Today I pulled the trigger on a small batch of Credit Card applications, all related to the Hilton Hotel family. I did this despite already possessing the Hilton American Express Surpass Card and two of the Citibank Hilton Visa Cards… the reason might appear counter intuitive at first, as it was for a Travel Hack, but I didn’t apply for new cards for the sign up bonuses (though I’ll take them!) i’ll get to that in a moment.

Today I pulled the trigger on a small batch of Credit Card applications, all related to the Hilton Hotel family. I did this despite already possessing the Hilton American Express Surpass Card and two of the Citibank Hilton Visa Cards… the reason might appear counter intuitive at first, as it was for a Travel Hack, but I didn’t apply for new cards for the sign up bonuses (though I’ll take them!) i’ll get to that in a moment.

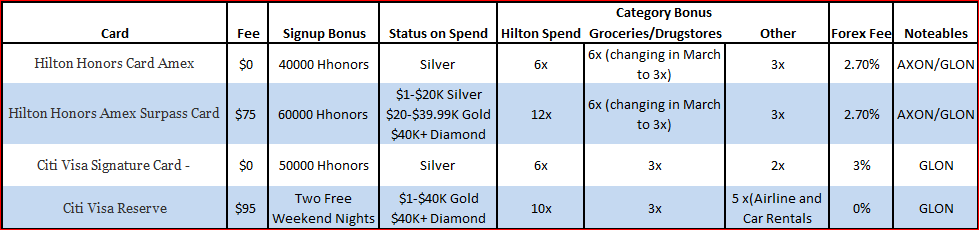

In this post I will compare the 4 cards on offer for the Hilton brand and share which 2 I feel you should have at all times if you plan to travel hack Hilton.

Firstly, don’t apply for credit cards if you can’t afford your current standard of living and think they will take the pressure off – we don’t do that here as it puts into long term debt, and is plain stupid. However, if you are in control of your finances then these Reward Credit Cards are a fantastic way to Travel Hack, AKA Travelling like a Rock Star for pennies on the dollar.

Next thing to note is that applying for a Credit Card creates a ‘Hard Pull’ on your credit file by the bank, this pull dents your credit score by 2-3 points at a time and takes several months to build back up. For that reason, I never just apply for 1 card. In fact I often apply for 3-4 at a time. People in the trade call this an App-O-Rama. The purpose is that you do ding the score, but you do it all in one go, so when 2-3 months have past all of those dings fade away, rather than just constantly applying every month or so for a single card.

Further more, I wanted to get my Hilton situation sorted properly, and my wallet needed a little juggling around to do this, here are the current cards on offer for Hilton, and their perks, and then you will see the perfect combination of cards to get the best value:

Also worth noting about these cards:

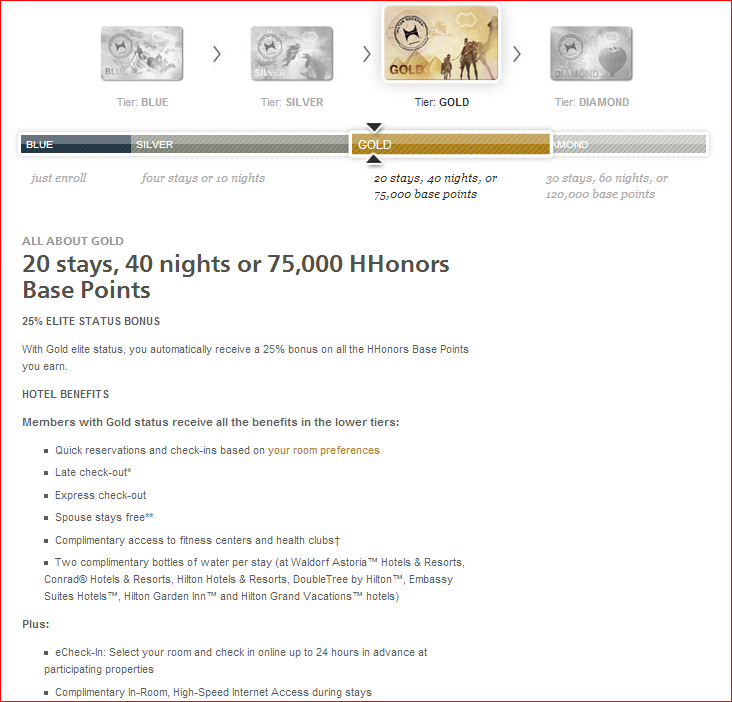

The Hilton Surpass from American Express starts off year one with Hilton Gold Status, then drops to Silver in year 2 until you meet spend requirements. I am currently a Hilton Honors Gold Elite due to this.

The Citi Visa Signature (fee free) is totally ‘churnable’, people apply for 2 of these at a time every 61 days just for the points, though I have only done this once as I don’t want to ding the score that much. People literally have dozens of these cards…

Elite Status that comes with the Premium (read paid) Card Memberships of the Surpass and Reserve

Currently In My Wallet

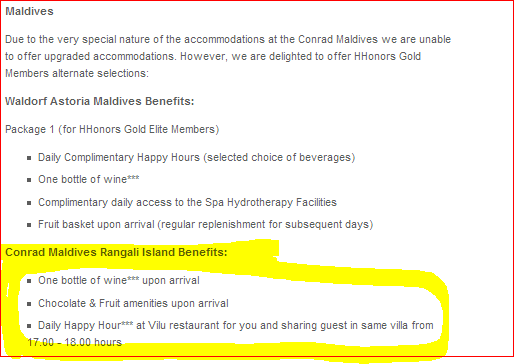

I have the Surpass and the Visa Signature (x2) though technically the Visa isn’t in my wallet since I never use it for anything after getting it just for the points last year. The attraction to me at the time for these cards were that the Surpass conveyed Hilton Gold Elite, if only for the first year. As we are planning our next vacation to include 2 hotels within the Hilton Family (the Conrad Maldives and Conrad Tokyo) I felt this would be very valuable to have. Gold Status doesn’t immediately sound good at all from the list of features above; but its the little perks in the small print that makes the difference. Check out some of the things highlighted at the Maldives Property I’ll be staying at next month (and bear in mind this is one of the ‘tighter’ properties in terms of benefits for Gold Elite).

Additionally, though not listed here Golds get complimentary Breakfast for me and Mrs Saverocity at this property, which will save us $400 over the trip… the value is starting to add up now.

The Visa Reserve is a newcomer to the mix, being released by Citibank late last year to compete with the Surpass Card. This card offers Gold Status for life whilst holding the card, without the $20,000 annual spend of the Surpass Card. This is a great addition for me so I planned to add this to my wallet, and remove the Amex Surpass as having two cards that offer overlapping benefits and each carrying a fee seems wasteful to me.

Axon Awards

The only spanner in the works is the AXON Awards. These are something that you simply have to take advantage of as a Travel Hacker. The AXON award is offered to holders of the American Express Hilton Card only – tough luck Citi. They allow discounted stays which make your points much more valuable, if used correctly. AXON are best used in blocks of 4 nights, when done so a Cat 7 Hotel which is normally 50K HHonors per night becomes 145K for 4 nights, and a Cat 6 which is normally 40K Hhonors per night becomes 125K for 4 nights. Add on Gold perks like the free breakfast, and we are getting something special right here. Also, the GLON award is available to any of those cards, it is like the AXON and is better value depending on how many days you plan to stay during your trip. I’ll do a post on how this works later if anyone is interested.

The reason for the switch today

With the upcoming trip to the Maldives and Tokyo I want to use a Hilton Card and get the massive Category Spend Bonus, currently 12x points with the Surpass and 10x points with the Visa Reserve. Whilst I could take the 12x points using my current set up of the Surpass I would be hammered with the Foreign Exchange Fee. Whilst this is almost a free vacation we will spend a fair amount of money enjoying the hotel, diving and enjoying dining on the beach, and I would rather not pay a 2.70% surcharge for the Surpass

With the upcoming trip to the Maldives and Tokyo I want to use a Hilton Card and get the massive Category Spend Bonus, currently 12x points with the Surpass and 10x points with the Visa Reserve. Whilst I could take the 12x points using my current set up of the Surpass I would be hammered with the Foreign Exchange Fee. Whilst this is almost a free vacation we will spend a fair amount of money enjoying the hotel, diving and enjoying dining on the beach, and I would rather not pay a 2.70% surcharge for the Surpass

So, today I applied for the Fee Free American Express Hilton and the Citi Reserve, the combination allows me Gold Status for life, one annual fee of $95 and access to AXON awards. I basically reversed my position on cards and now hold a paid Citi Visa and A Free Amex instead of a Paid Amex and a Free Visa… The perfect combination!

UPDATE 2/26/13

I learned the hard way that Amex won’t give you a bonus on the Fee Free Card if you hold the Surpass – you need to cancel and wait 90 days before you apply for the fee free one… that’s a 40,000 point lesson right there!

Leave a Reply