This post title seems to come up frequently, I think that blogs have a set format of fill in the blanks something like this, and just swap around the cards that they recommend based upon some loose fitting criteria. Those of you that know Saverocity will know that we don’t like that sort of fluff and nonsense, so here is my take on it.

Defining a Low Spender

Are you spending low because you are on a tight budget? There are a lot of good, hardworking people out there that live month to month to raise a family and budgeting is key to that. If you are, then you can profit from Credit Cards providing that you use them with extreme caution and are regimented in your payments. Personal debt, frequently in the form of Credit cards that carry a balance are likely the greatest cause of poverty in America. If you cannot pay off in full each month, don’t get a card.

Are you willing to get a new card every year?

If you have no other debt borrowing needs, such as a mortgage application coming soon, then applying for a new card every year is by far the best way to benefit from Credit Cards. The new cardholder signup bonus that comes with a card offsets any annual fee (in fact, annual fees are often waived in year one) If you are willing to get a new card each year then one of the best you could get is the (this is my affiliate link, it pays me a commission) Barclaycard Arrival World MasterCard – $89 Annual Fee Card because it comes with no annual fee in year one, and 40,000 points worth $440 in Travel after you spend $1000 in the first 3 months. However in year two you don’t get the 40,000 points and the fee kicks in.

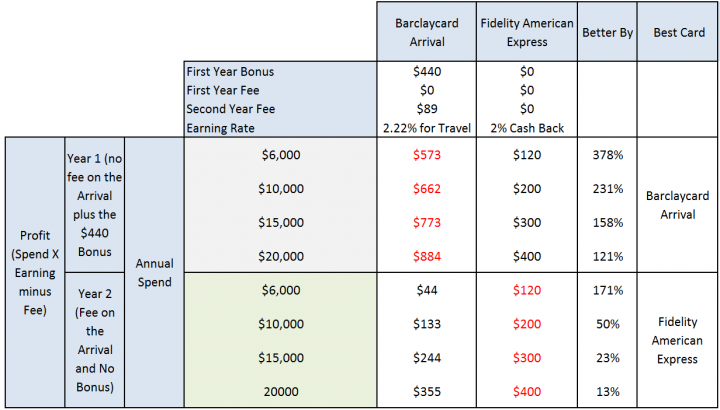

The Arrival card is still a really good card because it pays you 2.22% on everything towards Travel, but… if you consider two factors that are key, it actually isn’t as good as the Fidelity American Express in year 2:

The card doesn’t offer a signup bonus in year two, and instead the annual fee kicks in. Whereas the Fidelity Amex never offers a signup bonus and also never charges a fee. It is less exciting, but a workhorse of rewards cards.

As you can see, in the first year the Barlcay Arrival offers phenomenal value, basically because they are throwing $440 at you in order to buy your loyalty, and then in year two when the fee kicks in the value reverses as the annual fee eats up most of the savings.

More than one card with a fee? Watch out for Mr Colman

Excuse my British Digression here, but one of the things I miss about home is Colman’s Mustard. Jeremiah James Colman (14 June 1830–1898) was a wealth philanthropist and mustard manufacturer from England who when asked how he had made a fortune out of such a humble product, he replied

“I make my money from the mustard that people throw away on the sides of their plate”.

[source Derek James A dynasty which changed the face of Norwich forever Norwich Evening News 22 August 2008, and Wikipedia]

I would like to put forth that the card issuers are mimicking this concept. There is a breakeven spend where the amount of rewards earned would equal the cost of the fee, spend less and they profit, spend more and you profit.

For the BarclayCard Arrival the first year is complete profit for the consumer, but in the second year, if you do not spend $4045.45 over the year you would not break even on the cost of holding the card. Furthermore, you are paying real money for the $89 fee and in return are getting credit for travel. Credit for Travel is not equal to Real Money as its spend usage is restricted, though it could be considered a fair swap if your annual travel expenses are of that amount.

Searching for 5x

In the example above comparing the Barclaycard Arrival with the Fidelity American Express we are talking about 2x (more or less). However certain cards offer 5x rewards (or 5% Cash Back) which makes them very lucrative indeed. Unfortuntely every 5x card available has one or both of the following libations to slow down our reward earning:

Spending Cap Limits on 5x

This one doesn’t harm the Low Credit Card Spender, because the caps offered are high enough to take up a lot of the spend requirements. The most common cap we see is $1500 per Quarter in rotating categories, this happens with cards like the DiscoverIT and Chase Freedom Card.

Chase Freedom Card 5% Back in Rotating Categories No Annual Fee

Chase Freedom 2014 Jan- March Categories:

- Gas Stations

- Movie Theatres

- Starbucks stores

As a low spender you shouldn’t come anywhere near $1500 spend over those categories, but you could certainly get some value from the Gas Station for your monthly needs.

DiscoverIT Card 5% Cash Back in Rotating Categories No Annual Fee

DiscoverIT 2014 Jan- March Categories:

- Restaurants and Dining

Time Limited 5x

The rotating categories 5x shown above offer a spending cap AND a Time limit on the 5x, however there are some cards out there that have accelerated earning for the first 6 months which should be of interest. Two that spring to mind immediately are:

- TD Bank 5% Cash Back Card

- Wells Fargo 5% Cash Back Card

Both of these cards are available in branch only, and offer 5% cash back for the first 6 months of card ownership, the Wells Fargo card is typically being offered to people who have an existing relationship with Wells Fargo.

The Sallie Mae Card

This card has the Spend Cap mentioned above, but it resets monthly, so is actually very interesting for low spenders. The first $250 per month spent on Groceries or Gas earn 5% Cash Back. Also I find it very interesting that they offer a further $750 per month at 5% for the category of Books. As I am currently spending a large amount of money each month on books from places like Amazon I wonder if those purchases would qualify…

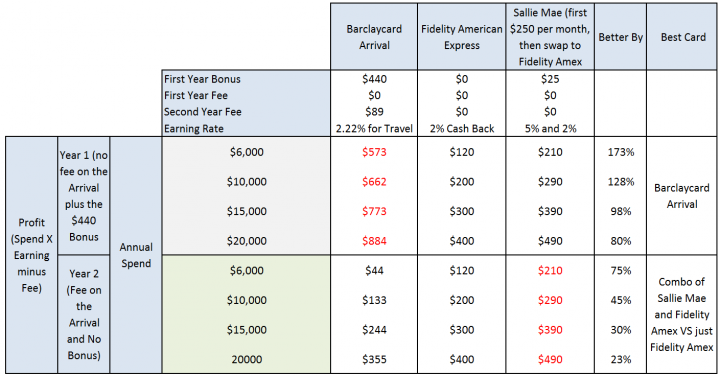

This card also has no Annual Fee. So you could hold this and the Fidelity card without worrying about the Colman Effect I talked about earlier. Spend your first $250 Gas Groceries on this, and the balance on the Fidelity card and you annual cash back would be:

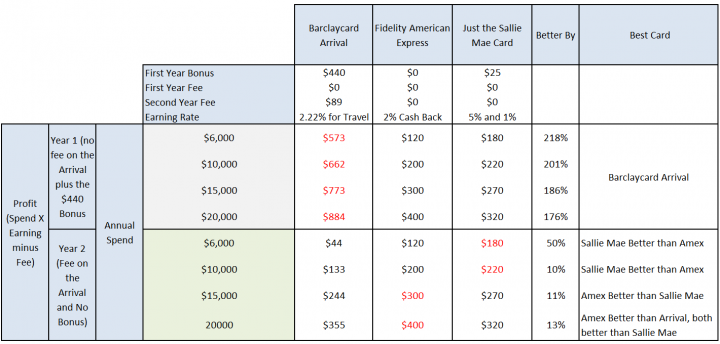

In the chart I highlight the extra savings of using the combo of the Sallie Mae and the Fidelity Amex, this is necessary because the Sallie Mae only offers 1x for anything outside of Groceries, Gas or Books categories (or within those categories after you exceed the monthly caps). However some people might not like the hassle of two cards and remembering their spend. So if you want to simplify, here is how the chart would look if you compared all three cards separately, putting the full spend on the Sallie Mae rather than carrying both.

This is the first time in the study that in year two there are two winners depending on your spend limit. The tipping point for this change over would be an annual spend of: $12,000 where both the Fidelity Amex and the Sallie Mae card would earn the same amount of $240, anything above $12,000 per year spend makes the Fidelity Amex the best card.

Interestingly, if you only hold the Sallie Mae the value of it really starts changing depending on your spend, the chart shows a massive 50% benefit of using the card for those people spending $6,000 per year on the card, it is because the assumption is that $3000 of that is at 5% and the balance at 1%.

The best situation from an earning perspective in year 2 remains the combo of the Sallie Mae followed with the Fidelity Amex, but again, for those at the $6,000 annual spend level we are only talking about adding an extra $30 per year by squeezing 2% rather than 1% for the $3,000 not spent on Gas and Groceries, so it doesn’t seem worth the hassle.

Finally, the best possible combination (for year 2 spending), but would require many cards would be to hold:

- Sallie Mae

- Fidelity Amex

- Chase Freedom

- DiscoverIT

Then you could squeak out the extra points on the rotating categories, and find yourself using the Fidelity Amex at 2% even less, but then you are adding up the number of cards in your wallet, the good news is that these all have no fee so it wouldn’t do you harm to hold them year on year. But even then most well planned out combination of these four cards would earn less than the BarclayCard Arrival in Year 1, which is a great card for your first year of spending.

I would probably swap Discover IT card with US bank Cash plus. Thats because with the latter you can choose the categories, where you can earn 5 and 2 percent back. Discover and Freedom bonus categories sometimes overlap.

Nice, I forget that card. I think I have a mental block since it is US Bank and they keep on declining my business…

Also, forgot to add. Amex Blue Cash Preferred is a very good choice and may beat out Sallie Mae for some, especially families. 6 percent on groceries (on up to 6000 per year), 3 percent on gas,though with 75 dollar annual fee.

It’s certainly worth a mention. Depending on the spending habits of course… might be better than the Sallie Mae card but it would be close.

fyi, the US Bank Cash+ is available in-branch only, so it’s not an option for those of of us outside of the footprint.

You can always travel to a branch in a different state. I went for a 4h ride to the closest branch. $9k later, it was definitely worth it.

Matt, Really great post! I am forwarding the link to my daughter who would consider getting into this hobby but would do best with a simpler approach that does not demand she and her husband rotate cards in and out of their wallets like passengers hurrying into an airport through a revolving door.

A couple of questions: Is Sallie Mae available to anyone? And the Fidelity card – which I believe puts the cash earned into an investment account – may surely be a good way to get low spenders to save too. But for those of us who might want to pull out the cash back earned to fund travel, can you do a post or provide a link to a post you’ve already done on the Fidelity card? and getting the cash out?

Thanks!

Yay! The paragraphs remain 😉 !! And leaving a comment was quite simple. Good change, whatever you did!

Thanks Elaine, been grafting on the site over the weekend, still some more things to do but the little things like this are a good improvement I think. I’ve not written formally about the Fidelity card, though I do recommend it, I’ll put something together for you on that.

For the Sallie Mae, it is for anyone and you can cash out via statement credits, making it similar in concept to how the BarclayCard works for travel.

Hi Matt, good post. The Arrival does indeed appear to be the best general cashback card for year 1 (at least for those of us who travel). I’d just be less conclusive about year 2 – there may well be retention bonuses or fee waivers upon request, which might effectively preserve the 2.2% vs. 2% advantage relative to the Fidelity Amex. Or even better, given that Barclay’s US Air cards are among the most churnable cards out there, you may well be able to get a 2nd Arrival card & signup bonus. I haven’t heard reports of anyone trying that just yet.

Hi Neil,

Good point about the churning aspect, not considered that. But for fee waiver that still makes it $440 travel vs $400 cash on a $20k spend, which is questionable as to its value.

Best for sure is a new card each year but after that I’m thinking the Fid is taking the lead at that level.

Awesome straight-up comparison! Thanks!

One thing to note, however, is the power of using Barclay’s shopping portal. With places like restaurant.com offering an extra 10 points/$, that’d effectively give you ~10% back on dining if you’re willing to take the extra step.

Hey Tyler,

I’m glad you like it. Not sure I’m into buying those vouchers as it gets complicated on their asking price too, but certainly they are worth a look.

Cheers

Matt