As I continue to realign my portfolio, the next investment I will be focusing on is international exposure. I have decided that I want to be more focused in Europe and will do so via an ETF strategy. The overall weight of my portfolio will remain in US equities at this time, so I am just fine tuning the allocation that is assigned international equities.

As most will know, an ETF offers the opportunity to invest in a broadly diversified manner. And for this reason I favor them at this point in my own wealth generation timeline. There are two reasons that I like Europe:

A weak Euro

The Euro has dropped dramatically against the USD in the past 12 months. I see this as a buying opportunity.

An Emerging business cycle

If we compare the US business cycle since the 2008 financial crisis, the markets have been very bullish. We are already at a point in time where historically things have declined in terms of business cycle. While I do not anticipate a sharp contraction, I could see things becoming a little flat for the next 1-3 years. Europe, on the other hand, is still fighting hard to get their economy moving, with a rate of almost zero.

To hedge or not to hedge?

When you invest internationally currency risk becomes a factor. Regardless of how the underlying equities within such an investment should perform, you absolute return is pegged to the foreign exchange rates between your currency and the country involved.

A hedged ETF addresses currency risk

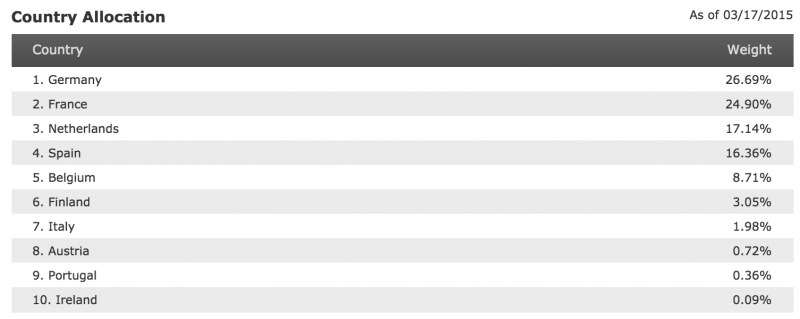

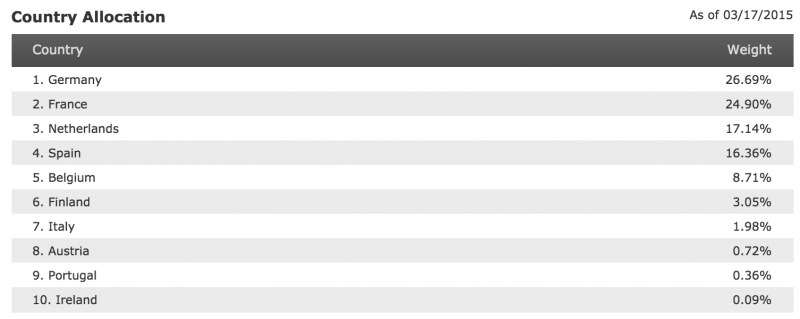

If you invest in a hedged ETF it will have currency risk strategies built into it. This means that the performance of the ETF will somewhat match the local returns, regardless of change in rates between the two countries. The downside of this is that hedging does create additional expense ratios. A good example of a hedged ETF is HEDJ, from WisdomTree, which seeks to track the WisdomTree Hedged European Index. Here’s a breakdown of the investments via country

Country exposure from HEDJ

Note, that while this does appear to reflect diversification by country, the companies within these geographies tend to be major multinationals that have global revenue streams, and this does impact correlation.

An unhedged ETF does not offer the same protection for currency

With unhedged investing you are investing in a 2 dimensional risk model. You have the potential for gains and losses on the companies within the ETF and additionally gains and losses on the currency.

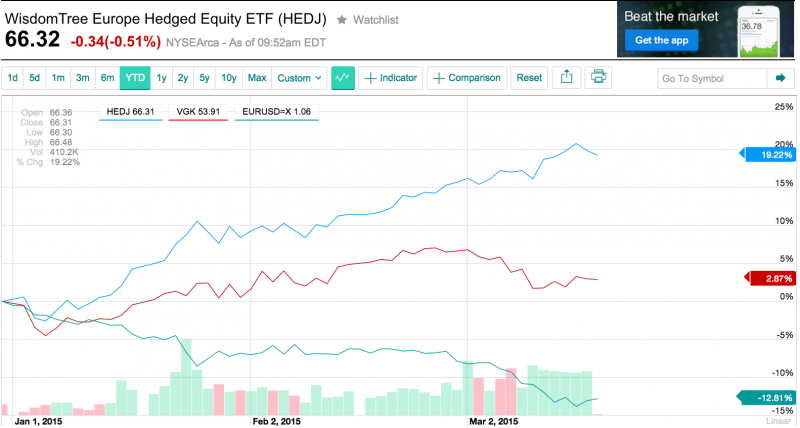

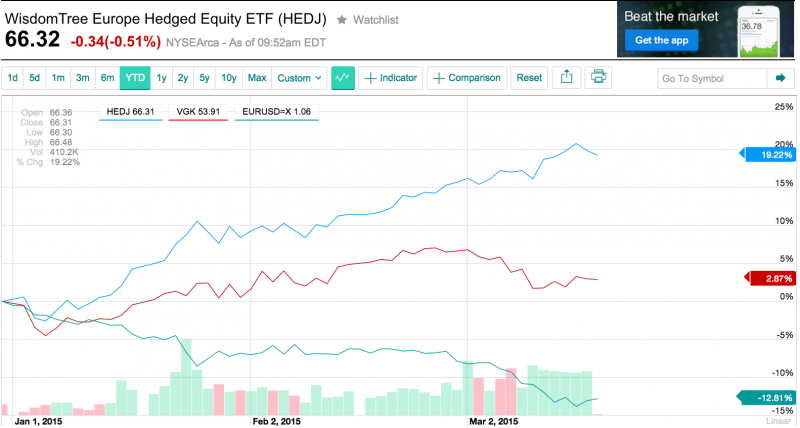

This chart is a great way to see how the impact of the declining Euro impacted the returns of an unhedged ETF, I selected Vanguards VGK for this comparison . As you can see, very similar funds performed in very different ways because one (VGK) was dragged down by the Euro whereas one (HEDJ)was hedged against that.

What do you think?

Would you invest in Europe now, or focus on the US market? If you do decide to invest overseas, would you seek to hedge that currency risk, or add it in as an additional upside potential?

The post European ETFs – Hedged vs Unhedged appeared first on Saverocity Finance.

Continue reading...

As most will know, an ETF offers the opportunity to invest in a broadly diversified manner. And for this reason I favor them at this point in my own wealth generation timeline. There are two reasons that I like Europe:

A weak Euro

The Euro has dropped dramatically against the USD in the past 12 months. I see this as a buying opportunity.

An Emerging business cycle

If we compare the US business cycle since the 2008 financial crisis, the markets have been very bullish. We are already at a point in time where historically things have declined in terms of business cycle. While I do not anticipate a sharp contraction, I could see things becoming a little flat for the next 1-3 years. Europe, on the other hand, is still fighting hard to get their economy moving, with a rate of almost zero.

To hedge or not to hedge?

When you invest internationally currency risk becomes a factor. Regardless of how the underlying equities within such an investment should perform, you absolute return is pegged to the foreign exchange rates between your currency and the country involved.

A hedged ETF addresses currency risk

If you invest in a hedged ETF it will have currency risk strategies built into it. This means that the performance of the ETF will somewhat match the local returns, regardless of change in rates between the two countries. The downside of this is that hedging does create additional expense ratios. A good example of a hedged ETF is HEDJ, from WisdomTree, which seeks to track the WisdomTree Hedged European Index. Here’s a breakdown of the investments via country

Country exposure from HEDJ

Note, that while this does appear to reflect diversification by country, the companies within these geographies tend to be major multinationals that have global revenue streams, and this does impact correlation.

An unhedged ETF does not offer the same protection for currency

With unhedged investing you are investing in a 2 dimensional risk model. You have the potential for gains and losses on the companies within the ETF and additionally gains and losses on the currency.

This chart is a great way to see how the impact of the declining Euro impacted the returns of an unhedged ETF, I selected Vanguards VGK for this comparison . As you can see, very similar funds performed in very different ways because one (VGK) was dragged down by the Euro whereas one (HEDJ)was hedged against that.

What do you think?

Would you invest in Europe now, or focus on the US market? If you do decide to invest overseas, would you seek to hedge that currency risk, or add it in as an additional upside potential?

The post European ETFs – Hedged vs Unhedged appeared first on Saverocity Finance.

Continue reading...