Fee Only Planners hold a treasured title within the wealth management space. To be a Fee Only one must only be compensated directly by the client, rather than in the form of a commission from a product. The theory is that this eliminates a conflict of interest. However, it does not eliminate all conflicts of interest, as Fee Only Planners might want you to believe.

Advocates of Passive Investing

Most Fee Only Planners will advocate a simple passive investing strategy using Index Funds.. They will use low cost funds with simple rebalancing when markets change. There are several reasons for this:

- It’s pretty easy to implement.

- It has generally been accepted to be a good way to invest, with plenty of supporting evidence.

- It allows the advisor to claim Fee Only status as such funds do not come with commissions.

A Fiduciary Defined

A fiduciary duty is a legal duty to act solely in another party’s interests. Parties owing this duty are calledfiduciaries. The individuals to whom they owe a duty are called principals. Fiduciaries may not profit from their relationship with their principals unless they have the principals’ express informed consent. They also have a duty to avoid any conflicts of interest between themselves and their principals or between their principals and the fiduciaries’ other clients. A fiduciary duty is the strictest duty of care recognized by the US legal system.

Examples of fiduciary relationships include those between a lawyer and her client, a guardian and her ward, and a director and her shareholders.

Source Cornell University Law School

The first crack appears

As you can see here, a fiduciary duty requires one to work solely in another party’s best interests. A failing of the CFP board, along with other Fee Only advocates such as NAPFA is that for the sake of simplicity they have cited that a to be able to act in a Fee Only manner you cannot accept a commission, and then they have made a leap of logic to assume that in order to act in a fiduciary manner you cannot accept a commission.

However, if it was proven that the ‘best interests of a client’ were to be offered a commission based product, refusing to do so to protect Fee Only status (and earning potential) conflicts with the Fiduciary.

Here’s where it gets interesting.

Fee Only Planners cannot sell Life Insurance

Life Insurance comes with a commission, so a Fee Only Planner is restricted from being able to sell it, for fear that they will lose the ability to be a Fiduciary due to the temptation of commission. However, everyone in the industry would agree that certain clients do require life insurance. The solution is simply that the planner will recommend an amount of Life Insurance, and then suggest 3-5 agents and have the client pick from them.

Would a Fee Only Planner walk from AUM the same way?

AUM, Assets Under Management are a huge point of conflict for a fee only advisor. This is a source of recurring income. There are many seasoned Fee Only Planners who have built a ‘stable’ of clients that flow revenue to them via AUMs. Rates range from 0.5%-1.5%. Furthermore, there are more older Fee Only Planners than younger ones.

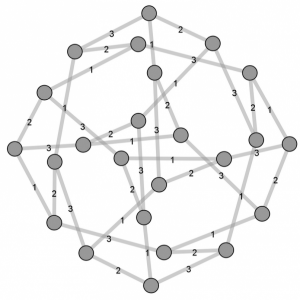

CFP Chart by Age

And a character trait for many Fee Only Planners that I have noticed is that they lend themselves towards farming rather than hunting in sales. Indeed, many will naively say they don’t sell at all. What that creates is a fear to lose business. AUM clients generate consistent cash flows with very little work compared to client acquisition, which requires a lengthy onboarding process and labor intensive plan delivery. These are all factors that incentivize the Fee Only Planner to not act as a fiduciary, and has an indirect tie to compensation.

Could an advisor walk away from AUM because another outfit can deliver it better?

The Algorithm that is highlighting this now is the ‘Robo Advisor’

The problem stems from Robo Marketing. They have successfully captured the term ‘Advisor’ to the point where a Fee Only Planner believes it and fears it. In fact, a Robo firm, such as WealthFront, Betterment or FutureAdvisor is an algorithmically rebalanced fund of funds. It is not an Advisor, it is a Fund.

As a fund, it offers no commission to the Advisor, so it could be recommended by them as Fee Only Planners, but for the vast majority it is not. This exposes a lack fiduciary duty.

I challenge any Planner who elects to offer a passive investing model to their clients, particularly within a taxable account, to outperform the Robo-Algorithm. I don’t think it is possible. That said, it is very easy to outperform the Robo-Algorithm, but not as an advocate of pure passive investing.

I personally believe that WealthFront now has the edge out of the pack due to direct investing. A concept I explored in my article Granulation of Investments.

In the words of Dennis Clark When interviewed by RiaBiz:

“If you can add tax alpha you’re out-Bogleing [Jack] Bogle,” says Clark [MD at Sheldon Capital Management], who previously founded his own direct index investing SMA company. Bogle is the founder and retired chief executive of The Vanguard Group of Malvern, Pa.

Planners scrambling to retain clients are coming up with the soft skill value of advising, the ability to coach clients through behavioral changes that occur with risk. In other words, they are rallying under the banner of ‘Algorithms Don’t Care’.

The flaw to this is that they still see the Robo-Fund as a competitor. It is easy to understand with the aggression and mix messages that these firms send out. Wealthfront hired a guy with a twitter handle @ibringtraffic to grow their business, and Andy Rachleff, co-founder and Executive Chairman isn’t afraid to say all that matters is their AUM growth.

But instead of sending the Fee Only Planner running for a flawed answer, they must, as a fiduciary, examine the Robo-Fund and offer it to their clients if it would be in the clients best interest. The fear of doing this is that they might find it hard to retain a client if they are charging a fee on top of someone like WealthFront in order to manage assets.

If the typical WealthFront fee is 0.25% and the assets are managed, what can the Fee Only Advisor do? Well they can still offer the soft skills, and the holistic planning, but in my opinion, if they are to call themselves a fiduciary, they can’t make up flawed arguments for why they offer better investment decisions manually compared to an Algorithm. Instead, they need to offer the best investment advice possible, free of conflicts.

The only way I can see this aligning with a Passive Investment approach to planning is for the Fee Only planner to advocate a move to the Robo Advisor, and find a way to align that with their own compensation. Because putting their own AUM money before the clients best interest surely is not a fiduciary decision.

The post Has this algorithm exposed a fiduciary flaw with Fee Only Planners? appeared first on Saverocity Finance.

Continue reading...