As I posted a few days ago, my family and I are on our way to the Middle East, specifically UAE, in a few months. I traveled extensively across the Levant when I was in the Peace Corps in Jordan but I have yet to see the Gulf region. I’m intrigued by the vast differences between these two distinct areas that find themselves bound together by geography and religion. When deciding on a final destination, UAE seemed to fit the bill nicely as I am completely comfortable that the infrastructure is more than sufficient to address any emergencies while traveling with my two and four year olds. And it has activities and attractions that are sure to capture my family’s interest.

Most airlines serve either Dubai or Abu Dhabi. We were interested in spending a little time in both cities so it did not matter which one was our final destination. But after changing our award tickets home from Kauai last winter, the decision was made to go with Star Alliance, and ultimately fly on Austrian Airlines in business class. As luck would have it, the flights we were interested in had 4 business class seats available. I’m slowly becoming an expert on airlines that open award availability for 4 business class seats per flight as we’re only willing to take long haul trips in business class or above.

So, after choosing Austrian Airlines and finalizing our reservations using our US Airways miles for two tickets, I still needed to book the two other tickets. It occurred to me that All Nippon Airways (ANA) has a distanced based chart and that the mileage required for a roundtrip to the Middle East was a bargain compared to its competitors. For 90,000 miles we could get a roundtrip from JFK to Dubai in business class on the exact flights we had gotten using our US Airways miles (which charges 120,000 miles per person, unless the agent makes a mistake). And we had a plethora of American Express Membership Rewards points available to transfer to ANA for the flights. But, before making the transfer, I did want to ascertain the taxes I would be expected to pay. While US Airways does not pass along the costs of fuel surcharges on award tickets, ANA does and they can be quite hefty, depending on the airline, route, and final destination.

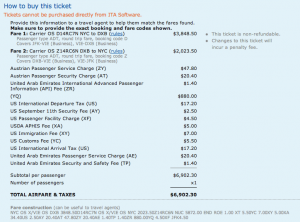

ITA Matrix is one tool that I use extensively when researching flight options. They have advanced routing codes that can help you pinpoint dates of travel, routes, etc. So, before pulling the trigger and transferring the 180,000 Membership Rewards points that I needed for two tickets, I priced out the taxes that I should be expected to pay. And this is what I found:

You’ll see that the taxes and fuel surcharges come out to approximately $1,030.30 per ticket. This is much more than I usually am willing to pay for taxes/fees/surcharges on an award ticket. But this was a special occasion and I rationalized (perhaps errantly so!) that our US Airways taxes were a pittance by comparison so the average across the 4 tickets would only be $594.74 per ticket (we never usually pay even close to this for an award ticket!). So reluctantly I made the transfer of my Membership Rewards points to my ANA Mileage Club account. The transfer was not instant but did occur within 24 hours.

I then called up the Mileage Club and made the request to book two tickets in business on Austrian Airlines from JFK to Dubai, roundtrip. The agent calculated the mileage required but said that they would have to call me back with the taxes as they weren’t calculating automatically. I had suspected this would happen as I tried to look up the taxes on ANA’s website but got the same message. A short while later, I got a return call quoting me taxes of $1360.24 per person! That was significantly more than what I was expecting to pay, and what I was expecting to pay was already way outside of my comfort zone! But, wanting to make sure that we all were on the same flights and fearing that those award seats would go away, I booked the two tickets, paid the taxes/fees and decided I would call back once I got all of my facts together to request a refund.

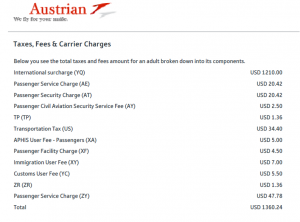

For the next few days, I continued to check ITA to see if the taxes and surcharges just weren’t updated correctly. I also asked a couple of experts for their advice. The taxes remained the same but the experts advised that ANA often gets the taxes wrong so I should provide ANA with the evidence of the correct charges and they should refund the difference. It occurred to me that ANA probably wouldn’t accept evidence from any source except Austrian Airlines as they are the ones applying the fuel surcharge. So, I got on Austrian’s website and went through the process of booking the exact same ticket we’re flying on.

And lo and behold this is what I found:

The taxes/fees/surcharges mirrored exactly what I was charged by ANA! Bummer. Now we were paying a lot more for award tickets than I imagined that we would. But, this was a 40th birthday trip for my husband and undoing the tickets with two different airlines would have been more hassle than I was willing to go through, so we’re now the lucky family that paid an arm and a leg for award tickets. Lesson learned, don’t always trust the taxes/fees/surcharges provided by ITA! I still love them, but I now verify the taxes they quote with the operating airline before jumping in!

Wow, that is a lot to pay just for taxes. That is a lot of money to pay for a free flight. At least you will know not to trust that site next time.