift cards be used to fund the serve account as a debit? Any red flags there?

I don’t use Buxx- but ask Chasing The Points about that, he’s an expert. For online loads, avoid Amex cards as I believe they don’t earn points.

SITUATION: Roommate wants to send me rent ($2100 per month) using her Amex card. She can only use Amex.

PROBLEM: Last month she transferred the money from her Amex into my PayPal acct & Paypal took a 2.9 percent fee ($60).

SOLUTION: We’re trying to figure out a way to do this without paying huge fees. A cash advance off Amex will be around 20 percent or more, and signing me up as a merchant (merchant services) is 2.9 percent (same as PayPal). Would serve or bluebird work in this scenario ??? Any other thoughts on how to do this are WELCOME !!!

It wouldn’t work. You could send $1k per month via amazon payments no fee, but more than that no go. Maybe you could split it up into two transactions and at least reduce the paypal by $30 by using amazon?

@Matt

how do you set up serve to perform recurring $200/day from CC please?

thanks!

It’s under add funds, just scroll down to recurring.

thanks. found it. but if i do it weekly, it may not max out the $1k/mo, since its $200/day, right?.. requiring 5 recurrences, but not every month has 5 weeks.

if i do it daily, will it auto stop after reaching $1k?

can you please explain how you can load serve with moneypaks? surprised that i havent read about this elsewhere. is there a disadvantage to this option?

thanks

Buy a money Pak, add it to serve. It’s very straightforward

@Matt

thanks! lol

5k/month limit?

any ideas why this method doesnt seem to be popular please? because of the $1 higher fee for $pak vs VR?

Anytime! And don’t complain about things not being popular.