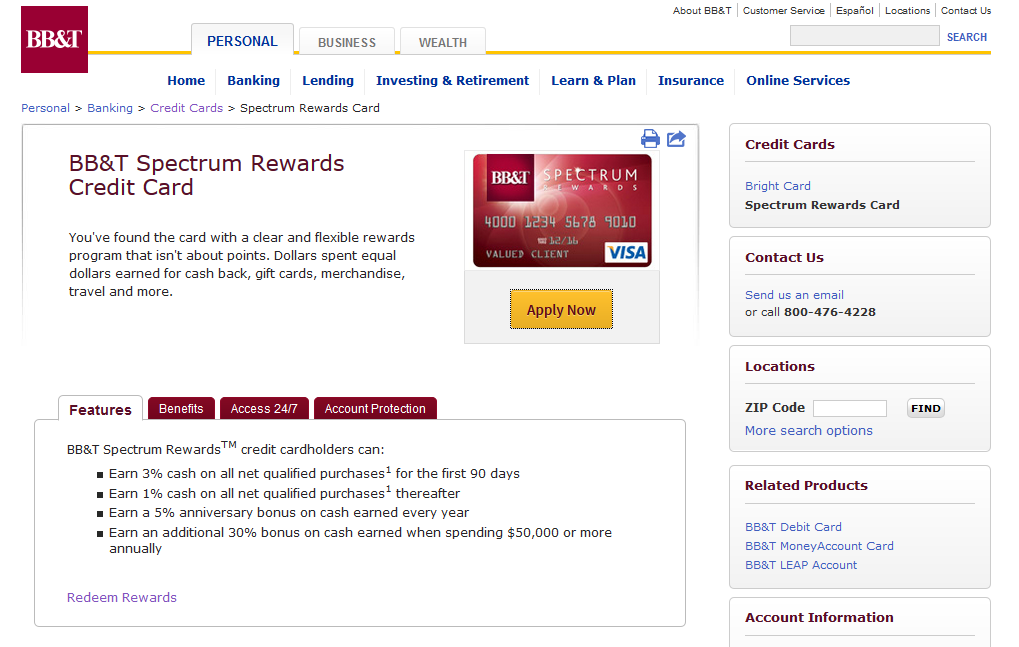

Unfortunately this is yet another limited time offer, but I was having withdrawal symptoms after not getting any new cards for a couple months and saw some articles on 60K Citi ThankYou Prestige cards that are available only in a Citi branch. The problem is, Citi closed all their San Antonio (maybe all of Texas?) branches a couple of months ago and most of them were converted to a bank I’d never heard of, BB&T. Browsing around their site, I found a really interesting offer for a cashback card with the this earning structure:

- 3% cashback on all purchases for the first 90 days.

- 1% cashback on all purchases after 90 days.

- 5% bonus cashback on cash earned annually.

- 30% more bonus cashback on cash earned annually if you spend more than $50K on the card during the year.

Points can also be redeemed for travel, but there is no indication of any additional value to do so, and there appear to be booking fees. You could also get gift cards, but I’m not sure why.

Some banks with limited service areas allow customers outside of their area to open accounts. I’m not sure if that’s the case with BB&T.

I am short on time to make the most of a card like this right now, so I don’t think I’ll do anything with this offer until early next year if at all. I don’t know anything about BB&T, their customer service or their willingness to allow large-scale MS and cycling your credit. But it definitely gives an interesting additional choice for some good earning over 3 months. What do you think? Is 3 months of unlimited 3% with another 1.05% to follow worth an application?

I happen to like maps. This one from Free Map Tools has nothing to do with anything, but it includes most of BB&T’s service area.

Disclosure: 8.15% is more than 4.05%. So is 19.15%. It would be extremely stupid to open this card, do a boatload of MS, lose track of it, and wind up carrying a balance that you pay interest on. So please don’t.

– Kenny

Continue reading...