Last week, I wanted to post data about the gift card churn rate amongst a handful of brands and look at how quickly a gift card will sell based off of the vendor and the denomination. It turned out to be a hot mess to which I take full responsibility because I wasn’t sure what to do with leaving the password or taking it off. I’m sorry for those that spent all the time looking for the clues, but I hope you learned a little more about our Saverocity team.

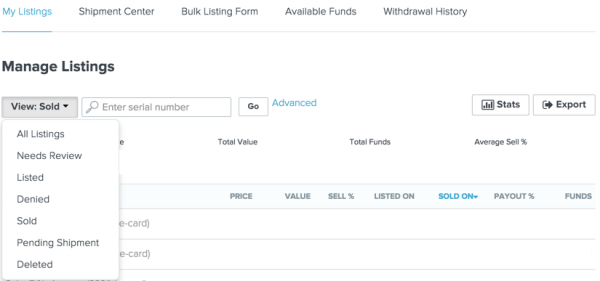

I forgot Raise offered this data for all bulk sellers. Once I list a card/sell it to other exchanges like Giftcard Zen and Cardpool, it is a very much a set it and forget it type of model. During the weekend, one of my department store gift cards sold and I logged into Raise to see how many cards I have left and remembered the metrics that they provided.

Since this isn’t proprietary data and are my own cards that were sold, I can post about my sales and explain a few things I wanted to do Friday, but couldn’t. Here’s the link to my data that I sanitized a little bit, like removing the name of the retailer for the gift card and how much I was paid out.

For the Gap and Old Navy cards, they are the generic Gap Option gift cards, so you can list as any of the Gap brands because here is the fine print on Gap option cards:

The Gift Card may be redeemed for merchandise at any Gap brand, Old Navy, Banana Republic, Piperlime or Athleta location, including Outlet and Factory stores. The Gift Card may also be redeemed online for merchandise at gap.com, oldnavy.com, bananarepublic.com, piperlime.com or athleta.com.

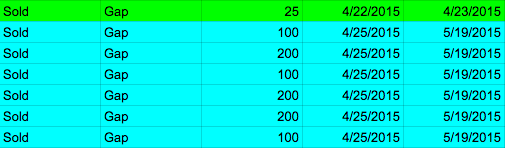

Below is a graphic of my Gap cards that were listed before Safeway flooded the market. I bought my Gap branded gift card at 85% and I was not budging on my discount rate. Meanwhile the lucky folks who have Safeway access were buying at 80% of the value so they were discounting further than mine, helping them cycle through the cards faster.

See the top row, the darker green? That was before the market was saturated. I listed it on 4/22/2015 and it was sold on 4/23/2015. Now the teal? They were listed a couple of days later, and sold on 5/19/2015. That day when the cards were sold, I checked Raise and there were still A LOT of Gap cards, but all low denominations like $25 and $50.

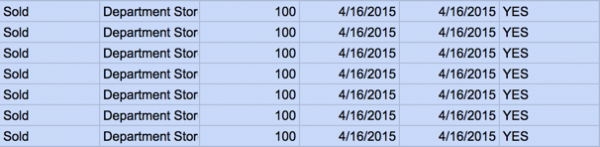

I also have a popular department store that when I listed them, you will find them highlighted in blue, they were listed the same day and someone bought it.

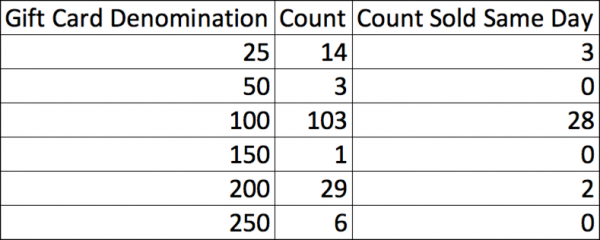

Let’s take a look at this as well, this is the count of the gift card denominations that I have sold on Raise. The third column is the count of all the cards that were purchased the same day that I listed the card. High level overview for me and the brands that I sell, I should be listing more cards in the $100 range to churn faster, but if I break it out by store, that dataset will change.

Again, I apologize for what I did to you last week, especially for the folks who went through all the lengths last week to get the password. If I remembered what was provided to me, I would have posted this instead of giving you the rigamarole.

Continue reading...