I’m in the weeds with my travel plans at the moment. A phrase I learned in kitchens where you just can’t seem to catch up with things. In this case, it is self inflicted, as I realized to get the best value out of a lot of concurrent needs, it helps to have them overwhelm you for a while.

My current travel schedule looks like this:

July – first cruise on Celebrity

The good news is that we snagged a balcony for ‘free’. The actual cost is just $130 pp (just taxes and fees) for the first two guests, then a reduced fare for the third guest. All in, we’re looking at $960 for three of us, which is great value for 7 nights on the Equinox, not as good as $260, thanks Dylan….

The bad news is that we need flights to Miami, and possibly a hotel if we decide to come in a day prior to departure. There’s no award space, flights to MIA are costing about $300pp, or closer to $220 if we were to fly into nearby FLL. The cruise is booked, but I haven’t figured out the flights yet.

Keep your fingers crossed that I get approved for the Altitude Reserve with a huge credit line, and the cruises will more than pay for themselves!

July – Thailand

Allison is heading to Thailand for coursework field study. The good news on this one is that we’ve already got the flights sorted. This is our first First experience with Cathay J outbound and F on the return, with a 2 night stopover in Hong Kong. We’ve also secured 3 nights in the Park Hyatt BKK, but I need to book two more single nights in BKK (before and after the course) and then two nights in Hong Kong.

August – Dallas

Yeah, Allison goes to Thailand and comes back on Cathay first, and I go to Dallas for a conference… I need three nights in a hotel, and roundtrip flights, or maybe I can hitchhike.

We do have another cruise booked in September, but that leaves from New York, so nothing required there, and we have a third one booked in January from BCN, with flights, in coach, paid.

Smarter decisions when you see the full picture

The good thing about the maelstrom of demand here is that it forces me to make smarter decisions. I was all but set to upgrade at least one leg of the BCN flights to business using the 25K+$350 approach. As crazy as that sounds, I do have enough AA miles, and I also have an Amex Platinum credit that I’ve not allocated yet. As an aside, I’ve talked about hidden devaluations for a while now, via inventory throttling, so it is hard for me to value AA miles at face value of Saver level awards these days.

Incidentally, the BCN flights were the first time that I’ve ‘paid’ for a flight in memory. I used about $800 in AA Giftcards that I’ve acquired over the years, plus a little cash, as they were about $380 each, all in, round trip.

However, now I need to book flights to Miami for our cruise next month. This makes me look hard at that decision to spend $850 ($1050-$200) of real money, do I really want to spend that twice, once to upgrade,and once to get us to Miami? I hate spending money on travel.

Points are worth $X a piece

A big part of my strategy to get everything booked is to look at the value of a point. When you see ‘everything’ you get that perspective. Typically, I assign a 12 month booking window when viewing all my spending needs, but now I’ve got a whole lot going on in just a few months.

I’m not a hoarder of points, nor am I a hoarder of cash. I’ll spend the latter when appropriate, but I do like points to be a first line of defense wherever possible. I rarely spend any cash on travel outside of fees and taxes on award travel. I do this via the idea of ‘expense pairing’, or rules based spending. If we look at some example balances, we can see this in action:

Supply

Flexperks: 37K x2 cards

- These can be used on Flights at a 2x multiple. 20K in pts = $400 of flight ticket. They can also be used on hotels, but at 1x (I think, I’ve never touched these beyond getting the signup bonus.

AA miles 80K x2

- These can also be used on things other than flights, which should be considered since I have hotel needs too.

Marriott Anniversary 1 Night Certs

- These pretty much book Marriott’s for 1 night…

The list goes on, but you get the point.

Demand

- 2 Nights in Bangkok (two single nights)

- 3 Nights in Dallas

- 2 Nights in Hong Kong

- 1 Night in Miami

- Flights to Miami

- Flights to Dallas

- Upgrades to BCN?

- etc

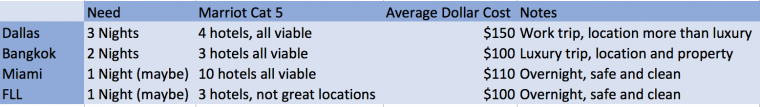

First consideration, expense pairing. The Marriott nights are the least fungible asset that I can spend. Is there any way that I can use both (or at least one) to reduce my expenses, while meeting my own travel needs. For me, I have base rules such as not being willing to swap hotels constantly, so I wouldn’t book one Marriott night and change, but maybe I would book one of the BKK nights here, or maybe there is something that would ‘do’ for a quick overnight in Miami or nearby, before the cruise.

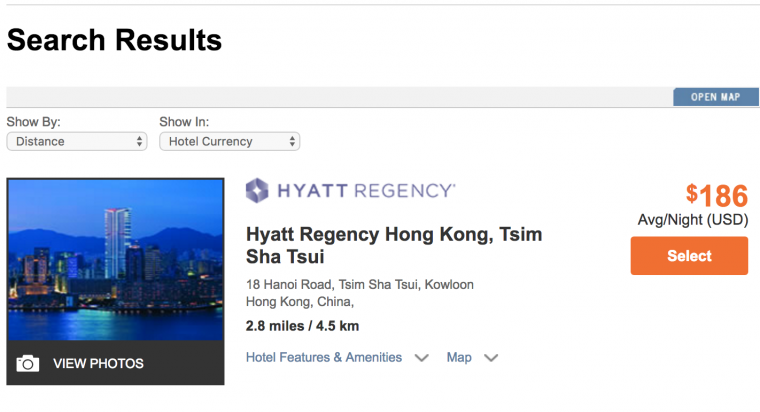

The expense pairing gets more complex for me with Hong Kong. Allison has expressed a desire to be on the Tsim Tsa Tsui side of Hong Kong for the night markets and dining. That then drives me to think about the Hyatt option there. I could book that for 15,000 Ultimate Rewards per night, or $186 per night.

This is a weird one for me. Unlike many, I wouldn’t spend $186 to save my 15,000 Ultimate Rewards. I would spend the points and keep the cash. I know that this also might be a good time to look at paying with points prices.

However, since I know that I need flights for Miami and for Dallas, I’d want to check to see if there were any flight partners available for those Ultimate Rewards before spending them. While this may differ from other strategies, a driving factor is balances. I have a finite number of points, so I want to leverage them all effectively before I touch cash.

Flexperks are tough ones for me, because I since I know I can get 2x for them, I want to spend them only when I get close to 2x options. Therefore, I’ll be looking at the Dallas and Miami airfare as options, but I’m not holding up much hope there.

Pricing and Alternate Pricing

My way through the quagmire is to work out what I will be happy with, then price out a primary option, expense pairing, and a secondary option. Then I can expense match. For example:

- Is there any acceptable option in Dallas to use Marriott certs Y/N?

- Is there any acceptable option in Bangkok to use Marriott certs Y/N?

- Is there any acceptable option in Miami to use Marriott certs Y/N?

Three possible targets. If all three have an option then we can calculate cost per night for the bare minimum option, and decide where to splurge.

This is where I get caught up, and try to think it through a little. My instinct is not to go for the $150 per night ‘value’ of Dallas, rather it is to go with the luxury of Bangkok. The hotels in Dallas are boring, vs some quite nice options in Bangkok. That said, by looking at it as a spreadsheet, I can decide to take that $100 in savings, and apply it to Bangkok, and see what I could get for that.

I’ve already decided that a $100 would get a nice enough room, would $150 get a better one than a Cat 5, and could I get something great for a little less and allocate the savings to another of the things to spend on?

Conclusion

I haven’t quite figured it all out, but I find that having all the travel needs on the demand side really helps allocate available resources wisely. There’s no sense in my transferring 30,000 to Hyatt for two nights in Hong Kong for $372 if that means I have to book my United flight for $400, but booking travel becomes more complicated when you have more than two options, and the ‘opportunity cost’ becomes complex.

My approach is also more convoluted because I don’t go on pure dollar value, rather I go on my own value. I can spend the night in a basic hotel for work, but I’d rather a fancy one for a well earned leisure trip, so it gets complicated. For me, I think that solving for the lowest denominator first helps, so taking the number of variables down by using expense pairing (from least fungible things like a Cert, to most fungible like cash) helps me get a grasp on it.

Hopefully I’ll get out of the weeds soon!

Bangkok is so inexpensive. Consider paying for a hotel there (or using 10k Hilton points for the excellent doubletree) rather than using a Marriott certificate or Hyatt points.

Yeah, I noticed that myself. The complication is that I was trying to burn the points up as they were owned by a friend (I gave him Guest of Honor with 60K and he owed me 60K) so I don’t want to keep him on the hook for the points.

For the other rooms, maybe a cash thing.