Howdy folks! Long time, no see. I’m not planning on getting back into blogging on a regular basis, but this story was interesting, financially speaking, and I thought I’d pass it along.

I started a new job in late November. The health insurance for my old job ran through the end of November and the health insurance for my new job didn’t kick in until January 1, leaving me without coverage in December unless I wanted to do COBRA. I did not want to do COBRA since I would have had to pay the full cost for the month–that is, not just the employee part but the employer part as well, or about $1,600 for one month of coverage. My genius plan for December: “Okay kids: none of you are allowed to get sick this month, is that clear?”

You scoff, gentle readers, but this plan came so close to working. For four weeks, our household was as healthy as it’s ever been.

Then came December 28. Right after midnight, our oldest son came to our bedroom complaining of a stomach ache, then barfed. He threw up a few more times that night and the next morning. His appetite had disappeared as well (very unusual for this one), so we took him to the doctor in the afternoon. The doctor’s verdict: “It’s probably nothing, but there’s a small chance it could be appendicitis, so keep an eye on it. Here’s some medicine to suppress the vomiting.”

We kept an eye on it and it got worse. Finally at about 9:00 that night we went to the emergency room. At 11:00, after some tests and an x-ray, the doctor informed us that our son has appendicitis and we need to get that thing out now before it ruptures. Surgery began around 2:30 am and finished up around 3:30 am. Success! I’m pleased to report it went smoothly and there were no complications. They put him in a recovery room and we chatted with the doctor, and my wife stayed with our son while I went home around 5:00 to sleep for a few hours. He was discharged at 11 am that very morning and was more or less back to normal two days later.

It was quite a 12 hours for the family.

A few weeks later came the bills. I’m used to insurance-adjusted bills, so I was curious how high they’d go. The final tally:

It actually gets even better because of our particular case. The way it works (this is what they told me, anyway) is that you continue your exact same health care plan right where you left off through the end of the year. Since we have four kids, two of whom have enough allergy issues that we usually hit our deductible for the year, we were at that magical point where incremental health care costs are mostly absorbed by the insurer. Here’s what we actually paid (after coughing up that $1,600, of course):

My takeaways from all this:

The post The one weird health insurance trick that saved me $23,000 on an appendectomy appeared first on Personal Finance Digest.

Continue reading...

I started a new job in late November. The health insurance for my old job ran through the end of November and the health insurance for my new job didn’t kick in until January 1, leaving me without coverage in December unless I wanted to do COBRA. I did not want to do COBRA since I would have had to pay the full cost for the month–that is, not just the employee part but the employer part as well, or about $1,600 for one month of coverage. My genius plan for December: “Okay kids: none of you are allowed to get sick this month, is that clear?”

You scoff, gentle readers, but this plan came so close to working. For four weeks, our household was as healthy as it’s ever been.

Then came December 28. Right after midnight, our oldest son came to our bedroom complaining of a stomach ache, then barfed. He threw up a few more times that night and the next morning. His appetite had disappeared as well (very unusual for this one), so we took him to the doctor in the afternoon. The doctor’s verdict: “It’s probably nothing, but there’s a small chance it could be appendicitis, so keep an eye on it. Here’s some medicine to suppress the vomiting.”

We kept an eye on it and it got worse. Finally at about 9:00 that night we went to the emergency room. At 11:00, after some tests and an x-ray, the doctor informed us that our son has appendicitis and we need to get that thing out now before it ruptures. Surgery began around 2:30 am and finished up around 3:30 am. Success! I’m pleased to report it went smoothly and there were no complications. They put him in a recovery room and we chatted with the doctor, and my wife stayed with our son while I went home around 5:00 to sleep for a few hours. He was discharged at 11 am that very morning and was more or less back to normal two days later.

It was quite a 12 hours for the family.

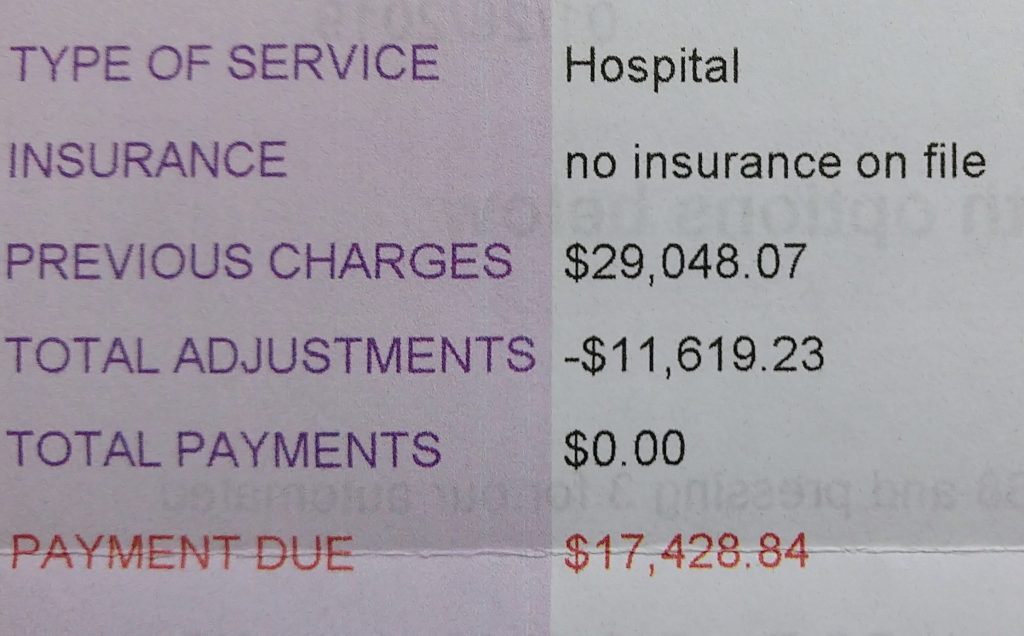

A few weeks later came the bills. I’m used to insurance-adjusted bills, so I was curious how high they’d go. The final tally:

- Initial pediatrician visit: $95

- Radiology: $165

- ER exam: $724

- Anesthesia: $2,721

- Pediatric surgeon: $3,800

- Hospital: $17,429

Pretty cool, huh? It’s a heads-I-win, tails-you-lose proposition, with “you” being your prior health insurance provider. That’s why I didn’t bother signing up for coverage initially. We only had a one month gap to cover, so going without coverage was risk-free in our case, aside from the risk of forgetting to enroll within sixty days. If we made it through the month without anybody having serious medical bills, great. If we didn’t, no problem–just enroll retroactively.COBRA beneficiaries have 60 days to decide whether they want COBRA coverage. If you enroll in COBRA before the 60 days are up, your coverage is then retroactive, as long as you pay the retroactive premiums. This means that if you incur medical bills during your “election period,” you can retroactively — and legally — elect COBRA and have those bills covered.

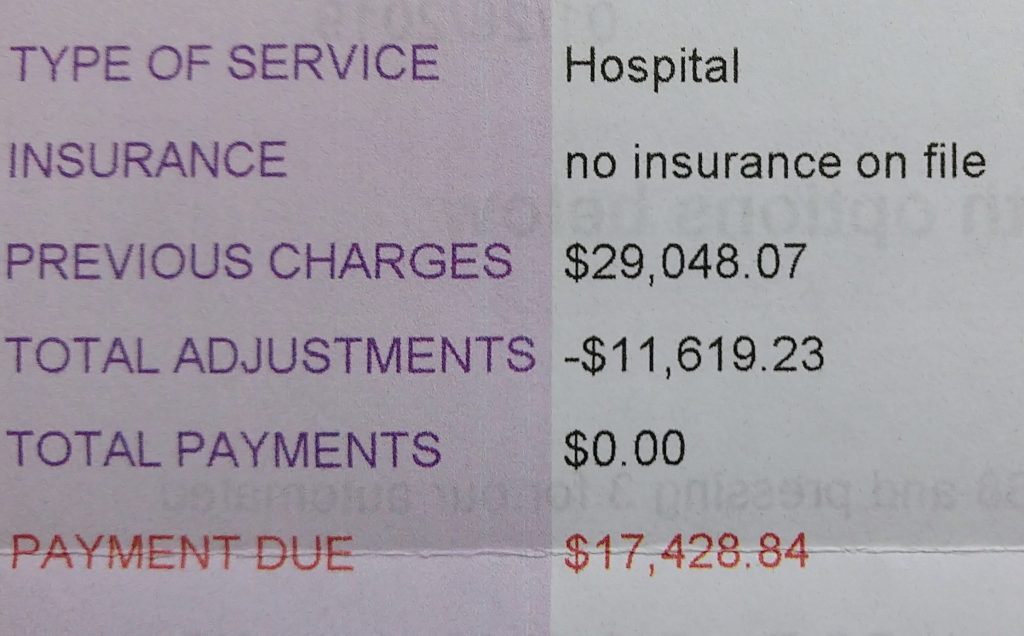

It actually gets even better because of our particular case. The way it works (this is what they told me, anyway) is that you continue your exact same health care plan right where you left off through the end of the year. Since we have four kids, two of whom have enough allergy issues that we usually hit our deductible for the year, we were at that magical point where incremental health care costs are mostly absorbed by the insurer. Here’s what we actually paid (after coughing up that $1,600, of course):

- Initial pediatrician visit: $12

- Radiology: $9

- ER exam: $29

- Anesthesia: $100 (estimated, I misplaced this bill after I paid it)

- Pediatric surgeon: $149

- Hospital: $0

My takeaways from all this:

- Health insurance coverage is complicated.

- Life stinks if you don’t have good coverage.

- I don’t have a clue about what to do to make things better.

- Retroactive COBRA optionality is pretty awesome for transitioning between jobs.

The post The one weird health insurance trick that saved me $23,000 on an appendectomy appeared first on Personal Finance Digest.

Continue reading...