Earlier this week I shared what credit cards I keep in my wallet on a day to day basis. One card that reader Shannon commented that she had cancelled her CSP in favor of the Barclay’s Arrival. That got me thinking even more (because, I had been thinking about cancelling before). A few months ago, my wife downgraded from the Chase Sapphire Preferred down to the Chase Sapphire. We haven’t really experienced any real impacts, because she still has 2-3 Inks so she maintains the ability to transfer Ultimate Rewards (UR) points to airline partners.

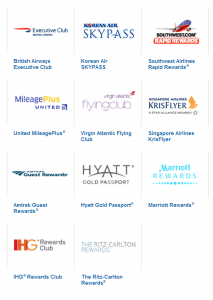

I figure everyone knows this by now, but a reminder that Ultimate Rewards points can be transferred to a ton of travel partners never hurts.

Needless to say – it is always a good thing to keep the ability to transfer UR points.

Are the benefits worth it?

Briefly (since others have really gone pretty overboard already) the benefits are:

- 2x Points on Travel and Dining

- No Foreign Transaction Fee

- 20% off travel when you redeem UR points for airfare, hotel, car rentals and cruises (you get this with the Ink though)

- 1:1 Point Transfer to travel programs (again, you get this with the Ink)

- 3x Points on dining on the First Friday of the month (see how Milesabound feels about it!)

While the 7% UR points dividend is no longer listed, I think those that do have the card get it for at least the next year (Update: Reader TJ commented that the 7% UR points dividend is good for existing cardholders through 2015). There are some other benefits that are rumored but don’t show on the link I can find, those include:

- Primary car rental insurance (again, you get this with the Ink)

- Double the trip cancellation / interruption insurance (now $10k) ($5K with Ink).

My conclusion

My card doesn’t come due until next March, so I might get my 7% dividend, but lets be honest, it won’t be much. Really, when you think about it, your opportunity cost for using the Chase Sapphire preferred is a minimum of 0.06% if you compare it to the Barclay Arrival (as many do). You might say that UR points are move valuable than cashback. Ok, but, then why aren’t you getting 5x instead of 2.14x? If we pull in the time-value of money, then waiting for that dividend is even worse of a deal.

So while I will try to milk the last bit that I can, I really can’t justify the annual fee.

Ed. Note: No affiliate links were included in this post and no blow torches were used on unsuspecting Chase Sapphire Preferred cards.

I think many people miss the point that UR points can be valued at 1.25 cents minimum if used for travel. Thus if i use my BA for dining, i get only 2.2% towards travel but minimum 2.5% from CSP (and whatever dividend you get on top of that). I am not saying CSP is better than BA but i guess both are complementary. If i have to continue after the first year, i will try to have both by calling the recon line. Only if i dont get a good recon, i would be willing to cancel any one of these but will try to get back after the cooling period. In fact one’s daily spend (outside MS) would have to be between CSP, BA, SPG and Amex EDP (for travel needs) depending on the category that one spends. In fact all these 4 cards are complementary to each other IMHO and one should always try hard through recon to get the annual fee waived for each one of them.

@Kumar – you raise good points. I guess I never think of using UR points for anything other than transferring to travel partners. I think for me though the marginal benefit even if you value CSP restaurant spend at 2.5%, is difficult to justify the annual fee. Of course the reconsideration offer makes a huge difference. I’d say instead of the Amex EDP though that the old Blue Cash is pretty good, with 5% at drug stores and grocery stores.

They’ve been sending quite a few email notices to existing customers about what is happening with the dividend- they are “Discontinuing 7% annual dividend after 12/31/2015”.

So you get the 7% for all spend in 2014, and 2015.

@TJ – Thanks for the clarification!

I decided to keep the CSP when Chase added primary car insurance as a benefit. I have an Ink too, but if you aren’t traveling for business I’m not sure the primary car insurance there will be valid (I’m pretty sure that is the rule the other way around – if you use the personal card on a business trip, you don’t get the coverage). Correct me if I’m wrong.

In any case, once CSP added primary car insurance, I decided to give up my United Explorer card, which I was using only for car rentals (I have United status so the other benefits of the card basically have no value to me).

I’ve put the primary car insurance to use in the last year and never want to be without it!

@Neil – I agree – the Primary car insurance is a big benefit. You raise a good point that the Ink does not provide primary car insurance for personal travel. I would argue though that, if you’re doing manufactured spend, the 10k UA points after $25k points on the United Explorer card is a pretty good deal.

Yes, I agree – what I didn’t include in my 1st comment is that as soon as I got rid of the Explorer card (where I had already gotten the 10,000 bonus points this year) I signed up for the current 50,000 Explorer business offer – and I’ll start spending on it early next year to make sure I get the bonus (and the EQD United waiver). I might have gotten the biz card for the bonus anyhow but I wouldn’t have gotten rid of the Explorer card had CSP not added primary car insurance. So that change saved me one annual fee.

I’m hoping in a year I can move over to the United Club card since there seem to be some tricks to get it fee free for the first year. That card doesn’t have the 10,000 point bonus, but because it earns at 1.5 points/$ spending the $25,000 points generates 37,500 miles anyhow. And by the time that year is over who knows, might be time for a new Explorer card ….

@Neil – yeah – you pretty much have it set with respect to UA cards. I think the United Club card is interesting at 1.5 points/$, especially if you can get that annual fee waived. I feel like I go back and forth between wanting UA miles and not, lately I’ve been focused on SPG points for their flexibility, but I just run through UR points like they are going out of style.

I long ago put this calculator together, and recently updated it to eliminate the 7% dividend:

http://milenomics.com/2013/09/chase-freedom-vs-chase-sapphire-preferred/

Play with your own numbers and see what you come up with.

As I noted on another Saverocity blog (forget which one), at restaurants I’m still burning an Amex GC that I bought through a 4% portal using an SPG card. We have a CSP too; it’s in a drawer. Where Amex isn’t accepted, I just pull out whatever else is in my wallet (placed there for a sign-up bonus or category bonus or some other reason). Hopefully Discover & CFreedom will offer 5% in restaurants for different quarters next year too (as they did in 2013 and 2014).

2.14 points are good, but they’re a baseline.

This is a must keep card are you kidding me? $10,000 travel sickness cancellation insurance for FREE? Do you know how much you save in having to buy Travel Insurance with that? I put ALL my travel reservations on this now. And you get double points on travel!

I have seen some other premium cards (also with annual fees) have travel sickness cancellation insurance but no where near as high a limit as $10k (CSP just doubled it from $5k). I am telling all the customers of my travel agency to get the CSP and charge their trips to it…..

Note that it doesn’t cover PRE EXISTING conditions.