Intra-family lending is something that can be a real win/win for family members, it can also, be a complete nightmare, since mixing money and family can be a recipe for disaster. The two things that can go wrong in such situations are that the family members who borrow treat the loan as a lower priority than a regular loan against their home. From a behaviora finance perspective the primary reason that most of American’s wealth at retirement is in their home (401k accounts are secondary) is that payments are highly prioritized, come out of the paycheck first, and missing them means you can lose your residence and all equity paid into it.

The primary risk with a family loan is that the borrow believes that the lender (a parent or other financially secure relative) would not repossess the property if in default. This risk is very real to a lender, and really isn’t something that you can offset, the best that you could hope for is to establish documentation that states a lien on the property, and establish automated Payment Processing so that your payments are received from Paychecks prior to it being considered disposable income from the borrower.

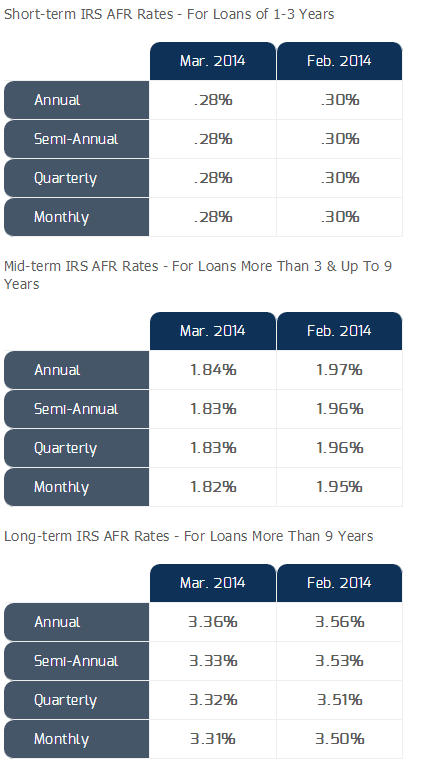

The secondary risk with such lending is that the IRS scrutinizes them for potential ‘gifting’, since it could be a way for a parent to pass large amounts of money down through from one generation to the next in order to avoid taxes. For that reason the IRS has established guidelines for intra-family loans, stating that the interest rate of the loan must be above a certain minimum level, which changes on a monthly basis, these rates are called IRS Applicable Federal Rates (AFRs) and can be found here on the IRS Website, below you can see February and March 2014 rates:

The rate table above was nicely laid out and available on the website of National Family Mortgage, established by Timothy Burke, a former exec with Circle Lending (acquired by Virgin Money) that specializes in facilitating intra-family lending, it seems to be one of the few larger firms that offers this service.

If you do set up an intra-family loan incorrectly, there is a methodology that the IRS will employ to penalize doubly, the interest that the Lender should have received from the borrow using the AFR table will be imputed, it would be considered to be collected and added onto his interest income. The borrow, who is frequently in a higher tax bracket therefore would pay taxes on ‘what they should have received’ at the higher rate. The second penalty is that it will be considered a gift, an anything about $14,000 per year gifted would require gift tax.

You can set up an intra-family loan without using a third party like National Family Mortgage, but I would advise doing so under the watchful eye of a Financial Planner, who may bring in a CPA and Attorney to help oversee things, overall your costs may actually be lower by taking this to an expert like this National Family Mortgage than making a DIY one. Fees from National Family are $725 for establishing the documentation (vital for IRS defense of the loan) and an optional ongoing maintenance charge of around $15 per month for payment processing.

Conclusion

Lending money to family or friends is always a risky play, and no matter how well organized a service is this should not be entered into lightly. However, if you had already intended to ‘gift’ such money to these family members this could be a way to get it to them faster and allow them to benefit from lower mortgage rates. Furthermore, you become the bank, and get to collect interest rather than it going to an external company, which over the course of the loan can mean hundreds of thousands of dollars in interest payments ‘staying in the family’. The Borrower gets a rate below market, and the lender gets a fixed income investment, that can be a win/win.

Note, I didn’t approach National Family mortgage about this article, and it is not approved or compensated by them in any way.

Leave a Reply