Loyal3 is a stock purchase platform that was founded in 2008. The thing that makes this company worth taking note of is net positive transaction fees for stock acquisition, I am currently testing the scalability of this system. The platform does have quite extensive limitations, but it could still be an interesting part of an overall strategy.

The limitations are as follows:

- Purchase Limit of $2500 per month, I have not tested this out to see if it is a per transaction (or stock) purchase limit or a monthly account maximum yet. It is common thinking to assume it would be per account, but sometimes its good to check….

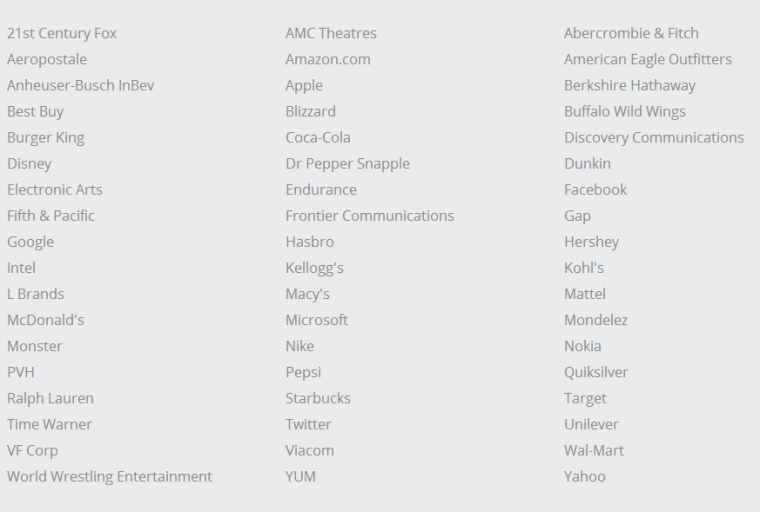

- Stock selection is limited to around 50 companies only

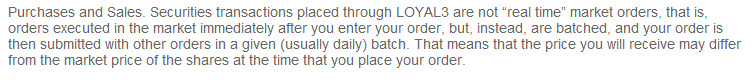

- Stocks are bought in Batches (twice a day) to reduce company side transaction fees, so you won’t get real time pricing.

The benefits are quite attractive:

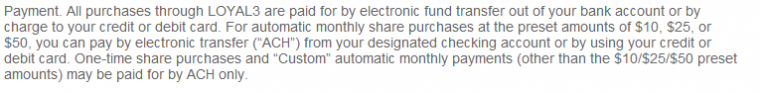

- Stock Purchases of $10, 25 or $50 can be made via Credit Card, this can be set up for a monthly recurring purchase. I am currently testing this to see how it posts with my card (cash advances would make this useless, a purchase transaction would make this very interesting)

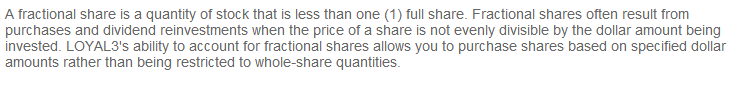

- Fractional Share Ownership – you can buy in from $10 per transaction, so you could buy 0.17% of one share of Apple per month, making it easier to create a diversified portfolio.

Access to IPO offerings

I wasn’t sure where to put this, as a positive or negative, my personal feeling is that allowing people access to IPO’s at very low entry prices is a hugely negative thing for the consumer and hugely positive for the company with the IPO. There is massive artificial pricing involved with IPOs from the mosh pit of investing, and it is likely that novice investors will be the ones that get mangled by this.

Ethics

Frankly I don’t think it is a good idea to allow more people into the market by lowering boundaries of entry, I know that it sounds somewhat Orwellian to make a decision of access level and control in things like this, but I know from my first experiences with the market in my youth that being able to trade without any real knowledge of what I was doing cost me a lot of money, and lowering the price to trade gets more dumb money into the market, which the sharks will sweep up. However, smart money can use the characteristics of the Loyal3 program to their advantage.

Risk Management with Loyal3

If we are playing around at the $50 level offsetting risk of ownership with an options play is not viable due to the transaction costs incurred. However, if this scales up to higher levels it might be worthwhile to start building downside hedging into your plan by acquiring Put Options within a separate account, I would suggest OptionsHouse for this as they offer some of the lowest costs. Read here for more information on how I use Covered Calls and Put Options to protect my Retirement Account in a tax savvy manner.

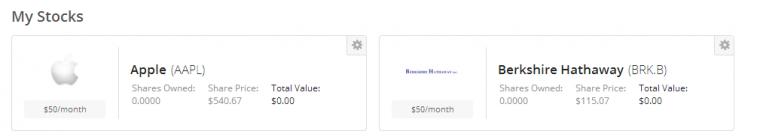

The biggest issue we face is purchasing single stocks, with that in mind it would be wiser to buy many of them at the lowest price point than buy just a couple, so if you have a monthly budget of $50 it would be a better decision to split that between five stocks than one, especially if this the only investment that you hold. I bought into Apple and Berkshire Hathaway as they both made sense to me and my current portfolio, but they may not make sense to you.

Two Things I like about recurring payments

Having a monthly ‘set it and forget it’ purchase plan without transaction costs is a good way to force a savings plan, some people react well to such things and will reduce their spending around the need to cover their credit card bill. It is a good way to build up an account over time. Secondarily, I like that buying monthly creates a dollar cost average on the stock position, so over the course of a year you have bought in 12 times, at different prices, making a nice stable base, which is easier than trying to pick highs and lows.

Using Credit Card points to increase profit

Credit card purchasing is restricted to Mastercard and Visa, so my trusty Fidelity Amex is out, which is a shame since from a mental perspective I like to be able to think pure Cash Back when reviewing this strategy in isolation. The next best choice for me would be the Barclaycard Arrival since it offers Cash Back for Travel specific needs at 2.2% (that is my affiliate link).

I am waiting to confirm that the points will be earned as a regular transaction, if they do this is a nice way to create dollar cost averaged positions in stocks and earn credit cards rewards in the process. I will be slowly ramping up the process from here to test the limits of that.

Caution – this is NOT a pure arbitrage play

You should not look at this as a way to earn points monthly, it should be a way to earn points from a forced savings plan with dollar costed shares. If the latter is appealing to you, and you like the idea of dripping $50 a month into Apple then I think this is a great option. If you think that you can buy larger amounts and sell the stock again during the same month you are making a huge mistake, because you cannot tell when the stock will drop.

I cannot guarantee when it will happen, but for absolute certainty the price of any stock in this plan will drop on a certain day, you cannot hope to buy and sell to capture 2.2% Cash Back in travel if it means selling the stock at far below that in cash value. Don’t even entertain the idea of that, don’t apply for the Arrival card and you won’t lose your shirt in the process.

I’ve been using my freedom card for over a year now. Posts as a purchase

Excellent, I thought it would, but wanted to check. Next up is to find how it posts, and if we can get a multiplier on it…

Not sure what others will classify it as but blueprint shows it as “tax legal or financial services”.

I had it set up with freedom back when it was 10pt per transaction but I’ll probably switch it to the arrival card when it comes in next week

hmm good to know, thanks Daniel.

I’ve been investing with them for a few months using my Barclay Arrival card and the transactions are posting as a purchase.

good to know – thanks Andy

Is the maximum credit card charge $50 per month or can you buy (say) $50 worth of 20 stocks each month (i.e. $1,000 charge per month)?

I don’t mind that orders are batched, so long as at whatever point a transaction is made they are getting the best possible pricing with a reasonable bid/ask spreads? There really isn’t a lot on their website to explain or to assure tight pricing. You are as cost-aware as anyone – do you have any insight into this or am I worrying about something that doesn’t matter?

I tested it out with two $50 transactions, Apple and Berkshire and they both went through at 12:45pm, the price of the transaction was inline with market rates at that time. I believe it is a market order that is issued and therefore it could theoretically have spiked in one way or the other, but it is the market price.

Selling would be the tricky part, you would have to see when the batch order is processed (If it is actually at 12:45pm EST as it appears- or if that is when the email comes though) and then put in a sell order just before then in order to control the market price.

I imagine that putting through upto 50 of these $50 transactions for $2500 would be fine.

OK, I’ll give it a shot so long as the prices seem fair. I don’t mind that market prices can move – I would mind if Level3 is not really giving market prices. Also, I just don’t want to waste time if indeed I can only charge $50X12 a year.

Now here’s hoping I can find at least three or four stocks that I like on the list …if I am understanding correctly I am limited to $50 in a single stock per month.

Thanks

Yep, that sounds right. I think you can find a few good ones, I am happy enough with Apple and Berkshire Hathaway B shares. It does seem to be $50 per single stock by card, but that might not be the case, I only explored the monthly automated system.

I’ve got 10 of the money transactions going at $50 a month. You can buy up to $2500 at one time per stock but it would need to be paid by checking account.

One minor annoyance that just started last month is that they take your dividend payout and use that balance before charging your card. That wasn’t the case prior to last month.

That should say “monthly” transactions not “money”. Damn autocorrect

With IPO’s you can have a much larger charge put through a much larger charge, just be sure to let your CC company know.

Don’t forget that you can’t offset long term gains with a short term sale.

An IPO has too much volatility to make this play viable. It’s a good way to get in on it if you were planning to otherwise, but super risky and not for me.

Looks like as of tonight you can only use credit card to purchase one of the three low preset amounts (up to $50). Any custom amounts will come from a checking account. Too bad – I was trying to add a new monthly plan and ran into this. Hopefully existing monthly plans will continue to execute via cc but we’ll have to see …

Should have noted in above comment – from the time I opened an account until today, credit card charges were NOT limited to $50 per month per stock – I was purchasing $400 worth of one stock monthly via cc with no issues whatsoever. It now does appear that (at least for new orders) cc purchases are limited to the $10, $25, $50 points mentioned in Matt’s review.

Thanks for the update Neil, at least my post is accurate now, if nothing else. Sorry to hear that it changed on you.

It’s very expensive to both buy and sell shares with LOYAL3. You get the worst lowest price on sell for the day and highest price on buy, again for the day. If the stock fluctuates $1 during the day you can lose as much as $100 – or an average of $50 per trade.

I don’t think that’s necessarily true- you certainly risk that, but it’s not certain to occur.