Like many of you I’m the proud owner of a shiny new Chase Sapphire Reserve card. Unlike many of you I’ve had extensive experience with travel insurance claims. Because I’m an accidental expert on travel insurance a number of you have asked me if the Chase Sapphire Reserve travel insurance is comparable to what I would buy through a company like Allianz.

The answer is an emphatic NO. For our upcoming trip to Chile and Argentina I will not be relying on my Chase Sapphire Reserve travel insurance. Here’s why I shelled out the $102 for 5 weeks of family coverage:

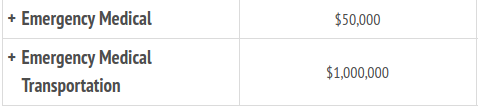

Allianz offers:

It’s that simple. Allianz Basic Plus plan covers 50K in medical and 1 Million in evacuation. Chase Sapphire Reserve? $2,500 Medical and 100K in evacuation.

Medical

Deal Dad rang up over 5K in bills during a five day hospital stay in Gran Canaria last year. In the grand scheme of things his malady was minor compared to the worst that can happen. Chase’s $2500 wouldn’t have even begun to fill the bill. We saw 100% of our expenses reimbursed in 14 days.

Chase’s coverage is SUPPLEMENTAL. That means they pay after your home insurance company. Even great coverage in the USA will require a co-pay. In our case we would have paid 30% (of course we were out of network) after our annual deductible was satisfied. If we were lucky our health insurance might have covered the $2500 Chase wouldn’t have. They certainly would have taken longer than two weeks!

Evacuation

The $100,000 Chase offers sounds like a lot. However, FT4RL alum Michael used to operate emergency medical charters and clued me in on the cost. From a remote area 100K might not even cover one person. What if you’re in an auto accident and multiple family members need evacuation? Take out a 2nd mortgage.

Use Chase to Hack Allianz

That’s not to say that Chase Sapphire Reserve Travel Insurance doesn’t have value. Chase offers terrific insurance when it comes to trip cancellation, lost luggage, and delays.

Here’s the cool thing about Allianz: their medical coverage remains constant no matter the cost of your trip. So the difference between a 5K trip and a 1K trip is significant in cost, but nil in benefits.

So here’s what you do: use your Chase Saphire Reserve Travel Insurance for all of your tangible items, then claim the cost of what’s left over as your true trip cost for Allianz. You’re being honest- just leveraging to your best benefit.

An Example

For our five week trip coming up we have about 20 flights booked (5 trips, four people). The cost to cancel 20 individual tickets is 20 x $150 (average)= $3,000.

For five weeks we have 35 nights hotel. The vast majority of those are cancellable, so we could recoup those charges. Let’s say we lose $500 if we have to cancel something out of the cancellation window.

All of my car rentals are cancellable and most aren’t charged until pickup, so no lost cost there if we have to cancel. We do have $200 in ferry tickets, though.

Let’s say we book one activity in each city at a cost of $50/each. That’s $200 per city X 5 cities=$1,000. Activities are the hardest to refund so we could lose that money.

Adding $3,000 + $500 + $200 + $1,000 I come up with a trip value of $4700, or $1175/person.

Chase covers up to $10,000 per person per trip up to $20,000 total. We are well within their limits.

Therefore we don’t need Allianz to cover anything but medical. I usually set a floor value of $1,000 because no trip is worth $0.

For a $4700 trip an Allianz policy would cost $214. For the same trip at a value of $1,000 I paid $112. The limits for baggage, cancellation, etc. went down accordingly but the medical stayed the exact same.

Please share your travel insurance experiences. I’m sure other companies are great, also, I’ just have experience with Allianz. I’m happy to try to answer any questions as well.

The Deal Mommy is a proud member of the Saverocity network.

Any thoughts about the Amex Platinum benefits? How did you choose Allianz?

Also I didn’t follow what you meant about using the CSR and subtracting those benefits from what you reported to Allianz. This topic has been on our minds a lot, thanks for the post.

Hi Kate,

I’ve been using Allianz since the 90s when they were Access America, I’ve had to file 3 times and they paid each one.

Regarding cost: take the value of your trip (or change fees if award), deduct what you’ll get from CSR if you have to cancel. Then the remainder is your trip cost.

And regarding AMEX, I think they are even less than Chase when it comes to medical.

If you have the AMEX Business Platinum card the Medical Evacuation & Repatriation benefits are “unlimited” through Premium Global Assist.

You don’t even have to pay any trip expenses with your card.

They do not cover medical expenses unless part of your emergency medical transport….

Here’s the wording from Global Assist…..

Emergency Medical Transportation Assistance

In the event that the Card Member or another covered family member (your spouse or domestic partner, dependent up to age 23, or age 26 if full-time student) traveling on the same trip itinerary as the Card Member becomes injured or ill while traveling and is seeking or has sought medical treatment, the Premium Global Assist Hotline medical department can assess the medical need for transportation and provide the service.

A medical evacuation may be provided at no cost to the Card Member or covered family member from point of illness or injury (when the Card Member or covered family member is under the care of a local medical service provider or facility) to a more appropriate medical facility or to a hospital near the person’s home as determined by the Premium Global Assist Hotline designated physician. The Premium Global Assist Hotline designated physician, in consultation with the local medical service provider or facility, will determine whether such transport is medically necessary and advisable. The event must be within the first 90 days of the trip and cannot be a pre-existing condition. A pre-existing condition is any sickness, illness, or injury that has manifested itself, become acute, or was being treated in the 60 day period immediately prior to the start of a trip. The person needing evacuation may need to complete a medical information release as required by the Health Insurance Portability and Accountability Act (a “HIPAA Release”), or provide authorization for next of kin to complete the release. Emergency transportation services in connection with the medical emergency may also be provided to a covered family member pursuant to the full Emergency Medical Transportation Assistance Terms and Conditions at the end of this document. Subject to additional important terms, conditions and exclusions. Please see full Terms and Conditions at the end of this document.

Very Important: Any costs for medical transport not authorized and arranged through the Premium Global Assist Hotline Program are solely the responsibility of the Card Member and such costs will not be reimbursed. Premium Global Assist Hotline does not cover medical expenses (with the exception of cost incurred during the transport) nor transportation of personal possessions including luggage.

Repatriation:

In case of death of a covered Card Member or family member while traveling, PGA will provide the necessary administrative services to effect the transportation of the mortal remains of the covered individual back to the Card Member’s principal place of residence or place of burial, whichever is closer, and will pay all administrative and transportation expenses, and, subject to PGA’s approval, the cost of a coffin or other encasement of the remains suitable for travel.

Thanks for sharing. No medical and some pretty big pre-existing loopholes there.

Why does the value of the trip cost matter? Thank you.

Hi Kate, because Allianz charges per trip cost. For instance my 1k trip cost $112 but the same trip priced at 5k cost $250. Cancelation, etc coverage goes up but medical is identical.

Pingback: Can you have too many flowers? How about points? - Frequent Miler

Wow. After reading this I realize I have significantly overpayed for travel insurance. It had gotten so expensive that we just decided to self insure. Thank you for your article. It made the “value” of a trip clear to me.

Glad to hear.

Although I have never looked into it, I have always heard that Amex Plat covers medical evacuation regardless of whether you charge any part of the trip to the card. Is this fact?

What if we book through a tour company that booms hotels/intra country flights/excursions on our behalf? If we use CSR would we be covered for some portion and then could do Allianz, for example, on the remaining balance not covered by the CSR?

Exactly. Buy only the amount you need once other options are exhausted.

Good reminder but my understanding is that you can get just medical and evacuation insurance without having to get trip cancellation etc that is already covered by Chase or Citibank insurance. I’m not sure how Allianz would feel if they knew that your trip costs were more and you were deducting the part that other insurance would be covering. Usually, insurance companies want to know about all coverages that one has so they can coordinate benefits. Can’t you just get medical & evacuation coverage from Allianz?

I definitely don’t think one should lie. I’m just suggesting you look clearly at your existing options regarding refunds and reimbursement when assessing the value of the trip. This especially comes into play with trips on points.

Also folks might want to look into Medjet, a company that will fly you to the hospital of your choice after you have been stabilized at the nearest local hospital. They have annual dues that a pretty reasonable. We used it when we were on safe in Africa and thankfully didn’t need it, but a friend used it after a fall in Europe in which she fractured her arm badly.

If you have US issued AMEX Platinum or Centurion, Premium Global Assist is unlimited amount of funds for medical evacuation or repatriation. It is not even necessary to place the the trip on the Amex card on order to use this benefit. $100,000 may be enough to med evacuation but not enough if you require a reparation back to the US from a long distance. If you charge the trip on your chase card, you always have the Amex as a backup to choose from if this expense could be more than the benefit coverage amount of Chase. Need to notify in advance as per the written terms of the policy.

The best medical coverage is NO longer available available/ sold. It was Travel Medical by Amex, an annual policy that is very inexpensive. Still covering my family of 3 annually for less than $200/year on 50K coverage. No longer sold by Amex. Also, can use in the US as long as 150 miles away from home.

Im planning to visit the Great Wall, Hong Kong, and Cambodia. I have never thought about buying suplemental travel insurance. Do most travelers buy this? It sounds like a great idea and i would never thought about it until now.

Hi Ryan, as context I can share that I got bronchitis in HK. Dr. Visit and meds were $400. Deal Girl got tonsillitis in Danang and it was $100. Both paid out in days by Allianz. Anything can happen.

Thank you. Im going to buy that insurance. How do you calculate the value of your trip? Would it be airfare and hotel costs? What if im using points for the trip?

Hi Ryan,

If the trip is on points, I use whatever I would have to pay or couldn’t get back if I had to cancel at the last possible second. It’s generally $150/ticket to redeposit points and first night’s hotel on each reservation. Tours are also generally non-refundable so I include those, too. Hope that helps!

Thanks Dealmommy,

That helps. So I called my insurance at work. Its through Aetna and they said I’m covered when im out of the country. Its for emergency rooms only and theres no limit on the coverage. So does this mean I will be ok? I will probably need ask them more questions. For instance, If if i get into an accident and end up in the ER that would cost 50k, I would be covered. Now, what happens if I ended up being admitted? Would that be part of the ER coverage?

I checked Allianz and the quote I got was $600 for 5 people. Wow thats a lot.

Hi Ryan,

Insurance varies widely from company to company and from policy to policy. The main thing to think about is what to do if you have to come up with a large payment on the spot (as we did) and what your copay/deductible is. If you’re comfortable covering those, you’re good. If you’re not, travel insurance comes in handy.

As for the cost, it’s based on the cost you input for the trip. $120/person seems a bit high to me for a single trip, especially since kids are free on a trip plan. However, I don’t know how expensive your trip is. You might want to check into their family based annual plans. Hope that helps.

Dia,

Thanks for sharing that valuable information. Yes, my trip is about 5k total which includes hotel and sites fees. I need to dig a little deeper on what my insurance would cover. So I have coverage through my health plan from work, and also from Chase. If I do buy Allianz travel insurance, would that be my primary coverage, or what would be the best way to file a claim? Do we have an option to file with 3 different providers?

Hi Ryan,

Whether travel insurance is primary or secondary depends on the specific policy. You’ll have to get into the nitty gritty details to know for sure. You should not double-dip insurance- it’s a bad idea and one or both companies could claw back any benefits you get paid for twice. You can file for one and then any amount not paid with another, though.

Dia,

Got it. Thanks for your help!

I wonder if you could get a member of the insurance industry to comment.

We have been told that one must insure the full value of the trip (to the very dollar) to have valid coverage for *any* of it. Whether this would apply to the medical issues as well is unclear, but you can imagine the view of the insurer that does not want people “cherry-picking” their benefits at lower premiums. (As a made-up example, suppose you have a $1000 flight with a $200 change fee and an $800 non-refundable tour. You figure insuring for $1000 covers most of your risk at a lower premium than insuring for $1800. Insurers may not accept that practice. Similarly, how do you explain you are insuring part of the trip with your credit card and another part with trip insurance? When you file a claim, the trip insurance company may be skeptical — and might refuse to pay.)

Whether to include refundable costs or cancellable reservations in the total value of the trip is another unclear aspect.

The travel insurance industry has a reputation for reluctance to pay without checking and double-checking on you, including pre-existing health conditions (sometimes this issue is waived if you buy your insurance within a short period of your first trip reservation or expense).

I have purchased trip insurance many times and fortunately never used it, but it leaves a bad taste in my mouth.

Hi Chaz, I can only share my own experience. While primary health coverage forbids double dipping, Travel insurance in my experience has not even asked about other coverage. I am NOT suggesting anyone be dishonest. I am simply sharing my experience re: valuation, esp when awards are concerned. If you are using an award, the value is technically $0. I use what I would actually lose if I had to cancel as a guideline.

As always, do what feels right to to you.

Thanks! We agree — don’t be dishonest. I am in no way implying that using your system (of first calculating what your credit cards would cover etc. before buying trip insurance) is in any way dishonest. Indeed, it seems logical. I only mean to caution that the travel insurance company might have a rule that requires a different method of calculation (such as insuring ALL costs) for them to agree to pay a claim — or so I have been told.

It may be that most claims are paid without regard to this issue — if the insurer didn’t ask, well, we won’t know if this is an issue or not. Here’s the key question: Does anyone have any experience when your claim was refused for not insuring the entire trip?

If that situation has happened in our community I have a feeling that person would be stepping up to share. Readers?

I regularly buy Allianz insurance for trips, and their policy documents clearly state that their medical emergency insurance is SECONDARY. And the 3 times I’ve filed a claim, the form has asked what other insurance I have and they’ve only paid the claim when I’ve filed with my regular health insurance. Below is the quoted language for medical emergency coverage from my last Classic Plan with Allianz.

Important

This is secondary coverage. If you have health insurance, you must submit your

claim to that provider first. Any benefits you receive from your primary insurance

provider or from any excess coverage will be deducted from your claim.

If you’re eligible for benefits or compensation through a government-funded program

other than Medicaid, you don’t qualify for this coverage

Hi Beck,

Thanks for the update. It appears to be state by state- which state are you in?

Charged a family trip on Chase Sapphire Reserve card. Elderly Father died day before trip. All of us flew to Father’s hometown and then down to Florida. Chase benefits paid only for the one night house rental we missed. They paid nothing for the very expensive last minute trip alterations to New York. So instead of flying Detroit to Florida, all five of us had to fly Detroit to NYC and then to Florida at over $500 pp extra. Not one penny paid towards our travel airfare changes for the funeral, since we did get to Florida, but a day and a half late, at much higher airfare expense.

Allianz is my choice as well. I say that even as a person who works for a competing company (not a travel insurance position so I can’t comment on that coverage).

My experience with Chase has only been on the travel delay coverage, not medical. I just wish I could find coverage for award tickets to reimburse miles and also provide medical.

I plugged in my travel info into Allianz. Emergency medical turns out to cover only up to $10K, and emergency medical transportation up to $50K for the basic plan. If I want the $50K/$1M as you stated above, I would have to go with the Classic Plan with Trip+.

That’s the one I use for Deal Dad and the kids and when I go to developing countries. I use the annual for myself when I go solo to Europe, etc.

I am not sure where you got that Allianz provides medical as primary coverage.

It’s SECONDARY coverage and clearly stated on page 10 of Individual Travel Insurance Policy certificate.

Thanks for your comment. I do see that and will edit, but in practice Allianz paid out three medical claims for us at 100% without inquiring about other coverage.

in my California letter of confirmation and the Coverage policy PDF attachment there is actually an amendment stating that it is primary coverage not secondary

Mine did as well (and I’m in VA)- wonder if it’s state dependent. Thanks for sharing- commenters usually go out of their way to tell me I’m wrong so it’s refreshing to see someone share my actual experience.

Do you have any experience with buying travel insurance when all of your prepaid flights/hotel costs are paid for using credit card/airlline rewards points? I am trying to determine the true “trip cost” in order to determine the premiums for my travel insurance with Allianz and I am not sure how to proceed. I have the dollar amounts of the flights I have booked with points but I am not sure if that is covered. Any advice would be greatly appreciated.

Hi Sean,

I do. I’ve only submitted medical claims, not trip cancellation etc., but they’ve been paid without question using the replacement cost formula. I use any prepaid and non-refundable costs such as redeposit fees, cancellation fees, prepaid hotels, and tours as my trip value. The rest I could and would get back in the event of a cancellation. Considering Allianz covers award redeposit fees they show they are familiar with the process.

Why not do the GeoBlue travel health insurance instead if you don’t need the trip coverage due to using Chase for that? https://www.geobluetravelinsurance.com/products/single-trip/voyager-quote-results.cfm?qid=o7YL6Fi8ii1326876# I was looking at this and it seems less expensive than Allianz. Thoughts?

Hi Katie,

I’ve never tested it, but it might be a viable option. Readers?

I am hoping that you can shed some light on coverage for air that would be purchased by Chase through using my points.

I had a similar situation earlier this year: I actually had also purchased coverage through World Wide Trip Protector to cover the cost of air tickets/medical. I used my Merrill Lynch CMA credit card points to purchase the tickets. The entire cost of the plane tickets were covered by 100,000 points I had accrued. The credit card travel department purchased the ticket similar to that of Chase Travel Department. I had to cancel my trip due to unexpected kidney stone surgery. I was not covered because I cannot show a receipt for the cost of the ticket since I did not purchase the ticket on my own credit card.

So, if I purchase air through the travel department using points on my Chase Reserve Card will I have the same issue? Is this ticket “uncoverable” when using points?

Will anyone cover this? Additionally in this particular case, the kidney stone diagnosis is considered preexisting to preclude me from benefits from my Chase Card as well?

Any way to cover /insure tickets in the future using my Chase Card. Chase is my go to card for travel now.

Thank you for writing this. Now I’m better informed.

Does Allianz not cover if one is on Medicare. That’s what Beck seems to say.

I don’t think Medicare or Medicaid has coverage outside of the United states.

Medicare covers some conditions. The rest can covered by medicare supplement plans as follows:

Medigap plans C, D, E, F, G, H, I, J, M, and N pay 80% of the billed charges for

certain medically necessary emergency care outside the U.S. after you meet a $250

deductible for the year. These Medigap policies cover foreign travel emergency care if

it begins during the first 60 days of your trip, and if Medicare doesn’t otherwise cover

the care. Foreign travel emergency coverage with Medigap policies has a lifetime

limit of $50,000.