When two airlines merge it is never a good thing for the consumer. It reduces competition, reinforces the power of the ever shrinking oligopoly and makes puppies cry. There is a lot of chatter out there about this merger, and I’d like to give some thoughts on how you can get the best out of the situation. This post, like many here is an Op Ed, and if you would prefer the executive summary it is: don’t get any new US Airways or American Airlines Credit Cards, and burn your existing points if you can.

Do not get the US Airways MasterCard

I see silly bloggers pushing this card, saying it’s a great play, frankly its not. I have an affiliate link for this card somewhere, but I can’t be bothered to post it here because its good for nothing. Here is the for and against argument:

The argument for getting the card

Get the card, it comes with a 40,000 sign up bonus and when the two programs combine you will basically be getting 40,000 AAdvantage miles!

Actually this reminds me of a key stage in my travel hacking career. I have been traveling since the age of 19 but the first real play with points happened after the United and Continental Merger. I was actually happy that I could combine orphaned points from both programs and get close enough to single award by doing so.

The main reason for my late adoption was that until that phase everything was bum in seat miles, and I couldn’t even think of asking for any American Credit Card as I was a Brit assigned to various parts of the globe for work. I hope that gets me off the hook a little, as I know how much the game has changed since those days and how many opportunities passed me by!

Since I cannot remember the good ole days of Continental I cannot say if there was also a devaluation that occurred here, but I do know that almost everyone I know hates United Airlines. Having flown around the world with them many times for free I think these guys are kookie but that’s another story. But their anger towards United does shine a light on the potential danger that occurs in a merger, and how holding points is very very different from holding stock in such a scenario.

A digression into M&A

Let’s digress a moment to factor in the differences between a stockholder and customer in a merger and acquisition situation. When a publicly listed company seeks to acquire another it must make a tender offer that is to the satisfaction to the board and the majority stock holders. Typically the price agreed upon is the current market value plus a premium that takes into account future potential, symbiotic cost savings and goodwill. The premium builds in a ‘sweetener’ that makes the deal worth accepting and has to be attractive enough to the people involved in order to be accepted.

For the common stock holder of a insubstantial amount of equity there isn’t a lot that a person can do, other than band together with other similar folk in a class action suit to add weight to their voice. Once the acquisition is approved your existing stock will be exchanged for new stock in the bigger, better and bolder new company.

Acquisition Example: you own 100 shares in American Airlines (AMR is their holding company) at current market value of $10 per share. US Air (share price $20 per share) offers to buy AMR from you for $12 per share. Typically, you would receive a mix of cash and stock in the new company, the idea being that they fund the acquisition by using as much internal leverage (company equity) as possible as that is lowest cost form of credit. Therefore your brokerage account would look like this:

Today:

- 100 AMR @ $10

- Total $1000 value

After acquisition

- Cash $300

- 45 US Air Stock

- Total Value $1200

I hope the above was reasonably clear, because a merger example is actually more convoluted because its a case of the two companies are acquiring one another, though in reality the term merger is often given as a mask for a variety of business reasons.

In the actual case of this merger the inverse of the above is occuring, with a little twist:

AMR is currently in Chapter 11, a legal state that protects a company and gives them the opportunity to emerge from difficult times by fending off certain liabilities. It is close to emerging, and on December 12th is being rebranded AAL (at a different price…) and then all the US Air stock will be swapped over to AAL stock at a 1:1 basis. It seems that AA is acquiring US Airways.

In the case of the US/AA Merger US Airways is a much smaller airline, both in terms of fleet/service and revenue in comparison to AA yet in many ways it could be seen that due to the weakened debt position that AA created the smaller company is able to acquire the bigger company. Whilst this may not appear obvious since US is leaving its alliance and moving to AA’s OneWorld alliance if you look at the majority of the operational moves you can see that the new organization will be led with a heavy focus on the US Air management team. To me at least I would say it’s not as obvious as it may seem.

How does that affect the frequent flyer?

Hopefully, what this highlights is that whilst you have a ‘merger’ on some levels what you are really seeing is one savvy organization acquiring another, and cherry picking the things they want to keep in order to be most profitable. One key example is the management personnel from US leading the operational management. Another is the decision to move to OneWorld.

Clearly, by moving into OneWorld legacy AA customers will not have to change to the US program in order to keep their hard earned airmiles; it is those US Airways Dividend Miles that will be changing to American Airlines AAdvantage. This ties into the concept that those silly bloggers are harping on about, a quick way to gain 40,000 AAdvantage miles as you can get the US card, earn the signup bonus and then these will become AAdvantage miles.

However, the difference between a M&A transaction and a customer integration is that the former is financial agreed to by equity shareholders and they know what the exchange will be. The customer integration aspect is distinct from this in that they don’t ask approval of the existing customers as to how the new company will operate. Of course it would be naive to think that they would merge the companies and immediately strip all value from the frequent flyer programs of the loyal customers, but there will be ‘optimization’ steps that occur.

A look at the old tables

Elite Status Levels

You can see the status levels for US Airways here and for American Airlines here the primary differences that I note from these are:

4 tier vs 3 tier programs

Theoretically, the more tiers the better for the airline, since they have a basket of benefits they can offer, and there are some that are more valuable than others. For example, the most valuable aspect of the American Airlines program is the eVIP upgrades (8 per year) that allow a change up in cabin class for revenue tickets. For example, you purchase coach from NYC-Hong Kong and applying eVIP to it gets you the journey in Business Class for the price of a Coach ticket.

Worrying is that US Airways offers something similar, but with more restrictions to their Chairman’s level Elites, but only for 4 eVIP’s and it is to be used 2 for the Chairman and 2 for their companions. Perhaps a nice optimization would be to raise the restrictions on that to anybody can use the eVIPs, but to keep things consistent there would now be only 4 rather than 8 on offer.

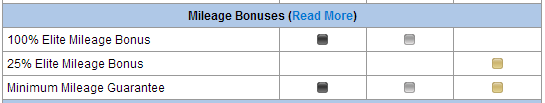

The good news here is that both US and AA have the following tiers for status, which implies that things won’t go up. overall. Indeed introducing tier between AA Platinum and Executive Platinum at the 75,000 level could be a benefit to the consumer, the question is if they decide to pull things out of Platinum and make them harder to achieve. Since we know it is to be an American Airlines chart we have to wonder what could go into that level. One thing that would look tidy from a mathematical perspective would be to adjust the Elite Mileage Bonus:

By reducing the tier 2 American (AA Platinum) earning it would allow the new third level to become more desirable. For example pulling down Platinum Elite Mileage Bonus to say 75% or even 50% that would allow them to make the new and improved third level 100% and appear attractive…

Of course, this, along with the rest of the article is purely speculative another solution would be to slot the US Airways (Platinum) customers into various parts of the 3 tier system, likely into the AAdvantage Platinum level. And furthermore it doesn’t really address the decision to get more miles or not via credit card signups. However, what it should do is make you think that when mergers happen changes to award programs will happen to.

The cost of a new American Award

Arguably American Airlines is due for an award chart devaluation. It’s major competition, Delta and United have both done this in the past 6 months and there is a discrepancy between the average costs of awards between these programs, with American offering some of the best value overall. Take a quick look at a this itinerary:

North America to Europe Business Class

- American Airlines 50K

- United Airlines 57.5K (effective 2/1/2014) or Star Alliance Partner 70K

- Delta 3 tiers of awards from 62.5K-162.5K (most likely to be at least 100K)

What a new award could cost with American when the devaluation occurs is anyones guess, but I think a little pop to the levels we see at United wouldn’t be a surprise. Also it is uncertain as to when this would occur, it could be anytime after December 7th, but there is some speculation that it might happen in January 2014.

Don’t buy into downside risk

The acquisition of a US Airways credit card, indeed also an American Airlines credit card at this time would be a speculative play. As you can see from my scenarios in this post there is a lot of potential for change occuring in this merger. In a financial transaction uncertainty creates potential for gain. Upside potential. When making any speculative investment it is key to factor in potential for both gain and loss. The flaw with the concept of acquiring more miles going into this merger is that the best case upside potential is going to be that you can use your US Air miles as AAdvantage miles.

The downside is that they devalue.

It’s just not a savvy play based on that. Also, it is important to factor in the time required to obtain miles from signup bonuses from credit cards, best case for cards like this the miles post at the end of the billing cycle after you meet minimum spend. If you apply for a card today, the best that could possibly be would be sometime in January. Since you don’t know when the news of a devaluation is going to be released, but we do know it is likely to happen you are buying into downside risk, and are going to have to hope that you get the miles in the account in time to burn them up before anything changes.

Burn Baby Burn!

My advice is to spend all of your American Airline miles that you reasonably can now, the award rates aren’t going to get any better in the future, if there are any trips you have been procrastinating about booking do so now. You are able to search ahead 330 days so you can book up travel throughout 2014 now. Lock in the awards at this price, to hedge against the two tier award chart that United implemented consider booking on Partner airlines such as Cathay Pacific for your Asia routes.

Conclusion

We currently have about 100,000 AAdvantage and 60,000 US Airways miles between our two accounts, I hope to upgrade my flights to Switzerland next month and burn through 90,000 of those AA miles, by doing so I guarantee value from them. Anyone that is suggesting you get the US card (or even the AA card) at this time is either naive or wants to earn a commission from the sale and doesn’t care about the outcome. It may have been a good idea on some levels to earn AA miles by getting a bunch of US miles and watching them transfer, but thinking redemption costs of such a transfer will not change lacks forethought.

Spend what you have, earn no more unless you can be certain they will post very quickly and lock in your tickets. It will be a lot more comfortable for you to sit back and watch the changes that occur when you are sitting on tickets already booked than currency that just changed in value.

Matt, I think part of the reason some folks are pushing the card (US Airways, at least) is because they will be changing the cards and then you will have an additional chance to earn points. Even if they are devaluated points. I know for myself, they’re sort of orphan points programs, so it would be great to be able to combine them.

Hi Bear,

Sorry, thought I had replied to this (perhaps my anti spam is so good it deletes me too! I do like the idea of combining the orphans, just like I did with Continental and United, but I wouldn’t buy into change, it is volatile and a risky play.

Matt, while I agree with your analyses, it’s not like: a) we have a choice, and b) it’s too costly. Of course they will devalue, but so what? If we take it that far then we should stop churning every time an airline or hotel devalues their currency.

Besides, I don’t see a lot of downside to applying for it. There is no spend, and it’s Barclays. Maybe it’s simplistic but I would grab whatever I can.

You have a choice to wait or act. Me personally I am going to wait to see what the AA miles are worth rather than pulling the trigger and getting new US cards now, I do have about 60K US miles sitting around so I will let them play out as they will, but I won’t be trying to boost them going into uncertainty.

Whenever a program changes we need to re-evaluate value and decide if it remains, or if we should change tactics.