When starting out in the Credit Card Travel AKA Travel Hacking game many people want to know ‘what is the best card for beginners’ well, if you think like that you are going about the whole thing in entirely the wrong way.

Before reading on – leveraging credit card rewards is a high risk game, and not for everyone, tread carefully and please read my primer on how to approach your first applications here: How to do an App-o-Rama Sufficiently cautioned? OK great, pull up a comfortable chair, I have a great story to share with you.

The ‘Best’ Cards don’t always mix

Do you know how some things individually are wonderful, but combined just don’t make sense? Think of Dom Perignon and Granola, or perhaps a nice Macallan 25 with red bull, Miley Cyrus and fame… Individually I am sure they are lovely, but together it just doesn’t work out.

The ‘Best’ Cards are relative to their current signup bonus

Without doubt one of the very best Credit Cards you could get is the Capital One Venture Card. Whereas one of the very worst cards you could get is the Capital One Venture Card – the difference? When it comes with 100,000 points signup bonus in the former, and 10,000 in the latter. Very mundane cards become very exciting with the right incentive, and when Travel Hacking it is all about the signup bonus.

Three Excellent Credit Cards (when you get the right bonus)

The American Express Platinum Card – Annual Fee $450 offset by:

- Lounge Access

- $200 Statement Credits

- Some other stuff

The Platinum card is excellent for travelers who don’t always fly Business, since it allows you Lounge Access when flying on American Airlines, Delta or US Airways. For me it works really nicely when I link up my British Airways Award flights for Domestic USA trips (great value) as they are always in Coach, so bolting on some Airport Lounge action is always a nice bonus. The $200 fee I have typically used to buy AA giftcards for free . However the annual fee is horribly high so unless I am using the lounge at least once per month (if not more) I wouldn’t keep this card.

Real Reasons I got it: They have a business version which offered me 100,000 points to join, and I can write off the annual fee as a Business Expense.

The Citibank AAdvantage Visa Annual Fee Waived First Year

- 10% Rebate on Miles used for awards up to 10K per year

- Access to reduced mileage awards

- Some other stuff

This card has come with up to 100,000 point sign up bonuses, but those days are long gone. Today, if you can find 50,000 be happy, and in hope to find that happiness for you there is a link here, but it is a Grey Offer, and it might not be right for you (post) AAdvantage points (at least at the time of this post) are some of the most valuable you could hope for, especially in light of the fact that United Devalued their award charts and Delta apparently has been sold to the Grinch.

The BarclayCard Arrival Fee Waived First Year

- Earn 2% everywhere, and get 10% back when redeeming for Travel expenses

- Some other exciting stuff

The Arrival card is great – comes with 40,000 signup bonus that can be used to offset your travel expenses, It is like a purchase eraser where you cancel out travel spending on your statement, wonderful for Cruises and non award travel.

Wait – you said their was no best card for newbies list!

I do like a savvy reader and you are correct, the above cards aren’t good for newbies, I mean, they are as good as any other card and certainly go ahead and use my link for the Barclaycard Arrival (since I get a commission, thank you!) but these cards alone, or in conjunction are hardly going to craft even a single trip for you, even if you are a solo traveler.

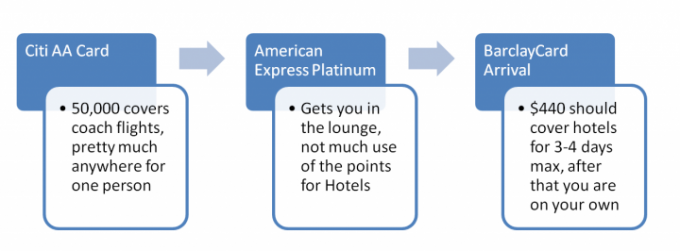

You can certainly achieve more if you are willing to fly in Coach, which I think all younger travelers should be doing initially anyway, but even then you need to think of each card here achieving just one part of the trip, such as:

Your AA miles can get you as far as Japan (and back again if you fly Coach), and you can bolt on free one ways if you play the magic dashes game if you do fly in Coach then your Amex Platinum can get you in the Lounge so you can load up on free Coors Light and Apples! Once in Japan you would have $400 worth of hotels covered by the Arrival card.

As you can probably see, you aren’t getting a free trip here, it is a (deeply) subsidized one, though if you got that Amex Plat with a $450 fee the subsidy value is quite low. If you like Business Class (or worse have a significant other that likes Business Class) then you need a bunch more points to make this happen.

Understanding Gelling Card Strategies

Certain cards work together to target points earning in one area – a great example of this is found with Chase, since all of their Ultimate Rewards transfer to United, and they also have many incarnations of United branded cards, therefore if you look at the following ways to focus on that airline:

Business Credit Cards

- Chase Ink Bold 50,000 United Miles (when transferred)

- Chase Ink Plus 50,000 United Miles (when transferred)

- Chase United 50,000 United Miles details here on Flyertalk

You can browse for these Business Credit cards here using my link I do get a referral from these.

Personal Credit Cards

- Chase Sapphire Preferred 40,000

- Chase United MileagePlus 50,000

There are more versions of these United Cards, but frankly I got bored and think I proved the point – you could easily consider applying for the Ink Bold plus the Sapphire Preferred and the United Card and have access to 150,000 miles. Now, it is worth noting that such miles will be less valuable after February 2014 on certain routes, but still a very powerful travel tool to own.

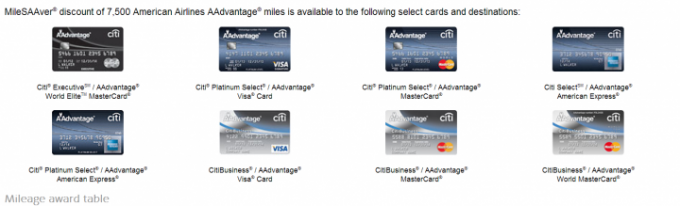

A similar case could be made for Citibank and their AA miles, they have 8 iterations of their AAdvantage Card, whilst some are alternatives (Such as Gold Version of the Platinum card, or the World/non World version of the Mastercard) that don’t stack well, you can still apply for multiple versions, such as all three Personal cards in the Visa, Mastercard and Amex formats.

You could easily apply for 3 of these in a short space of time if you take on the Business and Personal first, then apply for a second personal (I’ve actually applied for 2 personals on the same day and been approved, but YMMV).

You can see how by App Attacking a particular loyalty program you can gain enough points to achieve your travel goals, rather than picking the best overall, you can pick a very focused approach. Personally I went through all the Citi cards first (when they were offering 50000-75000 bonuses before I even thought of Chase and their United relationship.

Be Goal Orientated – have a dream, and find the tools to achieve it

As a beginner, or an old pro, come at things with a clear goal in mind. Rather than approach the problem as ‘what cards are best for me’ ask yourself what would you love to see or do when it comes to travel, and then work out what cards are best for you – please feel free to enter in your dream trip in the comments below and I would be happy to suggest ideas to make it happen using points and miles.

Ask yourself:

- Does the flight need to be in Coach, Business or First Class?

- Does the hotel need to be high end or just a place to rest?

- Is my home airport a hub for a certain carrier?

- Do I have real revenue earned miles that I am seeking to boost?

Once you have completed a few cycles of Apps and created some wonderful travel memories bolting on new cards to boost up balances will be easier, but starting out, you need to be very focused and driven to make this work.

Good post. I completely agree, that there is no “best” cards list. But I personally focus on limited time offers. For example, given a choice between Chase Sapphire Preferred an Arrival, I would go with the latter, because its a limited time offer. Though my top choice currently would be CITI AA card, since for me they have the most valuable miles at this time. But it does depend on the person and their needs.

Well, if you have a number of cards then picking between one or the other makes sense, but if you don’t and are starting out just saying that one is your favorite doesn’t do much, since it doesn’t pay for an entire trip.

As a person with ‘several’ cards already I would pick the AA too, I’m not sure how I rate the Sapphire since devaluation of UA.

Actually my valuation of CSP has not changed. I value Ultimate rewards point at 1.25 cents just as I did before. Thats my floor, because of travel redemptions through the program. So by that logic CSP should supersede Arrival. Yet I would pick the second one, since its a limited time offer.

Not sure I agree with your valuation, but that’s no surprise with such things.

I’d also argue that 40k isn’t limited since that’s all I’ve seen for the arrival?

Yes, my valuation is very conservative compared to others. Mostly because we are a family of 4 with limited vacation time. Thats just my opinion, as always. As far as Arrival, it did say “limited time’, though it has been out for a long while. Not sure if its just a marketing gimmick. Most likely.

Yes, I agree, a very nice post that gives the lie to all those “Top Ten” and “Best Cards” posts out there. It is indeed a very personal choice.

I am gearing up to do a retention offer call on a US Airways card. This card was my first foray into this game and also my “initiation-by-not-the-best-offer” since I was unaware of the offer that not only waived the fee but also promised 10,000 miles on anniversary date. I was able to get US Air to refund the fee when I wised up a few weeks later, but won’t get the 10,000 mile bonus on either my card or my husband’s. So we will call to ask for waived fees and bonuses. I can have them move the credit to his new Arrivals card if they say no, but I have not yet gotten that card in my name.

I will keep the cards if the fees get waived. But I am trying to decide if it is worth paying any money for points. The best offer to get US Air miles during one of their promotions would get me 100,000 miles for $1881. Which makes 10,000 worth $181. But I have no plan in mind for using US Air miles at this point and our balances are pretty low, so I question if I should spend the $89, even if it is a good buy, at this point? I can probably just re-apply for new US Air cards during a future churn.

Do you have a rule of thumb when considering renewing US Air cards? Thanks!

Tough call for a rule of thumb – If they waive the fee I keep it open , if they offer points I would both price them (as you did) and also look at present balances.

If you were 10k away from your next award then it’s more valuable than if you are far from that and they become orphans.

Factor in a future merge with AA too. The miles could combine, but also could devalue at the same time…

If possible at the least don’t close before transferring as much of the line as possible to any other cards you have with them.

Thanks for confirming my analysis. What you said is about where I am at with it. I did think about the merger with AA and as you point out, hard to know if that will make the Dividend Miles with US more or less valuable and with the merger not yet a done deal, they could become orphan miles. Here’s hoping US Air will at least waive the fee; then I can reconsider in a year. I’ll let you know once we call. Thanks again!

Good luck! I canceled a card today, but did pull over 99% of the line from the UA card to the CSP ( whose days may also be numbered…)

We called and they did not need to speak to my husband – they were perfectly willing to discuss it with me as an authorized signer. I thought that was weird. I was told several times that the rep could do nothing, and that she could not connect me to retention, and even if she did they would do nothing different. But I persisted.

She finally came back from the third time of putting me on hold to say that I should call back a day or two after the fee hits the account, and that she would notate the account to reimburse the fee when I call. So I will sit tight, call on the date she advised, and see if that indeed happens.

I was reading the various responses people posted on FT – some reps immediately reimburse the fee, some offer a deal involving the fee and/or points, some handle it the way the rep did for me. I expect that there are a few variables that dictate the responses; that it is not simply which rep you get. I imagine the initial offer you had matters, the amount/pattern of spend matters, and whether or not the fee has already hit makes a difference too. From what she said, she couldn’t do anything until the fee hit, and this was not made clear in her initial comments that she could do nothing.

To be continued!

Yes, I think the account must flash up as an alert if you are a ‘desirable customer’ if not then it takes more effort to get through to retention. When I first started out I had few cards, so was naturally using them more and found that they would always seek to retain me. But as time went on and I had dozens the cards weren’t being touched so they were less worried about keeping me as a customer… good luck with this, let us know how you get on as it is good reading for other people in a similar situation.