It’s been a while since I did a product review, but Aspiration leaped out at me this week. We started to discuss them in the Forum to see if they might be a good investment option. And then today they ran a new Ad campaign trying to benefit from the current little spat between Betterment and Wealthfront (which is over a $3 monthly fee.. oh the humanity!)

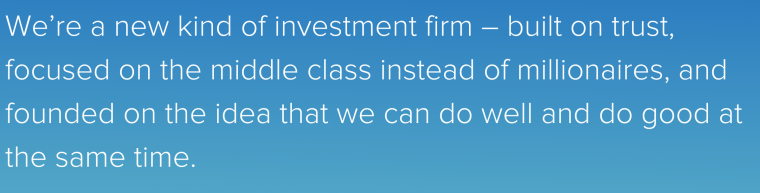

So enter Aspiration. They make bold claims, positioning themselves as the firm you can trust, the firm that isn’t like Wall St and is designed for the average middle class American. They cite transparency and openness, and they offer something interesting: You pick what you pay in fees.

Sounds amazing right?

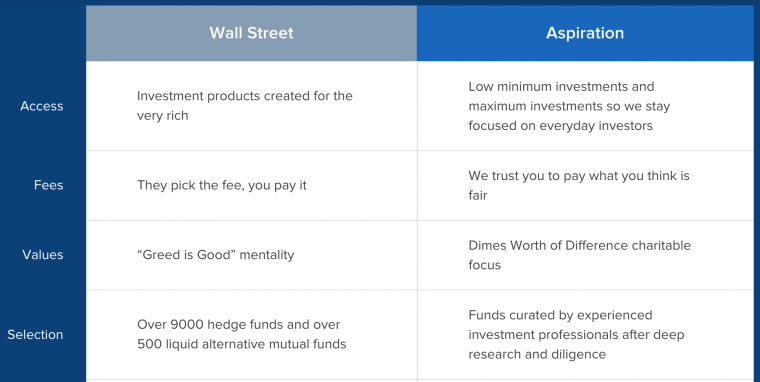

Differentiation (note the fee section)

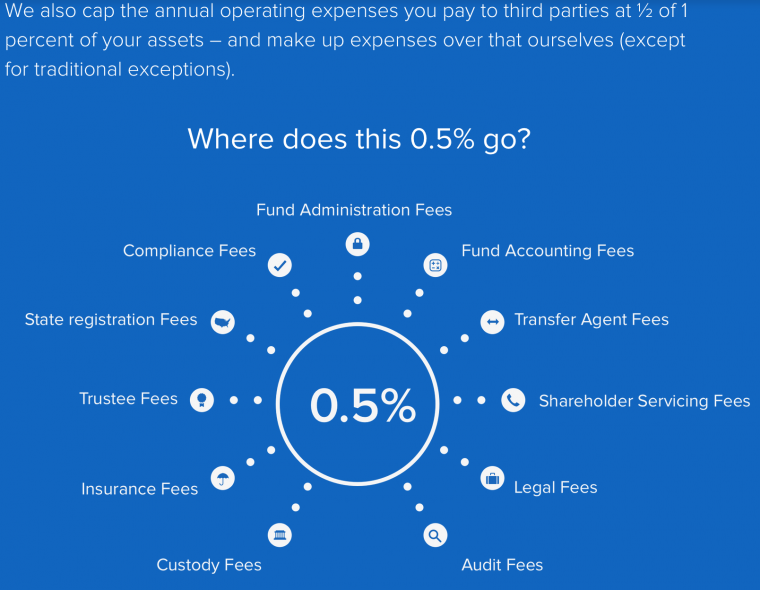

So what are you thinking so far? Pretty cool company, and you pay what you want in fees, what the heck! Let’s do this… but before we dive in, perhaps there are other fees to consider? For example, the Robo giants of Betterment and Wealthfront both charge a management fee (around 0.25%) on top of the underlying ETFs that make up the portfolio. Maybe there’s some underlying fees to look at with these guys too, and your choice is to pick the management fee aspect?

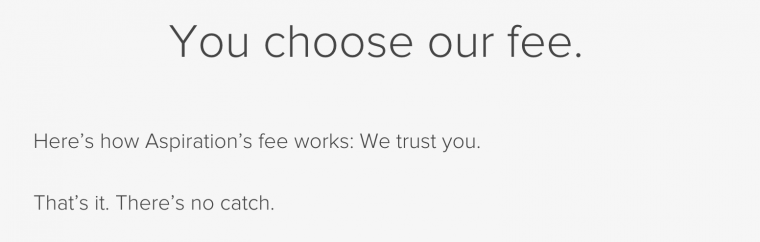

I have to say I love the transparency here, the confidence in which they say this makes me feel that ‘trust’ they talk about. Great stuff.

What are Aspiration’s fees? What is “Pay What Is Fair?”

Most investment firms impose a flat management fee on their customers. That means you pay a set amount no matter how well the investment does, how hard the adviser is working, or how much you like what the company stands for. We think that’s not right and not respectful to customers.

Instead, at Aspiration, you decide how much to pay us. We’re confident enough in our products and confident enough in the honor of our customers to trust you to do the right thing. We call this “Pay What Is Fair” because this fee model is fair to you and because we’re counting on you to be fair to us. We will not earn a cent from you other than the fee you select.

Looking good! Click around a bit more, and we are sent to an external website that discusses their funds a little more deeply.

But wait.. here’s a fee!

Let’s pause a moment to see if you kept up with all that no fee, no fee, no fee, FEE! Shazam, and ask a quick question:

If you invest with Aspiration, how much will you pay in fees?

The savvy among you might think that it would be 0.5% + a ‘tip’ perhaps something between 0%-2% for their management fee. Compared to Betterment charging perhaps 0.15-0.2% for their underlying ETFs and a 0.25% management fee. Kinda close, maybe lean towards the Robots?

That’s actually what I thought on first glance too, but when you look at the prospectus for the above fund something odd happens. You have to go off this website and to the SEC to find it (the folk at Aspiration sent me the link for some reason) and you get the following:

Aspiration Flagship Fund SEC Filing

The fees…

The left column shows how much you would pay in fees if you paid no fees. 1.35%. The right column is for illustration and shows what you would pay in fees if you elected to pay the top end of the ‘tip’ at 2%, you’d be looking at 3.35%. It’s worth noting that this entire fee doesn’t go to the firm, but the point is that fees are deducted from your earnings, and it appears they could be up to 11x more than the Robo firms that they are bashing on Twitter.

Interesting stuff.

So another what you see isn’t what you get (again)