Bluebird, from American Express is a powerful tool in your manufactured spend strategy. You simply apply for the card and purchase Vanilla Reloads from local stores and earn points in the process.

The only fees are on the loading side, as the Vanilla Reload cards come with a purchase fee of $3.95 per card, and each card can be charged to a value between $20-$500. As you can imagine, that $3.95 is a percentage in relation to card cost, so if some poor sap was to put $20 on the card and pay $3.95 they would be paying a 17% penalty for the privilege of owning a card.

However, on the flip side, when loaded with $500 the fee becomes a minor percentage, the penalty for buying the card drops down to 0.8% per transaction. Since we know that some cards, like the Fidelity Amex offer 2% Cash Back we can find a Credit Card Arbitrage opportunity for 1.2%. In other words, for every dollar we buy, even with the fee we are earning a profit of 1.2 cents.

Fixed and Variable factors in this study

There are a number of things that are fixed in this study and some that are variable, understanding these will help us shape the best strategy:

Fixed Components

- $5,000 (10 x Vanilla Reload Cards) per month per Bluebird Card

- $60,000 Annual Manufactured Spend that this Bluebird will generate

- $474 Amount in Annual Fees to buy 10 cards x 12 months

- Fixed Category Spend Multipliers such as 2x at Gas Stations for cards like the Ink Bold and 6% Cash back at US Supermarkets for Amex Blue Cash Preferred Card. These are often capped.

Variable Components

5x Earnings in Rotational Spending Categories for Chase Freedom Card – this year has offered Q1 and Q3 as Gas Stations earning 5x Ultimate Rewards or 5% Cash Back. The DiscoverIT Card also offers similar rotating bonuses and can earn 5% Cash back for Gas Stations.

Another variable factor is short term earn bonuses. These are quite common from AAdvantage Cards from Citibank, and also the US Airways cards, typically offering a bonus if you spend $750 per month for 3 months. Should you qualify for one then that would make the card an obvious choice for spending on, though rarely more than the minimum they ask for.

Value for Big Spenders

As mentioned above, you are able to generate $60,000 per Bluebird card owned, if you owned two cards you could earn manufacture $120,000. It is important to break this down here because that doesn’t mean you need to put it on two credit cards. You could buy as many Vanilla Reloads as you like – even $500,000 per year on the same card (theoretically) but each Bluebird can only handle $60,000 of that action.

Certain cards trigger bonuses for high spend, I would separate these into two categories:

Category 1 Private Banking Affiliated Cards

These cards require banking relationships, and are aimed at high net worth individuals, fees range from $450-$595 per year for these cards. The Amex cards are Co Branded versions of the American Express Platinum card and come with the same perks of the regular Amex Plat.

- Goldman Sachs Amex Platinum 40,000 Membership Rewards points when you spend $100,000 per year. Note, a $5MUSD Investable Cash Requirement to get into the Wealth Management Group and access this card…

- Morgan Stanley Amex Platinum – $500 credit for spending $100,000 per year. Note, they claim no charge for additional cardholders which is a great way to share the perks of the Amex Plat, which would normally cost $175 per additional cardholder. Requires a Morgan Stanley Brokerage Account.

- JP Morgan Palladium Card – designed to compete with Amex and is own brand card. Offers 35,000 Ultimate Rewards from Chase for $100,000 in spend per year.

Category 2 Cards that require no relationship to obtain

These cards are much more accessible and have a lower entry point regarding fees.

Hotel Branded Cards

- Hilton Reserve Visa from Citi – $40,000 grants Hilton Diamond Status

- Fairmont Visa Signature – $12,000 grants you a Free Night Stay annually.

- American Express Starwood SPG Card – $30,000 grants SPG Gold status

- Marriot Rewards Card – $3,000 gets you 1 Elite Night Credit, this is credit towards Elite Status with Marriot.

Airline Branded Cards

- Chase British Airways Visa – $30,000 spend generates a Travel Together ticket, this ticket means your Avios reward booking is a two for one deal.Due to exorbitant fees that come with this most people never use this feature.

- Chase Southwest Airlines Visa – $10,000 grants you 1500 Tier points, you can earn up to 15,000 tier points by spending $100,000 in the year – these count towards elite status and help gain the very valuable Companion Pass.

- Chase MileagePlus Explorer Visa – $25,000 spend generates a bonus of 10,000 United Miles, which are worth a bit less since devaluation but still remain very useful.

- American Express Platinum Delta Skymiles Card – $25,000 grants you 10,000 MQM miles, and another 10,000 MQM can be earned at $50,000. These count towards elite Status on Delta.

- American Express Delta Skymiles Reserve Card $30,000 grants you 15,000 MQM miles, and another 15,000 at $60,000 in spend. These count towards elite staus with Delta.

- Citi Executive AAdvantage Card – $40,000 spend grants you 10,000 AAdvantage EQMs which count towards your Elite Status.

- Citi AAdvantage Platinum Visa – $30,000 spend grants you a $100 Flight Credit on American Airlines

The American Express Premier Gold also offers 15,000 additional MR points for $30,000 spend in one year.

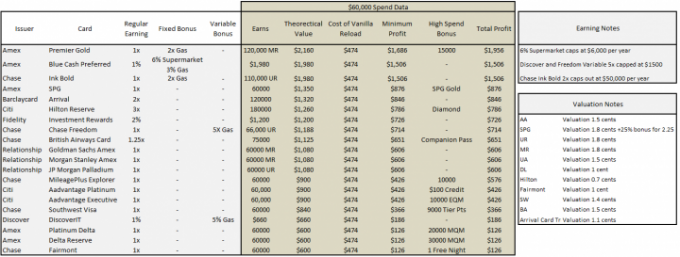

Profit per card for $60,000 Annual Spend

The winner is the Amex PremierRewards Gold Card (PRG Amex – #8 on this list) , it actually comes top in spending at the 60K and the 100K level. The defining factor for this victory is a combination of 2x earning at Gas stations, matching the Ink Bold and the earnings boost for spending $30,000 in a year. Additionally the PRG Amex doesn’t suffer from the $50,000 Earning multiplier cap of the Ink Bold, which means that card from chase will start earning at just 1x for the final $10K of earning.

The American Express Blue Cash Preferred comes in a respectable second place, it starts out a clear leader earning 6% Cash Back at Grocery stores, but that is capped out at $6,000 – the remainder earns 3% Cash back so the real value of this card is in pure cash. The only reason it did not win was my valuation of Membership Rewards points. The Ink Bold did tie with this card based on me valuing the Ultimate Reward points at 1.8 cents each, which might perhaps a little on the high side. I would give the edge to the Blue and rank the Bold in 3rd spot due to this.

A note on Valuations

I decided to value based upon my subjective criteria. The basic premise of which was:

- Airlines that give good international awards are worth 1.5cents per mile.

- Ultimate Rewards and Membership Rewards can transfer into such airlines so I give them a 20% weighting for their flexibility making the 1.8 cents per point.

- SPG points offer the value of UR and MR points above plus offer a 25% bonus when transferring in blocks of 20000, so I gave them 2.25 cents per point.

- The Barclaycard arrival I weighted at 1.1% additional to its 2% earning in order to reflect the Travel bonus you gain from it.

- The hotel cards I gave my own personal pricing based on value to me.

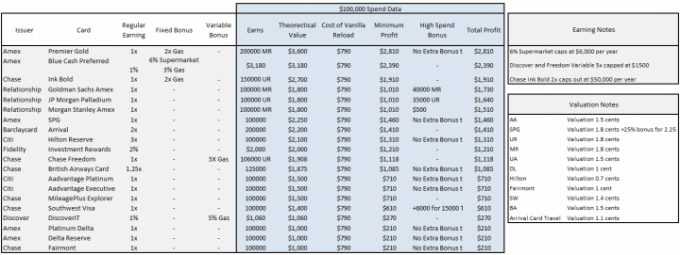

Profit Per card on $100,000 Spend

The top spot remains dominated by the Amex PRG, and the Amex Blue Cash Preferred solidifies its position in second place. The reason it pulls further ahead of the Ink Bold is that once the Ink hits the $50,000 limit it starts earning at 1x instead of 2x for Gas. Also the relationship cards kick in here as they offer generous bonuses at the $100,000 level which is a unique bonus to them. However, they all do carry hefty fees along with more complicated acceptance so they aren’t really ideal candidates for this.

Being fickle with your loyalty is best

Rather than loyally manufacturing vast amounts of profit from just one card it is better to spread your spending around as follows:

- First $6K Groceries Amex Blue (6%) $360

- $30K Gas Amex PRG 2x + 15,000 = (2.5X average, valued at 1.8 multiplier for 4.5%) $1,350

- $1.5K Freedom and 1.5K Discover when they are at 5x $150

- $21K Gas Amex Blue Preferred (3%) $630

Cost of cards $474

Total Profit from the above hybrid approach: $2,016

When is a Gas Station not a Gas Station?

A popular category for bonuses is Gas Stations, many of the cards offer bonuses in this category, and the Freedom and Discover card regularly offer 5x rotating categories. The thing that matters when charging your card is what merchant code is sent to the Card Issuer. There are instances of when certain vendors that actually aren’t Gas Stations at all code as such, and they do offer Vanilla Reloads. A famous recent example of these was 7-11 stores, some of the offer the category of Gas Station and some do not. Also, finding ones that accept credit cards for payments is a skill in itself.

What if everything fails?

There will be cities, such as Manhattan where finding multiplier stores just doesn’t seem possible, in these cases you can find a non multiplier store, such as a CVS and pay for it with a card that has built in multiplication. The cards I would pick for this would be the Fidelity American Express and the Barclaycard Arrival. These both offer great value, and in a year at $60,000 spend will generate a profit of between $700-$800 respectively.

The race for Status

Some of you might be interested in leveraging the status that can be earned for higher spends and value that above the points/cash alone. Certainly things like the Hilton Honors Diamond Status have value, but lets keep perspective and realize that the Citi Hilton Reserve does offer Gold status as standard, so you are only going from one level to the next. I have never held Diamond Status but Gold with Hilton is in my opinion the best ‘mid tier’ status of any program and certainly good enough for me in itself.

Those of you just short of an American Airlines or Delta Elite Status tier level may wish to focus on those cards to help push you over the limit, but for me, I would rather take the Amex PRG points at 2x if I can find a gas station, and the Barclaycard Arrival at 2.22% if I cannot.

The Hunt for 5x

If you can find a 5x card that doesn’t have earning caps, your earning potential is massive. $100,000 at 5x would generate $5,000 at 1 cent a point, netting a profit of over $4,000. As a family you could hold one Bluebird per person, so a couple could clear through $120,000 and if you have hard working kids they can pull their weight and offer you a further $60,000 each. A family of 4 would be earning over 5 figures per year with a 5x card!

Don’t like the Valuations? Here’s the Excel Sheet

best cards for bluebird 97-2003v

Please feel free to play around with the numbers. Bloggers, feel free to reuse and republish this using a simple common license by including the following text (and hyperlink): Chart Data Courtesy of Saverocity Travel

Great post! Nice to see the comparison done as a spreadsheet. Thanks!

It seems, though, that the trick is to find gas stations that will sell VRs for credit. In my area, I’ve come up blank, even with plenty of gas stations around that carry them. Some have even swiped for me and the register declined. Any tricks?

Rick

Thanks- thought it would help to share the sheet since we all value differently, though it’s not perfectly created for plugging in new numbers

Could add Citi TYP Presitge card. Only 1x but 60k bonus when you hit $15k. So $60k spend turns in to 120k points. With flight bonus of +33% on points equals $1596.00. No worries about finding a merchant with multipliers.

Nice- not as good as the 5x TYP but solid bonus there! Will look at it later and revise

Could you point me towards the card that offers this bonus? I couldn’t see it anywhere… thanks. Matt

In branch only, I believe.

If you’re city gold the fee is $350, otherwise it is $400. But plenty of ways to get your fee back (free coach companion ticket anywhere, $200 airline fee / year (and not tied to 1 airline), $100 global entry).

Are you adding a signup bonus too to get to 60k? It sounds too much…

Nope. 30k for sign up and I think $3k spend, Additional 30k at $15 spend.

Yeah, that’s what I mean, it is 30k at 15K spend, not 60K. I ignored the signup bonus (and the annual fee) in this study, just for simplicity and to show the card as a pure MS device rather than a churn device. So we would need to look at the Prestige card as a 30K big spender bonus.

Still worth a mention I agree, but not anywhere near the top compared to the others here, providing of course you could actually get the Gas multiplier, which is questionable. The prestige based on what you told me here would come in ahead of the SPG but behind the Ink Bold. And that is ignoring that the Bold has a higher signup bonus and a much lower fee than the Prestige.

Would you consider the Amex surpass for similar benefits/rewards to the citi reserve?

Yeah I guess so. Personally I wrote off the Surpass when the AXON7 award stopped being viable. When you look at the Amex and the Citi Reserve side by side they appear very similar, but the signup bonus on the Visa is much better, 2 nights up to a cat 10 can be worth 180,000 HHonors vs the 60 or so you get with a Surpass.

Great analysis Matt, but any card that can get you 5x for even a limited time would trump all these. I also think you are way over-valuing Amex points, but this is coming from someone who caps pretty much everything at most 1.25 cent per point value. But for 5x TD Ameritrade and Wells Fargo among others have limited time 5x opportunities. I am still using my City TYP 5x

I may be overvaluing the Amex I agree, but I couldn’t rightly give UR a higher value when they do pretty much the same thing. Perhaps both should be down to 1.6-1.7.

Totally agree about the 5x I am very sad that I don’t have that TYP card 🙁

Where I am I can’t leverage PRG 2x at gas stations but I do have grocery store options at 2x.

Also, I think annual fees need to be considered in these calculations. I’m considering hitting the 30k bonus as fast as possible in January on the PRG then cancelling and getting a pro-rated annual fee refund.

Fair point will. I left out annual fees and also signup bonuses for brevity, but they should both factor into play.

Thanks for the helpful post. I did the math on my Amex Blue Cash that is grandfathered in to earn 1% at grocery and drugstores for the first $6,500 then 5% on every dollar above that. On $60,000 spend you net $2,266, which trumps all the others ($4,266 on $100k). Given the recent devaluations I’ll stick with cash I think.

Cash is king! And that card sounds amazing.

Awesome post Matt. I too have difficulty finding Vanilla Reloads at gas stations that will take a credit card, although I can buy Visa gift cards (for a couple extra bucks) that can be loaded to Bluebird at Walmart. I’m a little hesitant to go crazy with the Amex cards since there are lots of stories of triggering a financial review. I try to spread out my Bluebird loads using Amex Preferred at grocery stores, Amex SPG at CVS, and Chase Ink Bold at gas stations (using visa gift cards). I personally value SPG points higher (since I predominantly use them for SPG hotel stays) where it’s easy to get 3-4% using cash + points, and some of their other redemption options. Everybody has to come up with their own system that works best for their comfort level and point needs.

Yep, finding that Gas station isn’t easy, but it is worth the effort. Since I live in the City I don’t have lot of chances to test that out, but hopefully we can find some ideas to help that.

Very interesting to see all the cards laid out like that with the net profit. Did you take the annual fees of the credit cards into account anywhere? The Amex PRG is $175 so wouldn’t that cut down the profit? There would also be expenses in driving to the places where you buy the VRs and depending on what else you would be doing with your time, maybe a value for your time? I can see the value in MS for meeting spends for the bonus but with a few exceptions, it isn’t looking so great for after you have made your spend.

I ignored annual fee and signup bonus. Cards like the PRG do have a fee, but are frequently waived in the first year, so it is confusing to factor in. Yes, there is driving costs if you are driving for the sole purpose of buying the card, though that is eliminated if you go to a gas station in a car for another reason, such as buying gas, and the cards are present.

Finally someone runs the numbers and oft touted SPG is nowhere to be seen. Agree with your conclusions, except I find it next to impossible to find placesnto buy VRs at gas stations/7 Elevens any more. As such, BCP value is overstated for vast majority of users methinks (but it was fantastic when it was unlimited 6% at grocery – hands down best card I ever had).

Amex Surpass also gives Hilton Diamond status with $40K spend. Plus if doing MS at 6x grocery, gives cheap HH points. I put $100K in MS on the card for 600K HH for $1200/yr. Good for a week or so at a Cat 10 property where cash cost would be as much as $5K.

PRG gets 2x at grocery, so is tops for MS, especially when you can combine with the regular Catalina gift card promotions that allow you to generate points at negative cost. Amex is also best CC company as they don’t unilaterally close accounts (unlike Chase/BoA/Citi et al). Instead they give FR and let you prove income

Paul, thank you for the warm comment. I agree that it is a little ‘theoretical’ in approach due to the difficulty in finding a gas station. The PRG is a solid card.

I just move to Denver and, to my horror, I discovered they don’t have any CVS stores. any ideas on gas stations that sell VRs?

Oh Noes! Here check out the list of approved retailers, hope it helps:

https://www.vanillareload.com/index.php/where-buy

thanks matt–i guess i wasn’t specific enough–i need ideas on places that sell them and allow payment by CC…… 🙂

I don’t even know where Denver is! I hope you will have some success with the list, Good luck. If you are ever in NYC I can help.

Tips for VR cards in NYC? I would love some advice!

Buy them from a drugstore 🙂

Great work with the spreadsheet! I think the value of cards and points depends on how you utilize them. Certain points are worth a lot more if you live near a strategic airline hub. The PRG has a $175 fee, but they are offering so many statement credits that you can pretty much eliminate that fee. $5 off for every $25 you spend at a BP gas station; $25 off a $75 purchase at Amazon, etc. I’ve generated $115 in credits in the last 2.5 weeks using both mine and my wife’s card(she’s an authorized user but she can also get credits, so it’s like doubling up). I also value their MR rewards points higher than any other card. I live in Miami and can transfer these points to British Airways when they have transfer bonuses(sometimes as high as 35%). I then use BA’s awards to fly R/T from Miami to the Caribbean for as low as 5850 points. These flights are actually on American, which charge as much as $460 for these short distance flights. That puts a value on the MR points at 7.8 cents each. You can also use them to fly from California to Hawaii for around 18,500 points. Of course these points are worth far less if you don’t happen to live by a useful hub or have easy access to one(another reason to get the SW Companion Pass!).

Thanks Scott, glad you like it. I think there are some fantastic opportunities for value with the Avios program, but I would argue that you can’t get more value per point than the cost of purchasing them from points.com…. still love the value though!

what about wells fargo cash card – 5% at drugstores for the first 6 months you have the card, no limit. I’m gonna open one of these and in 6 months my wife will. Doesn’t it blow all of these away?

https://www.wellsfargo.com/credit-cards/cash-back/

Yes it does- there are a couple of 5x cards like that which are fantastic, they come and go and the hunt continues for the next!

Hi Matt, great website and blog. Thanks for sharing!

I know I’m a bit late to the party, so, hopefully you can still help.

How best to pay mortgage using VR and BlueBird in 2014 and beyond?

I’m based out of Utah (If that helps or matters).

Would love some help, tips, and/or any advice you can offer.

1 Get a Bluebird Card

2 Get VRs

3 Pay Mortgage from Bluebird

4 Profit

Matt, thanks for your quick response. Where is the best place to Get VRs and pay using a 5% (Or, at least 2% cash-back) credit reward card? Also, has BlueBird automated BillPay yet?

I just got two SouthWest cards late last year and hit my 50K bonus on both and I am sitting about $5,000 away from my companion pass so I went and purchased the $5,000 in Vanilla Reload cards.

I have seen other sites that advise of using caution using this method.

What is the downside of doing this?

I obviously don’t want to run up balances on these cards and want to pay them off. So I see purchasing my $5,000/Month and just rolling it over to pay the card.

Is getting another BlueBird for my wife and doing $10K/Month. Is that pushing it?

What am I missing? Very new to this.

The only caution I’d advise is not to put $5,000 on just 1 or 2 cards all at once. I like to spread it out over several cards in a month so as not to raise red flags. But if you’ve already done it, then it’s done. My wife and I each have a Bluebird and do $10K a month.

Thanks.

Point taken. I have been doing other types spending on those two cards, but I did a little catch up so I can hit my companion pass. The past several years I have strayed away from credit and did all my spending from my check card. But when I saw a post last year on the SouthWest companion pass I had to give it a try. I have been looking for ways recently to divert my monthly spending over to these cards. Some of my bills take CC payments but most don’t. So the Vanilla reload is great.

Just reading about alarm bells got me thinking what could they do? Worst case shut the card? But what is bad about doing that? You have the credit available. You buy a product they have in the store and pay a fee to do it. Then you pay your bill.

What terms of service or policy is broken?

You could be shut down for a variety of reasons, but likely will be ok.

If you have lots of vanilla readily available then there is no harm in staggering your purchases. Here in NYC they leave the shelf like hot cakes so I would buy as many as I can here.

I’m less worried by cards like the Southwest card as your points are sent out to that program- but if you are doing this with ultimate rewards or membership rewards the impact is higher should they shut you down.

You could be shut down for a variety of reasons. One, you’re abusing the way you’re earning points, which is considered fraud and in violation of their T&C. Two, money launderers are also doing similar activities to channel their funds. There is no way for the bank to differentiate you from a money launderer, and as such they will shut you down if they believe this is what you’re doing. Just spread the funds around on different cards and over a longer time period and you should be okay.

Am I missing something? Doesn’t the Ink Bold earn 5x up to the $50k cap at office stores, allowing you to apply this method at Staples / OfficeMax with a much higher return?

Hey Will- you can’t get $500 for $3.95 at office stores- kills the value

Ah I see. I’ve just bought a $3k AmEx gift card with 6x rewards. I’ll try to convert that into Vanilla cards at CVS and hopefully get the high return through this detour.

Hi Will

Do you mean you purchased amex GC using another 6x rewards card and then you plan on using the GC to purchase vanilla cards?

Which rewards card is giving you 6x for purchasing the GC?

Yeah I purchased an Amex GC using the rewardsboost shopping mall which gave 4x on top of the 2x that comes with the Arrival card.

Upgrading to vanilla is not easy though. I’ve only had luck at 1 CVS store so far to buy $1k of OneVanilla. Other stores demanded cash and other CVS stores asked for cash or credit and don’t accept prepaid. I think I’ll try giftcardmall.com next and then convert debit into moneyorders.

That’s quite a bit of detouring… I hope it works for you.

Aren’t VR also available at Walmart? Will they not allow you to purchase Vanilla via the GC?

Not sure, there’s no Walmart near me, so it’s a bit painful to go there.

If I buy a vanilla card at Walmart, will they let me load it up using a credit card?

Can the VR only be reloaded in-store using a credit card?

Does bluebird allow you 100% to load it with a VR card? My understanding is that bluebird does not allow use of prepaid cards for reloads.

Ok here is the simple version:

Buy Vanilla for $500 anywhere that sells then via credit card.

Load the Vanilla to BB on vanillareload.com

Finish.

Next level- pick a credit card that toes into store for a category bonus.

Guys, thanks for your help with my questions earlier.

Just a follow up. With advice here, I did some manufactured spending and I got my Southwest Companion pass yesterday. To my delight, a flight I had already booked for this coming April in which we all paid cash, I was able to book my wife as my companion and put her fare as a credit to her account.

Bonus!

Amex Delta Skymiles – T&C says “reloads and cash equivalents do not count towards points”. Several “points” sites say that this isn’t really a problem. Any insight as to Amex not applying reload purchases toward points?

How would Amex know that you’re buying a reload card? They don’t get an itemized description of what you’re buying. I’ve bought a few reloads using Amex but try not to overdo it with them. I’ve heard of people getting financial reviews if they do too many.

How can you do MS in grocery stores? My local grocery stores GC/VR is cash only.

Do it in someone else’s Grocery store then :). Some stores just don’t let you do it but others do.