So many people rave about the Barclay Arrival card...

EDIT: I get it now, it's 2.22% CB

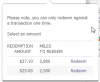

I recently received my Barclay Arrival card that I signed up for with a 40,000 "miles" bonus and "2x miles" for all purchases. Upon finishing my minimum spend, I sought out to use these "miles" and found that what you really get is either a credit towards travel spend (my 40,000 "miles" is good for a $400 credit statement towards any travel-related purchases I made in the past 90 days), or some payouts that equal half that ($200 worth to be exact). There is a 10% bonus added back to your "miles" balance when you choose the 1st option (travel spend credit), so effectively a $400 travel spend credit is like a net cost of 36,000 "miles" to get the $400 cash back (CB).

Based on the above, the most that you can expect from this card is not 2x "miles" (really its 2.2x "miles" given the 10% bonus), but rather you are really only getting 1% CB. And this CB is only for travel expenses (1.1% CB with the 10% bonus).

Apart from the initial 40,000 "miles" ($440 CB, really), and the ongoing 1.1% CB, what is the advantage of this card?