Last week, Doctor of Credit and I were in a Twitter chat about a special Discover offer.

@ChasingThePts Link for $150 offer? What did you search for?

— Doctor Of Credit (@Drofcredit) May 14, 2015

If you set up your GMail to use the tabs like below:

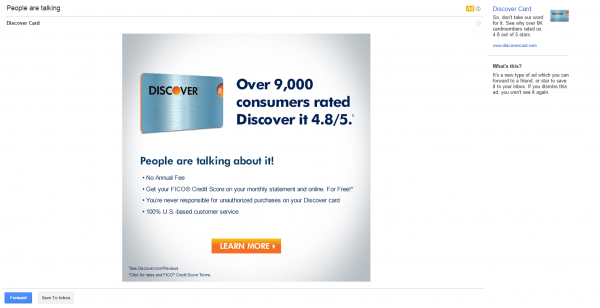

You may see this offer:

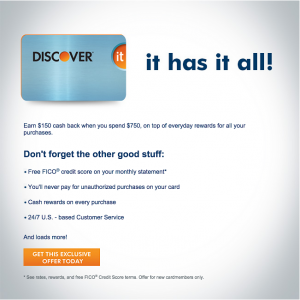

That particular offer had this promotion:

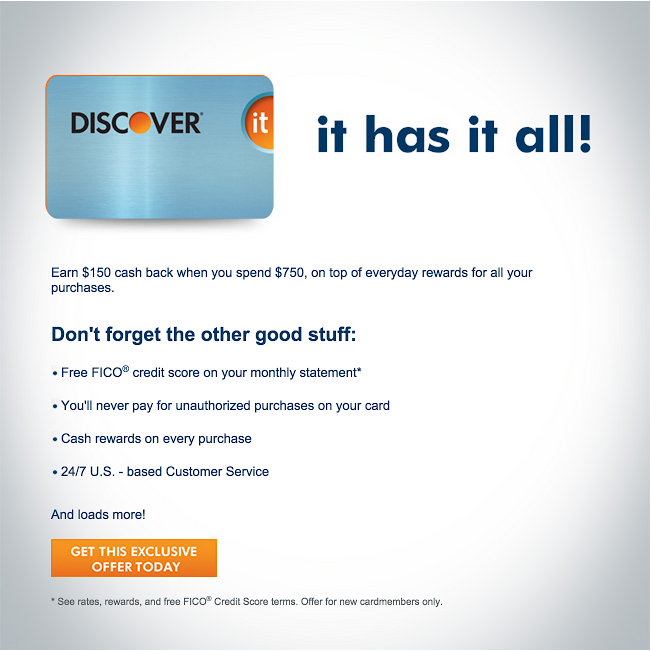

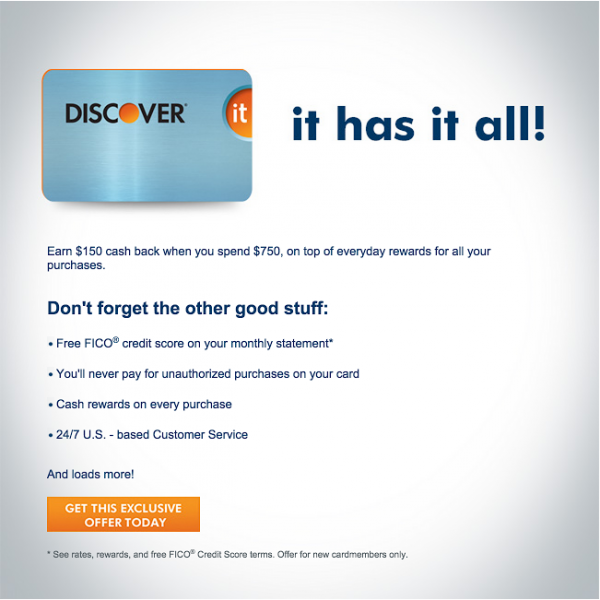

It doesn’t have a $150 bonus for $750 in spend, which is the graphic all the way on the top (it is below):

The Second Discover Card:

In case you didn’t know, I’m a huge fan of the 5% quarterly cards. I also didn’t see many good sign up offers for the Discover card until I saw the ad in my GMail account. When the buzz was all about the Discover Miles card, it set forth an idea about signing up for another Discover card. At the time, I also saw this post from Chuck on Doctor of Credit that I kept in the back of my head. Here’s a quote from the post:

- One Flyertalk member applied online and the system told him to call in. Seems that those who have an existing Discover account will automatically be prompted to call in and verify if they want to open a second account or if they want to close the old one and open the new one. We’ll have to wait and see more reports on whether everyone has this experience or if it was an isolated experience. (I’m putting my money on this being the case for everyone.)

This was absolutely my case. After applying, a prompt came up and said I needed to call Discover. After I called, a very very pleasant CSR asked if I really wanted a second card and that it wasn’t a mistake. I told her it was not a mistake and I was giving her my story where she cut me off and said “OK” and began to process the application. No story needed as to why I need the second card. The only thing needed from me was moving some credit to the new card.

Rotating Quarterly Cards:

For those keeping notes at home, I now have seven, yes 7 cards that have a rotating quarterly bonus. In the next couple of months, I anticipate to apply for a second US Bank Cash+ card. I have the following:

- Citi Dividend- 1

- Discover – 2

- Chase Freedom – 3

- US Bank Cash+ – 1

If you sell a $100 gift card at a rate of 86% and in the end you receive 500 points:

$9/500 = $.018/pt

$14/1000 = $.014/pt

As you can see if the 5% went to the bottom of the fraction it drops the cost per point.

Continue reading...