I recently came across a company called Betterment that is seeking to offer an alternative structure for your investments. On first glance I didn’t like what they were appearing to do, but when I said so in a post here on Saverocity their CEO and Founder Jon Stein reached out to me to clear a few things up. Between the information he gave me, and the further research that I compiled I think that they are offering a very powerful solution for your investment needs.

I recently came across a company called Betterment that is seeking to offer an alternative structure for your investments. On first glance I didn’t like what they were appearing to do, but when I said so in a post here on Saverocity their CEO and Founder Jon Stein reached out to me to clear a few things up. Between the information he gave me, and the further research that I compiled I think that they are offering a very powerful solution for your investment needs.

In fairness I do still hold a few reservations with regard to this being a one stop shop for all your asset allocations, however I do think overall it is a very powerful and useful solution for your core holdings and long term investment strategy. Fundamentally, your core holdings should be your largest and most important ones, so what is on offer here from Betterment is a very serious proposition indeed.

A Passive Investing Model

Betterment advocates a Passive Investing Model, which is one where your costs are kept low by purchasing large index funds that are low cost to own. There are two main reasons that costs are low with these types of investments:

- Sales and Marketing Fees – the Passive Index funds on offer by these large corporations (Vanguard being the most famous) aren’t sold in the same manner as Traditional Mutual Funds – they don’t have a large cut that is paid out to your Broker/Dealer every time a new sale is made, or based upon annual account holding percentages. In a high cost fund, that you typically find with Actively Managed offerings you will see more fees attached to ownership, this comes down to the Fund offering incentives to people for selling the fund, this has to be priced in as a Cost against any gains you make in the investment, so your Costs therefore increase.

Every Penny taken from your investment in costs is a Penny out of your pocket, and with the power of Compound Interest this will be felt by the average investor to a surprising degree over the lifetime of your investment.

- Taxation Costs – Funds that are actively managed require frequent trading as their fund managers seek to beat the market by buying and selling. When they do this they are hit more frequently with short term Capital Gains Tax. Passively managed funds can build in Capital Gains savvy transactions by making their transactions factor this in and sell with less frequency. Captial Gains for the short term transactions that build the majority of an Actively Managed Fund are at the higher rate of 30%+ whereas the short term rate that will be seen most by a Passive Fund will be 15%. Simply put, by trading at a slower rate more of the gain is kept in the fund and that goes into your pocket, rather than Uncle Sams.

Betterment offers a selection of these low cost funds to build your Investment Basket – by picking a balanced amount of what they offer you get to spread your risk amongst a diverse range of investments and keep your costs low. Remember though, that as gains and losses occur over time you need to keep an eye on your Current Actual Holdings to make sure they still align with your Original Investment Strategy. This is done with Portfolio Rebalancing. I’m liking what they do here in terms of coupling both the ability to hold a Passive Portfolio and offer the rebalancing as part of the Platform.

The Betterment Investment Baskets

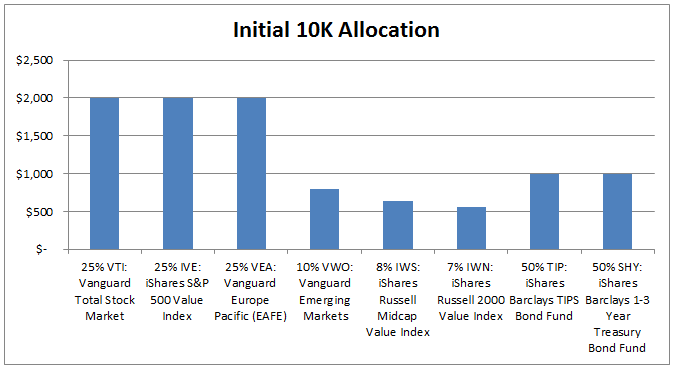

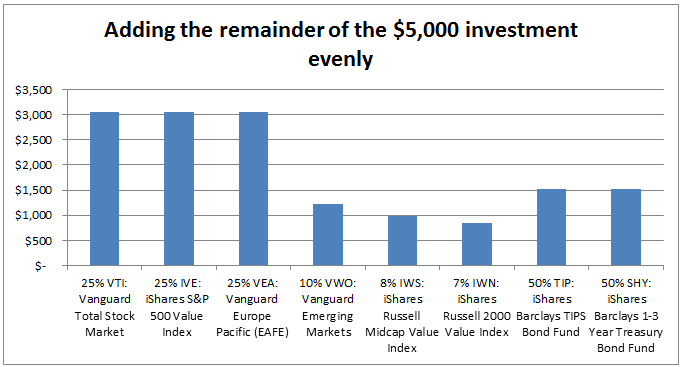

When you decide upon your asset allocation you will be able to pick how much of your deposit is allocated into Stocks and how much into Bonds. Betterment has pooled together a blend of ETFs, which are themselves a pool of stocks. The concept being that by selecting a blend of ETF you are getting the optimal exposure to the Stock Market (both US and Global) and the Bond Market. Here is the current breakdown of the Basket, this is subject to change as the Investment Committee evaluates changes to the global economy. You have a nice mix with a focus of 65% on the US market and 35% on the International Market, this offers a degree of Risk management and upside exposure to the Emerging Markets. It is worth noting that you will find double up positions on certain stocks (if you hold the VTI then you automatically hold the S&P 500 and so on). This might be something to think about when you are allocating your assets.

Betterment Stock Market Basket

- 25% VTI: Vanguard Total Stock Market(

download prospectus)

download prospectus) - 25% IVE: iShares S&P 500 Value Index (

download prospectus)

download prospectus) - 25% VEA: Vanguard Europe Pacific (EAFE) (

download prospectus)

download prospectus) - 10% VWO: Vanguard Emerging Markets (

download prospectus)

download prospectus) - 8% IWS: iShares Russell Midcap Value Index (

download prospectus)

download prospectus) - 7% IWN: iShares Russell 2000 Value Index (

download prospectus)

download prospectus)

Betterment Treasury Bond Basket

- 50% TIP: iShares Barclays TIPS Bond Fund (

download prospectus)

download prospectus) - 50% SHY: iShares Barclays 1-3 Year Treasury Bond Fund (

download prospectus)

download prospectus)

Example Portfolio Allocation – $10,000 Initial Deposit, 80% Stocks, 20% Bonds

If you open your account with a deposit of $10,000, and select an Asset Allocation of 80% Stocks, 20% Bonds, you would open positions in all of the ETFs mentioned above, to the following amount of Cash Value. As you can see below, it assigns based upon their Basket methodology, and allots $2K to the 3 major holdings of VTI, IVE and VEA and $800 to VWO, $640 IWS and the final 7% of $560 to IWN. That accounts for the 80% ($8000) and the remaining $2000 or 20% of your allocation that was aimed into Bonds is split 50/50 into TIP and SHY, for $1000 each.

Betterment Takes Care of Portfolio Rebalancing

Any Investment Strategy requires Portfolio Rebalancing, there is a link to article on this at the bottom of this article. It doesn’t matter if you opt for an Active Fund or a Passive Fund approach, the overall balance of your portfolio needs to be monitored and adjusted to cater for the gains and losses made. For example if you are 80% in Stocks and 20% in Bonds, if the Bond Market drops by 25% and the Stock Market soars by 50% your allocations are suddenly off – and you will need to sell some Stock and buy some bonds to rebalance out your Portfolio to the 80/20 you desire. It might sound odd to sell your winners and buy more of your losers, but by doing so you are ensuring that you keep the Risk Profile of your Investment Strategy aligned with what you decided upon when you initiated this investment.

Betterment Automates the Rebalancing Process

Betterment will analyze your portfolio every afternoon. If the assets are more than 5% away from the optimal allocation that you set for the portfolio you they adjust accordingly to bring them in line. Further to this, whenever you make a deposit to your Betterment account they will buy up the ETFs that are falling behind to help balance up without forcing a sell.

Selling in Portfolio Rebalancing is something that we try to avoid because it reaps Capital Gain on the profits, making it tax inefficient.

This takes the thinking out of it when it comes to tracking the development of your Portfolio and ensures you are kept on track. I find this option particularly useful when combined with their automated deposit system – each month you add to your investment and the proprietary Algorithms will calculate how to funnel each dollar into the relevant fund to ensure you are maintaining balance.

Example Portfolio Allocation – 1 year later when you add another $5,000 to your initial investment

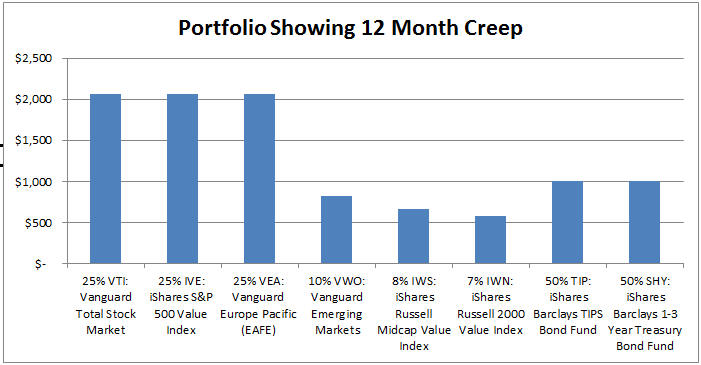

Each of these ETFs within both the Stock and Bond Basket will change in value daily; and your portfolio will creep away from its initial allocation, if Bonds do well and Stocks do poorly you will have a Portfolio that has a higher Bond Value, and therefore more of your money in Bonds than the 20% you wanted initially. If the difference every became more than 5% Betterment would step in and rebalance by selling and buying accordingly but if it was lower than 5%, say 3%, they would wait for the next investment to come in from your deposit, and when it did they would just buy up more of the Stock Basket, and less of the Bond Basket (or the individual components of them) and the end result would mean your $15K investment would be balanced to 80% Stock and 20% Bonds again, ready for action.

Figure 2 shows the effects of Portfolio Creep on the initial $10,000 Investment

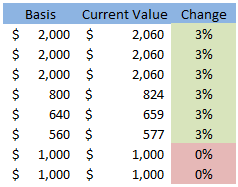

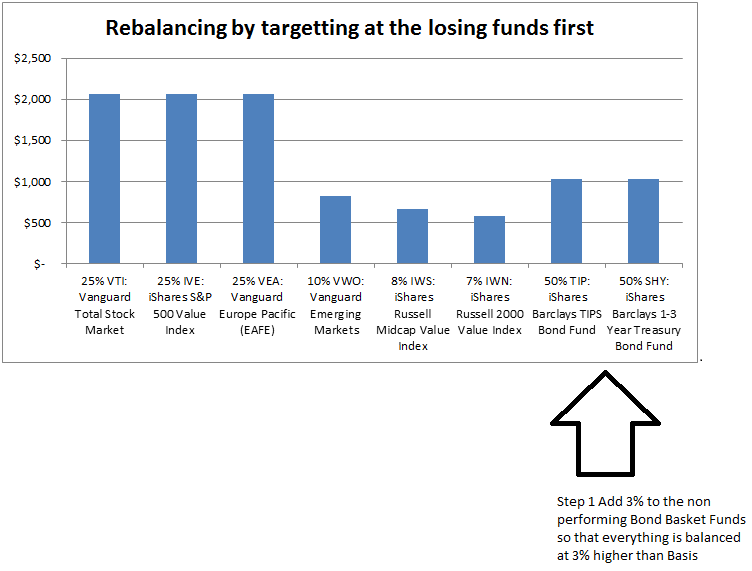

Figure 3 shows how by taking the additional funds for investment ($5,000) and allocating a portion of it directly at the poorly performing funds (the Bond Baskets) and immediately allocating 3% ($30 each ETF for $60) to them you get a Balanced 80/20 portfolio.

Figure 4 then allocates the remaining $$4,940 into each fund by the exact percentage amount decided upon (the 80/20 split and then split by how much of each individual ETF you are purchasing within the Basket)

What has happened in this theoretical portfolio above is after 12 months of investing the Stocks are doing well, with 3% growth, but the Bond Basket is unchanged. As the numbers are quite small lets look at them side by side to show the changes.

Since the changes are small, Betterment hasn’t sold any positions in order to Rebalance – this is a good thing since that means no Capital Gains Tax. However we now have a Portfolio that is valued at $10,240 due to the gains from the Stock Basket, of which only $2,000 is in Bonds. This means that the 80/20 mix for Asset Allocation is off. and currently you are holding a mix of 81/19. So, when we add the new $5,000 investment to the Betterment account they automatically add more to the Bond Accounts to bring them up to parity, then share the balance in the 80/20 pattern that you decided upon.

IE The add 3% to Both Bond Funds SHY and TIP for $30 each, making your entire portfolio balance out at 80/20 with a value of $10,300 then take the remainder of the $5,000 investment ($4,940) and distribute it evenly as per the allotments in the Baskets.

Once the Portfolio is at parity, the remaining money from the $5,000 investment is divided up accordingly, this creates positions that are perfectly at 80% Stock Basket and 20% Bond Basket.

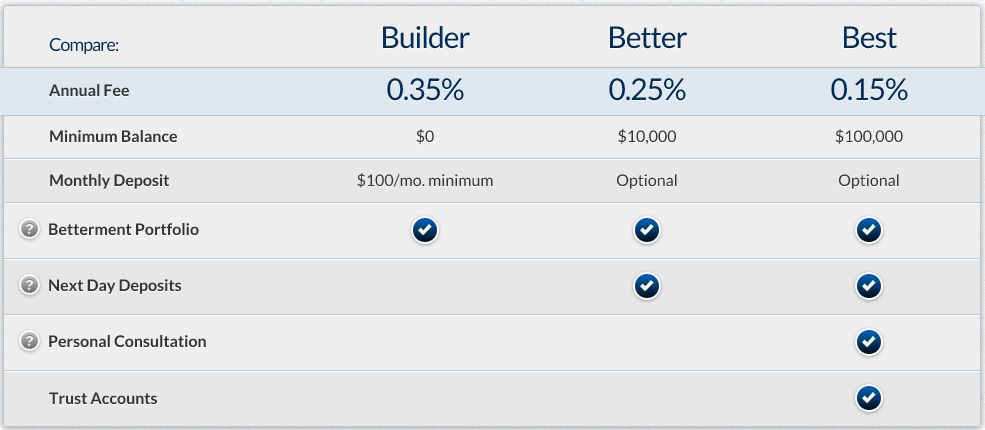

The Fees, and What they Pay for

Betterment offers fees at 3 price points and uses an annual management fee model. The fee amount reduces based upon the overall account value, this sort of model is consistent within the Financial Industry as they are seeking of course to attract the highest value individual accounts and incentivize these High Net Worth individuals with more attractive pricing. So it will cost a little more per annum for the lower accounts, it translates to very little in reality – the difference between 0.15% and 0.35% on $10,000 is only $20 a year.

With Betterment you are paying this management fee to handle the following two things:

- Automated Portfolio Rebalancing – this is one of the few headaches that come with a Passively Managed Portfolio, outsourcing the heavy lifting on this to Betterment is certainly going to add value as it makes sure that your investments are being rebalanced properly without your effort – it is a set it and forget it approach.

- Automated, low value depositing and immediate investing. Whilst it seems simple, actually finding Brokerage accounts that will encourage and allow you to set a standing order for a fixed monthly amount to be deducted from your Checking Account and swept into your Brokerage account, to be invested without any input from the investor is incredibly hard to find. Vanguard will allow a monthly investment, but you have to decide upon the allocation and manually place a trade. The only options I could find that would automate the entire process are packaged investments with horrendous management fees built into them.

Who should invest in Betterment?

I think it is accessible to everyone. With their 3 tier model investing can commence with as little as $100 per month which would be a great thing for a young saver to dip their toes in the water. Not only is the price point acceptable, but I personally believe that investing in this manner increases your financial savvy and takes away a lot of the gambling that comes with investing. When I first started to invest, without any real education and a fistful of money I found myself betting on a plethora of different companies, primarily in the tech market based upon what I felt would work. I did pick a few winners, but I picked a lot more losers. The approach offered by Betterment makes the investor ask powerful questions, and starts them out well on the way to financial freedom, questions like:

- What is my risk allocation from this basket of funds?

- What are the costs attached to the individual funds, and why am I paying for this?

- What is the impact of taxation on my trading habits?

If you can work with your family and friends and help them formulate a small and affordable investment account with Betterment and discuss questions like this with them you can accelerate their learning process considerably and help them to avoid some of the pitfalls that I have encountered in my learning curve.

Further to this, I like the idea of Betterment for people with a higher Net Worth, people who have recently inherited a decent sized sum of money from perhaps $30K-$1M+ through means such as a beneficiary or perhaps a large bonus from work or Pre-IPO stock awards being excercised. The value that Betterment offers here is a chance to lock the funds up somewhere safe, where they are being constantly adjusted in allocation to ensure they meet the Investment Strategy that you want for your money.

I would look at your overall investment portfolio;as it should include asset classes where Stocks and Bonds are only a part of your overall wealth allocation. Personally I would compare the overall costs, risks and rewards of putting the majority of your Bond and Equity positions into Betterment, and perhaps keeping a small amount separate in a Special Projects account for investing in those select individual companies or sectors that you wish to gamble on. Just realize that this should be a small part of your overall investments and you should keep the majority in stable, low cost funds that are rebalanced properly. For those of very High Net Worth I would consider comparing your management costs for your core funds like the Vanguard Index Funds and see what you are losing annually compared with the 0.25% that Betterment is offering, I think that the answer may surprise you.

At the start of this article I mentioned my reservation towards it being a one-stop-shop. This is simply that whilst Betterment allows you to create and track goals for savings and investments it follows a Passive Investment strategy tracking Stock and Bond Indexes. This is a fantastic approach to Investing and Betterment does it very well, but, it is not a short term play. If you are planning to buy a new car or form a down-payment for your home – or anything that has a short term goal attached to it then playing in the Stock Market is not a smart move. The reason for this is short term volatility will throw the risk on your investment out of the window. Whereas if you plan long term, when you encounter a short term drop in the Market (and therefore your portfolio since it is Index Tracking it) you have the opportunity to ride out the storm by dripping funds in and dollar cost averaging your investments.

Overall, Betterment is offering a fantastic feature packed alternative to having your portfolio managed by an Investment Management Company; it offers tremendous value for the consumer who is looking for a Passive, Index tracking portfolio, but who doesn’t want to worry about tracking Portfolio Creep for Rebalancing. Furthermore, I hear that they are about to launch several new products that will make their offering even more comprehensive and might address some of the current limitations they have regarding short term investments.

Leave a Reply