We’ve been having some great discussions on The Forum recently. One that came up was ‘What to do with the cash from a 0% Balance Transfer’. I thought it was post worthy as a concept. Firstly we need a quick caveat that the topics in this post contain a lot of inherent risk, and many people shouldn’t actually try them, rather this should be taken as an exercise in understanding value and risk.

0% Balance Transfers are free loans

But watch the fine print. The vast majority come with a transfer initiation fee such as 3-4% of the amount transferred. A few notable exceptions do exist, such as the Slate card from Chase (15 months, no fee) and there are a couple of cards that pay you to transfer. However, while the list seems sparse, you can create your own 0% Balance Transfer if you get one of the much broader cards that offers interest free purchases, and can magic up some way of turning that into cash.

What to do with the money?

When it comes to finding where your best rate is going to be, it is wise to look at both your existing, tax adjusted debt, and savings opportunities. However, a special rule kicks in when using something like a balance transfer(BT). The rule is:

Don’t finance long term debt with short term debt.

If you have a student loan of $20,000 at 5.6% APR the amount will be amortized over a period of years that makes monthly payments somewhat reasonable. Perhaps you would have a payment of $300 per month over 80 months – this is a long term debt. The BT is a 12 month loan and, particularly when compared with the 80 month period, considered short term. Technically, of course, the BT can be as long as you like… but that is what the card company is hoping for when they extend these offers to people, and we should never hold long term credit card debt due to the oppressive APRs. As soon as you make the credit card transfer a long term debt for long term debt transaction, it becomes vastly inferior.

How to decide what is long term debt financing

Due to the somewhat odd nature of this long term/short term debt situation it is easier to make an informed decision on the debt characteristic by your own ability to pay the debt off. Here are some different examples.

Example 1

Bob has $20K in a savings account, $20K in student loans and a $20K line of credit available for 0% balance transfer. Bob might otherwise be reluctant to pay off the debt in full as that would leave him without an Emergency Fund. But if he was to trigger the 12 month free period, he would have the safety net of the $20K should something go wrong. IE his emergency fund is an emergency fund!

Bob’s ideal situation would be to freeze the debt, but continue making payments. Credit card companies typically demand a 2-3% monthly payment. This would be $400 – $600. Because there is no accrued interest during the 12 months, this becomes a forced (and accelerated) savings plan.

Ideally, it would be best here if Bob can manage to increase his payments from other income, rather than from the emergency fund. If he can, then the final month will have seen him pay $6000 down on the principal of the loan. He will have:

- $20K emergency fund

- $14K loan about to explode

Here is where he can use the emergency fund to take on risk. The gamble is that at month 12 (or month 11.5 to be safer) he finds another opportunity for balance transfer at 0%. If he fails, he can can lean on the emergency fund to cover the debt, and then has $6K remaining for other things.

There’s risk here. If a black swan event happens, and he also loses a job or other things, he will be in a potentially weaker position, but perhaps not an immediately dire one, unlike Larry..

Example 2

Larry has the same debt as Bob, but also doesn’t have an Emergency Fund. He transfers his student loan to the credit card, and starts the countdown ticker on needing to clear the debt, or roll it again within 12 months. However, in his case, should he lose his job, he doesn’t have a way to clear off the credit card debt, as there is no emergency fund. When 12 months comes up, he could be in tremendous trouble, paying 3x the interest he would otherwise be paying.

Savings vs Refinance

Here is where the savings aspect could come into play. Larry, not having an ability to pay off the loan on demand is making a bad decision to shorten the debt, because the impact would be much more dangerous should things go wrong. He’s taking a gamble that is unnecessarily stacked against him. However, he can still make good use of that 0% transfer rate, in a different way.

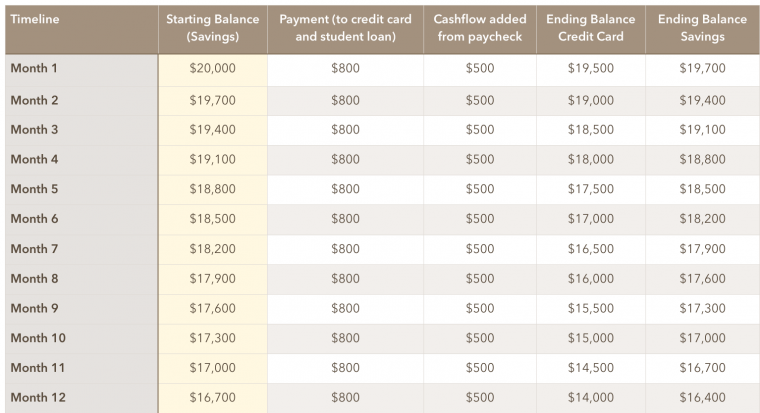

If Larry was instead to leave the long term debt untouched, and maintain $300 monthly payments on it, he could go on to borrow from the 0% line of credit to fuel a savings account. The problem with this is that the credit card still requires monthly payments, so chasing a bonus is cash flow dependant. Let’s say that Larry can also handle a $500 monthly payment:

- $300 student loan payment

- $500 credit card payment

He’d need to find $300 from somewhere.. the location of this would be the $20,000 in savings. As you can see, at any time during this cycle his balance in savings is greater than his balance due on the credit card, so he can pay off in full.

Value. What’s all this worth?

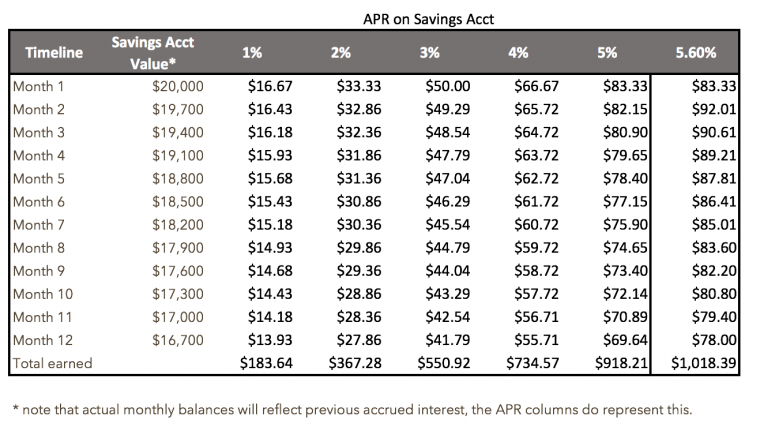

Seems like a lot of hassle to borrow this $20K to then use it to slowly repay the same money, here’s the value of the transaction at different APR levels. For clarity I haven’t shown how each month the balance would increase by the accrued interest, but I did factor that into the interest earned for an accurate number. IE the math for month 2 at 1% APR is $20,000+$16.67-$300*(1/12 of 1%).

As you can see, if you are able to find a 3% APR for the full $20K, you could earn $550 from the transaction in one year. However, you should note that doing so will impact your credit score quite heavily, as it reacts poorly to carrying a balance.

Going back to Larry’s example. If he had a loan at 5.6% APR it might be tempting to use that rather than the 3% or so that could be (perhaps) found via high yield savings. But we should note that the 5.6% rate is reduced due to the deductibility of interest, below certain MAGI thresholds. Furthermore, if he was to focus on squeezing out the extra savings, he’d be creating a situation where he has a ticking time bomb in terms of that debt coming to maturity and no means to clear it off.

This is a good example of understanding your ability to ‘float’ a gig. If you can float the full amount, you could play at the top end of the APR spectrum, and earn over $1000 in savings, but if your float is limited, you should adjust your tactics so that you do not take on more risk than you can afford. It’s very important when reading and looking at other people in the game that you remember everyone has a different ability to float, and that some things that appear safe, can be very risky.

To recap – if you can clear the debt in full, you may be able to refinance, if you don’t have that ability, you might be able to use the savings in isolation, but either way comes with risk.

Note that the above examples included forced savings plans, they could also be calculated without this.

BT may be dum for churners/msers. Carrying a balance will kill your fico, making it difficult

to get sign up bonuses. The shorter your credit history, the worse it will be.If you only have a year or two, carrying a 50% balance on just one card may cost you 30 points+.If you carry 90%, you may cry. To maximize fico scores before apps, make sure to pay before statement cuts. If you MS, you can just juggle balances.

Of course there may be opportunities for which it may make sense. But if earning say 5% on 10k for a year keeps you from just one signing bonus, I don’t think it’s worth it.

Yep. I was thinking along these lines that it might be good to do if you need to lay off churning.

Only reasons to lay off churning I can think of:

1. you’re really overdoing it for your credit profile, i.e. apping for a bunch of premium with so-so scores (under 720) and getting denied while racking up inquiries

2. you want to apply for a loan in the near future, in which case you still wouldn’t to carry a score killing balance.

One good alternative I should mention is that you could carry a balance on a business card with a 0% intro on purchases. I think Capone has 6mo. Ink cash has 12mo I think, but would never want to take that instead of the 5% office store returns. Just do a search for 0% business credit cards. Amex and US Bank have offers.Bear in mind if you do it with one of the Big 6, you may not be able to get more cards from that lender while you carry that balance.

Maybe you get to a point where you are not welcome at the big banks for 12-18mths- you can use this to cool off.

Great read. I haven’t thought about doing this with a savings account. I had about 32k in student loans at 6.55%, so I used a BT to pay off just 5k since I couldn’t float the full loan. Next time I’ll have to try out the saving plan.

My other posts don’t take into consideration that one may already be carrying a loan.

You would have to consider if interest savings outweigh any lost sign up bonuses. Student loans are forever, but moving them to a different type of credit can solve that.

If you have a used auto loan, consider a refi from dcu.org (not affiliated). A 680+ score can get you under 2% loan they use NADA retail go up to 120%, and the car can be up to 12 years old at the end of the loan. Example 2009 car 72mo loan. I think the prime rate only goes to 60 or 66mo though. If you had 5k loan on a 10k value car that you plan on keeping for awhile and a 7k student loan,you could possibly refi both (12K)for 2%. They also give you free Equifax Fico each month.

Good tip- thanks!