If you underpay estimated taxes, you may be subject to penalty. IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts is the form that you use to report this.

With proper planning, all penalties can be avoided, but in order to do this you need to understand the rules of Estimated vs Withholding tax.

Withholding tax is what people have deducted from payroll. The most interesting facet to this tax is because of the method, it is always considered to be timely filed. This means if you pay $0 in taxes throughout the year, but run a single ‘special’ payroll at the end of December, providing you pay ‘enough’ of your obligation for the year, you avoid Withholding Tax penalties. The limit for penalty occurs if you owe more than $1,000 after all payments.

For the sake of clarity, let’s assume you have a $10,000 tax liability for the year, and you pay $9,500 via a payroll withholding in December, you get no penalty.

Estimated tax is a separate payment that can be made directly to the IRS, and can be paid by check, or credit card. Estimated tax does not carry the same privilege of being ‘timely filed’ that withholding tax carries. Therefore, if you were to take the same situation, where there is a $10,000 liability and you were to pay $9,500 in December via Credit card, you would be subject to a penalty that goes back to Q1 of that year.

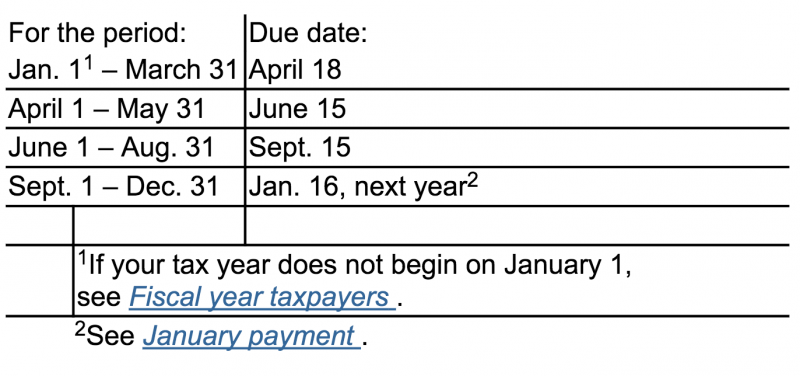

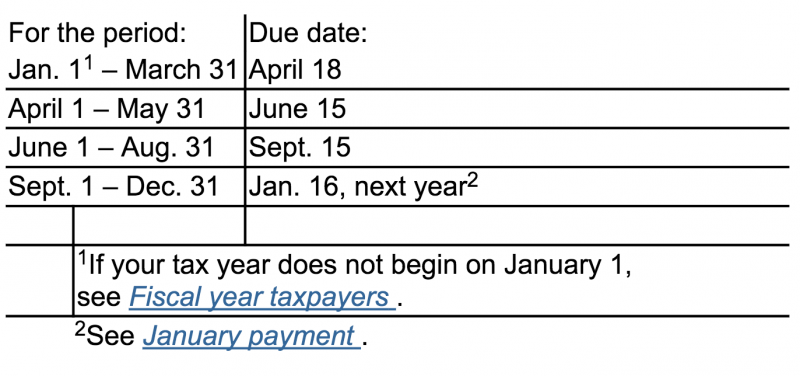

Estimated Tax Deadlines

The distinction is small, but very important. The quality of the Withholding Tax being considered timely filed is a very useful tool when people haven’t paid taxes through the year. We see this when new self employed people have started earning money, but haven’t started paying themselves.

Another time where this nuance may come into play is for when people try to manipulate their exemptions and ‘make up’ the difference via Estimated Tax. If they do this, the Estimated Tax payments must be made for each applicable quarter, and cannot be simply ‘trued up’ via an end of year lump sum.

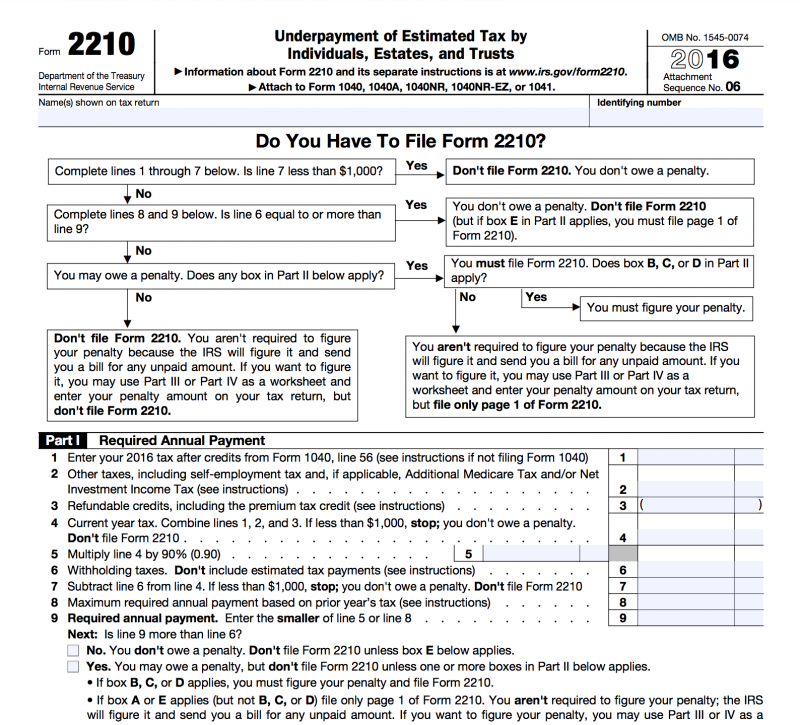

If you want test it for yourself, work through form 2210.

Form 2210

Check out line 6, this gives you the information that Withholding is treated differently from Estimated tax, regardless of the date of the transaction.

Line 7 shows how with a ‘timely filed’ line 6 amount, and a balance less than $1,000 in taxes owed, you do not have to complete the penalty form.

The post Estimated vs Withholding Tax Penalty rules appeared first on Saverocity Finance.

Continue reading...

With proper planning, all penalties can be avoided, but in order to do this you need to understand the rules of Estimated vs Withholding tax.

Withholding tax is what people have deducted from payroll. The most interesting facet to this tax is because of the method, it is always considered to be timely filed. This means if you pay $0 in taxes throughout the year, but run a single ‘special’ payroll at the end of December, providing you pay ‘enough’ of your obligation for the year, you avoid Withholding Tax penalties. The limit for penalty occurs if you owe more than $1,000 after all payments.

For the sake of clarity, let’s assume you have a $10,000 tax liability for the year, and you pay $9,500 via a payroll withholding in December, you get no penalty.

Estimated tax is a separate payment that can be made directly to the IRS, and can be paid by check, or credit card. Estimated tax does not carry the same privilege of being ‘timely filed’ that withholding tax carries. Therefore, if you were to take the same situation, where there is a $10,000 liability and you were to pay $9,500 in December via Credit card, you would be subject to a penalty that goes back to Q1 of that year.

Estimated Tax Deadlines

The distinction is small, but very important. The quality of the Withholding Tax being considered timely filed is a very useful tool when people haven’t paid taxes through the year. We see this when new self employed people have started earning money, but haven’t started paying themselves.

Another time where this nuance may come into play is for when people try to manipulate their exemptions and ‘make up’ the difference via Estimated Tax. If they do this, the Estimated Tax payments must be made for each applicable quarter, and cannot be simply ‘trued up’ via an end of year lump sum.

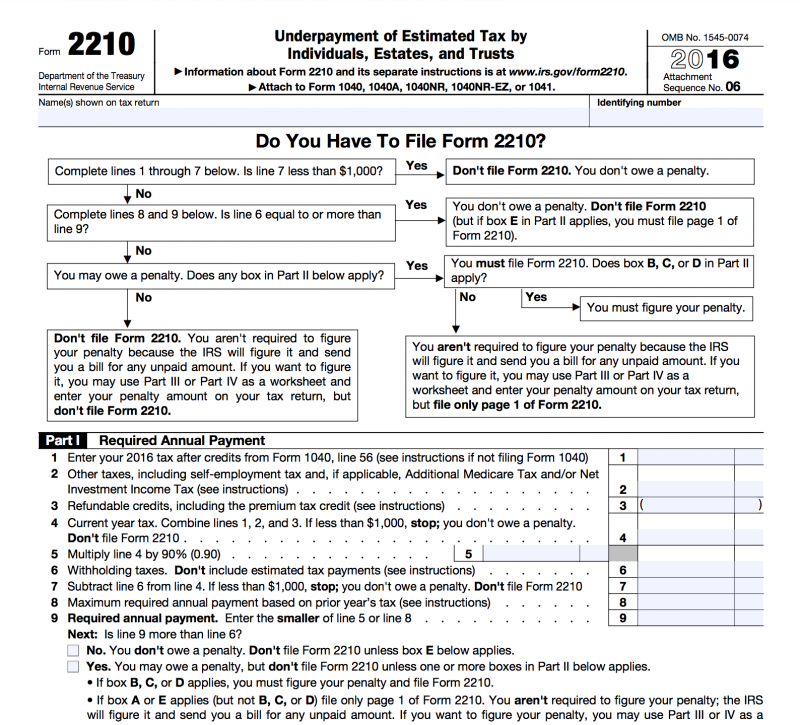

If you want test it for yourself, work through form 2210.

Form 2210

Check out line 6, this gives you the information that Withholding is treated differently from Estimated tax, regardless of the date of the transaction.

Line 7 shows how with a ‘timely filed’ line 6 amount, and a balance less than $1,000 in taxes owed, you do not have to complete the penalty form.

The post Estimated vs Withholding Tax Penalty rules appeared first on Saverocity Finance.

Continue reading...

Last edited: