100,000 AA miles, enough to get one ticket from New York to Kentucky using the Anytime Award from American Airlines round-trip no less! Or you could use it to fly from New York to Tokyo in International Business Class, return and then stop over for 9 months before then heading onto St Thomas, for the same price – who am I to say which is the best value?

100,000 AA miles, that is the deal with this Citi Executive American Airlines Card that is getting everyone excited, I have to agree it sounds lucrative, but is it really such a great deal? Let’s explore that here.

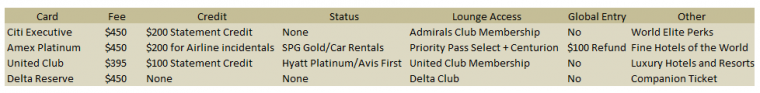

The Citi Executive American Airlines Card is one of those top tier cards that comes with a hefty $400+ annual fee. It competes with the American Express Platinum, the United MileagePlus Club Card, and Delta’s Reserve Credit Card, among others. The annual fee often scares off many people, and rightly so. But in truth these card companies often create ways to offset that fee by providing value in the form of statement credits, lounge access for frequent travelers, and other perks. Lets take a look at how this card stacks up within its peer group:

Fees and Credits

If we ignore signup bonuses for a moment (we will get to them) then the AA card from a pure cash perspective wins, you get the $200 credit for any spend you make, whereas the Amex Platinum, the only other card that offers $200 of credit restricts that to specific, airline related reimbursements. These are still good, but not as good as the Executive card, which is as good as cash.

Lounge Access

From a lounge perspective, I am not liking the lounge access that American Express now offers. It went from the best to the worst since they stripped away first United Clubs, then AAdmirals clubs, and both this card and the Delta card now only allow the Card Member only to enter (sorry Mrs Saverocity, you will have to hang out in Chipotle until I return from gorging myself on Coors Lite). Amex is playing catchup and building Centurian Lounges, but they are too few and far between to be a viable option for most serious travelers. Therefore, I think the Citi Executive card and the United Club card come out joint winners.

Other Perks

The Amex Platinum and the United Club card both offer Hotel status as a benefit, albeit the lower level status that aren’t mindblowing, but are appreciated, with SPG Gold and Hyatt Platinum respectively. You do get little perks with these that aren’t too bad, such as free wifi and welcome gifts, which are nice touches. Also these two cards offer status with Car Rental companies.

The Amex Platinum also offers a $100 Global Entry fee reimbursement, the other cards do not, this is a great value if you travel frequently.

Midway Summary

Since my posts are always a little in depth, I need midway summaries… I should work on that. But anyway, I wanted to pause here and show that whilst these three airline cards compete for a similar demographic, I think there is a clear difference between those that are co-branded: The United Club, Delta Reserve and Citi Executive, and the Amex Platinum that doesn’t have that affiliation.

I would go on to say their edge is in the lounge area, but overall the perks that come with the co-branded cards is quite lacking compared to what you can get with the American Express Platinum, though for me the United Club card is the strongest contender.

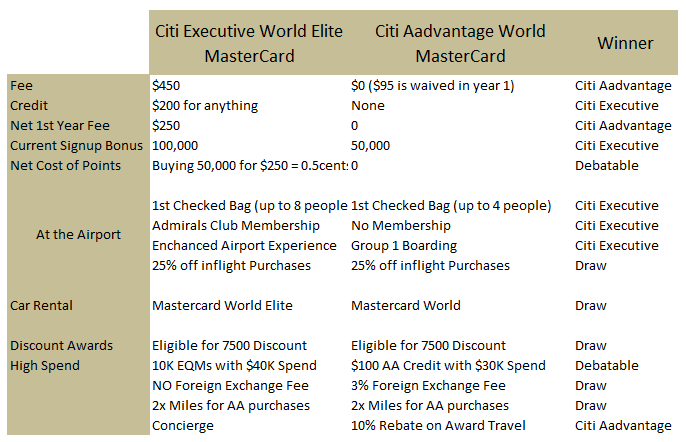

Citi Executive Mastercard Vs Other Citi AAdvantage Options

We have identified that these co-branded top tier cards are all somewhat lacking, so I wonder if a better benchmark to compare the Citi Exec would actually be to ignore price for a moment, and look at what it offers vs the other Citi options, I tried to pick a Visa card as comparison, because the Visa Signature is closest to the Mastercard World Elite level, but I couldn’t find one… have they all vanished and now Citi is 100% Mastercard?

If so, then the level you get in terms of insurance drops when you compare the World Elite to the World level (if you aren’t sure what I am talking about, look at your Mastercard, and next to the logo on the front or back it will say World, or World Elite, or if it is a really low end card it will say just Mastercard. You can read more about the perks of these 3 levels here. These are pretty cool because they are perks that are built into the ‘logo of the card’ rather than the card type, so you get a whole new bunch of perks, which do help offset where cards like the Amex Platinum covered these bases. My Ink Bold has World Elite.

So, that skews things because now we have to compare perks between:

- Citi Executive AAdvantage World Elite Mastercard

- Citi AAdvantage World Mastercard

Let’s see how they stack up:

The big deal here for the Executive Card is twofold – one is Lounge Membership, that you are effectively buying for $250 after your credit hits, and the signup bonus. For people who would ordinarily purchase the lounge membership this card is an absolute no brainer, but for those who don’t value it, perhaps because they are not such frequent travelers we hit an interesting debate.

Are free points better than cheap points?

Many people who use points to travel are happy to acquire them at a low cost, here we can acquire 50K for free with the lower end card, which is amazing, but for another $250 you can ‘buy’ 50,000 more, meaning that you are happy to buy at 0.5 cents each. Many would argue that this is a good deal, but only you can decide. Some serious ‘travelers’ will only buy points like this at a net positive, such as using the SPG Amex with DC Brokers method, they would be paid to get those 50,000 AAdvantage miles. It would only take 40,000 of purchases and then a transfer 1:1.25 to AAdvantage and you would have the points and money in your pocket.

Some others don’t want the hassle/risk of that and instead think it is worth purchasing. Again, $250 could be used for something as daft as flying to Kentucky indirect, or it could get you TransCon and then onto Asia in Business Class, certainly worth its price, if you use it wisely.

What would Matt do?

I wouldn’t get the Citi Executive Card today, I cannot justify the net $250 fee for buying 50,000 worth of points. These days when I travel it tends to be Business Class, so I get lounge access for free anyway, and also I kinda like that little 10% rebate that the cheaper card offers. I can easily spend 100K in miles per year, so that is a free 10K on the top. Also, I wouldn’t necessarily leap on the current 50K offer. The last one I signed up for was 50K plus $150 statement credit (for AA related costs, but no $30K spend required) plus the 10% rebate on miles used. That card I would jump on, if it comes up again and I am not in the middle of mortgage applications, these two, they are just ‘ok’ deals in my mind.

That thinking is mainly due to my own points and plans right now, if I had an epic trip planned, then I may bite the bullet and pay for that card, but not just for the sake of it being ‘an Amazing Deal Alert’. There is too much of that in this space. Too much ‘oh I must get it before it is gone’ mindset, new deals are always popping up, if you don’t need this now, take a moment to think about if you really need to jump on it.

Hi Can you elaborate more on the SPG Amex/DC broker method? in particular, how do you/did he liquidate the Amex gift cards?

Yes – what is the SPG Amex/DC broker method??

Why not get both? It changes the math considerably.

I know that you don’t have an epic trip planned right now, and totally understand where you are coming from Matt. However, why not get both? (Keeping in mind the post about affiliate links, obviously only do this if you have your financial house in order and learn how to MS responsibly) Then the cost calculation comes out to $250 for 100k points or .0025 per point for the executive since it’s not an either or proposition (heck get two Executive cards, I need to do a cost analysis of my upcoming tickets and confirm the the second bonus is posting before I jump in). Not only that, but when you redeem the 100k, then because you have the other card, you’ll get the full 10k rebate on points.

If you do this then definitely have a trip in mind and, as always, keep an earn and burn mentality as I can’t believe that there won’t be a massive AA devaluation coming post merger. For me, I’ll have amassed 322k between myself and my wife (possibly 220k more with more exec cards). I have three kids (one a lap infant, if flying up front, look into having one adult book the same trip with avios as they charge 10% points for the infant instead of the 10% $ as AA does). I know that I will use the miles, and am setting up a vacation for next summer as far out as I can plan it. Total cost (obviously the MS takes time, but I count it as hobby time) for the flights is $500 ($1,000 for another two exec cards) for an overseas destination. I was resigned to only being able to do road trips once we had children, but since it would cost $1,000 to pay for plane tickets to Florida, I’ll jump through the hoops to pay the same or less to fly internationally (heck, fly coach and throw a few more trips in there, you would have been in coach anyways). Also, if visiting Asia, you’ll save money on the rest of the trip versus a local destination.

I agree. Get both card and then some! It’s going to be hard getting those award spaces secured though…..with all these miles inflation. I wonder about the AA devaluation myself. I hope that at least they are going to give some advance notice.

Tell me about it, we’re flying united to Europe this summer. Luckily 10 months out I was able to get four business seats on the same flight (this was pre United deval, but using ANA miles). It is possible to book for four, but I am realistic and let award availability shape my travels a bit.

You’re valuation of buying miles at .5 cents each is off, the real value after 10k spend is .0023 cpm, which is very cheap. Also in your case since you already have the lesser card without the fee you shouldn’t go after the same one bc you probably won’t get the points again.

Hmmm I don’t know, I hate to be told my value is off (though I have been known to make a mistake every now and then) could you show me your logic/math not that?

Oops I read it wrong, my apologies. I guess I should not try to do math while on vacation.

Lounge access reciprocity in oneworld stinks and Admirals clubs have disappointed. Get it for the points? Maybe. Depends on summer plans. May get Hhonors Res instead for nights at the Seelbach.

Yep, for lounge access it really makes sense for the Domestic road warrior type most of all. That hotel looks pretty nice too!

On your comparison of Citi Cards, you list as a draw the foreign exchange fees. I think most of us would choose the 0% versus 3% every time.

Yes, your statement is valid.

I called it a draw because I have so many cards that I would actually use in that situation. A 1x AA card (which is what it is on international generic spend) isn’t going to be used.

Thanks for this analysis. It makes me realize how easily swayed we can be when a six figure offer comes along. I now see that if I miss getting it for my husband – I did get it for me – it is not such a huge loss. Moreover, maybe we do better to get another card which would be complementary, providing different benefits/access to other lounges, rather than double up here, especially since I have no definite plans for the points. That said, I also probably have much lower point balances than the rest of you, and one reason I wanted it was to bank some points for emergencies/unanticipated trips. I will re-evaluate once we have the refi in the bag! Thanks again!

Especially with no trip in mind, just wait and let it go – get that Refi sorted and go nuts!

To me, the time commitment of MS 40K is more expensive than the $250, but everyone will value that differently. So I got 2 of them (in addition to the Platinum I already had). I better start putting a little MS on the Platinum, though so they waive the fee next year.

Agreed, your personal situation matters a lot, and it can change from having a lot of time, and being willing to generate more, and having little, and paying more.