Classic advice from the Credit Card crowd is that you should not apply for card prior to a major loan. This post will explain why people think like this, and go on to explore the logic behind that to seek contrarian value opportunities, with the reasons why, for certain highly sophisticated people, it can actually be a good idea.

A good analogy of this credit decision would be deciding to start dating strippers in the 6 months prior to your wedding day, it can be a lot of fun until your darling wife looks through the bank statements and finds out about it, and wants to know why. The mortgage is like the wedding, it is a long play, with serious long term commitment and impact.

Notable Limitation – I was not able to find direct correlation between credit applications and mortgage rates, so I had to use scales and probability to explore the concepts I am presenting here.

The principle behind any lending is that there will be a a Principal and Interest portion of the repayment schedule, both the Principal and the Interest are impacted by the credit worthiness (AKA risk) of the borrower. The amount that will be loaned, and the rate at which the loan will be offered will increase or decrease according to how likely the borrower will repay. Originally such credit worthiness decisions were conducted by highly trained and intuitive people, who often knew the borrower directly. In the effort to grab as much cash as possible lenders turned to Credit Rating companies to instead help vouch for this Credit Worthiness.

Short Term Credit Hit

The theory is that when you apply for a credit card you get a hard Credit Enquiry (Hard Pull), which is a registered event on your credit score. Flags like these will lower your overall score, making you less attractive to lenders and therefore be forced to pay a higher level of interest as they ‘bake in’ additional points of interest for the higher risk profile that you represent.

Long Term Credit Rebound

The reason why most people who are highly active in Credit Card rewards conduct an ‘App-O-Rama’ is because the Hard Pulls are supposed to drop off your report within 90 days, what many people do is apply for a bunch of cards every 91 days and it is supposed to look as though nothing happened, the score has rebounded (often higher than before) and there are no pulls on file. You appear to be a good customer.

How far back can they look?

Here’s the key. I have applied for a lot of cards over the past few years, if the bank looks back further than 90 days they will see a bunch of applications. However, my credit score would remain ‘Excellent’ if we went on score alone, since it bounces back up to above where it was before. The general advice tends to be don’t apply for any cards within 1-2 years of your mortgage application, since anything they see there will harm your score, and thus cost you on a loan.

However, the truth of the matter is that from a pure ‘score’ alone, applying for cards in the past 1-2 years, and paying them off in full every month will increase my score, so it should lower the rate of my mortgage. Here is where this article lacks information, since I don’t know how exactly they do decide on what rate to offer you based on score, since it logically cannot be this arbitrary metric alone, else doing the illogical of applying for credit would lower your mortgage rate. For illustrative purposes I will assume a pure credit score = APR concept, even though I suspect it may be more convoluted than that in reality.

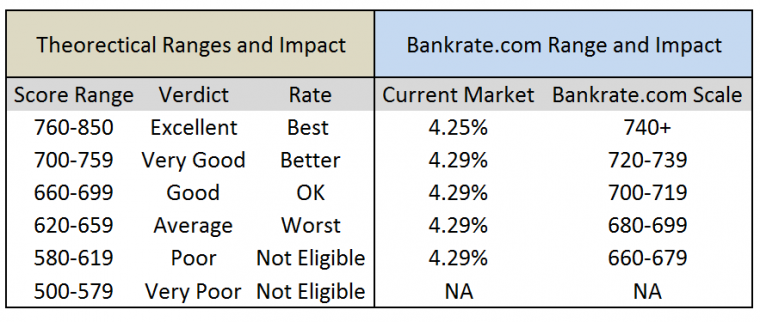

Traditional Thinking On Credit Scores to Mortgage APR

The traditional thinking on this matter is that Credit Scores are loosely bracketed into tiers, and the tiers will then qualify you for a scaling rate, I thought to test this out with what Bankrate.com is offering for a $300,000 mortgage in NY Metro with a 20% down payment, the results are below.

As you can see, the difference on Bankrate between a ‘Prime’ customer and the worst they will lend to is only 0.21% per year. Granted, this may have been a hook rate by the company offering it and when you actually process the mortgage it would bait and switch into something higher, but there were a lot of options offering around 4.5% and the worst I saw was 5.2% for the worst mortgage offered to the lowest tier (scoring around 660 range).

What impact does that really make?

If we look at the worst case and round it up to 1% extra APR between the best borrower and the worst borrower it doesn’t sound like a lot, but it is an increase of around 25% interest rates, and these things will be noticed over the length of the loan. A mortgage is the longest loan a consumer will hold, and during its duration the impact of Compound Interest will be incredibly important.

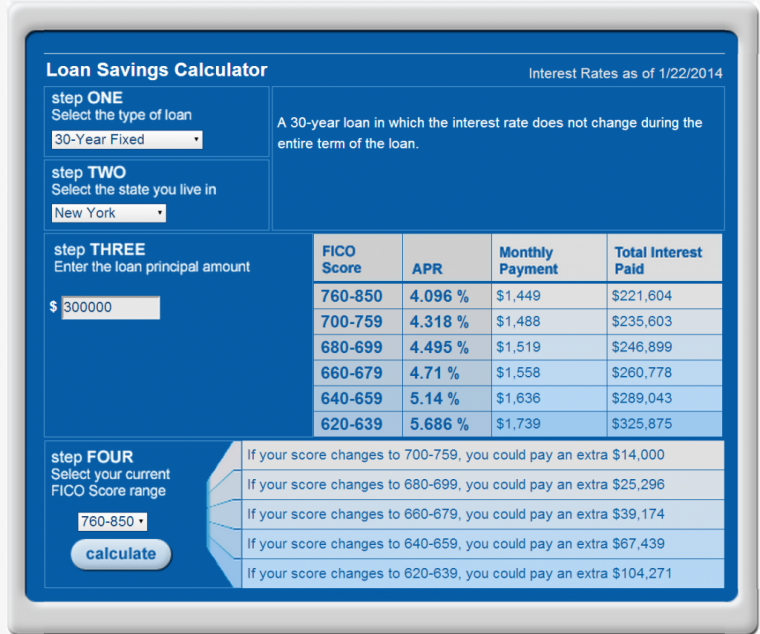

The MyFico Credit Score Calculator

Check out this fun tool to model the impact of your loan and your score, here’s a screenshot of my example:

The tool shows the additional interest you would pay over the course of the loan based upon the Credit Score=APR scenario, which is interesting to see.

I knew this, and I still applied for a new Credit Card

The numbers above seem massive, but they are factoring in Compound Interest over 30 years. The monthly figures are a lot smaller and might be worth looking closer at for a moment. The difference between the best and worst credit in this example results in over $100,000 additional interest over the course of the loan. But when thought of on a monthly basis it only adds on $290 per month to your payment.

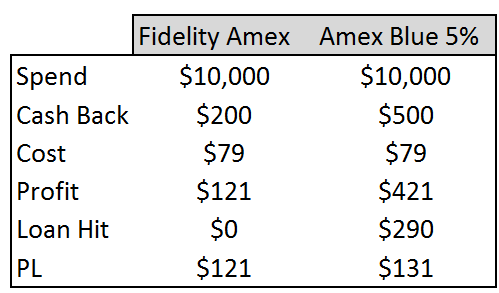

Now, for many that amount far outweighs the benefits of a couple of nights in a hotel or a free flight, but for me, I think that there is one card that makes it worthwhile… the 5% Amex card. As a married couple we have 2x Bluebirds, so we could clean out $10,000 of gift cards per month on that alone. At 5% that would be $500 minus costs (20 cards at $3.95 each for $79) would result in a net profit of $421 per month, making us ahead on that alone, never mind real spending.

In reality, we could have stuck with our trusty Fidelity American Express at 2% so we are only capturing a 3% increase on this card, so it would look like this:

As you can see, in this example I am $10 ahead, but that is assuming that the single card application takes my credit score down from the top to the bottom (which I doubt) so there is upside potential in the loan hit, also it does not take into account annual regular spend which would come back in at an additional 3% over what we are getting now.

The interesting thing is that if we are disciplined with the additional inflows of cash and apply them to the mortgage principal, we will have a more dramatic affect on the repayment of the loan, and it will actually be paid off way faster than not applying for the card.

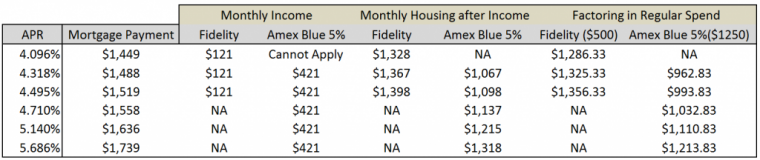

Scenario

Lets say we take the first $290 of Cash Back and add it into our bank account to balance out the difference in lowest rate and highest rate of APR (thus making the monthly payment have zero impact on our monthly housing budget). Then lets add on an annual spend in Gas Stations, Drug Stores and Supermarkets of say $25,000. For another $1250 ($750 more than using the Fidelity Amex).

Cash Flow Impact

Since we know that both mortgages are fixed 30 year terms, we can deduce that lowering the monthly cash flow drag on our housing budget will create a lower effective rate of interest. Therefore, in the scenarios below because on the increased cash back inflow your annual mortgage rate, even for the worst performing APR becomes lower than the the best rate offered.

Additionally, this can be leveraged even more if instead of using the cashflow to offset housing budget it instead targets an early repayment schedule on the loan, in the example above you can pay off that 30 mortgage, at the same monthly rate out of pocket as the best loan, faster by taking the APR hit and throwing all the cashback at the Principal, you would pay the same out of pocket each month the person who has the 4.096% rate, yet pay off almost 3 years earlier, whilst paying an APR of 5.686%.

It is ironic, but by paying the worst APR in the list, you pay off sooner with this card. Savings are stacked further since Cash Back is non taxable income, whereas Mortgage Interest is a Taxable Deduction for many filers, so you would get Tax Arbitrage savings on the 1.59% difference also, which would result in a large tax savings each year.

Conclusion

Applying for regular cards when looking at a loan is likely a very bad idea, but for the right card, with enough spend strategies, it could be a savvy move. The reality is that it is likely the Amex card will stop proving to be such a great deal over time, since everything dries up, but for now, I really doubt my score is going to drop by several hundred points for applying for the card, and providing I make regular payments mid month to keep my credit utilization low I think I will be fine. What do you think, am I missing something major here?

If you are interested in getting the Amex I discuss here, PFDigest has a link for more details in this post

I broke my 3 month normal wait for the old amex blue…but buying a house? When I bought a house a year and a half ago I stopped the cc applying for a good while…there are a bunch of costs after the purchase you have to take into account. Keep cash on hand…for awhile.

my humble opinion

Great point Drew, home ownership isn’t cheap, we’ve done it before so plan to keep a nice cushion of cash too.

We refinanced a couple of time in 2012, we were asked by the lender to explain each inquiry (at least 6 month period I believe) on our credit report

So it is not just the credit score they are looking when they evaluate your application.

Yep, I got that impression too, thanks for the data point.

In hopes that folks looking for info on the impact of churning on mortgage apps will find their ways here, I wanted to post my experience. We just locked on a refi today, but it was not a refi we had planned. Indeed, the idea surfaced when I was opening a new bank account to get $100 for doing so, and the bank manager asked me about a refi. I was dismissive but he convinced me to at least look and to my surprise, paying extra as principal curtailment on a our current loan was nowhere near as smart as doing a refi to get a lower rate/higher payment.

As for the connection to CC apps, I had this idea that I would apply for the 100,000 bonus points CITI AA offer, since I’d heard it might end on March 26. Everyone I asked about it thought it was probably a foolish move, and in the end I did not do it. But both my husband and I have been busy with regular AORs since Nov. 2013, so there are many, many inquiries on our credit reports.

The Loan Officer went through every inquiry that happened during the last 119 days, matching each inquiry with the bank that subsequently gave us a CC, and as such was listed in another part of the report. I explained why I had so many, and she asked me to write a statement for the underwriters explaining it! I wrote:

Our Loan Officer, So-and-so, asked us to address the fact that we have opened multiple credit cards recently. We have done so to take advantage of bonus offers – such as receiving 50,000 miles towards airlines travel or $200 cash-back – for opening the new account. We make the minimum spend necessary to get the bonus and then put the card in the drawer. If you have any questions, please don’t hesitate to ask. Thank you for your consideration.

The Loan Officer did not expect it to be a problem, but she cautioned me about so many apps. She believes it does have an impact and she has seen people pre-qualify, only to return 4-5 months later to apply for the mortgage, having opened a new CC, which raises their eventual mortgage rate.

In our case, it was moot. We have enough equity in the house, the refi was for just 10 years, and our credit was excellent despite the many inquiries. We locked in a 3.25 rate, the lowest they offer.

What did have an impact was the fact that we did this during the week the Fed met! We should have pursued it as soon as the idea surfaced 3 weeks ago, when rates were 3.125, but neither of us was in much of a hurry and other obligations took priority. As a result, we’ll pay about $8-9 dollars a month more. I guess I’ll need to limit those lattes to make up for it 😉 !

On the upside, we used our shiny, new Arrivals card to pay the deposit, earning a nice 2% cash back!