Last spring Barclays took away the last application for the US Airways Mastercard that had the annual fee waived for the first year. Since then the signup bonus has gone up from 30K to 50K miles but the $89 fee must be paid. This larger bonus combined with the fact that it’s on its way out has made this a popular card. Barclays seems to be testing bonus offers to see what will get these cards out of the sock drawer and into our wallets, so you might want to check and see if there’s a bonus offer worth registering for!

We got one of these in February 2014, with the first year fee waived. In the fall we were able to pick up a statement credit for $25 by switching to paperless statements. Then at about 11 months we got the standard 15K bonus miles offer that Barclays likes to give: earn 15,000 bonus miles by spending over $500 in new purchases each calendar month in February, March and April. Keep in mind if you have (or when you get) a similar offer that $500.00 is NOT over $500. In the past people have missed the bonus by 3 cents, so make sure you spend $500.01 (or $750.01 if your offer says $750) or more. So sure, we’ll take that. Then I called and asked for a fee waiver which was granted with no questions at all. Along with an extra mile per dollar in a couple of categories. Today, a friend let me know he saw an offer on his account at barclaycardus.com, so I checked and sure enough we had the same one!

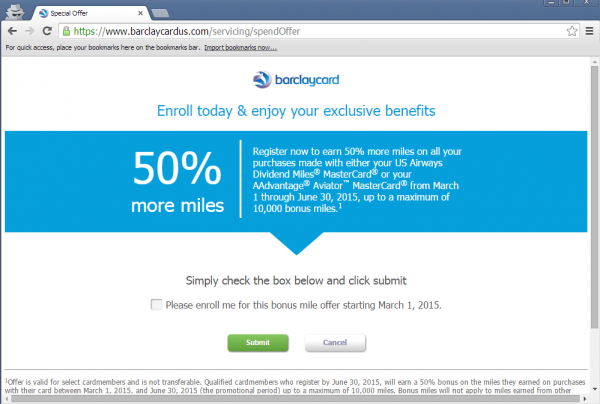

On the right hand side of the US Airways card account page, where there are usually button for the Rewardsboost shopping portal and other ‘Barclaycard extras’ was a button touting 50% bonus miles. Clicking on it brought up a signup screen

Yes, please!

Two clicks later, and we will be earning 1.5 US miles per dollar on up to $20K spending From March 1 to June 30. Along with the additional 15K bonus and extra mile per dollar from the other two offers we got in the past month.

I have been trying to figure out which card we should keep, between this one and the Citi AA Platinum card, to maintain the 10% rebate on redeemed miles and baggage fee waiver on AA flights. Barclays is making the choice far too easy! Check your account for a bonus, and see if it makes sense to shift non-bonus spending to that US Airways card that has been busy keeping the other cards in your sock drawer company!

– Kenny

Continue reading...