The idea of Manufactured Spend is a cornerstone of Travel Hacking, without it garnering enough Frequent Flyer Miles, Hotel Points and Cash Back to travel in style is beyond most of us. Unless you are a business owner who is able to charge off 6 figure sums per year you’ll take far to long to build up your points portfolio to achieve your travel goals. My personal goal for travel are to never pay for it again, and whenever it is available as an option to fly in Business and First Class for International Trips.

The idea of Manufactured Spend is a cornerstone of Travel Hacking, without it garnering enough Frequent Flyer Miles, Hotel Points and Cash Back to travel in style is beyond most of us. Unless you are a business owner who is able to charge off 6 figure sums per year you’ll take far to long to build up your points portfolio to achieve your travel goals. My personal goal for travel are to never pay for it again, and whenever it is available as an option to fly in Business and First Class for International Trips.

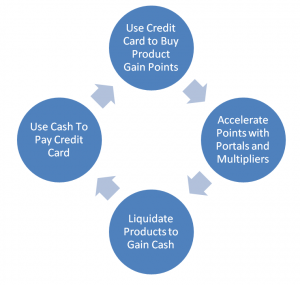

The Holy Grail with Manufactured Spend is to find a product that costs nothing to acquire, and can be liquidated for no cost and earns you high quality points in the process. These do exist, but are hard to find (and people don’t talk about them openly as once the word is out the deals implode) so the next best thing people look for is keeping the costs as low as possible, and the return to cash as quick as possible.

What is the value of the commodity that you are manufacturing?

Not all miles and points are created equally, and assigning a value to them is also a subjective matter based upon your plan for spending them. A simple way to look at this would be to compare American Airlines Advantage with the new Devalued Hilton Points Program under the new Hilton Honors loyalty program you will need 95,000 points for a 1 night stay in their top Category hotel (Cat 10) a Cat 10 would be the Conrad Tokyo, a great property, but available from $300-400 per night. Compare that with two flights round trip New York, which would cost 100K AAdvantage miles during the winter season. The cost of these flights would be about $1400 each, so you are getting almost 10x more value per point from AAdvantage compared to the new Hilton program!

Where is the Multiplier?

Most (though not all) Manufactured spend for points will incur a cost when accumulating them, this should be considered as a percentage of total spend, and can calculate your cost per point. Finding Multipliers (typically Category Spend Bonuses) are the key to reducing the cost per point, if you don’t factor this in then often your final value will cost more than the price of the point is worth, and you lose money. The best example of a Multiplier is the Chase Ink Bold card – it offers 5x points at Office Supply stores, so buying from them using this card is a massive points earner. One an example of a manufactured spend that you could create at Office Depot would be to buy a gift card for $500, it comes with a fee of $5.95 and would have earned 5x Ultimate Rewards points (transferable to several partners like United and Hyatt) if you use a different card, for example the Chase Sapphire Preferred you would have only earned 1x points at Office Depot. I have both cards, because the Chase Sapphire Preferred has its own bonus Category Multipliers for Travel and Dining (including the MTA and Taxi’s in NYC both at 2x). However if were to buy the same gift card in a Drugstore/Grocery Category that a card like Hilton Honors Surpass has, then you would 6x points for the Hilton and 1x for Chase Ultimate Rewards..

What boosters are there on top of the Multiplier?

These are things like shopping through portals rather than at the store, many online portals don’t give points on Gift Cards, but they do on other products, and there are one or two that also credit gift card purchases. The boosters you can get here can be massive (there was a promotion last year with Nordstrom for 36x British Airways Avios per dollar… ) If the booster is this high your costs can increase and profit not be hurt.

For example, if you buy $1000 of goods from Nordstrom, with the intention of reselling them at a loss, you would earn 36,000 Avios points (more than enough for 2 round trip tickets from NYC-Bermuda) so if you value those 36,000 Avios at 1.5 cents each, that is a value of $540, now if you can sell your product from Nordstrom for more than $460 you are in profit. These days I rarely purchase anything without a booster, either in the form of Cash Back from Big Crumbs or Discover (my new favorite Cash Back option), or from one of the Frequent Flyer programs.

What is your Float Time Tolerance and Exit Strategy?

The key with Manufactured spend is to get your cash back out of the product and pay off the card ASAP, if you incur interest on the card then you are failing here. Depending on the product acquired by the spend your float time will differ. If you are able to purchase a cash equivalent product, or wire money to your significant other using something like Amazon Payments then your float time is a low as a couple of days… with Amazon Payments you can wire $1000 per month, withdraw it immediately and in a few days it is back in Checking to pay off the card. The only snag with Amazon Payments is the low cap of $1000 per month, though it remains a great way to cash out gift cards or meet spend. The thing to think about now would be what other Exit Strategies are available? In this post I outline several ways to cash out gift cards – once you have done this and exited from the transaction you pay off the card and do it again.

Cash equivalents such as Gift Cards and Money Orders and Bank Accounts have all worked in the past, but they are one by one being removed from the options for Travel Hackers as people bleed the system dry, so to be more creative we have to think about other products and ways to exit them whilst making sure there is a profit being made. At this time I consider points to have an actual value and therefore profit and loss are easier to calculate, but they will have a different value from one person to the next. My plan going forward is to start exploring ways to increase my spend on the Ink Bold at Office Supply stores without relying on Gift Cards (they are pulling all the high value ones so the cost per card is increasing rapidly and the value is going from that option). The next big thing for me will be buying and selling a physical product, such as a Tablet and finding ways to reduce the purchase price and boost the points earned in order to manufacture increased spend. What Ideas do you have to increase spend without Gift Cards or Cash Equivalents?

Leave a Reply