I sat through a great demo last week explaining time value of money for college savings calculations, it was done on a ‘smartboard’ which is like a whiteboard but computer based. After seeing what a great medium for conveying sometimes complex mathematical calculations I decided that I want to do the same with Saverocity and run some tutorial posts that help explain concepts like this.

Fast forward a few days and I find the Khan Academy (these guys are going to change the world) who I have heard of but not taken much notice of and saw them creating videos in the way I wanted, 10 minutes later I find out how they make their videos, chatted with a guy who makes them for the Khan Academy and set my heart on acquiring a Wacom Tablet. If you have a little time, the TED Talk by Salman Khan will hopefully blow your mind.

After doing a little more research I decided that I wanted the Pen and Touch Wacom model, for $99.99 on the Wacom Website:

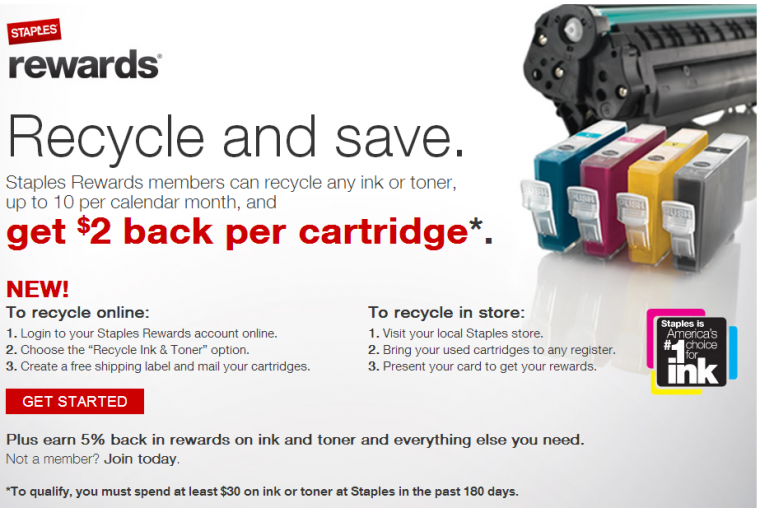

I went to Staples to see if they had it there, since they have so many things that you might not expect AND I had $80 of Ink Recycling Credit left (I spent $90 of it a few days earlier on a pair of really stupid looking Sony MDX headphones) here’s a great walkthrough of how to earn Ink Rewards by Big Habitat.

Update – Staples allows you to recycle Ink Online – meaning you print out shipping labels from home and never have to lug cartridges around, this is a great time saver, and one that I had missed previously.

When looking for Wacom products they actually had too many options at first, but with some sorting I found something similar, but priced differently, this one on offer for $89.99.From experience, whenever I find a ‘amazing deal’ like this I am hesitant that I may be buying a ‘similar’ product (by which I mean OLDER version) so I always check the manufacturer model numbers, in this case the number is CTH480, a match. For reasons I cannot fathom, Staples is selling Wacom for $9 less than Wacom is.

My price down to $89, I applied the $80 in Ink Recycling, new price $9.99 which I paid with my Ink Bold, but not before doing 3 things:

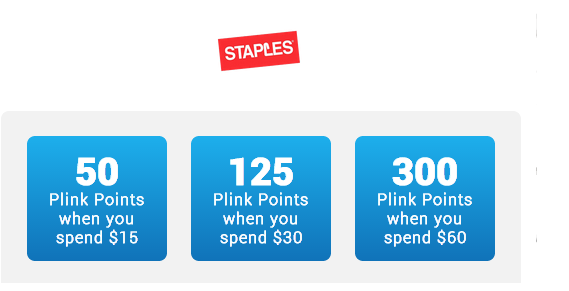

Linking my Ink Bold to Plink (if you haven’t already done this, here is my link, it gives you 300 Plink points valued at $3 and hopefully gives me something for my troubles too) in this case I didn’t actual earn Plink points, because they kick in at $15 of purchases and above, but it is one of those things that you need to ‘set and forget’ and you will earn without realizing it, and this seemed like a great opportunity to pimp my link for them.

Go through the Upromise Portal for 5% cashback – you should expect to earn the cash back on the $9.99, not the $89.99, but it is free money, so we will take it, even if it is only 50 cents.

Sign up (and then sign in) for Staples Rewards – you should have done this already to earn the Ink Rewards, but don’t forget to sign in on Staples.com in order for it to register. My personal approach is this: sign in, add product to cart, close window. Open Upromise, search Staples, click through (you should be signed in, with product in cart) hit cart, hit checkout, add coupons. I do it this way because I think if you are clicking around for products you might somehow click out of the Upromise/Staples linked window and it might not register, this way you know for sure your shopping experience came from Upromise, and I feel you are less likely for it not to register somehow.

Hey, it works for me, but it is all about your comfort level.

Deducting it for Taxes

I wrote recently about how credit card rewards are treated for tax purposes, and this is a great example of that in action:

- The Wacom Tablet is a justifiable business expense, I am buying it in order to build presentations for this site, so a deduction is allowed.

- The Wacom Tablet retails for $99 on Wacom.com, if I was to claim that I would be committing fraud, because I got it from another vendor (Staples) for $89.99.

- However, since I used $80 in coupons, my actual out of pocket expense was $9.99, that, I could claim for tax purposes and it would be acceptable (in my non professional opinion).

To be perfectly correct, I should probably add on the cost of acquiring the Recycled Ink Cartridges used to generate $80, and deduct the value of Plink (if any), the Ink Bold Ultimate Rewards, the Staples Rewards and Upromise, in order to create a true cost basis, but I feel that all of that isn’t worth the IRS time (even though personally I find it all very much worth doing) and they wouldn’t care less. The IRS frequently leans upon a De Minimis ruling on matters of triviality, and I feel that such rebates and rewards fit into that. Time will tell if that is the way they see it too.

If you haven’t got a Chase Ink Card yet, where have you been? It’s been the best card for Office Supply and Telecom services for years, and would be a good addition to your spending toolbox, you can find it, along with other great cards in my Business Credit Cards section

I think you could legitimately deduct the 89.99. Ink rewards are a type of gift card/store credit. You paid 89.99 it doesn’t matter if it was cash, credit, gift card, store credit, barter or wampum.

I guess it’s all about comfort level, I look at worst case, an audit, and feel more comfortable defending it my way in that scenario.