I discussed the behavioral impact of money recently, where I pondered how people perceive ‘free’ money vs ‘earned’ money, in that if it comes from a free source, such as AGC, logic goes out of the window. Check it out here if you were still in prison at the time.

I really enjoy this topic, because once you start exploring what money is, and consider where it came from, and what it is going towards, you start realizing that money, typically doesn’t care whether you earned it in ‘almost no time at all’ or if you spend it on financial independence or bottles of Krug. All that matters is the inflow, and the outflow.

Taking this further though, I found a disturbance in the force. It’s related to leveraging credit. Before we go on, repeat after me:

All that matters is inflows and outflows of money

The Story

I’m procrastinating heavily about getting a new car, by new, it might be used, certified pre-owned, new, leased or anything else. I’m generally faffing because there are too many options. While I would tend to avoid the outright purchase of a new car, I’ve found that starting prices (pre negotiations) for new vs reasonably new cars aren’t that far apart. I know that there is a fallacy here, its a high level example.

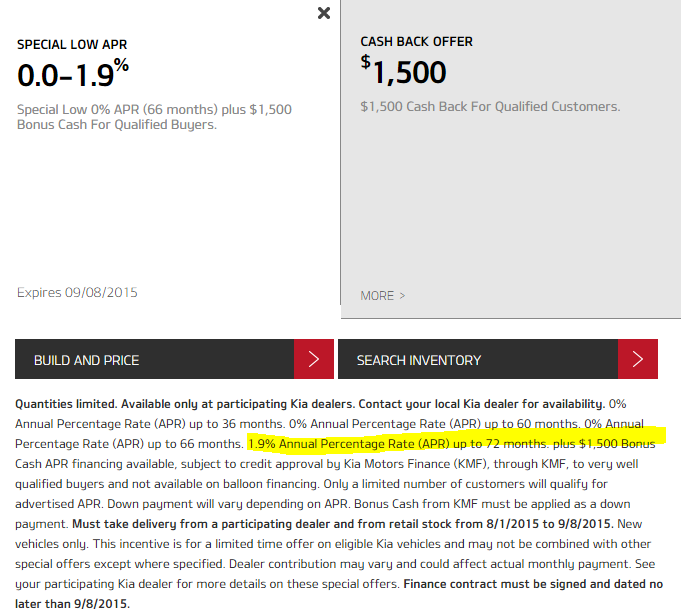

Here’s a car I looked at, it is a Kia Forte. There are 3 offers in this advert:

- Finance for 0% (no cashback) up to 66 months

- Finance for 1.9% ($1500 cashback) up to 72 months

- Buy outright ($1500 cashback)

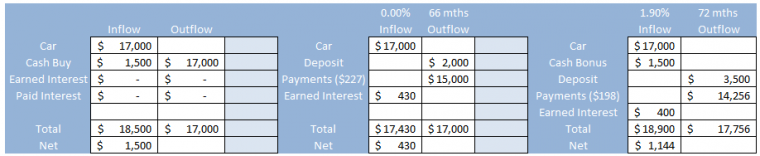

Let’s say the car is $17000, minus the $1500, minus a $2000 downpayment that leaves $13500 to finance for 72 months. That is a monthly payment of $198, total cost of $17,087 should you finance at 1.9%.

If you buy outright, you’d pay $15,500. The spread between the two is $1587 , but you aren’t actually saving that much… the maths:

Math Theory

If you outright purchase when you could finance, you are giving the dealership a free loan of your money. Alternatively, you could put $15,500 into a savings account, and each money make the payment. When this happens you are both earning interest, and paying interest.. the spread between the two numbers is where we seek arbitrage. Currently, 1.9% is generally higher than what you would earn elsewhere, though you could earn 3-5% with some accounts. Personally they are too much of a PITA for me right now, so lets pretend it is Ally at 0.99%. Note that every month your principal is decreased by the payment to the car finance company, so it is not $15,500 at 1% for 6 years..

Math Details

As you can see,the $1500 is still the best option here, but its not a clean cut $1500 gain,because the opportunity cost of giving up the principal, rather than investing it, was $430 at 0.99%. Incidentally, if you were able to gain higher rates of APR, the 0% financing becomes the leader:

- Invested at 3% = $1,402

- Invested at 4% = $1,939

- Invested at 5% = $2,515

Even with tax taken into consideration, if you are able to secure 5% APR on your earnings, its a better choice than taking the cash and paying in full. That is the arbitrage point we are looking for. Note that a variable that has been ‘goosed’ by the financing here is time. If you allow someone long enough at interest free, it will become superior, so by bringing this down, they control the value of the loan. It is less obvious than the APR.

Money don’t care, or does it?

If we are able to identify opportunities for cash gain, such as the chance to save $1500 on the car by paying cash, is there a way to do that while also gaining free financing? If we looked at it in black and white: you either finance, and get a price of X or don’t finance and get a discounted price of Y its in isolation. But if you could finance for 0% externally, you could gain an additional benefit?

Let’s magic up a $15.5K loan from a credit card, 0% APR for 12 months. Use the cash to pay the car in cash, receive a perk of $1500 for our trouble. That is an attractive rate of return. Now, you could argue that you should always be leveraging the 0% ‘free loan’, but if the APR available was 0.99% you might not bother. If the total gain for doing so happened to be about 9% though,does that make it worth it?

What really happened?

Technically, if you had enough money to buy the car outright, three things happened:

- You invested your principal at 0.99% for 12 months, meaning you earned about $164 profit.

- You keep liquidity for a period of time, but if you spend that cash, you may be in trouble because:

- You acquired a liability (month 12 payment due on full balance)

As you can see, if you were actually in a financial position to afford the car, the creating an interest free loan in this manner isn’t as attractive as it might seem. If however, you weren’t in a position to afford the car outright, you enter the land of risk, leverage and returns… you open the door to $1500 discounts without paying APRs, and you also open the door to getting yourself into a lot of hot water if you cannot balance the repayments and liability.

So, all that said and done, does money care? I think it can matter if you are using debt as a leverage tool beyond your means, but there’s a very heavy price to pay on the other side of the equation when you play that game. This is why I always advise people to stay within their means, and play within the money they can float.

Note, for the sake of this article I glossed over the impact of creating an interest free loan on your credit score, it may be a tangible cost depending on your habits, and I simplified the buy/negotiate side of things in order to highlight the offers.

Ironically, this is the ad that appears next to your personal finance rap sesh:

“DISCOVER HOW GOLD CAN PROTECT YOUR INVESTMENTS

So You Can Sleep Well at Night and Feel Secure in Good Times and Bad

We get a thrill out of seeing the peace of mind clients get knowing their IRA is finally safe. Ever crossed a rickety bridge? Did you hold your breath? When you made it across and breathed a sigh of relief…that felt good, right?

That’s how we feel when we see your assets safe and sound in gold.”

Just be grateful I turned them down as affiliate partners 🙂

When the dealership wouldn’t give a cash discount and I couldn’t charge the entire purchase price, I took a low interest rate car loan from USAA and paid it off in month or two, which I believe increased my credit score because I had never had an installment loan on my credit report.

That’s a good tip. Thanks Kim