Lately I’ve been a bit stagnant on my Manufactured Spending (MS). We were traveling a bunch, then I was focused on getting the Southwest Companion Pass, then I was trying to figure out the best way to leverage cash back, and I have no sign-on bonuses I’m working off. Really I think it was because I was at a loss for the best non-category bonus spending (of which there are some really great deals out there).

Kenny also got me thinking with his post on a Different Perspective on Collecting United Miles. The answer at first that came to me, was based on a post that Amol did on HackMyTrip, arguing that it was best to go for cash back, even if you end up buying miles with that cash back.

Caveats

Now I want to set at the start three caveats:

- Sign-on bonuses don’t count.

- This is for spending that there are no category bonuses.

- The goal is to pursue United Miles (however misguided that may be).

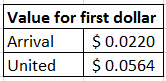

Based on these caveats, I’m narrowing the aperture to two cards. The Barclay Arrival Plus earning 2.2% on all spend regardless of category (for the sake of the argument, let us say that you can buy miles and earn that 10% rebate when redeeming Arrival points, thus 2.2%) and the United Club Card, which earns 1.5 United miles per dollar spent, regardless of category.

Small Scale

If you look at this from the perspective of “first point earned after bonus” standpoint, I think the United Club Card wins hands down, when you factor the “Buy direct” cost of United miles from United at 3.76 cents per mile directly. It’s for the Arrival to compete with that (you’d have to spend $2.56 in spend to earn the necessary points to buy same amount of points that you would get for $1 spend with the United card). If we look at FrequentMiler’s Fair Trading Value of 1.38 cents per United mile, the Arrival much more competitive (2.07 cents for the United Club card, and 2.2 cents for Barclay Arrival Plus).

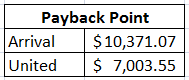

Large Scale and Big Picture

I’m more of a big picture guy, so I try to look at deals in a scalable context. When I do that, I try to include the Annual Fees too. In this case, the Barclay’s card $89 annual fee, vs. the United Card’s $395 annual fee. Here, I’ve “handicapped” the Barclay card because it does require $2.56 in spend to meet what the United Club card gets per dollar. I will note that in cash back terms, you only need to Manufacture $4,045.45 in spend to cover the Barclay Arrival’s $89 annual fee.

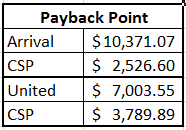

Alternative Analysis

Not having the United Club Card personally (and seeing the significant difference in return), I decided to consider an Ultimate Rewards card. For sake of ease, I went with the Chase Sapphire Preferred (CSP). Since United is an Ultimate Rewards transfer partner, I’ll simplify the comparison to equate 1 Ultimate Rewards point to 1 United Mile. This was perhaps the most surprising result to me.

Final Thoughts

When I started this thought post, I really thought that it would be clear that the Barclay Card would win for low spenders, but the United Card would become a clear favorite for big spenders. I was partially correct, but for the wrong reasons. The United Club Card, from the first mile earns a significant return, of roughly 5.64 cents, assuming the “buy direct” cost per mile. I really thought that the Barclay Arrival would be close, considering the United Club Card’s nearly 4x annual fee. But that is not the case. The United Club Card is the clear winner.

I think the real point is clear: Never buy United Miles with cash. Always pursue them through Flying (until 2015), Spending, Ultimate Rewards, or Sign-ups. I for one, will be looking to my Ink Plus or Chase Sapphire Preferred if I need to MS for United Miles in the future.

If you’re interested in Mileage Plus miles, wouldn’t the Mileage Plus Explorer card be a better deal if you spend up to $25,000?

Club card:

– 25,000 miles x 1.5 miles per dollar = 37,500 miles

– 37,500 miles x fair trading value of $.0138 = $517.50

– $517.50 – $395 annual fee = $122.50 in fair trading value

Chase Sapphire Preferred

– 25,000 UR points transferred to Mileage Plus

– 25,000 x fair trading value of $.0138 = $345

– $345 – $95 = $250

Explorer:

– 25,000 miles + 10,000 threshold bonus = 35,000 miles

– 35,000 miles x fair trading value of $.0138 = $483

– $483 – $95 annual fee = $388 in fair trading value

I believe you would need to spend an additional $1927.53 on the club card for an additional 2,891 miles to make up for the value of the additional fee of the Club Card… beyond that, the Club card becomes a clearer winner. I would personally go for the lower annual fee of the Explorer card (and maybe making exactly the $25,000 in spend) but I have started focusing earnings of all kinds away from United. The devaluations and reduction in routes I was using and could use make me believe that other forms of points currency or cash back are a better bet than trying to do any serious kind of MileagePlus earning. Even if AA goes to revenue based, there are markets where I previously would have flown UA strictly due to schedule and routing, but UA doesn’t even have the flights anymore.

Hua,

You make a great point on the UA Explorer card. I didn’t factor in threshold bonuses into my calculation. I think the point (which you echo), is that after a certain point, the United Club card is a clear winner, but its a pretty high point– as you rightly state, about $25k in annual spending.

I’ve been focused on earning AAdvantage miles as well, but with the Citi Executives, its much easier, for the time being. I think though the real winner is the flexibility afforded by the Ultimate Rewards cards (and the Membership Rewards cards to a lesser extent). Given United’s crazy partner redemption rates, you’d be better transferring UR points to Singapore’s KrisFlyer if you were flying in Asia for example.

Pingback: Follow-up to pursuing United Miles via Credit Cards - Tagging Miles